Wabtec 1Q22: ‘Strong’ Results, Backlog Grows

Written by Marybeth Luczak, Executive Editor

Wabtec Corp. posted “strong” first-quarter 2022 financial results, despite “rising costs, continuing supply disruptions and the impact on our business due to the conflict in Ukraine,” President and CEO Rafael Santana reported on April 27.

For the three months ended March 31, 2022, Wabtec GAAP earnings per diluted share of $0.80 rose 35.6% from the prior-year period’s $0.59; adjusted, they were $1.13, up 27.0% from $0.89. This was “primarily due to higher sales and increased operating margins,” Wabtec said. “GAAP EPS further benefited from a favorable effective tax rate, along with lower restructuring and transaction costs.”

Sales came in at $1.93 billion, growing 5.3% from the $1.83 billion posted during the same quarter last year. The company attributed this to “higher Freight segment sales, partially offset by lower Transit segment sales, which were adversely impacted by foreign currency exchange.” GAAP operating margin was 12.4%; adjusted operating margin was 16.5%, up 1.4 points. Both increased from 2021, “as a result of higher sales, increased pricing, improved mix and strong productivity, partially offset by $45 [million] to $50 million in escalating costs associated with metals, transportation and labor,” Wabtec reported.

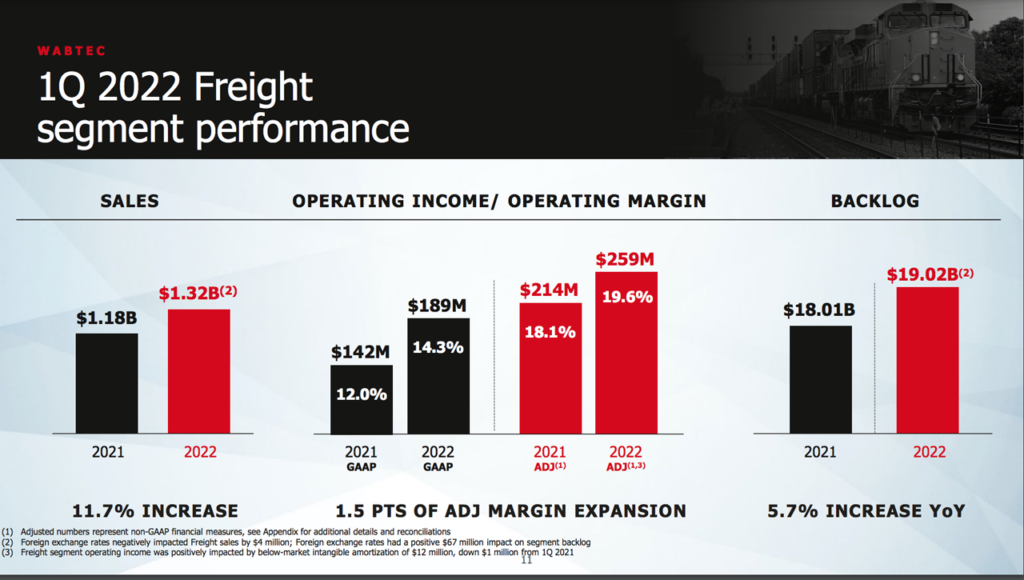

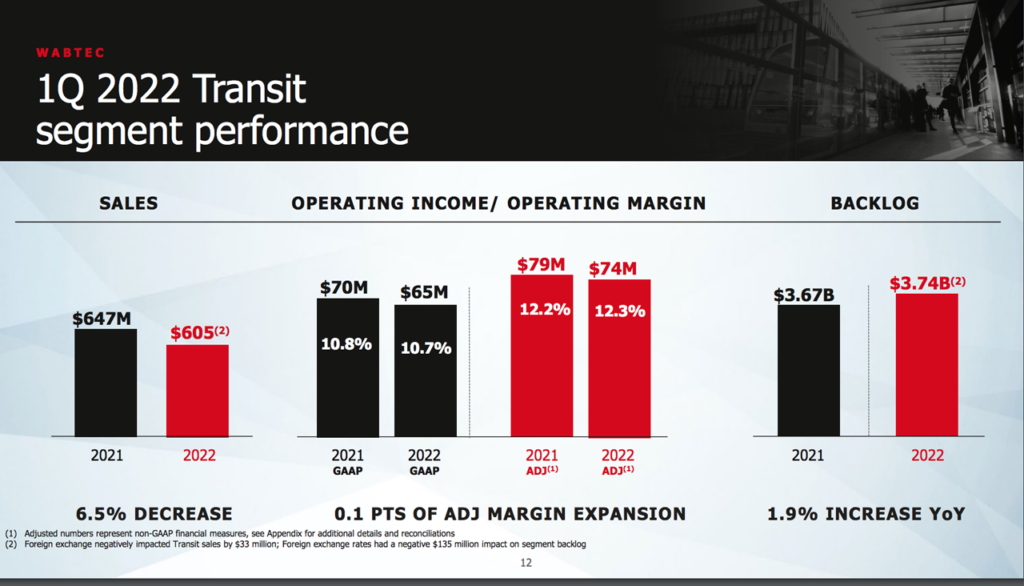

At March 31, 2022, multi-year backlog was $1.09 billion higher than at March 31, 2021, Wabtec said, “due primarily from increased orders for Equipment, Services and Digital Electronics.”

Freight segment sales for first-quarter 2022 were $1.32 billion, up 11.7% from the same point in 2021. This was driven by “demand for Services [up 18.5%], Components [up 12.8%] and Equipment [up 4.6%], along with the acquisition of Nordco [in second-quarter 2021],” Watco reported.

For first-quarter 2022, Transit segment sales of $605 million were down 6.5% from the prior-year period. This reflects “unfavorable foreign currency exchange, supply chain issues and COVID-related disruptions,” the company said.

2022 Outlook

Wabtec said its 2022 financial guidance remains unchanged with “sales expected to be in a range of $8.30 billion to $8.60 billion and adjusted earnings per diluted share to be in a range of $4.65 to $5.05.

“For full-year 2022, Wabtec expects strong cash flow generation with operating cash flow conversion of greater than 90%. The company is not presenting a quantitative reconciliation of our forecasted GAAP earnings per diluted share to forecasted adjusted earnings per diluted share as we are unable to predict with reasonable certainty and without unreasonable effort the impact and timing of restructuring-related and other charges, including acquisition-related expenses and the outcome of certain regulatory, legal and tax matters.”

“Looking forward, Wabtec is well-positioned to drive long-term profitable growth,” Santana summed up. “The growth opportunity and value proposition for the rail industry is improving as global energy prices surge and commodity flows are reoriented. The breadth and unique capability of the Wabtec product portfolio, combined with our multi-year backlog, provides us with a solid foundation for growth in 2022 and beyond. Our confidence in the company’s future is further reflected in our first-quarter purchase of $296 million of Wabtec stock and a 25% increase in our first quarter dividend.”

The Wabtec website provides more earnings details.

The Cowen Insight

“Revenue was shy of our and consensus expectations, but operating income and EPS beat consensus slightly and were below our estimates,” Cowen and Company Transportation Equipment Analyst Matt Elkott reported. “Freight had year-over-year revenue growth and a strong margin; transit revenue declined but had a solid margin. The total and 12-month backlogs grew year-over-year and sequentially for both freight and transit. The results may provide some relief for investors amid market uncertainty.”