Santana: Wabtec ‘Well-Positioned to Drive Long-Term Profitable Growth’ (UPDATED, Cowen)

Written by Marybeth Luczak, Executive Editor

“Our technologically differentiated portfolio of products and solutions, combined with our global installed base and multi-year backlog will allow us to capitalize on growth opportunities while remaining highly resilient,” Wabtec President and CEO Rafael Santana said during Nov. 1 financial report.

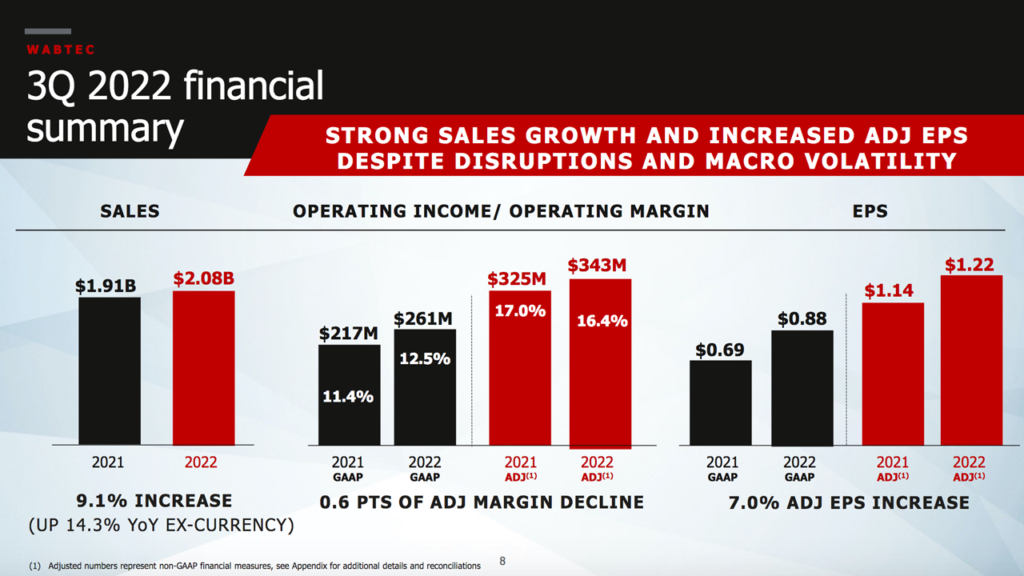

Wabtec “delivered a strong quarterly performance,” President and CEO Rafael Santana said during a Nov. 1 financial report. Third-quarter 2022 sales were up 9.1% from the prior-year period, which the company attributed to “significantly higher Freight segment sales, partially offset by lower Transit segment sales.”

“The team’s disciplined execution and the strength of the underlying business enabled us to navigate a volatile and dynamic environment that included significant headwinds from negative foreign currency exchange, supply chain constraints and high input costs,” Santana said.

For the three months ended Sept. 30, 2022, Wabtec GAAP earnings per diluted share of $0.88 rose 27.5% from the third-quarter 2021’s $0.69; adjusted, they were $1.22, up 7.0% from $1.14. “GAAP and adjusted EPS increased from the year-ago quarter primarily due to higher sales and disciplined cost management,” Wabtec said. “GAAP EPS further benefited from lower restructuring and transaction costs.”

Sales came in at $2.08 billion, growing 9.1% from the $1.91 billion posted during the same quarter last year. On a constant currency basis, consolidated sales were up 14.3%, the company said. Among the key drivers, according to Wabtec:

- Equipment: “Significantly higher international locomotives deliveries.”

- Components: “Higher due to improving OE railcar build and increased railcars in operation … partially offset by supply chain disruptions.”

- Digital electronics: “Higher demand for on-board locomotive products, software upgrades and acquisitions … partially offset by ongoing chip shortage.”

- Services: “Higher active locomotive fleet and increased modernizations.”

- Transit: “Decreased primarily as a result of unfavorable foreign currency exchange … sales up 2.6% on constant currency basis.”

GAAP operating margin for the quarter was up 1.1 percentage points “behind lower restructuring and transaction costs,” according to Wabtec; adjusted operating margin was lower, it noted, “due to a less rich mix of sales from significantly higher locomotive sales in the quarter.”

At Sept. 30, 2022, multi-year backlog was $0.77 billion higher than at Sept. 30, 2021, and “[e]xcluding unfavorable foreign currency exchange,” it was up $1.52 billion (or 7.0%), according to Wabtec.

Freight segment sales for third-quarter 2022 were $1.53 billion, up 18.2% from the same point in 2021. Sales, Wabtec reported, “were up across all product groups, with very strong growth in Equipment, Digital Electronics, and Services. On a constant currency basis sales were up 19.8%. GAAP operating margins were nearly flat to prior year and adjusted operating margin was lower as a result of significantly higher sales of locomotives during the quarter, partially offset by operational efficiencies and disciplined cost management.”

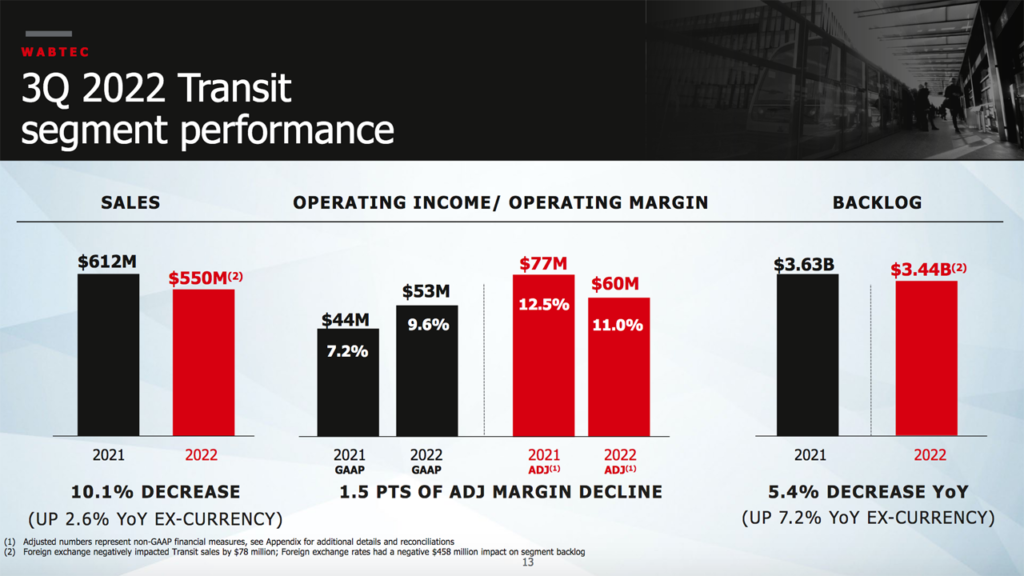

Transit segment sales for third-quarter 2022 came in at $550 million, down 10.1% from the prior-year period. The company attributed this to “unfavorable foreign currency exchange and the carryover effects from the previously announced cyber incident in the second quarter. On a constant currency basis sales were up 2.6%.” It added that “GAAP operating margin was up significantly as a result of lower restructuring and transaction costs, while adjusted operating margin was down as a result of costs associated with the cyber incident.”

2022 Outlook

Wabtec updated its 2022 financial guidance with sales to be in a range of $8.15 billion to $8.35 billion versus previous guidance of $8.3 billion to $8.6 billion. “The reduction reflects the expected impacts from unfavorable foreign currency exchange in the second half of the year,” Wabtec said. Adjusted earnings per diluted share is expected to be in a range of $4.75 to $4.95 versus previous guidance of $4.70 to $5.00, according to the company.

For full year 2022, Wabtec said it expects “strong cash flow generation with operating cash flow conversion greater than 90%.”

“Looking forward, Wabtec is well-positioned to drive long-term profitable growth as the team continues to deliver for our customers and execute against our value creation framework,” Santana said. “Our technologically differentiated portfolio of products and solutions, combined with our global installed base and multi-year backlog will allow us to capitalize on growth opportunities while remaining highly resilient.”

The Wabtec website provides more earnings details.

The Cowen Insight

“The quarter was an EPS beat, and EPS guidance was narrowed, with the midpoint unchanged, despite lowered revenue guidance on currency headwinds,” Cowen and Company Transportation Equipment Analyst Matt Elkott reported. “The margin performance exceeded our and Street expectations somewhat. The third-quarter 2022 backlog declined slightly sequentially but saw solid year-over-year (y/y) growth (up $0.77 billion, $1.52 billion on a constant currency basis). We note that the second-quarter 2022 backlog had reflected the Union Pacific modernization order.”

Key Cowen Takeaways:

• “The results are solid but in line with our neutral near-term view into the print. Our constructive overall view remains intact.

• “Third-quarter 2022 adjusted EPS of $1.22 beat our and the consensus estimate of $1.21. Adjusted operating income of $341 million beat our and consensus estimates of $329 million and $332 million, respectively.

• “Low-end and high-end of 2022 EPS guidance were updated with a new range of $4.75-$4.95 vs. prior guidance of $4.70-$5.00. Midpoint of $4.85 remains unchanged, despite lowered revenue guidance on currency headwinds.

• “The third-quarter 2022 backlog declined slightly sequentially but saw solid y/y growth (up $0.77 billion, $1.52 billion on a constant currency basis). We note that the second-quarter 2022 backlog had reflected the Union Pacific modernization order which is worth north of $1 billion. Union Pacific announced its deal with Wabtec for 600 locomotive modernizations on July 27.”

In related developments, Wabtec last month celebrated 10 years in Fort Worth, Tex.