Cowen: Who Will Win the Locomotive Race?

Written by Matt Elkott, Transportation OEM Analyst, TD Cowen

Matt Elkott

Cowen and Company examines whether Caterpillar, Inc. could explore strategic alternatives for its transportation business, or at least the rail piece. An enterprise value-to-revenue multiple of 2.5x-2.75x may not be unreasonable, putting the transportation business value at approximately $12 billion.

We don’t know the exact rail revenue contribution, but it’s a sizable portion. Potential acquirers cannot include Wabtec Corp., but a deal could be positive for both companies.

Caterpillar’s management said on the fourth-quarter 2022 earnings call on Jan. 31: “We believe opportunities exist for new locomotives, overhauls, re-powers and modernizations, but at lower levels than previously forecasted and occurring over a longer time horizon.”

We believe the tempered tone may be more specific to Caterpillar (either as a strategic adjustment or due to competitive pressure) than it is a function of market conditions. Our view is based in part on the following:

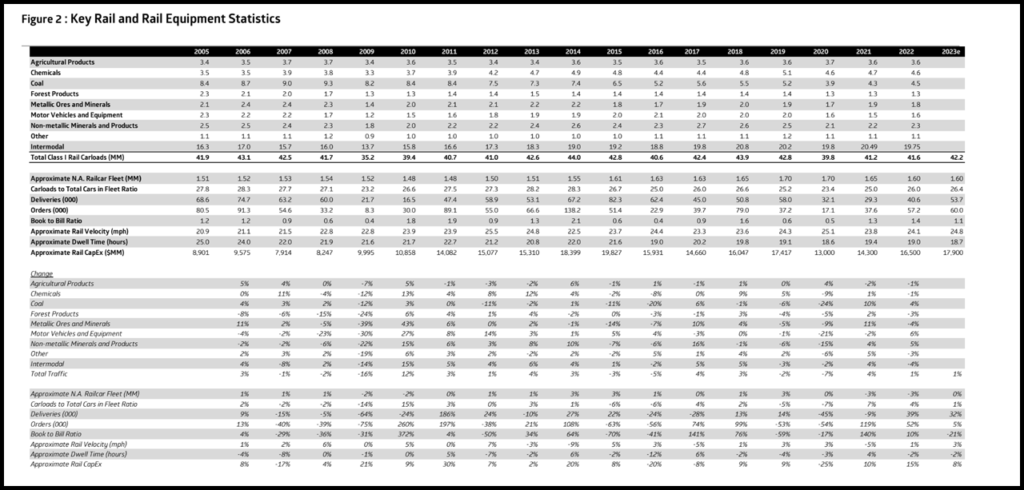

1. We see Class I railroad capex growing in the high single-digits this year, solidly in excess of rail inflation (Figure 2, below). That’s a level supportive of continued rolling stock investment and comes on the heels of mid-teens growth in 2022.

2. We’re projecting approximately 1.5% rail traffic growth this year. While this is modest and still below 2019 (by about 1.5%), the carriers have been scrambling to improve service further in order to take on more freight. Labor has been a key challenge over the last year, but modernizing more of the power fleet is an important lever for optimizing network fluidity.

3. International markets for locomotives remain fairly solid. North American freight locomotive manufacturing is effectively a duopoly. Wabtec has roughly 65%, with Caterpillar’s Progress Rail having the rest. The share-split tilts even more heavily in Wabtec’s favor for new demand, possibly exceeding 80%, especially with new builds.

Although that may not mean much given that the new-build market has been anemic to non-existent for a few years, a build cycle should eventually emerge once the industry is more clearheaded about what technology to coalesce around. Having Wabtec’s kind of scale has many advantages, not the least of which is software uniformity. All that being said, Progress Rail, which traces its roots back 100 years, has long been a formidable competitor. Additionally, as much as the railroads value a greater degree of seamless interoperability, they’re likely reluctant to be increasingly captive to one supplier in the long term. Regulators may share that sentiment. But Wabtec’s scale and focus on rail equipment as its core business may put Caterpillar at a bit of a disadvantage.

As far as we can tell, Caterpillar has not hinted at strategic alternatives for its rail business and likely sees know-how synergies with the electrification and hydrogen work it’s doing in other segments. What’s more, it can be argued that it would be somewhat unusual for a management team to highlight tempered conditions of a business it is hoping to sell.

Even so, we believe a sale cannot be ruled out completely in a challenging competitive environment and if the company deems it beneficial for focusing on its core off-highway businesses. It is not hard to see why Wabtec would be ruled out as a potential acquirer, as such a deal would give it substantially all the North American freight locomotive market—something that would not sit well with regulators and railroads. The acquirer would likely have to be a large industrial manufacturer such as Siemens AG, to whom rail is one of the core areas. Like Progress Rail, Siemens has capabilities in both freight and transit trains. Siemens on Jan. 16 reported that it was awarded an approximately $3.5 billion order from India for 1,200 freight locomotives and 35 years of full service maintenance. That’s the largest locomotive order in the company’s history.

Other acquirers could include private-equity or rail-equipment lessors, but we believe such a scenario may involve breaking up Caterpillar’s rail segment into existing assets (railcars and locomotives) to be taken on by private equity or lessors, while manufacturing is sold separately to an industrial manufacturer. Unlike what Caterpillar did with its retreat from on-highway engines to focus on its off-highway core businesses, we do not see the company just gradually phasing out its locomotive manufacturing business as this would eventually result in a near-monopoly in North America. On-highway truck manufacturing in North America is an oligopoly, while freight locomotive manufacturing is a near duopoly.

Beyond our own analysis, we do not have any concrete reasons to believe Caterpillar would sell its transportation business or the rail sub-segment. But if it does, we believe it could be well-received by investors, assuming a compelling price that would free up capital for shareholder return as well as to invest in construction, mining, oil and gas, power generation, and industrial equipment segments that are considered by many investors as more core to

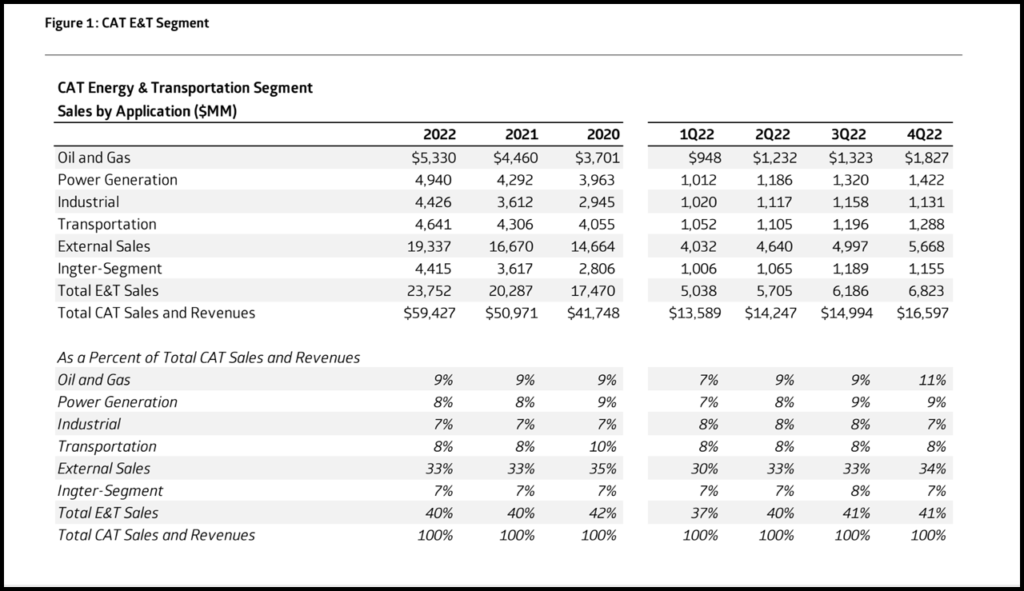

Caterpillar. Transportation is 8% of total Caterpillar revenue (Figure 1, below), and the rail sub-segment is likely less than 5% of total Caterpillar revenue.

Such a deal could also be viewed positively by Wabtec investors as it could be seen as a testament to the company’s competitive advantage. Additionally, a deal by a competitor would inherently create uncertainty and transitory hiccups around the integration, which could concern some rail customers. Longer term, it’s plausible that competitive pressure would intensify again, but in any case, Wabtec’s market position is clearly enviable.

As was our view on Caterpillar, we are cautious on Wabtec into the fourth-quarter 2022 print but remain constructive overall.