HFCTA Hydrogen Fuel Cell Overview

Written by Gordon V. Jefferson, President; and Jenalea Smith, Associate, Hydrogen Fuel Cell Train Association

The purpose of this article is to acquaint the reader with most Hydrogen Fuel Cell (HFC)-powered passenger trainsets, locomotives and streetcars that are commercially available, in development, or planned. In addition, the reader is introduced to examples of European national hydrogen fuel plans including the scope of HFC powered rail transportation.

The U.S. Department of Transportation has not offered similar plans. Thus, the U.S. does not have a national plan for the use of clean energy, zero-emission hydrogen fuel for the railroad industry.

The USDOT/FRA (Federal Railroad Administration) issued its Study of Hydrogen Fuel Cell Technology for Rail Propulsion and Review of Relevant Industry Standards document in June 2021. Despite the positive conclusion, neither the FRA nor the USDOT have actively pursued HFC locomotive powering.

The U.S. Department of Energy (DOE) on Feb. 24, 2022 released its Comprehensive Strategy to Secure America’s Clean Energy Supply Chain document. There is also its DOE Hydrogen Strategy. Neither document addresses HFC powered rail transportation. Again, when it pertains to HFC powered trains, the U.S. does not have a comprehensive policy.

The U.S. Environmental Protection Agency (EPA) establishes pollution standards. The current standard for off-road diesel engines, including prime-movers in diesel-electric locomotives, is Tier 4. Some U.S. railroads have made diesel locomotive purchases that comply with Tier 4 specifications. One example is Amtrak’s purchase of Siemens-built ALC-42 locomotives equipped with Tier 4 Cummins QSK95 engines. In this article, we address the issue of incentivizing U.S. railroads to transition diesel locomotives to zero-emission HFC.

How does a fuel cell function? In brief, an HFC is composed of a membrane, cathode and anode. As hydrogen gas is passed through the membrane, an electrical current is generated between the anode and the cathode. The electrical energy is temporarily stored in a battery. Multiple HFCs are stacked together with combined electrical energy fed to the storage battery. The number of HFCs stacked is determined by the electrical energy required to perform a desired function.

A diesel-electric locomotive uses a traction alternator (electrical generator) driven by the diesel engine to power traction motors. An HFC powered locomotive replaces the diesel engine and traction alternator with an HFC stack that provides the battery with the required electrical output for the traction motors.

Benefits of HFC

As an alternative to diesel power, HFC offers no fossil fuel combustion, as the HFC process is a chemical one. There are no hydrocarbon emissions (particulate matter, carbon dioxide, carbon monoxide, oxides of nitrogen). The only byproducts of the HFC process are heat and water. There are fewer moving parts, thus less maintenance.

As an alternative to electrification, there is no need for expensive catenary and its associated infrastructure (i.e., substations, transformers), because all HFC electrical energy is generated on board the vehicle. Eliminating catenary significantly reduces construction cost per track-mile and associated maintenance costs. A managed HFC system does require infrastructure (i.e., generation, storage, transport, and dispensing), but its cost is equivalent tro that of only a few track-miles of electrification.

HFC Train Manufacturers and Programs

Alstom, France, produces the Coradia iLint, the world’s first HFC powered passenger trainset in revenue service. The Coradia iLint has a passenger capacity of 300, top speed of 140 kph (87 mph), and an 800 km (497 mile) range before refueling is needed. It is operational in (or planned for) Germany, Austria, Poland, The Netherlands, United Kingdom and Italy. The Alstom “Breeze,” exclusive to the United Kingdom and expected to be operational during 2022, is similar to the Coradia iLint, but differs in architecture.

Stadler Rail, Switzerland, produces the FLIRT H2. It has a passenger capacity of 108, top speed of 130 kph (79 mph), and a 1,000 km (621 mile) range before refueling is needed. In the U.S., the Stadler FLIRT Arrow is expected to be in revenue service by 2024, on the OmniTrans system in San Bernardino County, Calif. It will be the first of its type in the U.S. The San Bernardino County Transportation Authority (SBCTA) awarded the contract to Stadler.

Siemens Mobility, Germany, produces the Mireo Plus H trainset. Currently testing in Bavaria, it has a top speed of 160 kph (99 mph) and 1,000 km (621 mile) range. Passenger capacity is to be determined.

Talgo, Spain, says its Vittal-One HFC trainset will be ready in 2023. Last year, it began validation testing. The company says it has designed its fuel cell technology “in a modular manner so that it can be installed on all types of trains and allow diesel trains to be switched to hydrogen operation.”

In the U.K., the University of Birmingham Centre for Railway Research and Education (BCRRE), in partnership with railway rolling stock company Porterbrook, has developed the HydroFLEX. The project involved conversion of an existing Class 319 trainset from diesel-electric propulsion to HFC, giving it the ability to run on hydrogen power on non-electrified routes. The HyfroFLEX became operational in September 2020. Plans call for many more Class 319 conversions by 2040.

In Estonia, OÜ Stargate Hydrogen last year signed a letter of intent with AS Operail to convert diesel-electric locomotives to HFC. After the conversion, the locomotives will operate as switchers. The project has two phases. First, a prototype will be constructed by the end of 2022. In the second phase, OÜ Stargate Hydrogen and AS Operail will convert an additional 40 locomotives. Each converted locomotive is expected to save 370 tonnes of CO2 emissions per year.

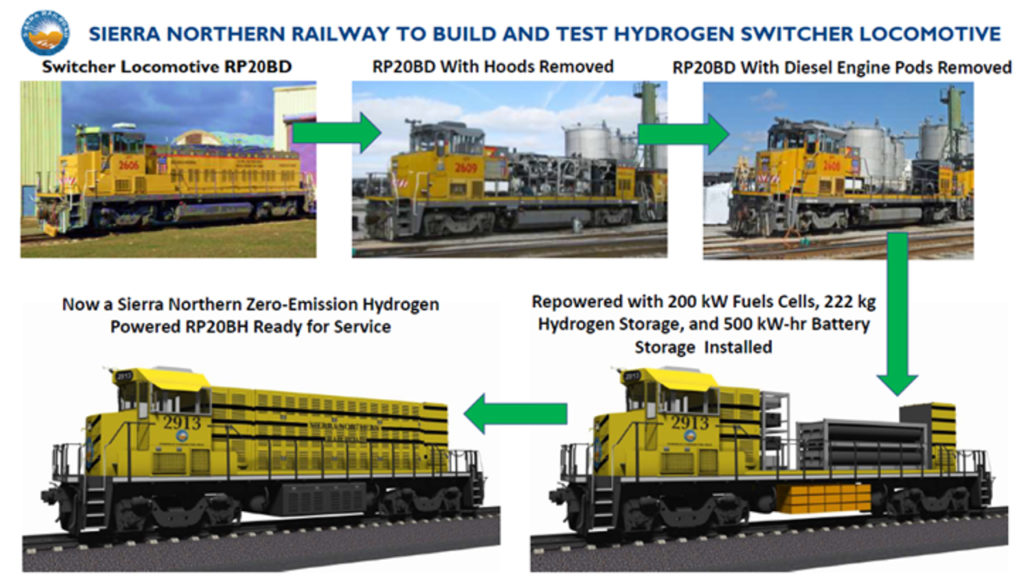

In the U.S., Woodland, Calif.-based Sierra Northern is converting a RailPower RP20BD diesel locomotive to an HFC-powered RP20BH switcher with partial funding of $4 million from the California Energy Commission (CEC). SoCalGas was named a technical partner and is providing additional funding. The new zero-emission switcher will integrate HFC, hydrogen storage, advanced battery and systems control technologies. Sierra Northern is serving as technical lead for the project; GTI, a Des Plaines, Ill.-based non-profit research, development and training organization, is the formal CEC applicant. Other technical partners are Railpower Tech LLC, Ballard Power Systems, Optifuel Systems LLC, UC Davis Institute of Transportation Studies, Valley Vision, Velocity Strategies, Frontier Energy and the Sacramento Metropolitan Air Quality Management District.

TIG/M LLC, Chatsworth, Calif., offers HFC streetcars. The company, which describes itself as “an innovative turn-key design/builder of street-running public transportation rail systems,” points to HFC’s elimination of catenary“or any other type of wayside power systems, resulting in savings of up to 50% in infrastructure construction and lifetime system maintenance costs. Each of our vehicles are powered by a battery-dominant hydrogen/electric propulsion system. Two large LiFePO4 traction battery banks are supplemented by regenerative braking and an on-board electric generator set, if required, to keep the batteries within a predetermined range of state. The generator set is self-contained and can be swapped out in about an hour. Our preference for the generator is hydrogen fuel cell, but our clients may choose H2, LPG or CNG as the fuel for this function. The overall configuration is project specific and designed for 20 hours of uninterrupted passenger service per day while maintaining at least 30% surplus power in the traction battery, thereby avoiding deep-cycles and extending the battery service-life.” TIG/m conducted the first U.S. HFC streetcar demonstration in Santa Cruz in October 2021, with a large local public attendance, including all HFCTA (Hydrogen Fuel Cell Train Association) members.

In the U.S., General Motors last year signed a deal to develop locomotives powered by an HFC/battery system. Under a nonbinding agreement with Wabtec, GM batteries and hydrogen technology will be used. The HFC systems will be assembled at a factory in Brownstown Township, Mich., near Detroit, that is a joint venture with Honda. GM and Honda have been working to jointly develop HFC vehicles. Wabtec already has built a battery-powered locomotive prototype, the FLXdrive.

In the U.S., BNSF, Caterpillar, Inc. and Chevron U.S.A., Inc. have teamed on a locomotive pilot to “confirm the feasibility and performance of hydrogen fuel for use as a viable alternative to traditional fuels for line-haul rail.” The companies, which made the announcement on Dec. 14, have signed a memorandum of understanding (MOU) for the project. Progress Rail, a Caterpillar company, will design and build a prototype HFC-powered locomotive for line-haul and/or other rail service; Chevron will develop the fueling concept and infrastructure; and BNSF will make available its lines for prototype testing.

In Canada, Canadian Pacific’s line-haul HFC locomotive, equipped with Ballard Power Systems technology, began operational testing in January 2022. CP’s locomotive is the HSOEL, which stands for Hydrogen Zero Emissions Locomotive.

In China, CRRC (China Railway Rolling Stock Corp.) has deployed an HFC switching locomotive. It has a top speed of 80 kph (50 mph) and a 972 km (600 mile) range.

Availability, National Programs and Goals

The availability of HFC trains for regional/commuter passenger rail networks in the U.S. is immediate using vehicles like Alstom’s HFC Coradia iLint. Acceptable results from the San Bernardino County Transit Authority experiment may provide an incentive for additional commuter rail networks to transition to zero-emission HFC powered trains.

However, the road to zero emissions appears bumpy. Only a few U.S. passenger railroads have acquired EPA Tier 4 diesel-electric locomotives, Amtrak among them, with the Siemens ALC-42 and its companion, the Charger, acquired by several state DOTs for regional use.

According to DieselNet, on Nov. 3, 2021, the California Air Resources Board (CARB) “held the first public workshop on the development of Tier 5 emission standards that will seek to further reduce NOx and PM emissions from off-road engines by 50-90%—depending on the engine power category—in the 2028-2030 timeframe. CARB has not yet released a formal Tier 5 proposal—rather, a number of concepts have been presented with the intention to solicit feedback from engine manufacturers and other stakeholders. The considered Tier 5 regulation is structured in a similar way to the California low NOx regulation for heavy-duty on-road engines—it includes more stringent emission limits, a new low load certification test cycle, and extended emission durability periods. However, the considered Tier 5 emission limits and other regulatory changes are somewhat less stringent compared to the on-road engine program. As was the case with the on-road regulation, a low NOx off-road demonstration project is being conducted by the SwRI. For the CARB Tier 5 emission standards to be meaningfully effective, the elephant in the room is the cooperation of the EPA. Without a corresponding non-road engine regulation by the EPA, California-only Tier 5 standards would have a limited scope and could produce only very limited emission reductions.”

Germany’s HFC trains usage plan is based upon Germany’s National Hydrogen Strategy. The U.K.’s usage plan is based upon its Hydrogen Law and Regulation in the United Kingdom document. The U.K. government also has a Transport Decarbonisation Plan.

The current EPA standard for new diesel-electric locomotives is Tier 4. Such locomotives are far more expensive. As a result, the Class I railroads have acquired very few new units since the standard went into effect, even though they are available from Wabtec and EMD (Progres Rail). They have chosen instead to rebuild and repower older (Tier 0 and 1) units to Tier 3 standards, which are about half the cost. Some railroads, like Union Pacific, working with the OEMs, have decided to increase the percentage of bio-diesel in their locomotive fuels. Tier 4 locomotives, as noted above, have been acquired by Amtrak from Siemens Mobility.

CARB is establishing regulations that provide incentives for the entire state to comply with Governor Gavin Newsom’s Executive Order N-79-20, that all vehicles be net-zero emissions by 2045, including elimination of new fossil fuel vehicles by 2035. The trucking industry is preparing to comply with CARB’s regulations by developing battery electric and hydrogen fuel cell power trucks. Many bus companies are also complying.

FURTHER INFORMATION

List of Hydrail manufacturers as of 2020, compiled by Stan Thompson.