Greenbrier 3Q22: $3.6B Backlog, 97.5% Lease Utilization (UPDATED July 13, Cowen)

Written by Marybeth Luczak, Executive Editor

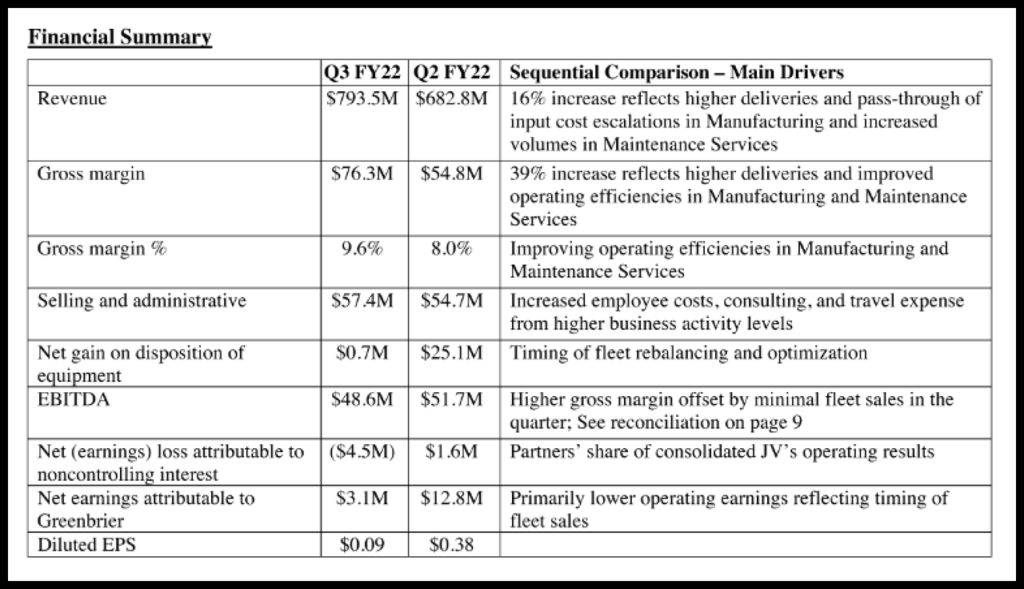

While The Greenbrier Companies posted “strong operating results” in the third fiscal-quarter ending May 31, 2022—with lease fleet utilization at 97.5%, deliveries at 5,200 units and a $3.6 billion backlog—the “performance was partially offset by inflation and the impact of the war in Ukraine,” President and CEO Lorie Tekorius said during a July 11 report.

“Pass-through of input cost escalations protect Greenbrier when raw material prices spike, but dilute margin percentages,” continued Tekorius, who took the throttle at Greenbrier on March 1 and was elected to the Board of Directors the same month.

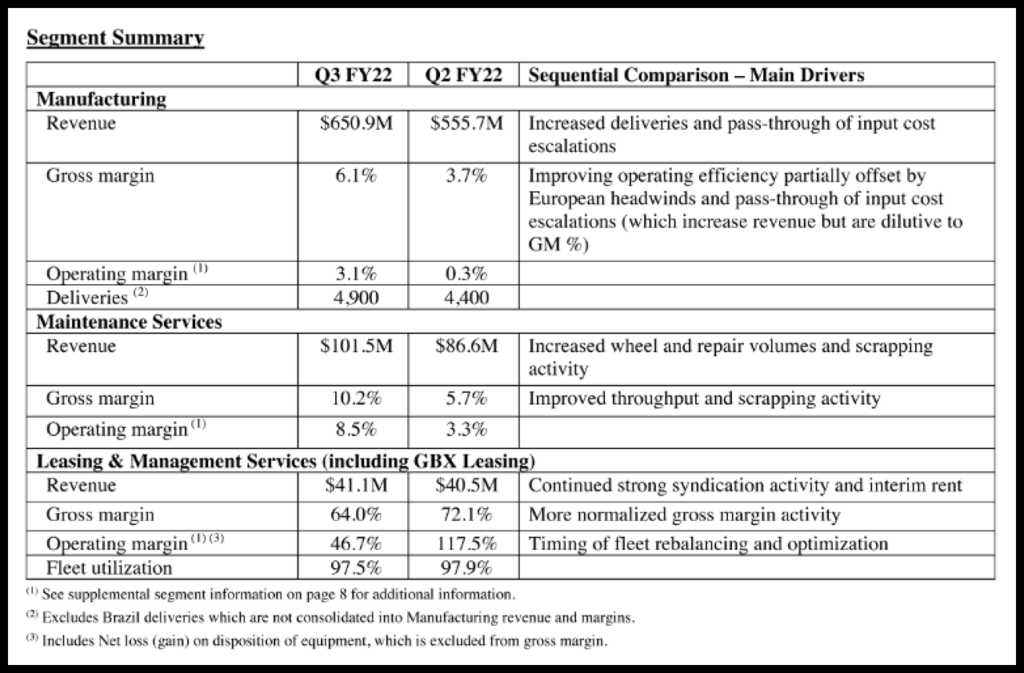

“In Europe, the war triggered a pause in order activity after securing orders for 2,300 railcars in the first two quarters of our fiscal year,” she said. “In recent weeks, European buyers are returning to the market and our sales pipeline is active. Lease syndications and Maintenance Services helped to balance our quarterly results, underscoring the value of Greenbrier’s diverse business activities. Uncertainty in the U.S. economy remains an ongoing challenge, but our operations continue to build momentum. When confronted with difficult externalities, Greenbrier has a proven ability to produce value through our integrated platform.”

Following are Greenbrier’s third quarter 2022 highlights:

• New railcar orders for 5,000 units (valued at $670 million) and deliveries of 5,200 units resulted in a book-to-bill of nearly 1.0x, according to the company, which noted that orders primarily originated in North America “as Europe navigates the continued impact of the war in Ukraine.”

• Diversified new railcar backlog as of May 31, 2022 was 30,900 units (valued at $3.6 billion). Not included in that total is Greenbrier’s railcar refurbishment backlog of 3,100 units (valued at more than $220 million).

• Lease fleet utilization came in at 97.5%.

• Greenbrier reported that gross margin and gross margin percent “increased sequentially as improvement in North American Manufacturing and Maintenance Services offset headwinds from Europe and pass-through of input cost escalations.”

• Net earnings came in at $3.1 million, or $0.09 per diluted share, on revenue of $794 million, according to the company.

Business Update and Outlook

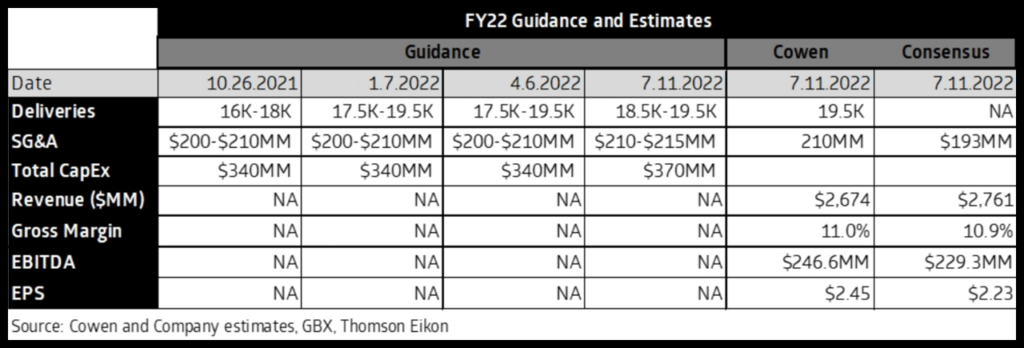

Based on current business trends and production schedules for fiscal 2022, Greenbrier said it anticipates deliveries of 18,500-19,500 units, including approximately 1,500 units in Greenbrier-Maxion (Brazil). Additionally, it expects selling and administrative expense to be $210 million to $215 million, and capital expenditures of approximately $310 million in Leasing & Management Services, $50 million in Manufacturing, and $10 million in Maintenance Services. “Net of proceeds of equipment sales of approximately $155 million, capital expenditures in Leasing & Management Services will be $155 million,” according to the company.

More earnings report details can be found on the Greenbrier website.

The Cowen Insight

“We had been cautious on Greenbrier (GBX) into the print,” Cowen and Company OEM Transportation Analyst Matt Elkott reported on July 13. “We believe the bar has been reset. As the industry fleet approaches full utilization (approximately 82% vs. 68% at the mid-2020 bottom), a manufacturing expansion is largely inevitable, but the cadence and magnitude will be a function of interest rates; steel; North American rail conditions; and, in GBX’s case, Europe.

“We’re introducing our Calendar Year 2023 EPS estimate of $3.60 (FY23 $2.93). We’re lowering our P/E multiple from 15x to 13x—one turn to reflect the valuation change from CY22 to CY23, and one turn to account for continued macro uncertainty, including the conflict in Europe, where GBX has operations. As such, our price target drops to $47, from $54. GBX’s deliveries and earnings tend to be second-half weighted, and we are modeling for that to continue, albeit to a less pronounced extent due to the disruption of normal patterns by variables like steel, interest rates, supply chain issues, and the Europe conflict, all amid tightening railcar supply. As the industry fleet approaches full utilization (approximately 82% vs. 68% at the mid-2020 bottom), a manufacturing expansion is largely inevitable, even if the steel decline benefit is offset by higher interest rates. The cadence of the recovery, however, and any step-function increases along the way will depend on the aforementioned variables.

“For GBX, we are modeling for modest and steady sequential production upticks through fiscal fourth-quarter 2023, leveling off in fiscal first-quarter 2024, which is the company’s November 2023 quarter and the farthest our forecast goes. It is plausible that deliveries would then stay at or slightly below those levels for a few more quarters, while manufacturing gross margins trend along the low-to-mid teens. This would be a positive scenario for FY24 earnings.”

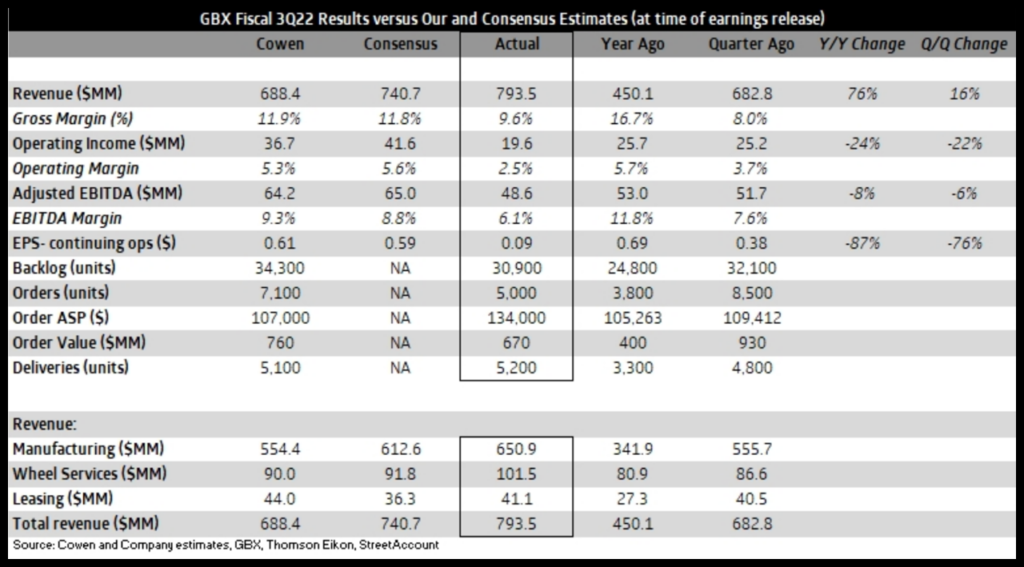

GBX 2Q22 Results

“EPS of $0.09 was a miss compared to our estimate of $0.61 and consensus of $0.59, but we estimate non-core items had an approximately $0.20 net negative impact on results relative to our model,” Elkott reported on July 11. “GM improved sequentially but was a miss. Elevated input costs and impacts of the war in Europe were among the culprits. We expect order activity to improve.

“The results affirm our near-term caution into the print, but we believe the company is well-positioned for a likely uptick in orders and a strong manufacturing up-cycle over the next couple of years.

“Net gains on asset sales were well below our estimates, resulting in an approximately $0.21 negative impact compared with our model. Other negative impacts relative to our model were interest and foreign exchange, net income attributable to non-controlling interest, and the share count. On the flip side, tax and earnings from unconsolidated affiliates helped the results compared with our model. The net negative impact of non-core items was approximately $0.20, without which EPS would have been closer to $0.29.

“The low end of the delivery guidance was raised. Total capex guidance was raised. The gross margin improved sequentially, but was a miss. Elevated input costs and impacts of the war in Europe were among the culprits.

“The stock is likely to come under pressure today, creating a unique buying opportunity in our view for patient investors wishing to capitalize on a looming manufacturing up-cycle.”