Trinity’s Savage: ‘Busy’ Start to 2023 (TD Cowen Update, May 4)

Written by Marybeth Luczak, Executive Editor

“The start of 2023 was busy at Trinity as we continued to ramp up production and optimize our business,” Trinity President and CEO Jean Savage said.

While lease rates and utilization improved in first-quarter 2023 for Trinity Industries’ Railcar Leasing and Management Services Group, margins in the Rail Products Group “continue to reflect headwinds,” according to President and CEO Jean Savage, who said during a May 2 financial report that company officials are “optimistic about what Trinity can accomplish in 2023.” TD Cowen weighs in on May 4.

The start of the year “was busy at Trinity as we continued to ramp up production and optimize our business,” Savage continued. “We also completed the acquisition of [software logistics services and terminal management solutions provider] RSI Logistics in the first quarter and have been very encouraged by customer feedback that reinforces our strategy to grow this business.”

Trinity reported total company revenues of $641.7 million for the three months ending March 31, 2023, up 36% from the prior-year period’s $472.7 million. It attributed this to “higher volume of, and improved pricing on, external deliveries in the Rail Products Group.” Additionally, quarterly GAAP and adjusted earnings from continuing operations were $0.09 and $0.07 per diluted share, respectively, for first-quarter 2023.

Rail Products Group revenues came in at $637.8 million in first-quarter 2023, rising 63.08% from $391.1 million in 2022. The company said this reflects a “higher volume of deliveries and favorable pricing, partially offset by the mix of railcars sold.” In the three months ending March 31, 2023, the Group delivered 4,045 railcars; received orders for 2,690 railcars, valued at $300.8 million; and had a backlog value of $3.7 billion. This compares with first-quarter 2022’s 2,470 railcars delivered; 5,055 railcars ordered, valued at $634.7 million; and a backlog value of $1.9 billion.

In this Group, “we are seeing improvement in hiring and retention, rail service levels and supply chain challenges,” Savage said. “This gives us confidence that we will continue to see margin improvement through the year, and Trinity will take advantage of the operating leverage in this business.”

For the Railcar Leasing and Management Services Group, revenues were $203.5 million in first-quarter 2023, up 11.14% from the prior-year period’s $183.1 million.

In this Group, “lease rates and utilization improved again,” Savage said. “The Future Lease Rate Differential improved sequentially to 44.3%, giving us optimism about lease rates continuing to increase this year. Additionally, our lease fleet utilization of 98.2% shows customer demand remains robust, further supporting strength in this market.”

2023 Guidance

Trinity offered the following guidance for the year ahead:

- Industry deliveries of 40,000 to 45,000 railcars.

- Net investment in the lease fleet of $250 million to $350 million.

- Manufacturing capital expenditures of $40 million to $50 million.

- Confirming EPS of $1.50 to $1.70, which Trinity said “excludes items outside of our core business operations” and which Savage added “reflects revenue and margin improvement through the year.”

More details can be found on Trinity Industries Investor Relations site.

TD Cowen Insight: ‘Maintaining EPS Estimates and Target; Near-Term Upside Limited’

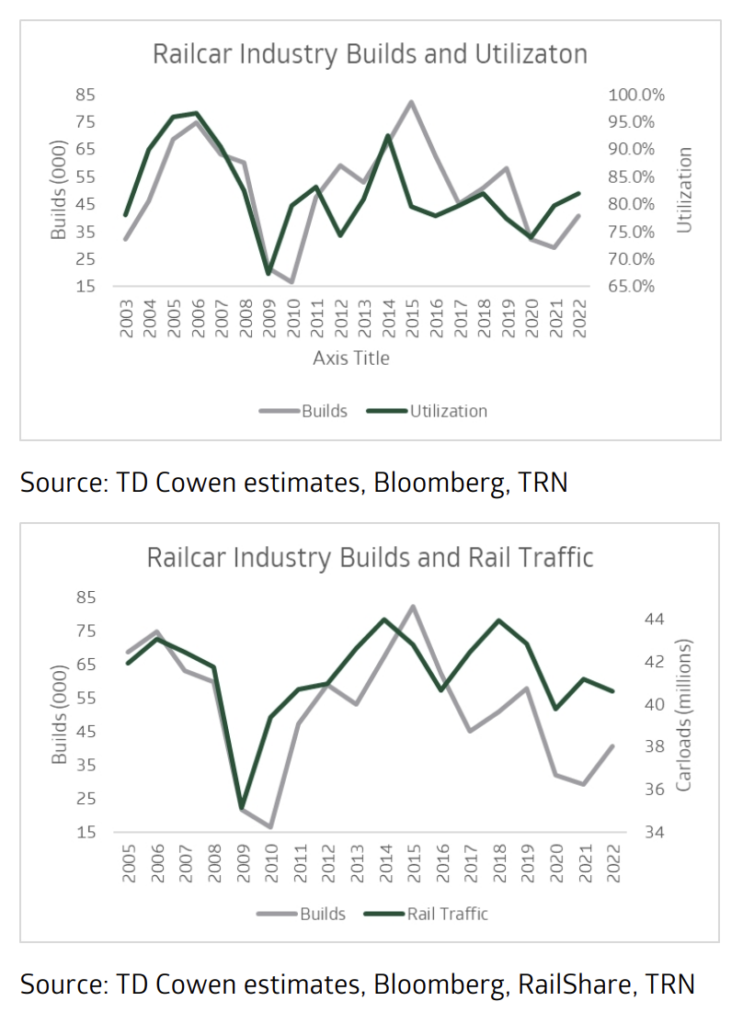

“Frustration is likely to linger about execution, which has not been helped by an anomalous cycle marked by labor and component tightness that has hit the narrow railcar manufacturing sector harder than others with scale,” TD Cowen Freight Transportation Equipment Analyst Matt Elkott reported May 4. “It could take more than one solid quarter for significant share price upside to materialize, but a historical look reveals more demand fulfillment is needed.

“Railcar industry builds have lagged utilization directionally in the last three years for the first time in over a decade. Production in the last three years has been tempered by high steel prices, then labor and component shortages. And now interest rate hikes and economic uncertainty are likely to keep production from significantly exceeding replacement demand in the next two years. Assuming rail traffic begins to stabilize (we are expecting a full year decline of approximately 1% compared to the year-to-date decline of approximately 4%; we’re expecting approximately 2% growth next year), the combined last three years of railcar production 15% below replacement should support continued strength in lease rates and secondary market valuations—two key sources of income for Trinity. On the manufacturing side, we are modeling for the increase in deliveries this year to occur at a 6.6% margin (up from 2.8% last year) and an exit rate of 9.5%, which should carry into next year.”