FCA 1Q23: Gross Margin, Profitability Improvements (UPDATED May 12, TD Cowen)

Written by Marybeth Luczak, Executive Editor

(FCA Photograph)

Reflecting continued efforts to ramp up the Castaños, Mexico factory and to mitigate supply-chain challenges, FreightCar America, Inc. (FCA) “experienced sequential improvement” in gross margin and profitability in first-quarter 2023, according to President and CEO Jim Meyer.

The railcar manufacturer on May 8 reported financial results for the three-months ended March 31, 2023.

Among the highlights:

- FCA’s first-quarter revenues were $81.0 million on deliveries of 738 railcars. This compares with fourth-quarter 2022 revenues of $129.0 million on deliveries of 1,150 railcars, and with first-quarter 2022 revenues of $93.2 million on deliveries of 783 railcars.

- The company logged orders for 1,960 railcars in first-quarter 2023. Quarter-end backlog totaled 3,667 railcars for an aggregate value of some $413 million. At the end of fourth-quarter 2022, backlog totaled 2,445 railcars with an aggregate value of approximately $288 million. At the end of first-quarter 2022, backlog totaled 1,380 cars with an aggregate value of about $137 million.

- Gross margin came in at 9.2% with gross profit of $7.5 million, vs. gross margin of 3.6% with gross profit of $4.6 million in the prior quarter, and gross margin of 10.8% with gross profit of $10.1 million in first-quarter 2022.

- “[A]ccounting primarily for non-cash income associated with the change in fair market value of warrant liability,” FCA reported a net loss of ($5.0) million, or ($0.19) per share, and an adjusted net loss of ($5.7) million, or ($0.21) per share.

- Adjusted EBITDA was $2.1 million, compared with adjusted EBITDA of $1.2 million in the prior quarter and adjusted EBITDA of $3.3 million in first-quarter 2022.

FCA reported signing a “deal to issue non-convertible preferred stock with [a] financial partner to reduce debt and provide additional growth capital.”

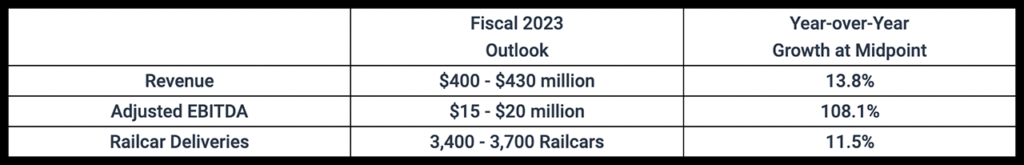

Fiscal Year 2023 Outlook

The manufacturer said it “reaffirmed” its outlook for fiscal year 2023, providing the following details:

“We continue to feel confident in our ability to approximately double adjusted EBITDA this year while continuing to expand the new manufacturing campus,” Jim Meyer said. “Our production schedule is essentially full for 2023, and we are now heavily focused on next year.”

Added FCA CFO Mike Riordan: “Given our strengthening order backlog, we are increasingly confident in our outlook. … Going forward, our organization is focused on executing and delivering the business in-hand, continuing to build backlog for next year, and creating opportunity for further improvement in our capital structure.”

For more financial details, visit the FCA Investors’ webpage.

TD Cowen Insight: ‘In-Line Quarter; Guidance Unchanged; Maintaining Estimates and Target’

“The first uneventful, in-line quarter in recent years could portend a better hold on execution in future periods as a result of the company’s operational plan of the last couple of years,” TD Cowen Freight Transportation Equipment Analyst Matt Elkott reported May 11. “It could take more than one solid quarter for significant share price upside to materialize, but a historical look reveals more demand fulfillment is needed.”

“FreightCar America reported first-quarter 2023 results generally in-line with its own expectations as well as our and consensus estimates,” Elkott continued. “While guidance was largely unchanged, we sensed a more positive tone from management in the release and on the call. Orders of 1,960 units exceeded our estimate of 1,300 units (Trinity Industries and GATX orders were somewhat below our estimates).

“The company’s manufacturing lines are largely full for the remainder of the year, and we estimate that at least 20% of the quarter-end backlog stretches beyond 2023; and current inquiry and order activity remains solid.

“We’re encouraged by the progress, but remain on the sidelines as we monitor the sustainability of the execution improvement as well as industry and macro variables.”