Greenbrier: $3B Backlog in 1Q22, ‘Strengthening’ Market Demand

Written by Marybeth Luczak, Executive Editor

“Order intake for the quarter was more than 35% of all new orders received during fiscal 2021,” Furman said during Greenbrier’s first-quarter 2022 earnings announcement on Jan. 7.

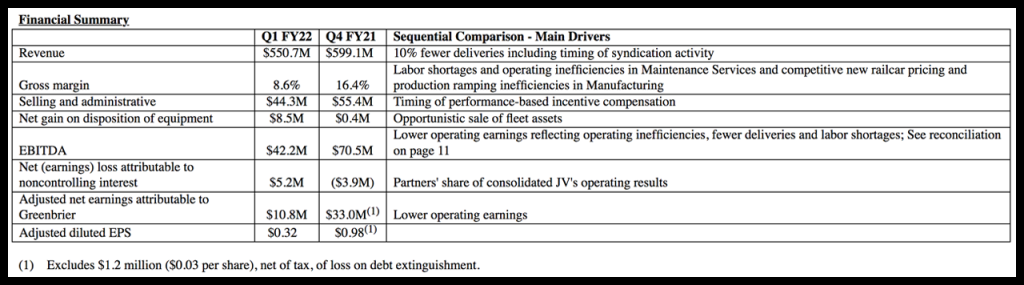

“During the first fiscal quarter of 2022, Greenbrier achieved its fourth consecutive quarter with a book-to-bill ratio exceeding 1.0x amid the strengthening demand environment,” Chairman and CEO William A. Furman reported on Jan. 7; net earnings came in at $11 million, or $0.32 per diluted share, on revenue of $551 million.

“Order intake for the quarter was more than 35% of all new orders received during fiscal 2021,” Furman said during Greenbrier’s first-quarter earnings announcement for the three months ending Nov. 30, 2021.

New railcar orders for 6,300 units (valued at $685 million) and deliveries of 4,100 units drove the book-to-bill, which was 1.5x, according to the company.

Diversified new railcar backlog for the quarter was 28,000 units (valued at $3.0 billion). Not included in that total is Greenbrier’s railcar refurbishment backlog of 3,500 units (valued at $200 million) for delivery during fiscal 2022 and 2023. Greenbrier said the refurbishment program in the first quarter received orders to rebody 1,400 units.

Subsequent to the quarter end, Greenbrier reported two “important strategic developments”:

1. A collaboration with U.S. Steel and Norfolk Southern (NS) to develop what it called a “new, sustainable high-strength steel gondola railcar,” with an NS order of 800 units. The partnership, said Furman, “brings significant benefits to all three companies and the entire freight transportation industry, helping lead the way to a net-zero carbon economy.” (For details, read “First Look: New ‘Green’ Gondola From U.S. Steel, NS, Greenbrier.”)

2. Membership in the RailPulse coalition “to support the aggregation of North American railcar fleet data on a single platform,” Greenbrier said. “Increased safety and operating efficiency and enhanced visibility of customer goods are two of the coalition’s primary goals.” (For details, read: “Greenbrier Joins RailPulse Coalition.”)

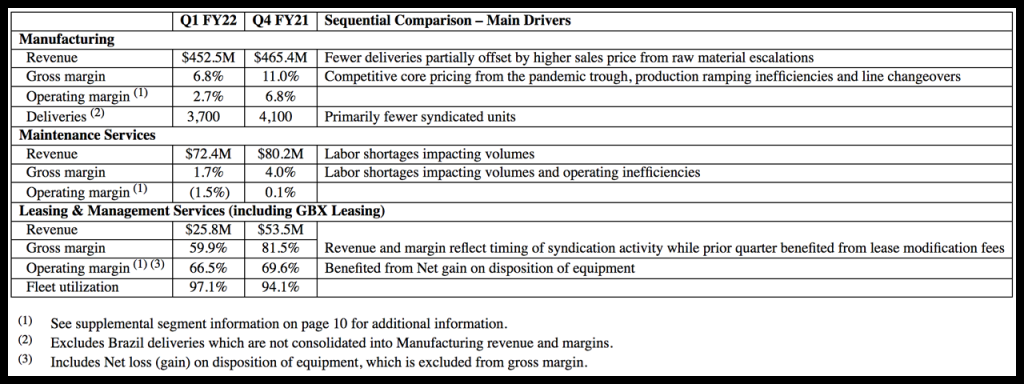

In first-quarter 2022, Greenbrier renamed two of its business segments “to more closely align with the nature of customer solutions provided.” While the Manufacturing segment name did not change, Wheels, Repair & Parts became Maintenance Services, and Leasing & Services became Leasing & Management Services. “The name changes have no impact on financial information previously reported,” Greenbrier said. “However, effective September 1, 2021, we also changed the measurement basis for allocating syndication revenue between Manufacturing and Leasing & Management Services. This change reflects how management assesses operating performance consistent with Greenbrier’s refined leasing strategy and has no impact to total consolidated revenue. Segment results for the prior periods have been recast to conform to the current period presentation.”

Additionally, in the three-months ending Nov. 30, 2021, Greenbrier said it “grew GBX Leasing by approximately $200 million through a railcar portfolio purchase and railcars produced by Greenbrier. GBX Leasing is funded with a combination of 75% non-recourse debt and 25% equity and is consolidated in Greenbrier’s financial statements.” Subsequent to the quarter end, “GBX Leasing increased the $300 million non-recourse railcar warehouse facility by $50 million to support strong lease portfolio momentum,” the company reported.

(GBX Leasing was formed in April 2021 as a joint venture with The Longwood Group “to own and manage a portfolio of leased railcars primarily built by Greenbrier,” according to Greenbrier, which noted that it owns approximately 95% of GBX Leasing.)

Business Update and Outlook

Based on current business trends and production schedules for fiscal 2022, Greenbrier said it expects increased deliveries of 17,500-19,500 units including approximately 1,500 units in Greenbrier-Maxion (Brazil); selling and administrative expense to be $200 million-$210 million; and capital expenditures of $275 million in Leasing & Management Services, $55 million in Manufacturing, and $10 million in Maintenance Services.

“Looking forward, the strength and flexibility of our global manufacturing and supply chain networks that support our integrated business model will sustain growth in a market environment that is characterized by strong underlying demand along with unique operating challenges,” Furman said. “As our commercial and manufacturing operations build momentum, we have also continued to increase the scale of Greenbrier’s railcar lease fleet, with investment opportunities outpacing preliminary expectations. This provides Greenbrier tax-advantaged cash flows and reduces our exposure to the inherent cyclicality of freight transportation equipment manufacturing. We expect the result will be an increasing baseline level of cash flows with substantial manufacturing upside as end markets continue to recover.”

More earning report details can be found on the Greenbrier website.

The Cowen Insight

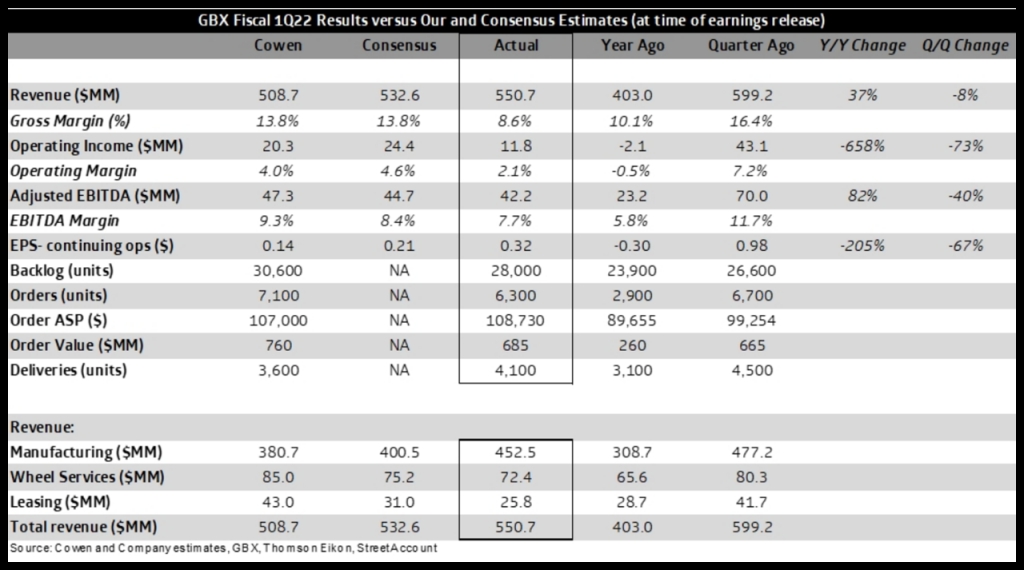

Greenbrier (GBX) “raised its FY22 delivery guidance by 1,500 units and noted continued demand strength,” Cowen and Company OEM Transportation Analyst Matt Elkott reported. “The gross margin was well below our and consensus estimates due to labor shortages, competitive pricing, and inefficiencies, including ones related to production ramp-up. EPS still beat expectations on unconsolidated earnings and asset sales, which are a fairly regular occurrence in leasing operations.”

Key takeaways from Cowen:

• “GBX raised its FY22 production guidance to 17.5K-19.5K units, from 16K-18K units. It maintained its SG&A guidance of $200-$210MM and its CapEx guidance of $340MM.

• “EPS of $0.32 was above our and consensus estimates of $0.14 and $0.21, respectively. If the asset sales had been in line with our assumption (which is well below the actual result), EPS would have been largely in line with our $0.14 estimate, all else equal.

• “Revenue of $550.7MM also beat our and Street expectations of $508.7MM and $532.6MM, respectively, on higher deliveries (4,100 units compared to our estimate of 3,600 units). But the gross margin of 8.6% was well below our and the consensus estimate of 13.8%. The company attributed the weak margin to labor shortages, competitive pricing, operating inefficiencies in maintenance services, and production ramping inefficiencies in manufacturing.

• “EBITDA was $42.2 MM, compared to our and consensus estimates of $47.3 MM and $44.7 MM, respectively.

• “GBX ended the quarter with liquidity of $610 MM ($835 MM at the end of fiscal 4Q21), including $410 MM in cash ($647 MM at the end of fiscal 4Q21) and $200 MM of available borrowing capacity ($188 MM at the end of fiscal 4Q21). Cash use in the quarter reflected investment in GBX Leasing and working capital deployment to increase production rates.

• “The board declared a quarterly dividend of $0.27 per share, payable on Feb. 17, 2022.”