Cowen: Wabtec Investor Day Insight

Written by Matt Elkott, Transportation OEM Analyst, TD Cowen

Matt Elkott

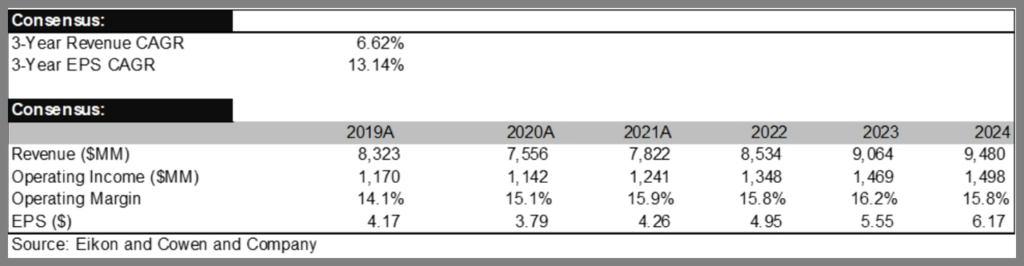

March 9 was Investor Day for Wabtec (WAB), and its five-year margin target is ahead of consensus for the next three years (the maximum available). Revenue and EPS targets are not inconsistent with Street expectations. Cowen and Company believes WAB’s geographic breakout could position it well as some rail commodities shift from Russia to other world regions.

Here is our initial take on WAB Investor Day:

• Management is targeting adjusted operating margin expansion of 250 to 300 bps (basis points) over the next five years. At the company’s previous investor day on March 10, 2020, it was expecting 300 bps margin improvement for the ensuing five-year period. Since then, WAB has achieved a roughly 180 bps increase (from 2019-21). Consensus estimates for the next three years (the maximum available) reflect no operating margin expansion, although we do not see the 2024 estimate as very reliable as it likely does not capture a large enough number of estimates.

• The company expects mid-single digit core organic growth over the next five years. This is unchanged from the March 2020 goal. The consensus estimate for the next three reflects a 6.6% CAGR (compound annual growth rate) for total revenue.

• WAB sees double-digit EPS growth CAGR over the five-year period. This is not inconsistent with the 13% CAGR reflected in consensus estimates for the next three years. At the company’s previous investor day on March 10, 2020, it was expecting a 10% EPS CAGR for the ensuing five-year period.

• The company sees cash generation greater than 90% conversion. This is unchanged from the March 2020 investor day.

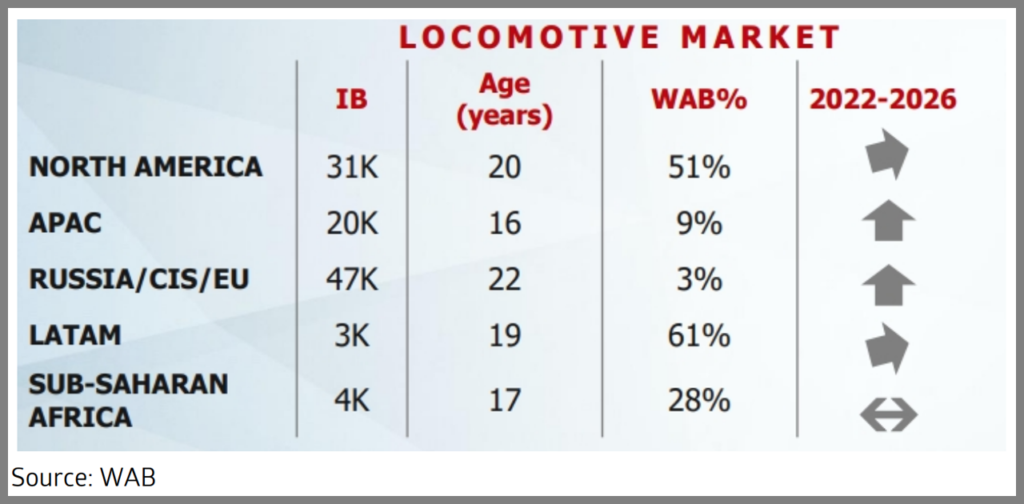

• As shown in the WAB-released slide below, we believe that its potential hit from Russia in the locomotive segment could be more than offset by a rail traffic shift to other world regions. The shift away from Russia could also come with a positive price mix if regions such as North America and Australia are key beneficiaries. Australia, for example, is proactively working to position itself as a substitute supplier for Russian coal to Europe, which has historically imported more coal from Russia than any other country. WAB does have facilities in Russia and Ukraine, but it only generates 5% of its revenue in the Russia/CIS regions, with Russia being materially below 5%. WAB generates about 3% of its revenue in China.

• WAB dedicated a large section of the slides outlining new power technologies and the path to zero emissions in rail.

• In North America, rail traffic remains inconsistent, but is starting to show signs of life, with cumulative-four-week traffic through Week 8, which ended on Feb. 26, up 4.6% year-over-year. This is a figure that normalizes Chinese New Year and Presidents’ Day holiday comparisons. The prior cumulative-four-week period, which ended on Jan. 29, saw a 9.5% year-over-year traffic decline. For Week 9, the most recent week, traffic is down approximately 3%, excluding BNSF, which is yet to report.

• The WAB-released slide below shows locomotive modernization opportunity as outlined by the company. We estimate modernizations are about half the revenue of a new-build but at much higher margins.