Intermodal Briefs: ITS Logistics, UIPA

Written by Marybeth Luczak, Executive Editor

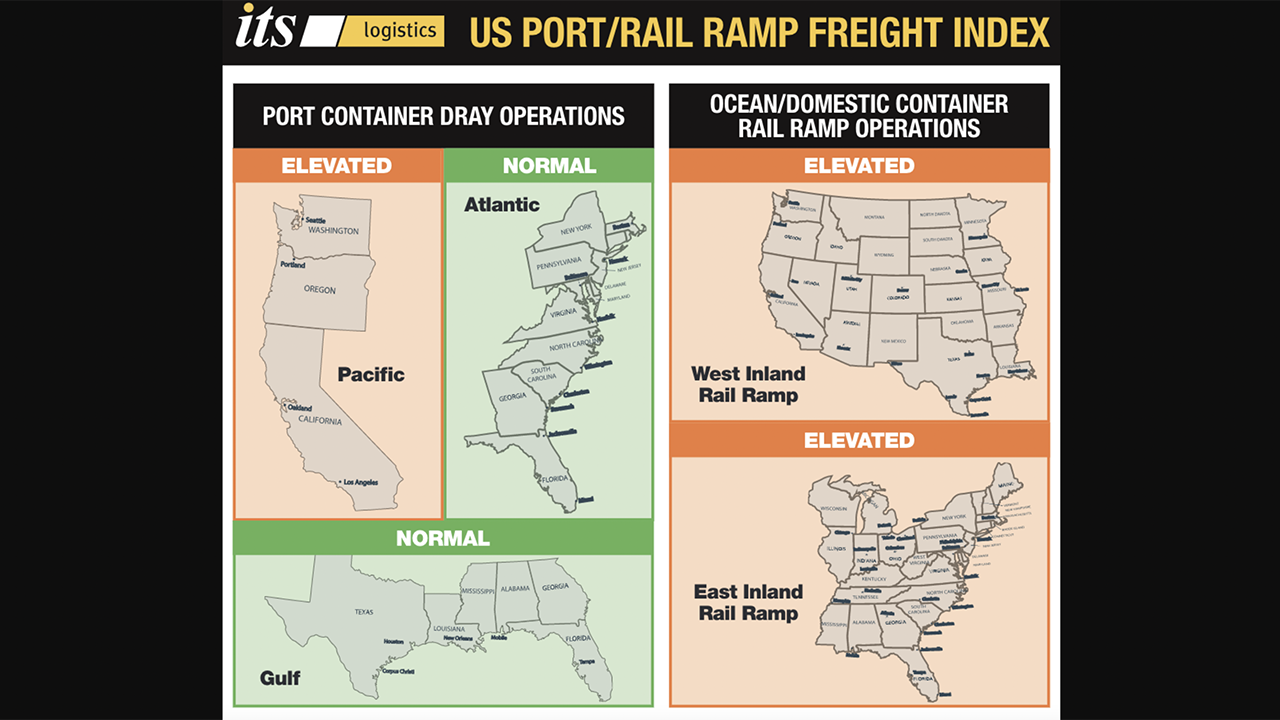

“We are still advising caution when conducting business on the west coast,” said Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics. “The International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) have agreed to some tentative terms, including automation, but more difficult negotiable topics surrounding benefits and pay have not yet been decided.” (Image from ITS Logistics' May U.S. Port/Rail Ramp Freight Index)

“Los Angeles and Long Beach ports make progress in [labor] negotiations, but empty returns and terminal operations are problematic,” reports ITS Logistics in its latest U.S. Port/Rail Ramp Freight Index. Also, the Utah Inland Port Authority (UIPA) completes a rebranding initiative.

ITS Logistics on May 17 issued its May index on port container and dray operations for the Pacific, Atlantic and Gulf regions and on ocean and domestic container rail ramp operations for the West Inland and East Inland regions. The 3PL (third-party logistics) firm based in Reno, Nev., forecasted “an improvement from severe concern to elevated concern for the Pacific Ocean Region but continued problematic empty return availability and dual transaction mandates at the terminals.”

“We are still advising caution when conducting business on the West Coast,” reported Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics, which offers drayage and intermodal services in 22 coastal ports and 30 inland rail ramps. “The International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) have agreed to some tentative terms, including automation, but more difficult negotiable topics surrounding benefits and pay have not yet been decided. In addition, empty return availability and dual transaction mandates at the terminals in Los Angeles and Long Beach are still proving to be problematic for the industry.”

Despite the ports’ success over the years, “currently, the risk of losing more cargo to the East Coast is steadily increasing as negotiations continue,” according to ITS Logistics.

Brashier reported that industry experts “are still uneasy about doing business at these specific ports, which as we’ve seen has resulted in the East Coast Ports receiving increased cargo.” Should the trend continue long-term, he said, “then there is the risk that the Los Angeles and Long Beach ports will gradually decline from being the number one ocean gateway. As of now, there have been no work slowdowns or red-tagging activity since April 24, so we’re hoping that business begins to pick up and negotiations reach a conclusion in the coming months.”

The ITS Logistics’ forecast is “stable” in that region through May. The Gulf and Atlantic Ocean Terminal activity is still at normal operations, according to the 3PL firm, which noted that inbound volumes remain low as retailers and manufacturers “continue to burn through high inventories.”

ITS Logistics is also seeing various clients across industries use rail containers, 53-foot trailers and ocean containers for storage because distribution centers are full, according to Brasher. “Peak season will be here soon in the third quarter and fourth quarter with volumes increasing more later this year,” he said. “Shippers and carriers must take advantage of this lull to focus on planning.”

UIPA on May 17 reported that it has rebranded, adding a new logo (see above), forthcoming new website, and new social media platforms to communicate its ability “to drive economic development and create sustainable solutions for the benefit of Utah and its residents.” UIPA, a builder of inland ports, has kept its original name that was given in statute by the Utah Legislature in 2018.

UIPA outlined its updated mission, vision and values statements to: maximizing “long-term economic benefits in Utah by developing and optimizing economic project areas and logistics-based infrastructure”; moving “Utah forward” and aspiring “to transform Utah through multi-generational, logistics-based, economic solutions; and “collaboration, sustainability, respect, accountability and innovation,” respectively.

“[B]y creating better access to rail and better employment opportunities statewide, we are creating a more future-focused Utah,” UIPA Executive Director Ben Hart said.

In a related development, the Port of Long Beach (POLB), UIPA and Union Pacific in 2021 announced that they were adding capacity to an existing regularly scheduled direct rail intermodal service connecting the POLB to the Northwest Quadrant of Salt Lake City, part of UIPA’s jurisdictional area. The initiative was meant to “bring rapid relief from existing port congestion by optimizing rail deliveries between California and Utah.” UP provides the long-haul service from POLB to UIPA. Upon arrival, UIPA handles distribution via truck or rail to a new destination or to a distribution center.