Intermodal Briefs: ITS Logistics, RailState

Written by Carolina Worrell, Senior Editor

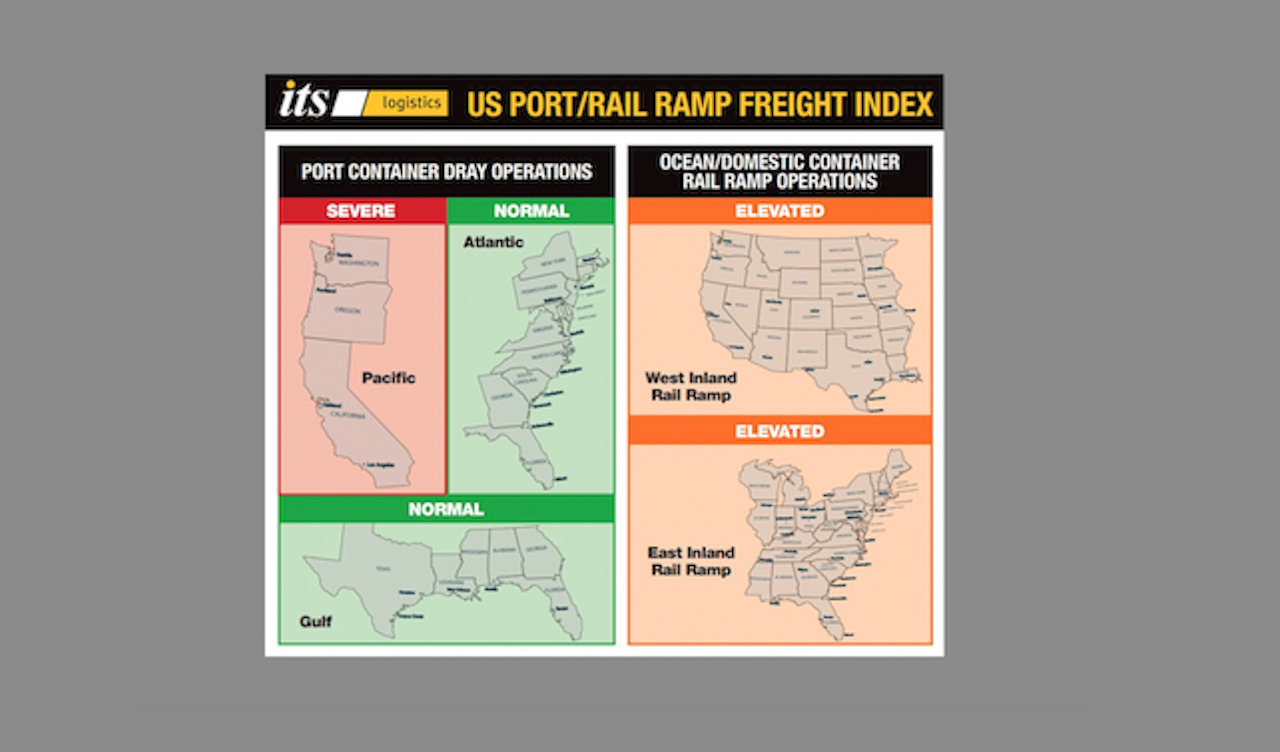

ITS Logistics releases its April US Port/Rail Ramp Freight Index. Also, real-time rail network visibility provider RailState sees slight decrease in Vancouver intermodal volume in the first half of April while significant capacity remains.

ITS Logistics

ITS Logistics announced that its April US Port/Rail Ramp Freight Index, released April 18, forecasts how the lack of empty container return availability is “negatively impacting shipping for beneficial cargo owners (BCOs).”

Additionally, ITS Logistics says the escalation of negotiations between the International Longshore and Warehouse Union (ILWU) and Pacific Maritime Association (PMA) is “negatively impacting the ports of Los Angeles and Long Beach,” according to the index (download below), which forecasts port container and dray operations for the Pacific, Atlantic and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions.

“There is a lack of empty return fluidity at U.S. ports—especially in LA and Long Beach,” said Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics. “In most cases, dual transactions and off-hours/off-port termination facilities are the only options for truckers to return empties.”

According to the index, when shippers were being warned in 2020 of severe congestion at the LA and Long Beach Ports, the Federal Maritime Commission (FMC) made recommendations to “have truckers return empties to the terminal of origin to facilitate more dual moves.” The Harbor Trucking Association (HTA), ITS Logistics says, also “championed the improved use of dual transactions to aid in alleviating the drayage and chassis shortages at the time.”

“Three years ago, not incorporating dual transactions meant that more drivers and chassis would be required to move the same amount of equipment,” continued Brashier. “Having only two options to remove empty containers is inefficient and will only increase trucking and detention costs to BCOs. Operations will also be strained at terminals and current reports show that MSC containers are becoming the most immediate concern.”

According to Statista, Switzerland-based shipping firm MSC has a 17.5% market share in container traffic. As the world’s largest ocean freight line, they recently confirmed with CNBC that “freight orders would rebound once inventory levels declined in the U.S. and Europe, to enable trade volumes to increase.” While ocean freight bookings continue to be heavily dependent on manufacturing orders, shipper confidence has declined in part because of ILWU and PMA negotiations escalating. This, according to Statista, has caused a continued loss of market share in the LA and Long Beach Ports, but MSC expects the ocean container market to grow in the second half of this year.

“ILWU work slowdowns this month in LA and Long Beach are the opening salvo in what will be tense ILWU and PMA negotiations over the next couple of months,” continued Brashier. “This was the first major public display of how far both parties are apart and has moved the Pacific Region to a severe concern on the index. Ultimately the region is experiencing labor disruption on top of empty container termination restrictions.”

Currently, ITS Logistics says, ILWU does not have the leverage it once had, and volumes are significantly less due to economic factors and lost market share to the Gulf and East Coast ports. Shippers should avoid West Coast Ports for the next two months and add additional dray capacity immediately across North America.

ITS Logistics offers a full suite of network transportation solutions across North America and omnichannel distribution and fulfillment services to 95% of the U.S. population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, and outbound small parcel.

DOWNLOAD THE FULL INDEX BELOW:

RailState

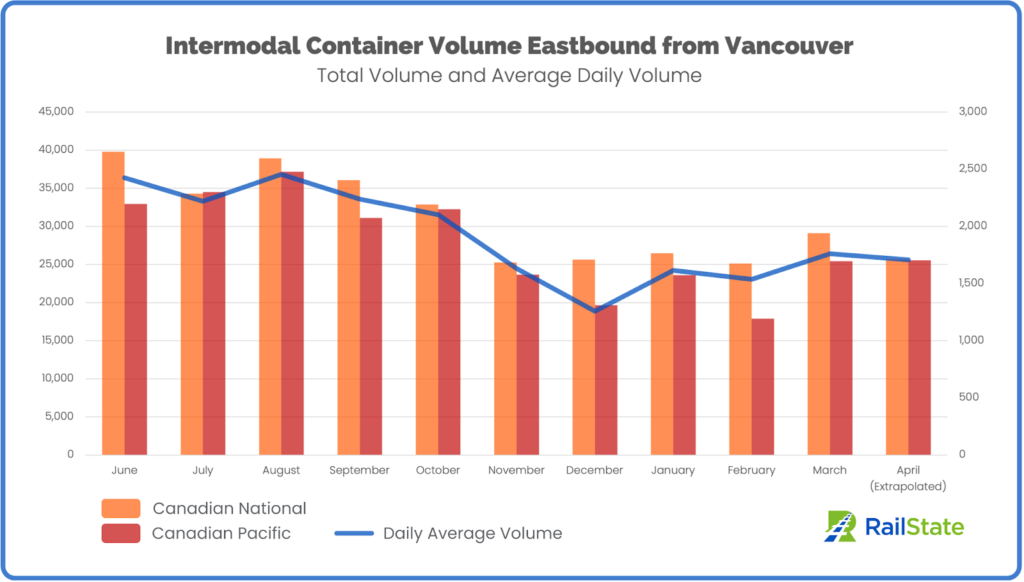

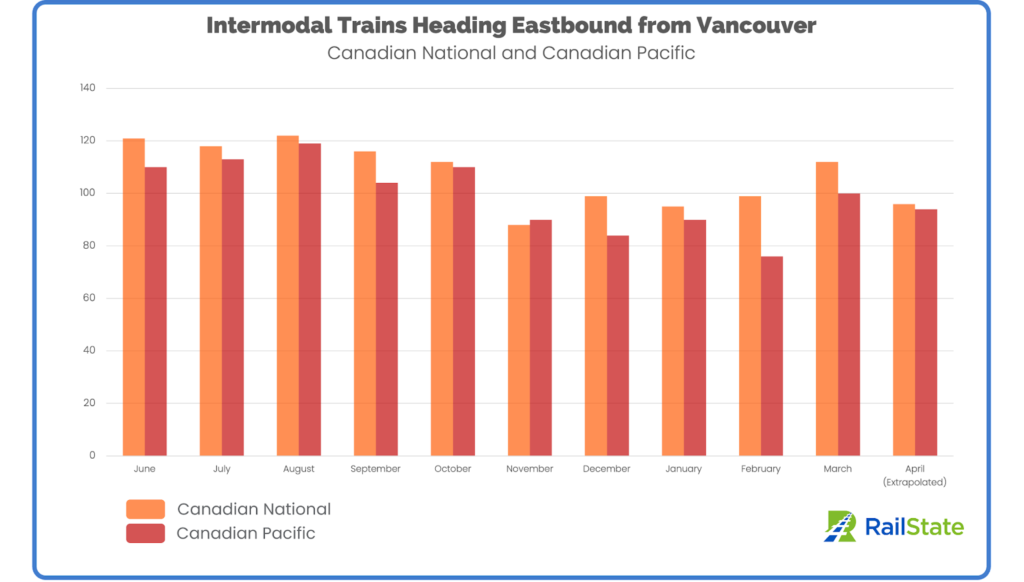

Real-time rail network visibility provider RailState, which independently tracks all freight movements across Canada, announced April 18 that a review of eastbound trains originating in Vancouver in the first half of April showed a decrease in intermodal traffic compared to the previous month, and a continuation of low intermodal volume over the previous six months.

For the period April 1-15, RailState says 25,607 intermodal containers originated in Vancouver, resulting in a daily average volume of 1,707 containers per day. This RailState adds, represents a 3% reduction in the daily average volume from March.

Without significant changes in volume in the second half of this month, RailState says “April intermodal volume will come in below March’s totals and continue the trend of 2023 intermodal volume lagging well behind the previous year.”

“We’ve seen lower import volumes through Vancouver for a while now and April shows no signs of reversing that trend,” said RailState Co-Founder and COO John Schmitter. “We’re constantly monitoring the entire rail network to identify any changes in real-time.”

For much of the past year, RailState says CN and CP (now CPKC) ran similar numbers of intermodal trains out of Vancouver. Recent months have shown more variation. In early April, CN ran approximately four fewer trains per week than in March. CP ran 1.5 fewer trains per week in April compared to March.

The container size mix also differs between the two railways. Most containers in this lane on CN trains (63%) are 40 feet, 21% are 20-foot containers, and 16% are 53-foot containers. CP’s container mix also has a majority (61%) of 40-foot containers, 20-foot containers account for 16%, and 53-foot containers account for a larger percentage (23%).

Currently, RailState says CN and CP are “running about 13% below their peak volume of the past year in terms of containers per train.”