SLRG Chapter 11 Trustee Eyes Auction

Written by Marybeth Luczak, Executive Editor

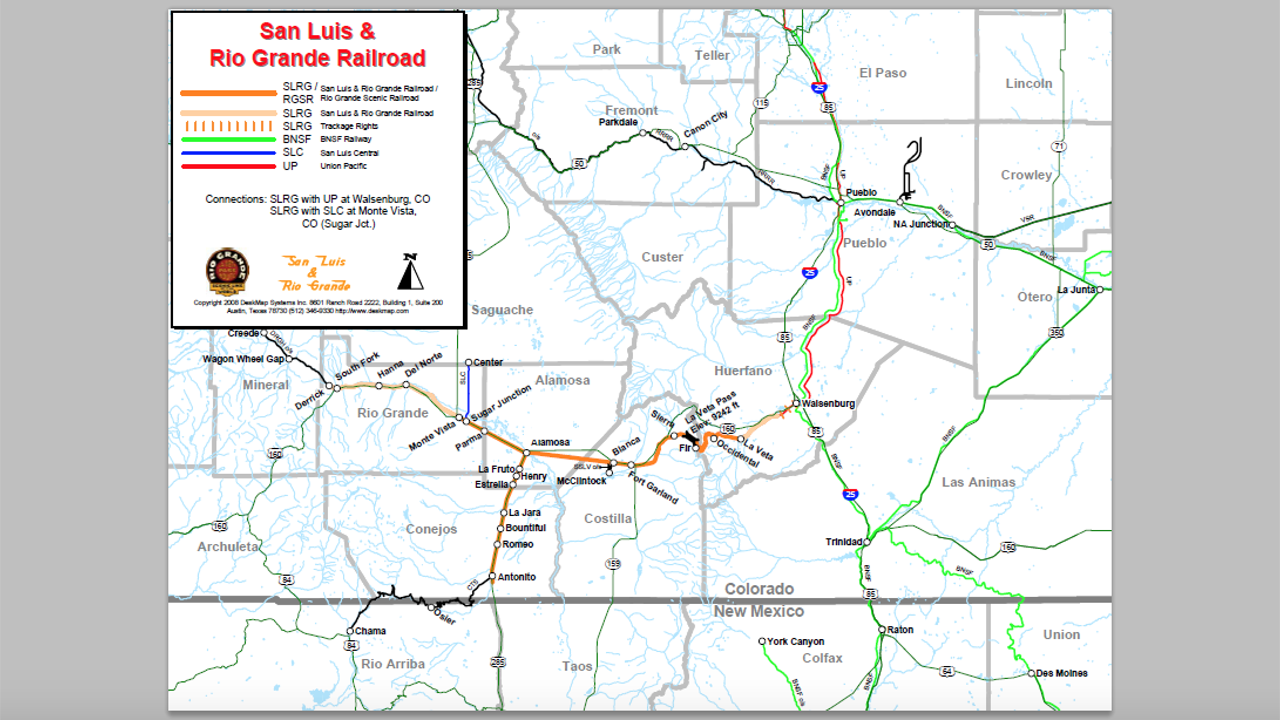

Serving the San Luis Valley in southern Colorado, SLRG was originally constructed in 1878. It traverses the La Veta Pass over the Sangre de Cristo Mountain range and connects the eastern plains of Colorado to the San Luis Valley. (Map Courtesy of William A. Brandt Jr., SLRG’s Chapter 11 Trustee)

The 155-mile San Luis & Rio Grande Railroad Inc. (SLRG) will be sold at auction, if the U.S. Bankruptcy Court for the District of Colorado approves.

William A. Brandt Jr., the short line’s Chapter 11 Trustee, on June 14 reported his intention to sell substantially all SLRG assets via auction.

Serving the San Luis Valley in southern Colorado, SLRG was originally constructed in 1878. It traverses the La Veta Pass over the Sangre de Cristo Mountain range, connects the eastern plains of Colorado to the San Luis Valley, and interchanges with Union Pacific (UP) at Walsenburg, Colo.

SLRG hauls industrial, mineral and agricultural commodities, and maintains railcar storage facilities along its right-of-way with a storage capacity of more than 3,100 cars. Prior to the bankruptcy filing, it also operated passenger excursion trains over the La Veta Pass at an elevation of 9,400 feet.

The assets to be sold primarily consist of trackage; roadbed; ties; other track material; inventory; maintenance-of-way equipment; vehicles; bridges; culverts; signals; stations; depots; yards; storage facilities; buildings; workshops; garage structures; and various other agreements or licenses relating to the real estate located on, along, over and under the SLRG rail lines, according to Brandt.

“The proposed auction will be in accordance with terms and bid procedures outlined in the Motion Approving Bidding Procedures recently filed by the Chapter 11 Trustee, which is currently pending before the U.S. Bankruptcy Court for the District of Colorado, Case No. 19-18905-TBM,” reported Brandt, who in concert with his Court-retained financial advisors at Development Specialists, Inc., has set a minimum bid of $5.75 million, “plus the assumption of all liabilities with respect to the purchased assets arising after the sale closing, as the required price for these assets.”

Bids must submitted by 4 p.m. MT on July 10, 2022.