PSLR (Precision Short Line Railroading)

Written by Jim Blaze, Contributing Editor

Genesee & Wyoming subsidiary Wilmington Terminal Railroad (WTRY) serves the Port of Wilmington.

It might be short lines that deliver precisely scheduled service at the shipper’s dock—not necessarily the Class I carriers.

Sometimes listeners pick a message that isn’t assimilated by the entire conference. That might be the case as a large group at this week’s NEARS (North East Association of Rail Shippers) meeting listened to and examined Michael Miller’s slide presentation. Miller, President North America of Genesee & Wyoming, shared interesting structural views of how the short line sector supplies customized first-mile/last-mile rail carload service in his “Short Lines Bridging the Gaps” presentation, offered as part of this year’s NEARS conference theme.

My takeaways:

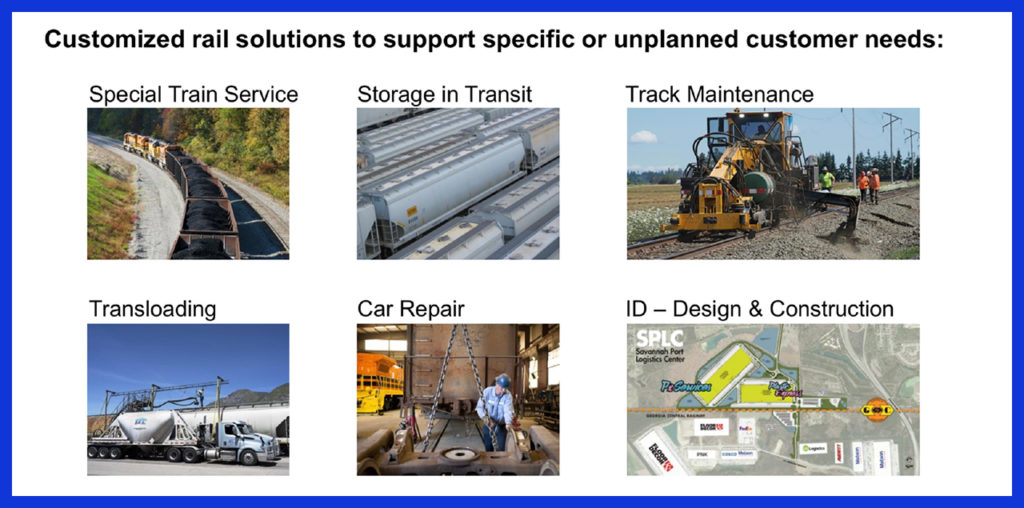

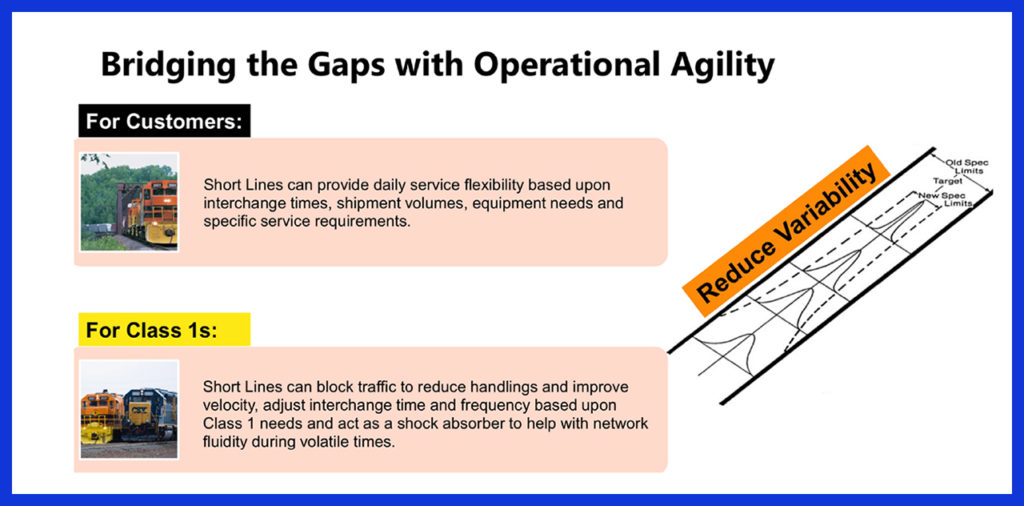

- Short lines can respond to variable customer car-placement and car-pulling requests at the customer’s location. That’s harder and more expensive to do when you have the cost structure per hour of time of a Class I railroad, or the rigidity of a large-network-scope track plant. Short lines might be the solution toward establishing a responsive local railroad sales team.

- Translation? Certain shipper plants and even large economic development projects from seaports to inland ports to inland industrial parks might actually receive better service than they’d receive from a Class I.

- What a local rail traffic location needs from the Class I is reliable and consistent terminal-to-terminal long distance service. That’s where some of the PSR business model railroads seem to perform best. It’s standardized train movement. Nothing really customized about it.

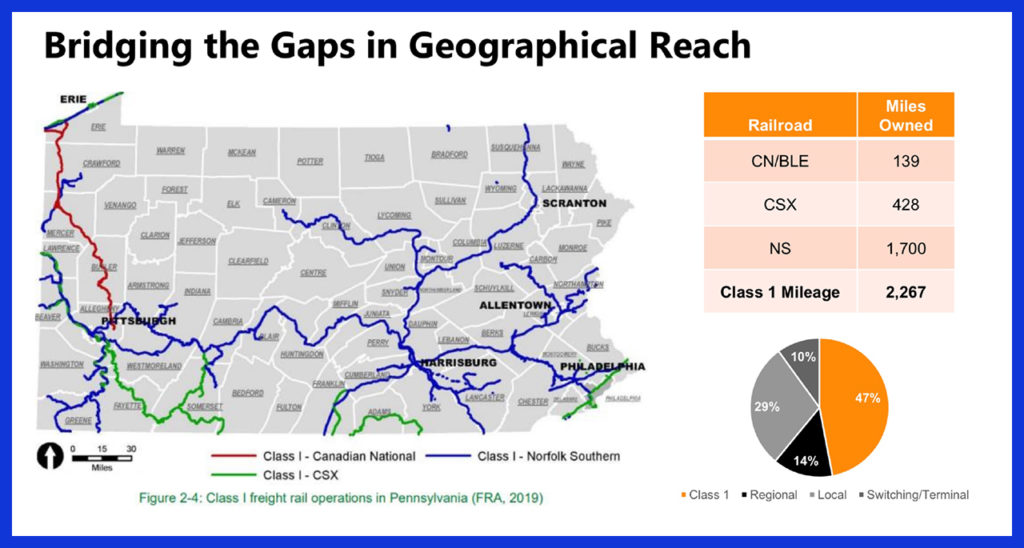

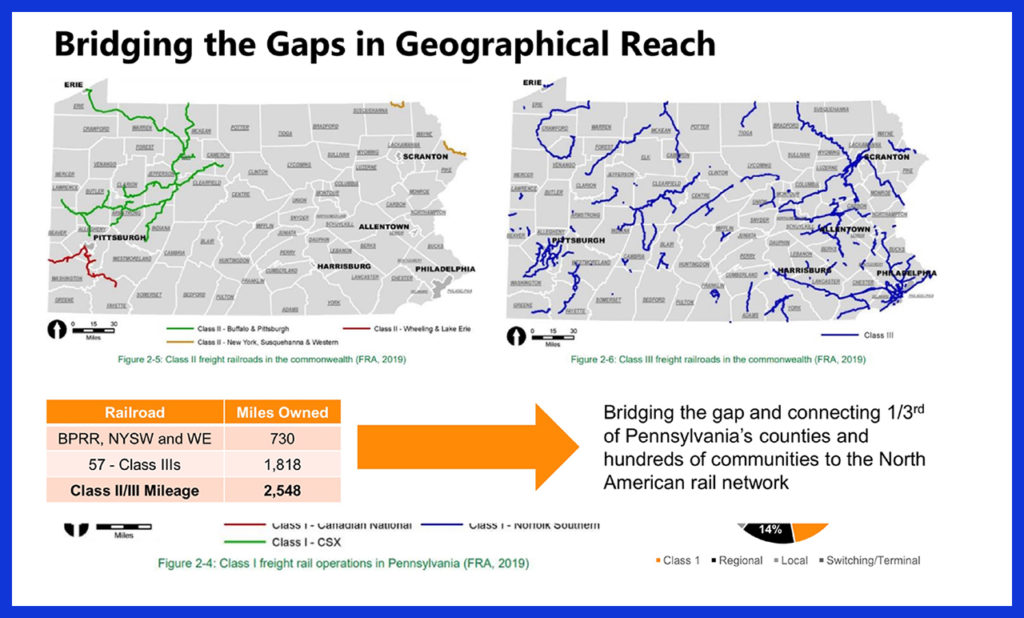

As evidence, Miller presented two maps showing how the entire state of Pennsylvania is actually covered by more miles of short line than Class I service:

How many of us career railroad professionals missed that five-decade-long morphing pattern? I missed it—and I was part of the Conrail USRA federal line/route restructuring that initiated this service track pattern change. If it’s true in Pennsylvania, by when might it be true for other states? Or even sections of states, like California and or Oklahoma.

That’s a takeaway that might or might not have been a message Miller intended. A different audience might or might not interpret the pattern changes the same way, for example, if you’re a Director for Union Pacific or CSX, or even a Berkshire Hathaway overseer of BNSF, ask yourself, “How and where might your Class I freight enterprise be better managed by outsourcing even more local industrial park and first-mile/last-mile branch line carload service? Might outsourcing that service promote more customer-responsive growth?

Short lines can be much more customer-centric when serving a plant, a dock, a port, or a carload park—not always, but certainly enough to be noticed. And short lines can handle a myriad of local customer rail services with almost immediate attention. No need to go through channels requesting remote headquarters attention to a faraway location.

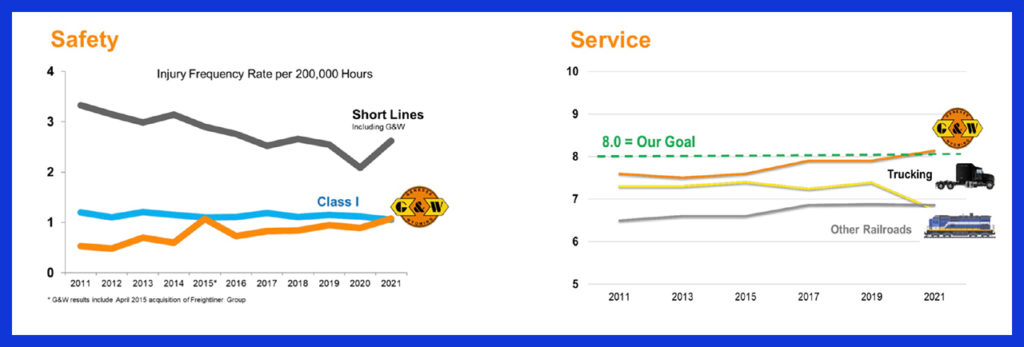

There’s lots of high-growth local short line service seen across America. Growth is not a monopoly of the Class I’s—far from it. As Michael Miller pointed out, both G&W and other North American short line carriers seem to have had significantly higher local carload freight volume growth than do the Class I’s. Why not explore that shift pattern further? Prove or disprove it? After all, G&W has operated with a superior safety record and excellent customer service delivery—perhaps far better than many Class I’s.

Let’s see if these themes can be further explored. Who might want to lead that type of a conference session at the next NEARS conference?

Independent railway economist and Railway Age Contributing Editor Jim Blaze has been in the railroad industry for more than 40 years. Trained in logistics, he served seven years with the Illinois DOT as a Chicago long-range freight planner and almost two years with the USRA technical staff in Washington, D.C. Jim then spent 21 years with Conrail in cross-functional strategic roles from branch line economics to mergers, IT, logistics, and corporate change. He followed this with 20 years of international consulting at rail engineering firm Zeta-Tech Associated. Jim is a Magna Cum Laude Graduate of St Anselm’s College with a master’s degree from the University of Chicago. Married with six children, he lives outside of Philadelphia. “This column reflects my continued passion for the future of railroading as a competitive industry,” says Jim. “Only by occasionally challenging our institutions can we probe for better quality and performance. My opinions are my own, independent of Railway Age. As always, contrary business opinions are welcome.”