Potential Modal Shifts as Diesel Stays Hot: Cowen

Written by Jason Seidl, TD Cowen, Wall Street Contributing Editor

Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl

U.S. diesel pricing remains elevated, passing along significant costs to shippers via fuel surcharges. At Cowen and Company, we believe sustained high diesel pricing will ultimately benefit the railroads and IMCs (intermodal marketing companies) as shippers explore different modes of transport.

We see Eastern carriers Norfolk Southern (NS) and CSX benefiting, and Hub Group (HUBG) and J.B. Hunt Transport Services (JBHT) well-positioned for the shift to intermodal over the short- and long-run.

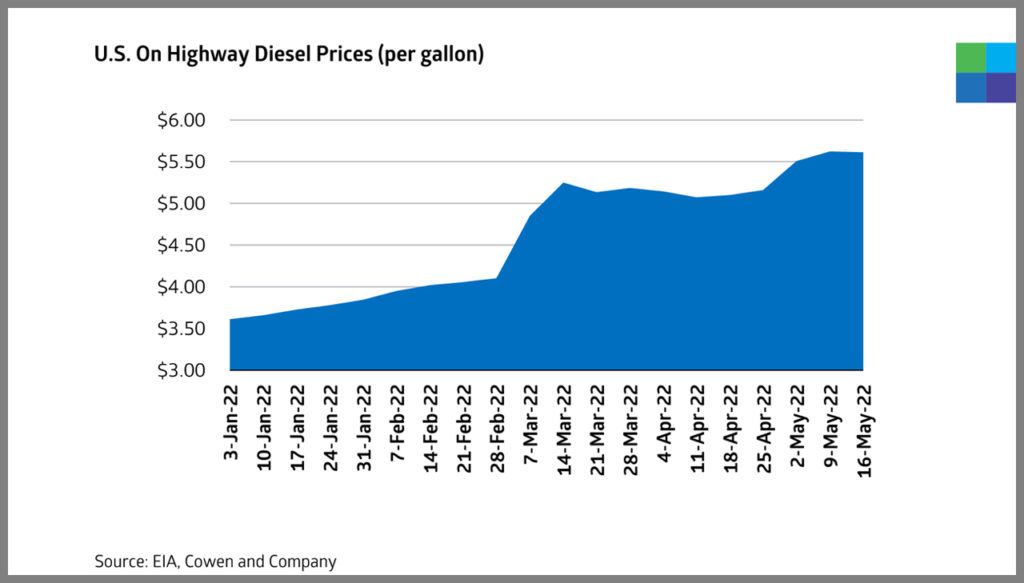

Diesel Prices Hitting New Highs

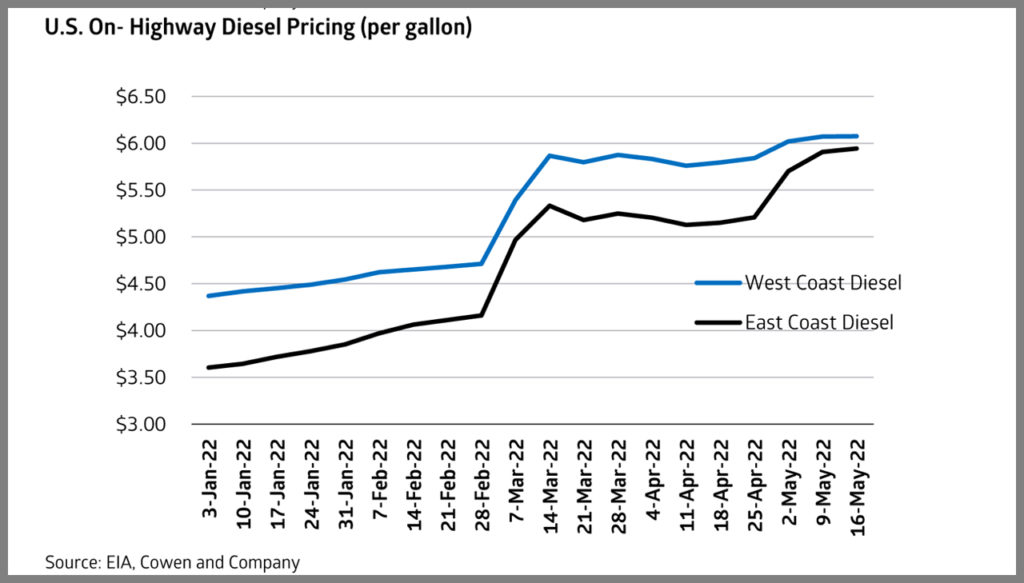

Weekly on-highway diesel prices (as reported by the U.S. Energy Information Administration, EIA) hit a national price of $5.61 per gallon last week and are more than 70% above prior-year levels. In terms of regions, the Eastern U.S. has been harder hit with prices rising approximately 84% (up more than 100% in New England), while the West Coast saw the lowest (but still high) increase at approximately 63%. (See charts below for year-to-date diesel pricing.)

The main reason why the East Coast was so impacted has to do with inventory levels, which hit 30-year lows in early May. Several refineries are operating notably below capacity due issues with the ability to import the semi-refined oil feedstock (historically imported from Russia), among other capacity restraints.

Modal Shifts Likely

Diesel prices are passed on to the shippers (customers of the transportation companies) via fuel surcharges. These surcharges are normally linked to an index (typically the EIA’s weekly on-highway average). Truckers have a small lag (about a week), while railroads see an approximately 60-day lag in recovery based on how contracts are written. (We note that domestic intermodal is an approximately one-week lag.) In general, higher diesel prices widen the gap in total landed prices between trucking and rail moves. This is because railroads are roughly three times more fuel efficient than their trucking counterparts.

We looked at a May 16 afternoon move between Newark, N.J. and St. Louis, Mo., which is a roughly 960-mile route. A shipper would have been quoted to pay approximately $2,400 for full truckload and approximately $1,800 for intermodal (with a one-day delivery differential). That suggests that a shipper would pay 33% less in transportation costs hauling via intermodal (well above the normal pricing differential between the modes), at the expense of one extra transit day.

The Knock-On Impacts

In short, big moves in the energy market are going to eventually make their way down to the consumer. Even if a shipper can switch some of his freight to intermodal, not all freight can make the move due to delivery schedules and the ability of railroads to handle the business. The good news is the rail industry has been on a hiring bonanza with some railroads hiring more people in April than all of the first quarter. Unfortunately, it takes four to six months to get these workers trained and out in the field making a difference. We are hearing that there has been some mild sequential improvement in box turns, and we expect that to continue barring any large shocks to the system.

Who Benefits?

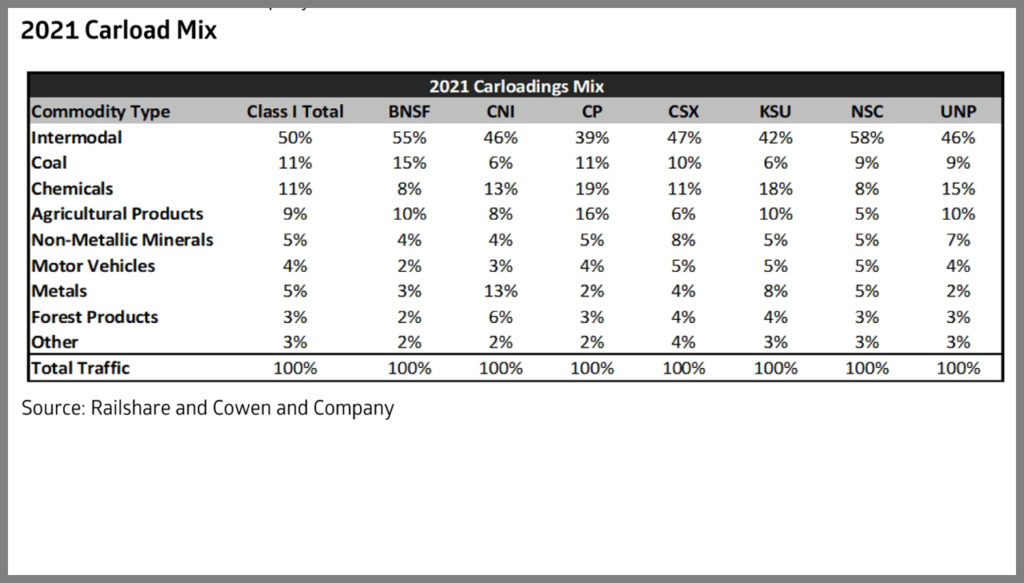

We believe sustained high diesel prices will ultimately benefit the railroads and IMCs. This should be especially true as we move throughout the year with anticipated improvements in the rail supply chain due to increased labor across the networks. The railroads set to benefit the most in our view are the eastern carriers, NS and CSX. They compete in a market with origin-destination pairings that are far closer, thereby having more truck competition. (See chart below on intermodal carload mix.)

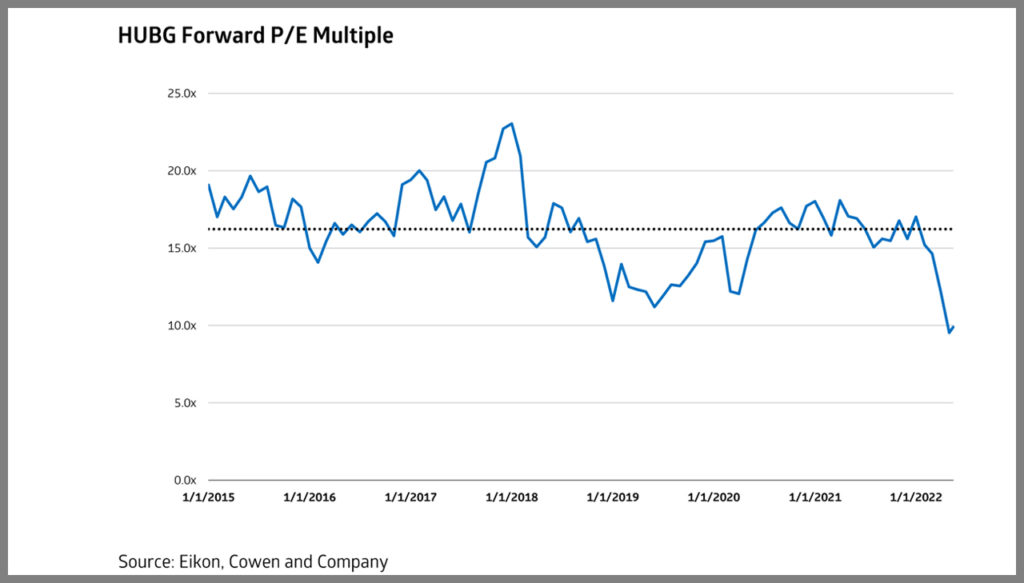

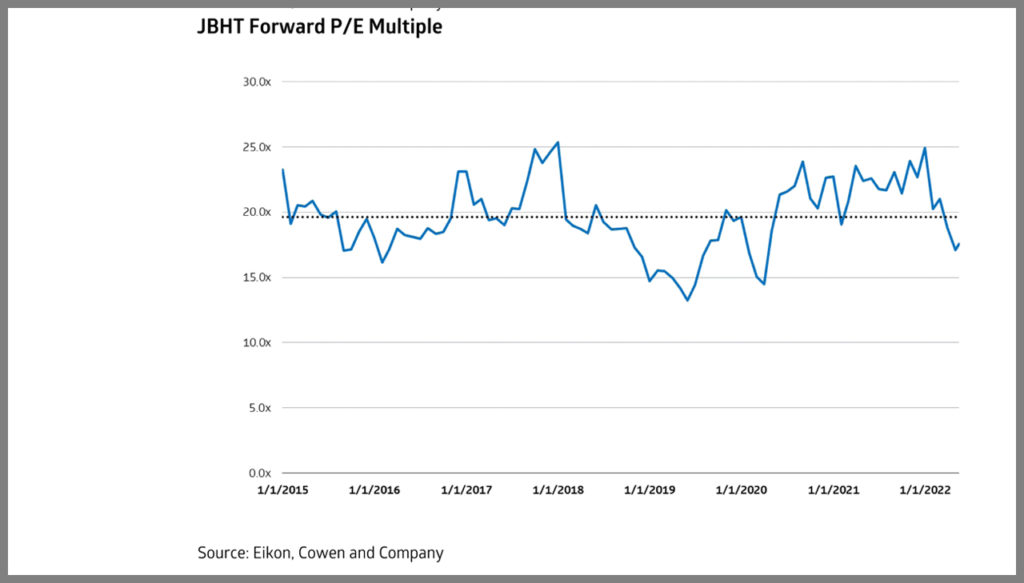

We also believe IMC’s like HUBG and JBHT will see benefits. HUBG is our top ESG pick this year and is currently trading approximately six turns below its historical forward P/E multiple, as seen below (along with JBHT’s forward multiple), representing an attractive entry point (in our view) for North American intermodal exposure for longer-term investors.