NS Bid to Acquire CSR Still Faces Legislative Hurdle (UPDATED Sept. 21)

Written by William C. Vantuono, Editor-in-Chief

Cincinnatti Southern’s yard adjacent to Cincinnatti Union Terminal. FOX19 News photo.

Norfolk Southern is looking to purchase the 338-mile Class II Cincinnati Southern Railway (CSR), which it and its predecessor railroads have been operating under a 141-year-old lease agreement with its owner, the City of Cincinnati, Ohio. The offer on the table, $1.62 billion, has been approved by the CSR Board and City, but the deal requires changes in state law approved by voters through a public referendum, for which a date has been set, as well as Surface Transportation Board (STB) approval. STB authorized the acquisition, subject to employee protective conditions, on Sept. 19.

On May 31, STB accepted for consideration an application and a related verified notice of exemption, both filed on May 1, 2023 by NS on behalf of itself and its wholly owned subsidiary, The Cincinnati, New Orleans & Texas Pacific Railway Company (CNOTP), which operates CSR under a lease agreement expiring in 2026. Funds from the $25 million-per-year lease are dedicated to City of Cincinnati infrastructure projects.

STB in its Sept. 19 decision (download below) reported that the acquisition “would not likely cause a substantial lessening of competition or create a monopoly or restraint of trade.” Additionally, approval is subject to employee protective conditions. Petitions for reconsideration must be filed by Oct. 10, 2023; requests for stay must be filed by Oct. 10, 2023. The decision is effective Oct. 20, 2023.

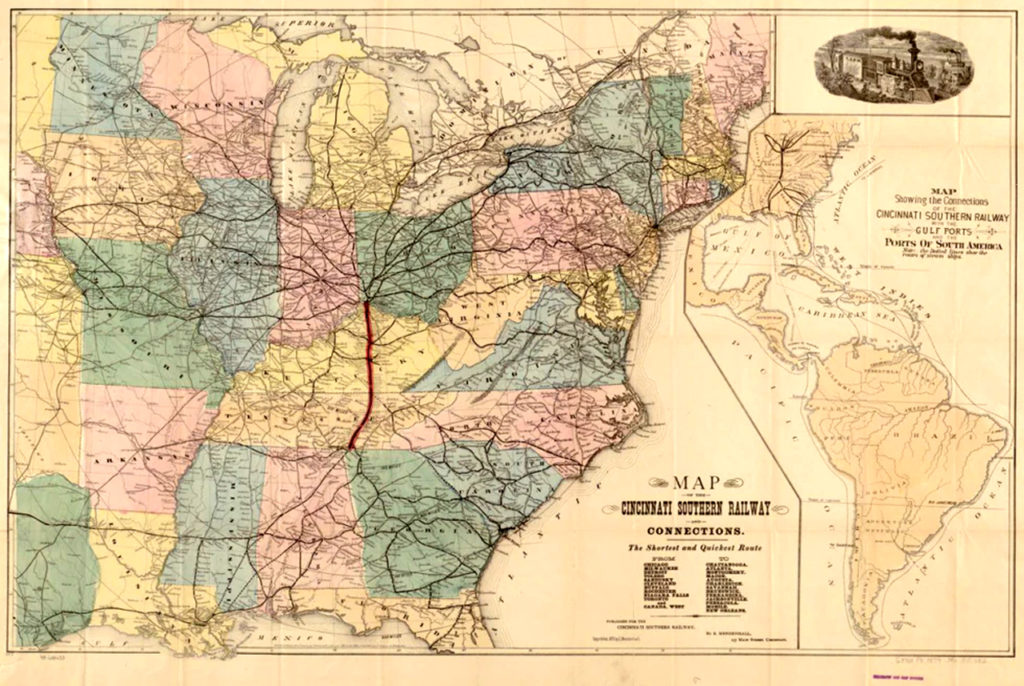

CSR, which connects Cincinnati with Chattanooga, Tenn., is the only municipally owned main line railroad in the U.S. Established through a $10 million bond issue approved by Cincinnati voters in June 1869, it “became a dependable cash cow for the city after its operations were leased out in 1881 to the company that would eventually become Norfolk Southern,” FOX19 reported Dec. 20, 2022. “The route, in turn, has become one of Norfolk Southern’s highest density segments, with as many as 30 trains traversing it every day. NS President and CEO Alan Shaw called it ‘a critical artery linking the Midwest and the Southeast[…]’ and a ‘core line’ in the company’s network.”

NS currently pays the city about $25 million in annual lease payments. The lease agreement, last renegotiated in 1987, is set to expire Dec. 31, 2026, with a 25-year renewal option. The Class I first offered to buy the CSR for an undisclosed (but lower than $1.62 billion) sum in July 2021 during lease renewal negotiations that fell apart, prompting NS and the CSR Board to enter arbitration, according to the Dec. 20, 2022 FOX19 report.

NS came back with the $1.62 billion offer In April 2022. CSR’s Board contracted with third-party accounting firm BMO to analyze the bid, “and the analysis deemed it a fair value,” FOX19 reported Dec. 20, 2022. The parties came to a nonbinding agreement on the proposed sale terms in June. NS, Cincinnati Mayor Aftab Pureval and the CSR Board of Trustees announced on Dec. 19, 2022, execution of a Board-approved, City-administration-vetted purchase agreement.

“The proposed sale could more than double the City’s income from the railway,” FOX19 reported Dec. 20, 2022. “It would come at a convenient time, as the City looks forward to annual deficits of around $35 million from deferred and unfunded infrastructure maintenance projects (as well as falling earnings tax revenue due to remote work.) Pureval cited $350 million in capital infrastructure projects that will require funding in the next five years.”

NS would acquire the CSR through of cash considerations placed in an infrastructure trust managed by the CSR Board called the “Building Our Future Trust Fund.” Board-retained money management firms would oversee trust fund investments. Annual interest of 5.5% would bring in $88 million per year (well above what NS pays now), $56 million of which would go to the City, with the remainder reinvested.

“The City claims the proposed sale would not change any day-to-day rail operations or lead to a significant change in rail traffic,” FOX19 reported Dec. 20, 2022. “The mayor argued the sale would unload from the City’s books an asset that’s extremely valuable but nonetheless susceptible to the whims of ever-changing global and regional supply chains.”

“This agreement sets the framework for Norfolk Southern to own a core line in our network in perpetuity, allowing us to advance our strategic objectives of improving service, enhancing productivity, and creating an even stronger platform for accelerated growth, all while eliminating uncertainty around future control of the line and lease costs,” Shaw said in announcing the proposed sale, which would require Surface Transportation Board approval as well as Ohio General Assembly passage of proposed changes to a state law that governs how the City can use the lease payments. If voters do not approve those law changes in a public referendum, the sale agreement lapses and the City is free to go to public bid on an operator.

The Ohio State Senate did not consider changing the law during it year-end 2022 legislative session. “Ohio Sen. Bill Blessing (R-Colerain Township) has concerns,” FOX19 reported Dec. 20, 2022. “He stopped short of saying he’s against the proposed sale, but his reticence prompted Ohio Senate President Matt Huffman (R-Lima) to table the legislation. The law change will now be part of the state’s transportation budget, which is usually set by March after a series of public hearings. Ohio Sen. Cecil Thomas (D-Cincinnati) says the referendum could still make it on the ballot for the City’s next election in November 2023.”

According to a May 16, 2023, report by National Public Radio affiliate WVXU News, the CSR Board of Trustees will decide in July whether to put a proposed sale on the November ballot. “City officials hope to sell the CSR to Norfolk Southern for $1.62 billion and put the revenue into an investment account,” wrote reporter Becca Costello. “The sale needs approval from Cincinnati voters to go through. The board has tentatively scheduled a special meeting for July 11 to decide on whether to move forward with the November election or wait until next year.”

That meeting took place July 13, and the Cincinnati Southern Railway Board of Trustees voted unanimously to put the sale on the Nov. 7, 2023, ballot, according to a FOX19 July 13, 2023, report.

“Once the board sets an election date, Cincinnati City Council must approve the ballot language and send it to the Hamilton County Board of Elections,” National Public Radio affiliate TWVXU News reported May 16, 2023. “This step is ministerial, meaning Council has no discretion over whether to approve the ballot language or not. Council’s step in the process needs to be done at least 90 days before the election. Because of the summer council calendar, Council would need to approve the language at its meeting Aug. 2 in order to appear on the November ballot. State lawmakers limited the election options to this November, or the primary or general election next year. The City Solicitor’s Office gave the CSR Board a memo outlining how board members can and cannot be involved in the eventual campaign for the ballot initiative. The memo references the city charter, which prohibits spending public money for political activity.”

According to FOX19’s July 13, 2023, report, “If voters reject the sale, the CSR Board or Norfolk Southern have 30 days to terminate the sale agreement, after which a lease extension would go to arbitration. If neither party terminates the agreement, they are obligated to work cooperatively to seek another change to Ohio law allowing them to go back to Cincinnati voters a second time, which is prohibited as of the March passage of Ohio’s 2023/24 transportation bill.”

NS “can avoid an inflation adjustment that would increase the sale price by around $24 million if Cincinnati voters approve the sale in November and the STB gives the greenlight by Dec. 31, 2023,” FOX19 reported July 13, 2023. “The CSR Board has set the minimum annual amount it will send the city if the sale goes through in 2024 at $26.5 million. The minimum is indexed to an inflation metric. Conservative estimates place the City’s real estimated annual windfall at around $60 million, more than double what it currently receives.”

Railway Age Executive Editor Marybeth Luczak contributed to this story.