UP’s Fritz: 2021 ‘Most Profitable Year Ever’ (UPDATED)

Written by Marybeth Luczak, Executive Editor

“The Union Pacific team concluded its most profitable year ever in 2021,” UP Chairman, President and CEO Lance Fritz said during a Jan. 20 earnings announcement. “We produced double-digit fourth-quarter revenue growth by leveraging our great rail franchise to generate positive business mix and core pricing gains, despite ongoing global supply chain challenges that impacted volumes.”

Union Pacific (UP) on Jan. 20 reported fourth-quarter 2021 results, including operating revenue of $5.733 billion, up 12% from the same period in 2020 and 10% from 2019. This was driven by “higher fuel surcharge revenue, a positive business mix, and core pricing gains,” which were partially offset by a 4% decrease in business volumes, as measured by total revenue carloads. The Class I railroad also posted results for full-year 2021, which Chairman, President and CEO Lance Fritz called the “most profitable year ever.”

For comparison purposes, UP noted that its 2020 results are adjusted to exclude a previously announced $278 million pre-tax, non-case impairment charge related to its Brazos yard investment.

For fourth-quarter 2021, UP’s 57.4% operating ratio deteriorated 180 basis points from fourth-quarter 2020, with higher fuel prices negatively impacting it by 100 basis points, according to the Class I railroad.

Net income came in at $1.711 billion for the quarter (or $2.66 per diluted share), compared with $1.589 billion (or $2.36 per diluted share) in 2020, up 8%. Operating income was $2.440 billion, up 7% from the 2020 quarter’s $2.284 billion.

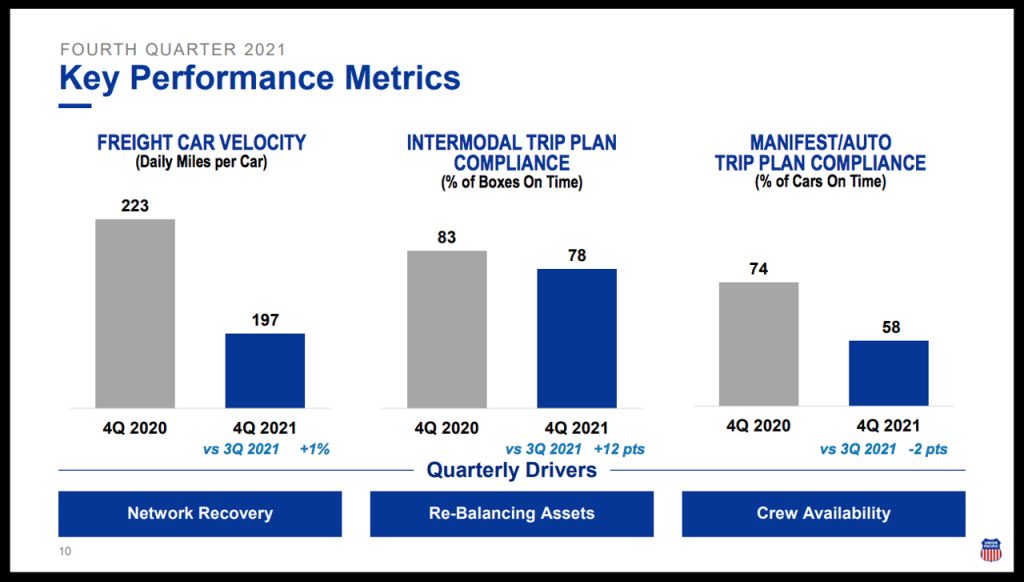

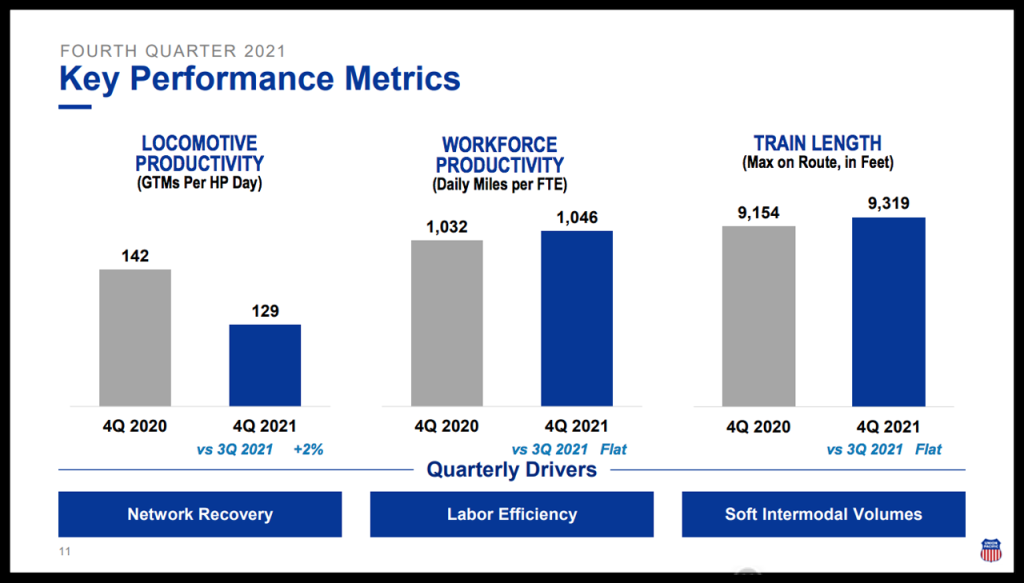

On the operating performance side, UP said that its network recovery efforts were “slowed by COVID impacts to crew availability.” Quarterly freight car velocity was 197 daily miles per car, a 12% decline from fourth-quarter 2020, and quarterly locomotive productivity was 129 gross ton-miles (GTMs) per horsepower day, a 9% fall-off. Additionally, average maximum train length came in at 9,319 feet, a 2% increase.

Full-Year 2021 Vs. Adjusted Full-Year 2020 Highlights:

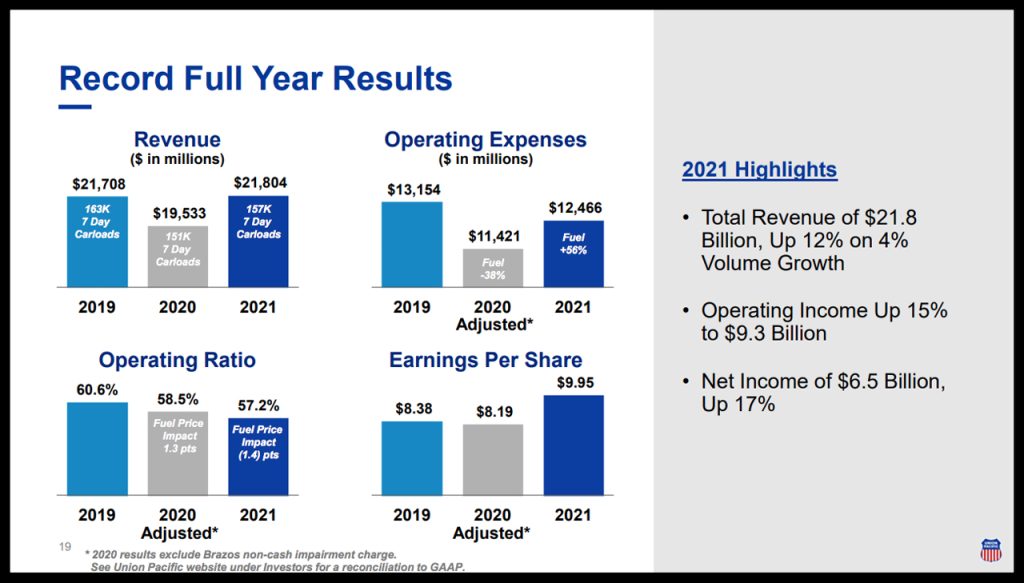

• Operating revenue of $21.8 billion was up 12%, driven by volume growth (4%), higher fuel surcharge revenue, core pricing gains, and a positive business mix, UP reported.

• UP’s 57.2% operating ratio improved 130 basis points, with higher fuel prices negatively impacting it by 140 basis points.

• Operating income of $9.3 billion was up 15%.

• UP said that network operations were “challenged by weather events, wildfires, COVID-impacted crew availability, and supply chain disruptions.” It reported freight car velocity of 203 daily miles per car (an 8% decline); locomotive productivity of 133 GTMs per horsepower day (a 3% drop-off); and average maximum train length of 9,334 feet (a 6% increase).

In addition, the railroad’s 2021 capital program totaled $3.0 billion, a 7% increase over 2020’s $2.8 billion.

2022 Outlook

UP reported that its 2022 capital plan would come in at about $3.3 billion. It will cover infrastructure replacement (including energy management systems), $1.9 billion; capacity/commercial facilities, $0.6 billion; locomotives/equipment, $0.5 billion; and technology/other (including Positive Train Control), $0.3 billion.

Looking ahead, UP said it expects “full-year volume growth exceeding industrial production” and “pricing gains in excess of inflation dollars” as well as an operating ratio of approximately 55.5%.

“The Union Pacific team concluded its most profitable year ever in 2021,” UP Chairman, President and CEO Lance Fritz said. “We produced double-digit fourth-quarter revenue growth by leveraging our great rail franchise to generate positive business mix and core pricing gains, despite ongoing global supply chain challenges that impacted volumes. For the third consecutive year, we improved our fuel consumption rate, taking steps to reduce our carbon footprint and meet the goals of our 2021 Climate Action Plan. While our safety and operational performance in 2021 did not meet expectations, we look to convert recent progress into sustained improvement in 2022. Although uncertainty remains around COVID variants and supply chain disruptions, we see a positive demand environment in 2022 and continued traction from business development efforts driving growth as we deliver value to all our stakeholders.”

The Cowen Insight

“UNP reported a fourth quarter that came in above expectations on the top and bottom lines as volume challenges were more than offset with pricing,” notes Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “A first look into 2022 OR guidance suggests 170bps of improvement; our modest volume assumptions for 1H22 are coupled with strong core pricing and a 2H22 volume improvement, assuming congestion eases). We roll our model forward and increase our Price Target to $257 from $236.

“Adjusted 4Q21 EPS of $2.66 beat our estimate of $2.63 and the consensus forecast of $2.61. Revenue came in ~2% above expectations as volumes declined 4% (led by intermodal, down ~15%), which was more than offset by revenue per carload, leaving operating revenues +12%. A positive business mix and higher fuel surcharge revenue contributed to the growth as well. The OR of 57.4% missed our estimate by 50bps (fuel negatively affected OR by ~100bps in the quarter).

“4Q21 volumes were brought down by premium segments (autos, intermodal) that were partially offset by industrial and bulk. 1H22 will likely be a continuation of these factors, and we see the potential—if supply chain congestion eases—for 2H22 to be strong within its premium segment, and model as such. Coal and renewable carloads were +13% in 4Q, as domestic coal demands remain strong given high natural gas prices. What we previously modeled to be a secular decline for this segment now is in a position to potentially see growth in 2022. Grain carloads declined in 4Q21 and we expect them to step down in 2022 off tough comps and a weaker grain cycle, partially offset by new biofuel business.

“While intermodal carloads declined ~15% in 4Q21—and recent carload data suggests a continuation of negative carloads—we model improvement to begin in this segment in the second half of 2022. Domestic intermodal should benefit from continued inventory replenishment and tight truck supply, as well as a growing footprint in new terminals. UNP also announced a new partnership with Schneider (SNDR), which should begin benefiting domestic intermodal in January 2023.

“As we have heard on recent calls with industry experts, performance metrics continued to negatively affect the group. Intermodal trip plan compliance percentage of boxes on time) was 78%, down 5%, although stepped up sequentially compared to 3Q21. Freight car velocity was down significantly y/y as crew availability was challenged due to COVID-related impacts, similar to what we are hearing from our trucking names.