Report From MARS 2023

Written by Ron Sucik, Contributing Editor and Principal, RSE ConsultingThe Midwest Association of Rail Shippers (MARS) held its 259th meeting recently at the Westin Hotel in Lombard, Ill., with a record attendance of more than 900. Chicago is the center of the North American rail universe and the perfect place to gather a diverse group representing all facets of the rail and shipping industries.

As expected, MARS assembled a terrific group of speakers representing, among others, shippers; industry-related consultants; Class I, II and III railroads; industry associations such as the Association of American Railroads; government entities such as the Surface Transportation Board; and suppliers of railcars, components and advanced technologies.

Every conference has that one golden nugget of information you will grasp and want more of. Given the business environment of rail today, this year’s MARS conference offered an additional collection of gems worthy of taking note.

The Class I railroads that were present all talked about “what we will do to attract more business,” or in the case of this year’s environment, “how we will get some of that business back?” Add to those themes how they might treat customers differently to keep that business—almost a modern-day version of those ancient “sales reps” that used to travel the traffic lanes, periodically calling on their customers. Remember those people?

A Few Railroad Gems

CN (keynote speaker Tracy Robinson, President and CEO): “Chicago is the center of the rail universe. What happens to a railroad in Chicago affects the whole system.” To the shippers: “Bring us your problems. We will work with you to solve them.” “We challenge you to challenge us.”

Norfolk Southern (President and CEO Alan Shaw): “How can we make a difference to a customer, and how do we respond to a customer?” “We are not good at just-in-time.” “We are looking for balance, not just maximum profit.” “We need to build a culture that is customer-centered and operational-driven.” “Help our customers grow.” “Let’s start talking to our customers more and let’s treat our people the best we can.”

BNSF (President and CEO Katie Farmer): “We are a 170-year-old company. We know how to transform to meet the environment.” “We know the number one task is service. We need to deliver the product reliably and on time.” “This is not accomplished without technology.”

The short lines and regionals stressed that, to bring value to customers, they must be equal partners with Class I’s.

Key Takeaways

Responding to the existing post pandemic labor situation, all the railroads and manufacturers emphasized how important their human resources were and pledged to meet the requirements to attract and keep their labor forces. Quality of life remains front and center for hiring and growing the work force.

Railroad Development Corp. Chairman Henry Posner III offered an observation from his teaching: “College is too late to recruit employees. Find those that are already enthused about rail. Look as early as high school.” People who start working at an early age for the railroads and like it usually stay with it and are generally more satisfied than employees recruited on college campuses.

STB Chairman Marty Oberman stated the two most important items on the Board’s agenda are the Canadian Pacific-Kansas City Southern merger and Class I use of embargoes as a way to control congestion. He is also concerned about any form of retaliation for any testimony in a hearing. He feels uneasy that it could happen.

BNSF is moving toward a 30% emissions reduction of by 2030. Also of significance, BNSF will develop a new $1.5 billion intermodal terminal, currently named Barstow International Gateway, just west of Barstow, Calif., about 120 miles away from Cajon Pass and the Port of Los Angeles and Long Beach. Scheduled for completion in 2027, BNSF said this terminal will enable it to load an IPI (interior point intermodal) container train on dock at the port and go directly to Barstow to the import warehouses and transloading facilities that will locate on or near their property for movement eastbound in domestic equipment. JB Hunt has already signed an intent to locate a terminal on site. This will enable BNSF to greatly reduce congestion at the port during peak periods of import arrivals.

Good news on the U.S. manufacturing front was the announcement of Steel Dynamics Inc. (SDI) of continued new plant expansion plans to meet domestic market demands for flat rolled steel and aluminum. This will expand SDI’s annual steel production capacity to almost 14 million tons, more than 25% growth. The company will be targeting underserved markets reliant on “imports with long lead times and inferior product quality.”

SDI has partnered with OmniSource, one of North America’s largest scrap metal processors and distributors, for its source of recycling materials. It also invites customers to locate on site with the aluminum flat rolled mill to enhance cost efficiencies, providing a “closed loop” aluminum coil-to-scrap sourcing opportunity. SDI Senior Vice President Strategic Projects Glenn Pushis pointed out most flat rolled aluminum is shipped by truck to prevent damage in transit by rail. An opportunity exists to grow movement of coils by rail if they can be handled, packaged and secured to eliminate such damage. The same railcars could be used to ship aluminum slabs sourced from southern and western markets to the mill and then returned with finished coils.

RailPulse Update

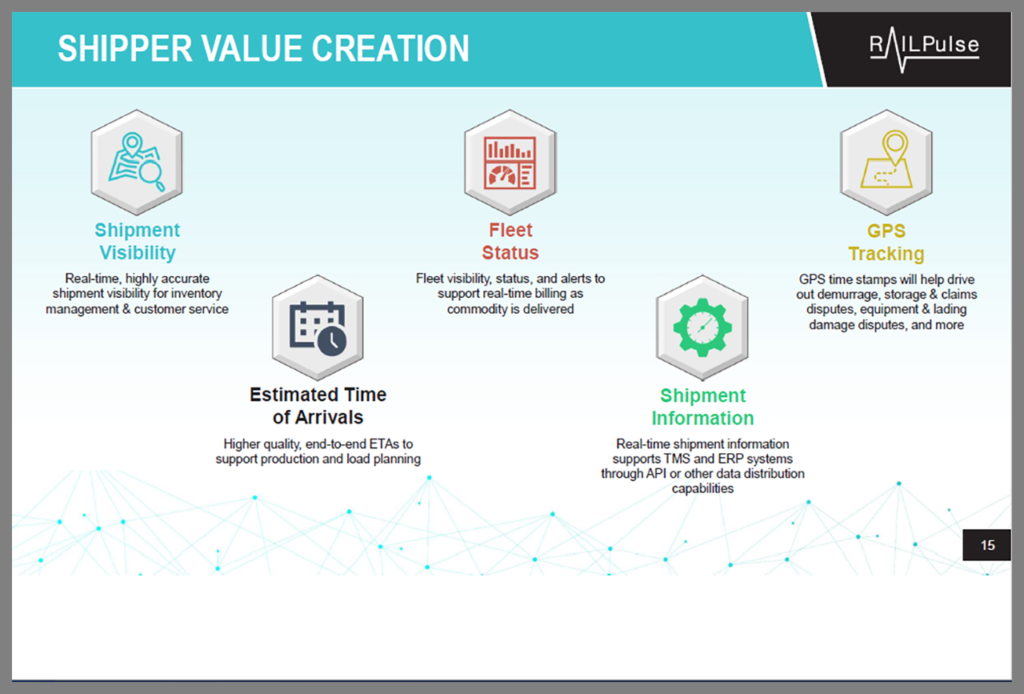

Attendees that may have not been paying close attention soon put aside what they were doing to pay attention to David Shannon, General Manager of RailPulse, whose technology he said could be a “game changer” for the equipment area of the rail transportation industry. RailPulse is a joint venture of Norfolk Southern, GATX, WATCO, Union Pacific, Trinity Rail, Genesee & Wyoming Inc., The Greenbrier Companies and Railroad Development Corporation.

Coinciding with a recent white paper released by Boston Consulting Group, David outlined how RailPulse was formed and what benefits we might expect from the technology. The white paper states: “Digital transformation is poised to promote a new era of growth in North American rail freight transport. The adoption of advanced tracking devices—known as telematics—has the potential to produce vast amounts of data on railcar location, condition, and health. Applying this data to improve the customer experience will help the rail industry grow its freight volumes after a decade-long decline in market share.”

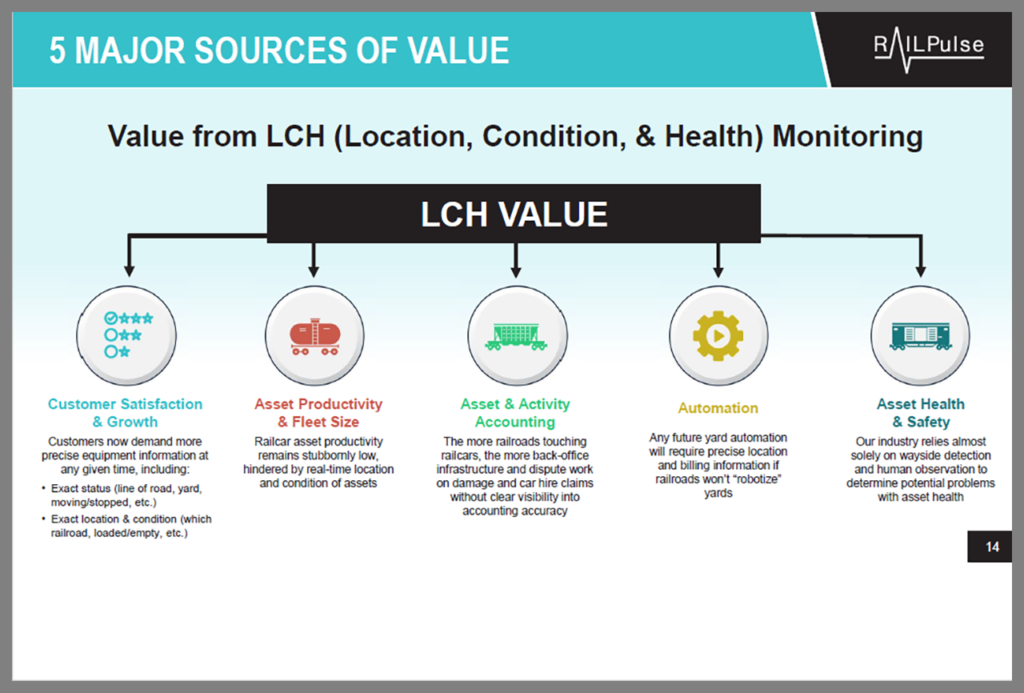

There will be five major sources of value derived from data collection:

- Customer Satisfaction and Growth.

- Asset Productivity & Fleet Size.

- Asset & Activity Accounting.

- Automation.

- Asset Health & Safety.

It has been suggested there could be an 8%-plus increase in productivity resulting in higher customer satisfaction and ultimately reduced expenses of maintenance or even fleet ownership.

Device testing and application is currently being tested and you can expect further information as they are completed later this year.

“Talking the Talk”

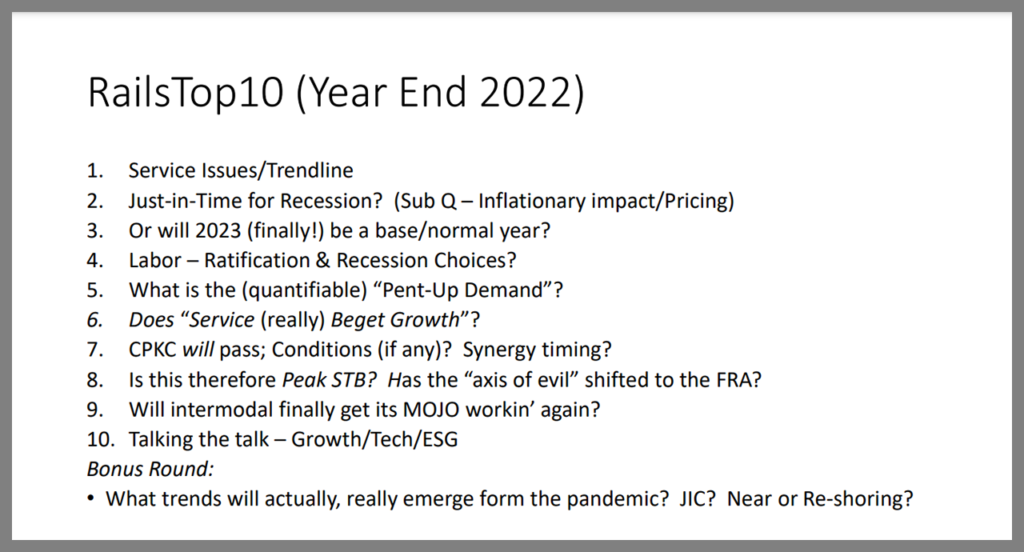

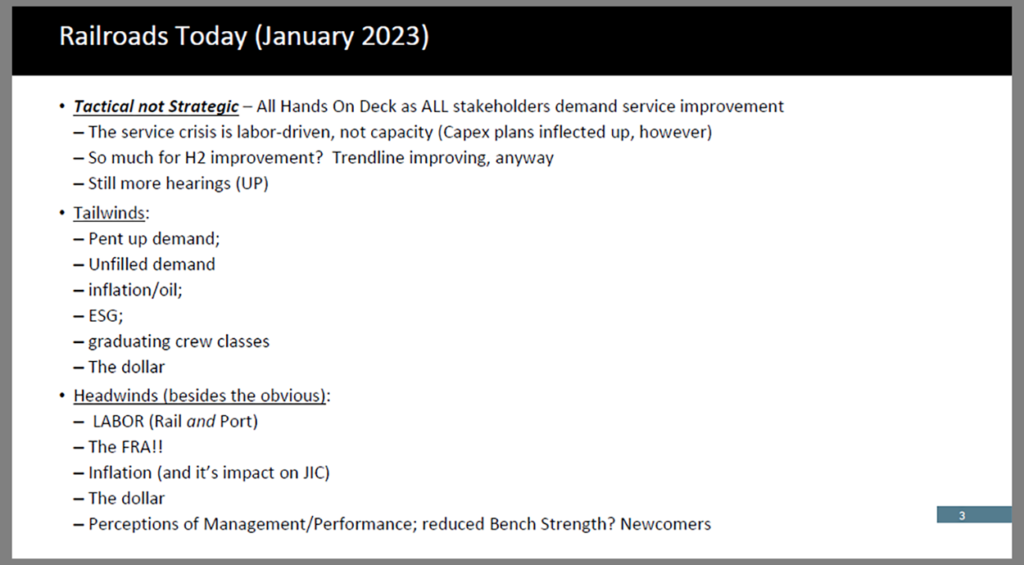

Independent rail industry analyst Tony Hatch gave his usual whirlwind but accurate presentation of the industry today, commenting on how it is “still talking the talk.” As always, he outlined the industry’s good and bad situations of the past year, and wrapped it up with a positive outlook.

I would like to pay tribute to Bill Schauer, who has retired after 15 years as MARS Executive Director. His friendly face will be missed at future meetings.

Ron Sucik is retired from the TTX Business and Market Planning Department but maintains his contacts with all elements of the rail intermodal industry. Ron offers his perspective to entities wishing to understand more about Intermodal and continues to present the Intermodal Situation at the annual Rail Equipment Finance Conference in La Quinta, Calif., scheduled next for March 6-8. Railway Age Contributing Editor Jim Blaze will cover the upcoming NEARS (Northeast Association of Rail Shippers) conference in Newport, R.I., April 12-14.