October: ‘Top Month’ for U.S. Carloads, Intermodal Volumes ‘Subdued’

Written by Marybeth Luczak, Executive Editor

(Photograph Courtesy of NS)

“October is usually one of the highest-volume months of the year for rail carloads, and it’s the top month so far this year,” Association of American Railroads (AAR) Senior Vice President John T. Gray reported Nov. 2. But U.S. intermodal volumes “remained subdued,” he said, “thanks largely to high inventories at many retailers, lower port volumes and still-scarce warehouse capacity for many rail intermodal customers.”

U.S. railroads originated 952,074 carloads in October 2022, according to AAR’s Nov. 2 traffic report, which covers October 2022 and the week ending Oct. 29, 2022. This was up 0.5%, or 5,121 carloads, from the prior-year period. U.S. railroads also originated 1,062,422 containers and trailers in October, down 1.4%, or 15,095 units, from the same month last year. Combined, U.S. carload and intermodal originations came in at 2,014,496, down 0.5%, or 9,974 carloads and intermodal units, from last year.

In October 2022, seven of the 20 carload commodity categories tracked by AAR each month saw carload gains compared with October 2021. These included coal, up 14,937 carloads or 5.8%; crushed stone, sand and gravel, up 8,615 carloads or 10.7%; and motor vehicles and parts, up 5,998 carloads or 11.4%. Commodities that saw declines included chemicals, down 6,195 carloads or 4.8%; primary metal products, down 4,645 carloads or 13.2%; and all other carloads, down 4,209 carloads or 16.8%.

“Carloads of grain surged upward as U.S. producers sought alternatives to the Mississippi River constraints while motor vehicles had one of their better months since pre-pandemic times,” Gray reported. “Carloads of chemicals were down in part because of high natural gas feedstock prices.”

Excluding coal, carloads were down 9,816, or 1.4%, in October 2022 from October 2021. Excluding coal and grain, carloads were down 8,950, or 1.5%.

Rail traffic results were similar in July 2022 and August 2022, with carloads up and intermodal volume down from the previous-year periods. But September 2022 saw both carloads and intermodal volume down from September 2021.

How does October 2022 compare with October 2021, October 2020 and October 2019? Let’s look back:

• “The shortages of dray trucks, drivers and warehouse space [at terminals] are significant constraints that drove intermodal volumes down in October [2021],” John T. Gray noted in AAR’s Nov. 3, 2021 rail traffic report, which found that container and trailer volume fell 7.9% from October 2020. Gray pointed out “rail customers have been unable to clear their freight as quickly as they and the railroads would like” at intermodal terminals, where railroads are feeling the supply chain challenges “most keenly.” U.S. Class I railroads moved 1,077,515 containers and trailers in October 2021, dropping 7.9%, or 92,400 units, from the same month in 2020; and 947,013 carloads in October 2021, rising 3.8%, or 34,510 carloads. Total U.S. carload and intermodal originations for the month were 2,024,528, down 2.8%, or 57,890 carloads and intermodal units, from October 2020.

• October 2020 was the “the best month ever” for U.S. rail intermodal, with volumes up by one-third from April 2020—“a stunning increase in six months,” John T. Gray said on Nov. 4, 2020. Intermodal again offset carload declines, as U.S. rail traffic for the month—2,082,646 carloads and intermodal units—rose 2.0%, compared with the same month last year. Also positive: Carloads rose for 10 of the 20 categories AAR tracks, “the most since the pandemic began,” Gray noted. In October, carloads of grain “were their highest in 13 years, while carloads of motor vehicles and parts have recovered after falling close to 90% earlier this year [2020],” Gray continued. “Changes in energy markets continue to pressure carloads of coal, petroleum products, and frac sand and holding back total carloads. Excluding those three categories, carloads in October [2020] were a few percentage points higher than last year [2019].” U.S. railroads originated 912,772 carloads in October 2020, down 6.6%, or 64,634 carloads, from October 2019. They also originated 1,169,874 containers and trailers in October 2020, up 10.0%, or 105,966 units, from the same month in 2019.

• In the AAR Nov. 6, 2019 traffic report, John T. Gray succinctly noted what was dragging rail freight down: “Sluggish growth abroad and trade developments are weighing on business investment, exports and manufacturing. Unfortunately, those are precisely what drive much of the freight carried by U.S. railroads, and their weakness goes a long way in explaining why rail traffic is down right now. Railroads are hopeful that policymakers here and abroad will take sensible actions aimed at accelerating growth and removing the uncertainty that’s constraining many economic sectors.” What Gray carefully referred to as “trade developments” were actually tariffs imposed by the Trump Administration on countries like Mexico, China and Canada, many industry observers noted. Indeed, the AAR itself strongly pointed out that “42% of rail carloads and intermodal units and 35% of annual rail revenue are directly associated with international trade. About 50,000 rail jobs, worth over $5.5 billion in annual wages and benefits, depend directly on international trade.” One industry observer noted that “Those tariffs, it logically follows, invite retaliation. And that hurts railroads.” U.S. railroads originated 1,224,477 carloads in October 2019, down 8.4%, or 112,703 carloads, from October 2018. U.S. railroads also originated 1,331,944 containers and trailers in October 2019, down 7.8%, or 111,910 units, from the same month in 2018. Combined, U.S. carload and intermodal originations in October 2019 were 2,556,421, down 8.1%, or 224,613 carloads and intermodal units from October 2018.

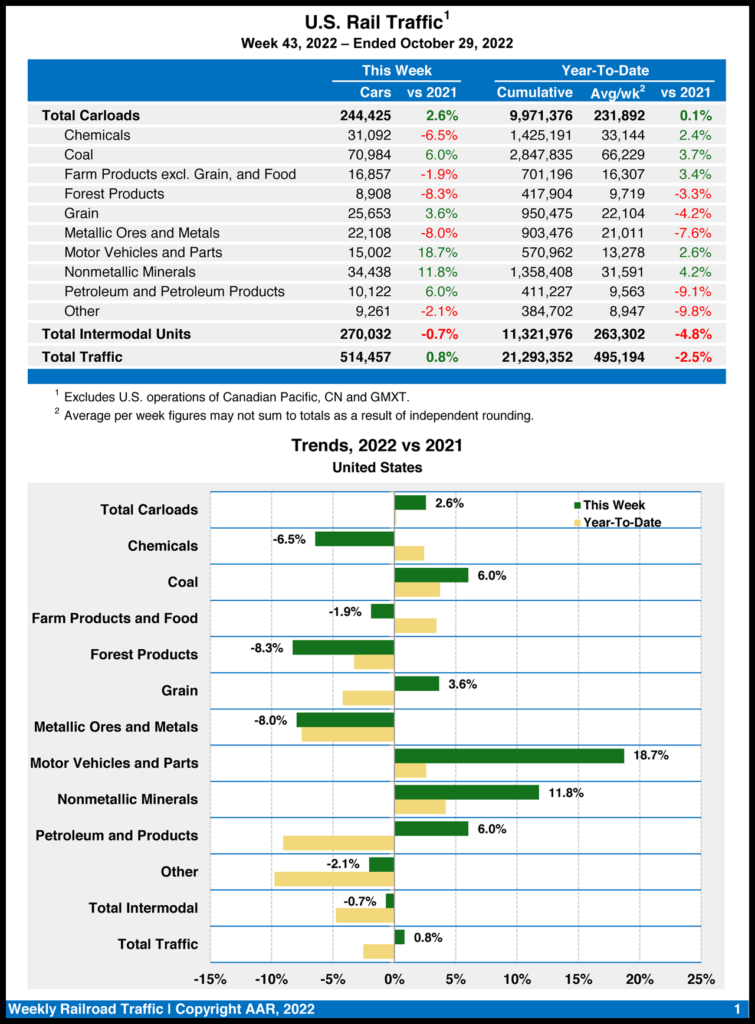

Year to Date 2022

Total U.S. carload traffic for the first 10 months of 2022 came in at 9,971,376 carloads, up 0.1%, or 14,912 carloads, from the same point last year; and 11,321,976 intermodal units, down 4.8%, or 567,366 containers and trailers, from 2021.

Total combined U.S. traffic for the first 43 weeks of 2022 was 21,293,352 carloads and intermodal units, a 2.5% fall-off from last year.

Week 43 (Ending Oct. 29, 2022)

Total U.S. weekly rail traffic for the week ending Oct. 29, 2022, was 514,457 carloads and intermodal units, up 0.8% from the same week last year. That comprises 244,425 carloads, up 2.6% from last year, and 270,032 containers and trailers, down 0.7%.

Five of the 10 carload commodity groups posted an increase compared with the same week in 2021. They included coal, up 4,036 carloads, to 70,984; nonmetallic minerals, up 3,631 carloads, to 34,438; and motor vehicles and parts, up 2,365 carloads, to 15,002. Commodity groups that posted decreases included chemicals, down 2,147 carloads, to 31,092; metallic ores and metals, down 1,916 carloads, to 22,108; and forest products, down 805 carloads, to 8,908.

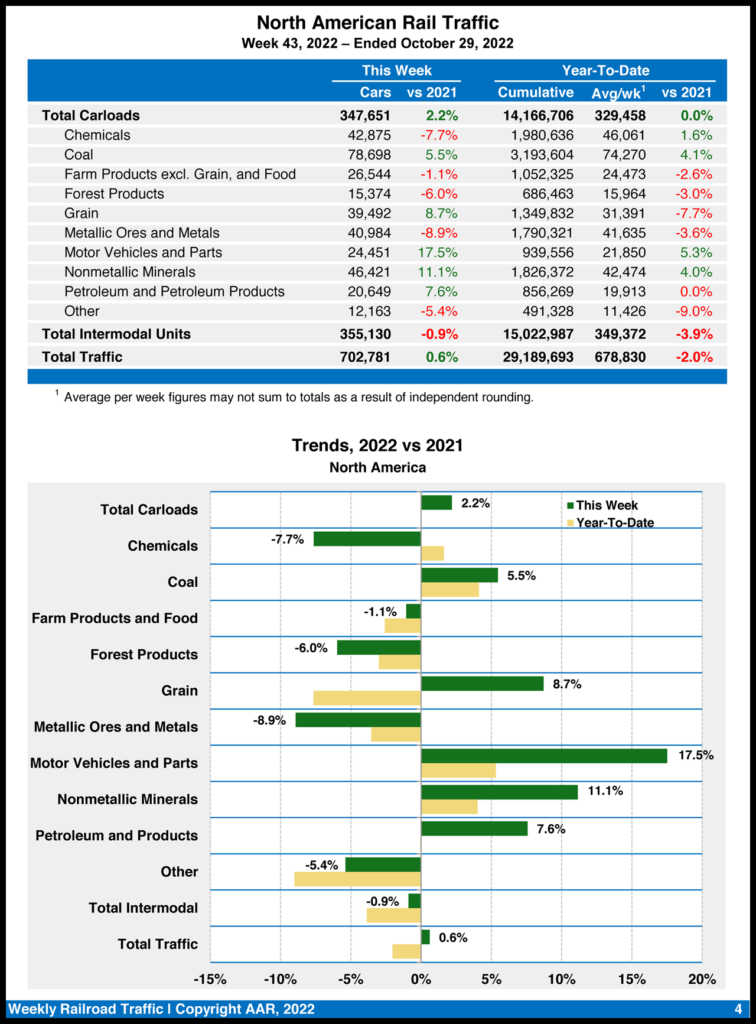

North American rail volume for the week ending Oct. 29, 2022, on 12 reporting U.S., Canadian and Mexican railroads totaled 347,651 carloads, rising 2.2% from the same week last year, and 355,130 intermodal units, dipping 0.9% from last year. Total combined weekly rail traffic in North America was 702,781 carloads and intermodal units, up 0.6%. North American rail volume for the first 43 weeks of this year was 29,189,693 carloads and intermodal units, decreasing 2% from 2021.

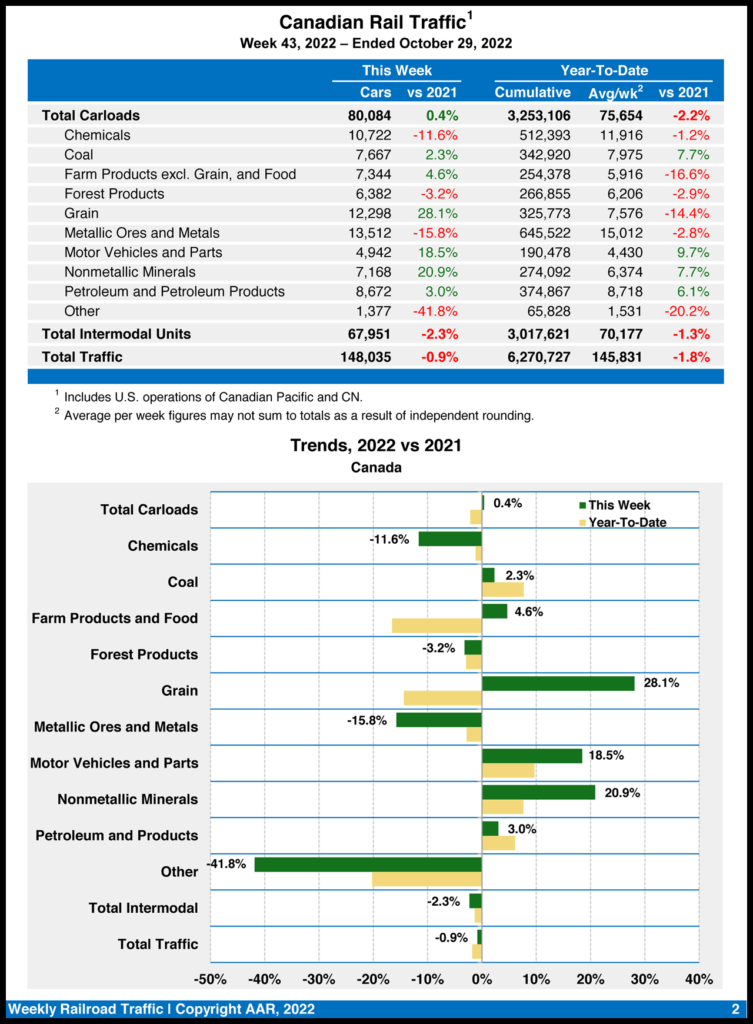

Canadian railroads reported 80,084 carloads for the week ending Oct. 29, 2022, up 0.4%, and 67,951 intermodal units, down 2.3% compared with the 2021 period. For the first 43 weeks of 2022, they reported cumulative rail traffic volume of 6,270,727 carloads, containers and trailers, down 1.8%.

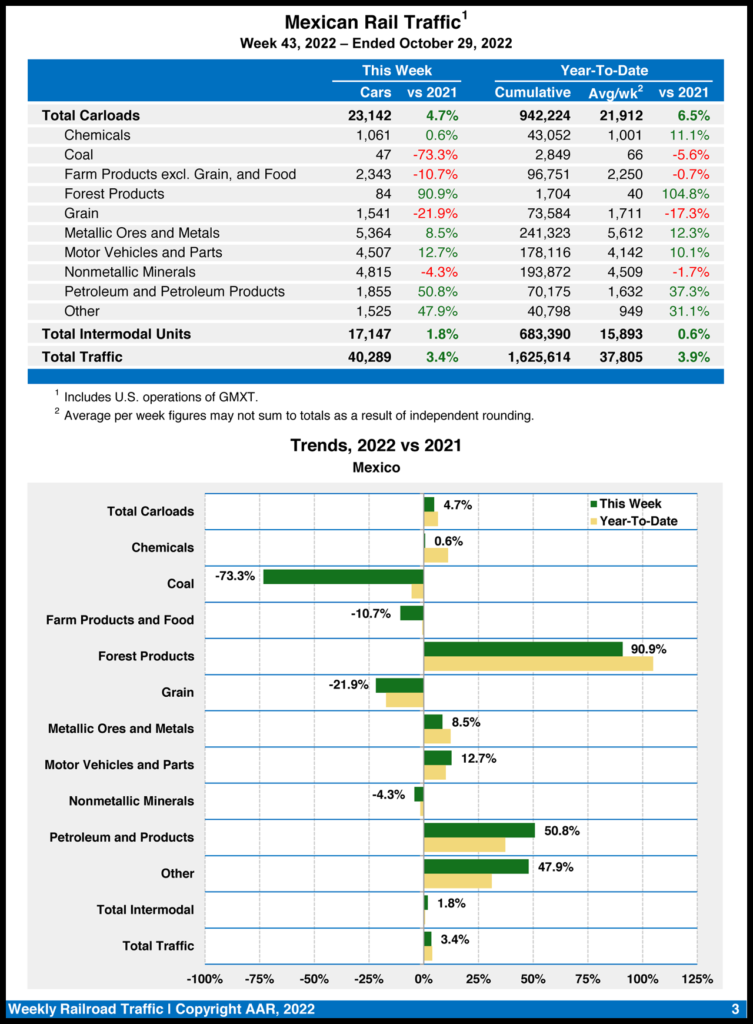

For the week ending Oct. 29, 2022, Mexican railroads reported 23,142 carloads, a 4.7% increase from the same week last year, and 17,147 intermodal units, a 1.8% gain. Their cumulative volume for the first 43 weeks of this year was 1,625,614 carloads and intermodal containers and trailers, up 3.9% from 2021.