NS’s Shaw: ‘Focusing on Long-Term Priorities and Value’ (UPDATED, TD Cowen)

Written by Marybeth Luczak, Executive Editor

NS President and CEO Alan H. Shaw (NS Photograph)

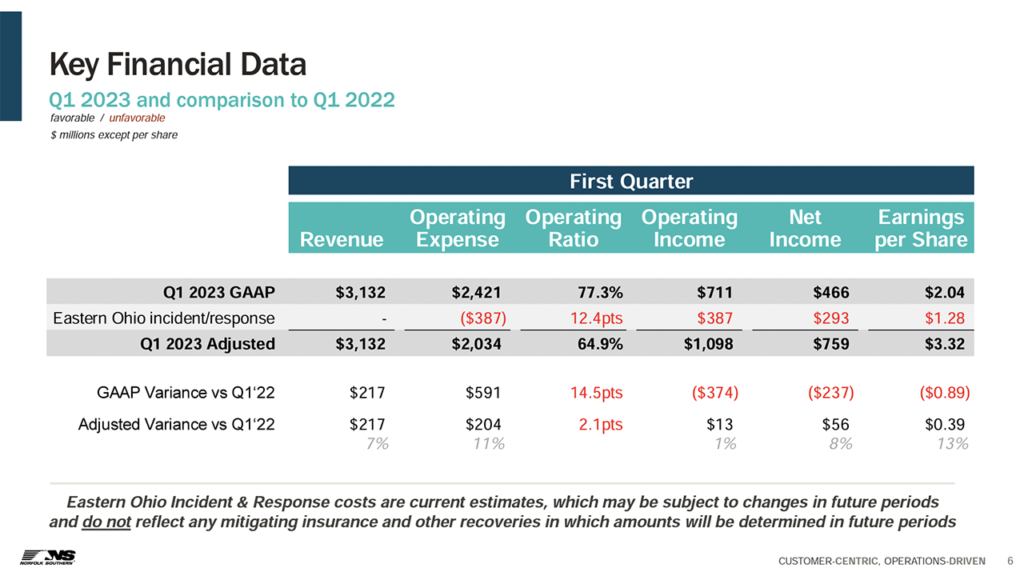

Norfolk Southern (NS) on April 26 reported first-quarter 2023 financial results reflecting an initial $387 million charge associated with the Feb 3 derailment in eastern Ohio. “From the beginning, we have been guided by one principle: We are going to do whatever it takes to make it right for East Palestine and the surrounding areas,” NS President and CEO Alan H. Shaw said. “We are making progress every day and I’m proud of our people. Our response reflects our strategy of focusing on long-term priorities and value.”

According to the Class I, the results for the first three months ending March 31, 2023, do not include “any amounts potentially recoverable under the company’s insurance policies, which would be reflected in future periods in which recovery is considered probable.”

Following are among NS’s first-quarter highlights:

• Income from railway operations came in at $711 million and diluted earnings per share were $2.04, declines of 34% and 30%, respectively from first-quarter 2022, due to the derailment charge. Adjusting for the effects of the change, NS said, income from railway operations was $1.1 billion and diluted earnings per share were $3.32, improvements of 1% and 13%, respectively from 2022.

Railway operating revenues came in at $3.1 billion, up 7%, or $217 million, compared with first-quarter 2022. NS reported that strength in merchandise (up 12% to $1.9 billion) and coal (up 13% to $389 million) offset weakness in intermodal (down 5% to $854 million).

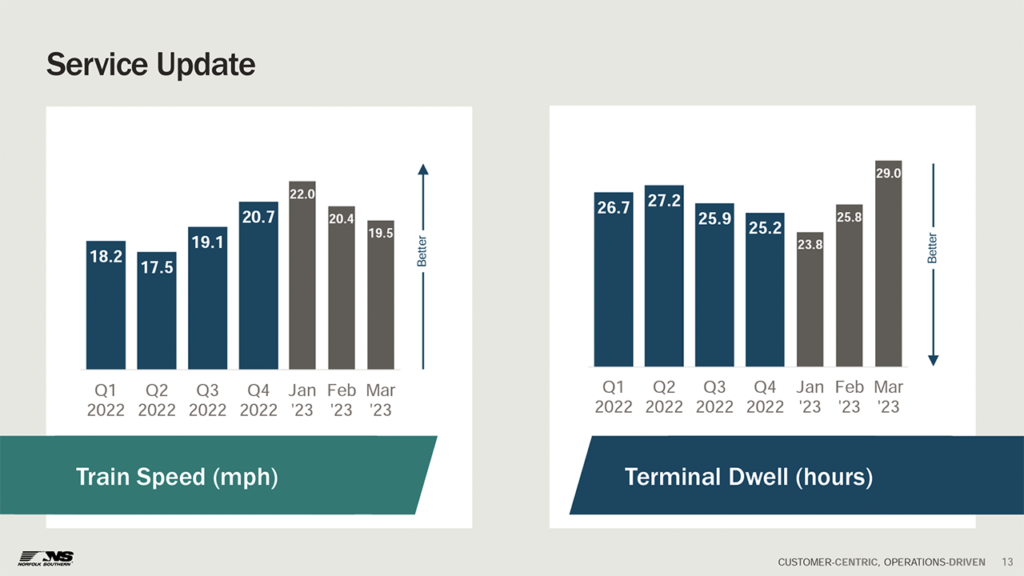

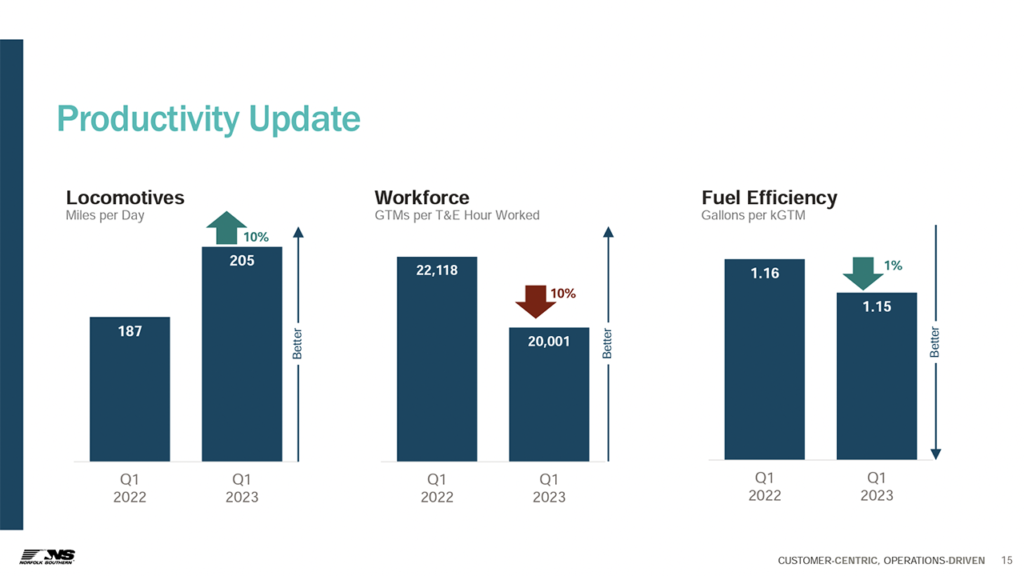

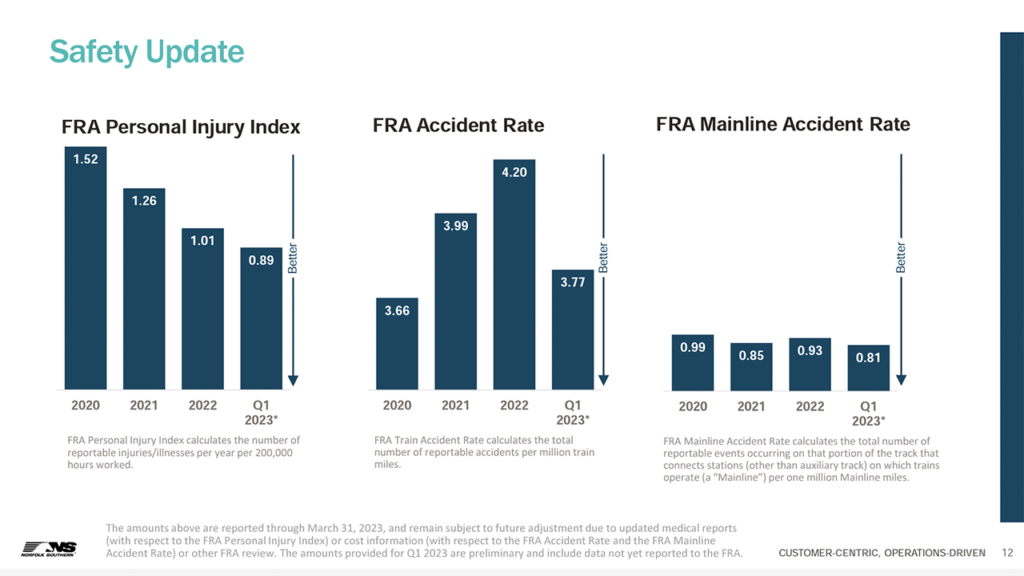

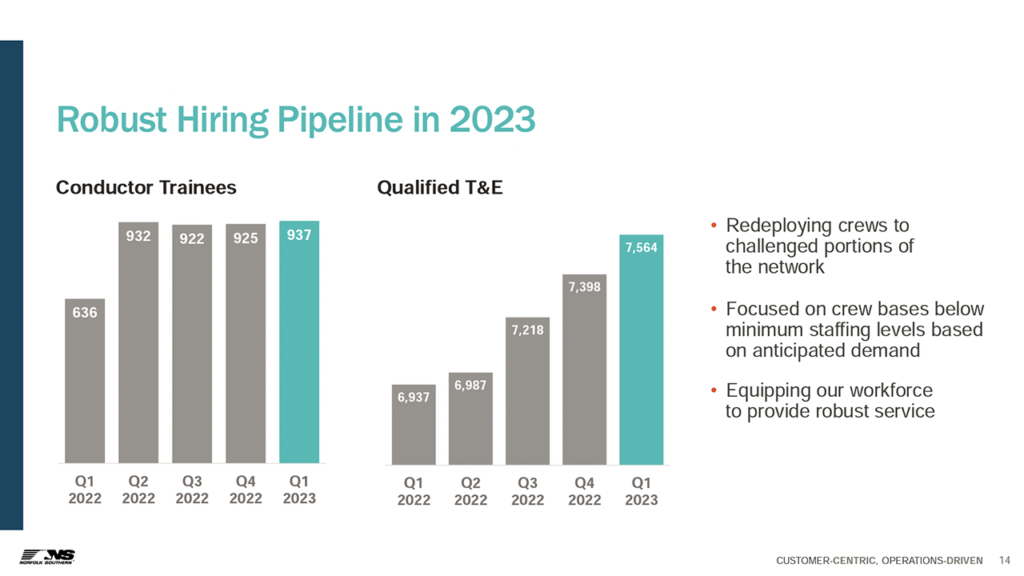

NS provided the following charts detailing its quarterly service, productivity and safety results as well as its hiring pipeline:

TD Cowen Insight: ‘Trying to Put Derailment Behind Them’

“NS recorded a first-quarter beat excluding $387 million in derailment-related charges, though resulting service impacts and macro conditions are already pressuring volumes in early second quarter,“ reports TD Cowen Managing Director, Industrials and Railway Age Wall Street Contributing Editor Jason Seidl. “Lingering service costs associated with the derailment and a pending fuel-surcharge headwind lay ahead. Service recovery should resume in the second half, leaving NS in a better spot once freight recovers. Lowering PT and Reiterate Outperform.”

Key TD Cowen Takeaways:

• “NS reported first-quarter adjusted EPS of $3.32 beating our estimate of $3.16 and the consensus forecast of $3.13. Adjusted results exclude a $387 million charge related to the East Palestine derailment. Inflationary pressures remain persistent with adjusted OR of 64.9% coming in worse than our expectations. The quarter was also aided by an approximately $0.21 jump in other income that was largely attributed to life insurance gains.”

• “The Ohio derailment was naturally the focus of today’s call. The $387 million derailment-related charge does not net out insurance coverage and is an estimate of total costs that NS expects to incur. To date, NS has incurred $55 million of these costs in cash and will be subsequently filing insurance claims to cover these. The estimated derailment charge presently consists of costs associated with site cleanup, community support and legal fees but also includes preliminary estimates of future claims and settlements. This latter component will likely be adjusted over time as claims are settled and insurance coverage comes through, though NS should continue to back these changes out of adjusted earnings numbers. We remind investors that NS had previously indicated it has $1 billion in insurance coverage that could be applied to the Ohio derailment.

• “Service improvements became a casualty of the derailment in the first quarter with sequential worsening of fluidity metrics witnessed in February and March. East Palestine is located in an important corridor and is presently operating at reduced capacity. Normal operations on this line are expected to resume by June this year. NS also undertook a reassessment of train makeup procedures in the aftermath of the accident, resulting in near-term impacts on capacity provisions.

• “The outlook for volumes was approximately in line with expectations with NS calling out weak intermodal volumes partially offset by resilient industrial activity. High inventory levels and weak imports underpin second-half volume uncertainty. Unfortunately, the second quarter has not started out well for NS and we have modeled the quarter as being the worst in terms of a year-over-year percent change. NS expects intermodal storage revenues and assessorial charges to decline with supply chain congestion now a thing of the past. We expect assessorials will finally come back in line with pre-pandemic levels by 2024.

• “Inflationary costs remain elevated in the system and are expected to persist through 2023, pressuring FY OR. Management reiterated a commitment to preserve resourcing levels to optimize reliability, commenting that headcount will continue to increase sequentially throughout the year irrespective of the volume scenario. Purchased services and materials expenses recorded double-digit increases in the first quarter and should remain elevated in the second quarter due to the service problems created by the Ohio incident. Lastly, as we noted for the other U.S. railroads, fuel will be a headwind going forward. We worsen our out quarter OR assumptions to reflect these pressures.”

For more details on the first quarter, download the NS financial report below:

As part of a special series in Railway Age’s April 2023 issue, Alan Shaw was one of 13 chief executives of leading North American companies to answer the single-most critical question: What is the biggest challenge facing the North American rail industry? Read his perspective on “Safety First, Safety Always.”