NS: ‘Solid Second Quarter Results Despite Network Fluidity Challenges’ (UPDATED, Cowen)

Written by Carolina Worrell, Senior Editor

NS reported a 21% increase in operating expenses over second-quarter 2021’s, due to "higher fuel prices, lower property sales, and increased costs from inflation and service challenges."

Norfolk Southern (NS) in second-quarter 2022 delivered a “solid financial performance, despite network fluidity challenges,” President and CEO Alan H. Shaw said on July 27 in an earnings announcement. Revenue and volume were both up from last year, he reported, up 16% and 9%, respectively.

Download the complete Q22 Earnings Call:

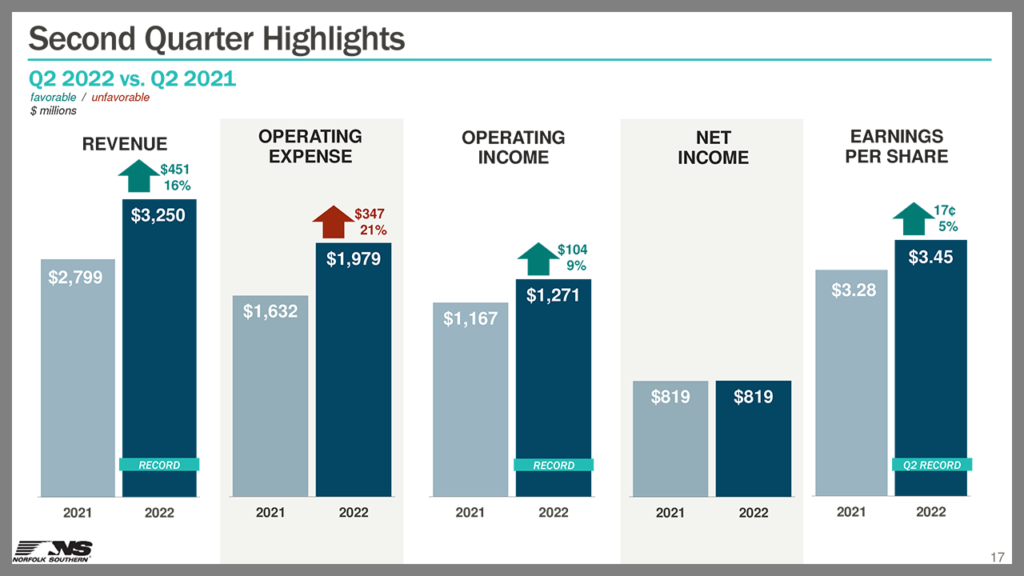

NS reported second-quarter net income of $819 million and diluted earnings per share of $3.45, and a quarterly record operating ratio (OR) of 60.9%, higher than second-quarter 2021’s 58.3% but down from first-quarter 2022’s 62.8%.

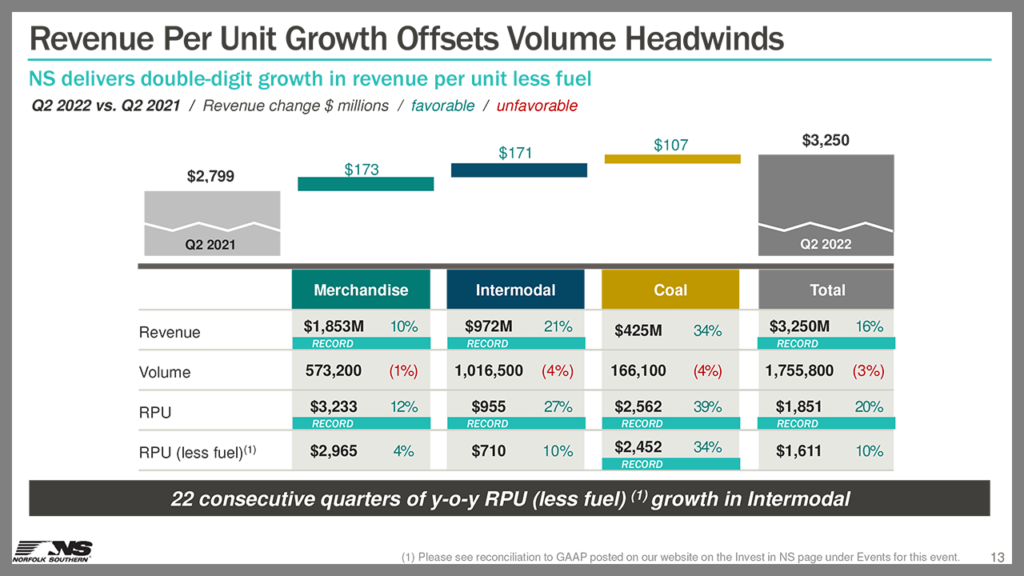

Railway operating revenues were an all-time quarterly record of $3.3 billion, up 16%, or $451 million, over second-quarter 2021’s $2.799 billion, driven by a 20% increase in revenue per unit, NS reported.

Railway operating expenses were $2.0 billion, an increase of 21%, or $347 million, over second-quarter 2021’s $1.632 billion, due to higher fuel prices, lower property sales, and increased costs from inflation and service challenges, NS reported.

Income from railway operations, NS reported, was a record of $1.3 billion, an increase of 9%, or $104 million, from second-quarter 2021’s $1.167 billion.

“We remain steadfast in our commitment to service recovery,” Shaw said. “In the quarter, we made considerable progress on staffing, and launched our TOP|SPG operating model, both of which are foundational to achieving our targeted service levels and long-term growth strategy. Already we are seeing visible upticks in qualified employees and train speeds as a result of these initiatives, and we expect to see further progress on service recovery in the months ahead.”

Download the complete 2Q22 Financial Report:

The Cowen Insight

“NS reported 2Q earnings in line with our estimates as pricing came in strong even as fuel expenses weighed on OR and volumes were held back by persistent fluidity problems,” reported Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “We remain somewhat cautious on the 2H and 2023 as management guided moderating yields offsetting volume improvements. Lower PT to $316 and reiterate Outperform.”

Key Cowen Takeaways

- NS reported 2Q adj. EPS of $3.45 in line with our forecast and slightly below the consensus estimate of $3.47. Adj. OR worsened by 260 bps to reach 60.9% and came in below our expectations. YOY Comps were affected by a large gain on sale recorded in 2Q21 and by higher than expected fuel expenses (up 117% y/y constituting a 140 bps headwind to OR) similar to the other Class Is that have reported so far. Revenues came in above expectations at $3.3bn, growing 16% y/y, as 20% yield growth offset a 3% volume decline in 2Q. The company noted a ~$0.09 swing below the line in other income.

- On the volumes side, the 2Q decline was driven by reduced merchandise and coal shipments, partially offset by growth in grain shipments and modest improvements in international intermodal volumes. Management guided gradual sequential improvements in volume growth in 2H, particularly in coal volumes, with the bulk of recovery occurring in 4Q. It was also noted that 4Q recovery will be tempered by typical seasonal headwinds, and we model as such.

- Pricing remained strong in 2Q with revenue/carload growing 20% y/y propelled by coal yield growth of 40%. Management noted that coal yield growth has likely peaked due to declining coal export prices and guided sequential normalization in 2H, although levels will remain high on a y/y basis. We model moderating RPU for the company as the coal tailwind slows down but is partially offset by continued yield growth in automotive, intermodal and merchandise.

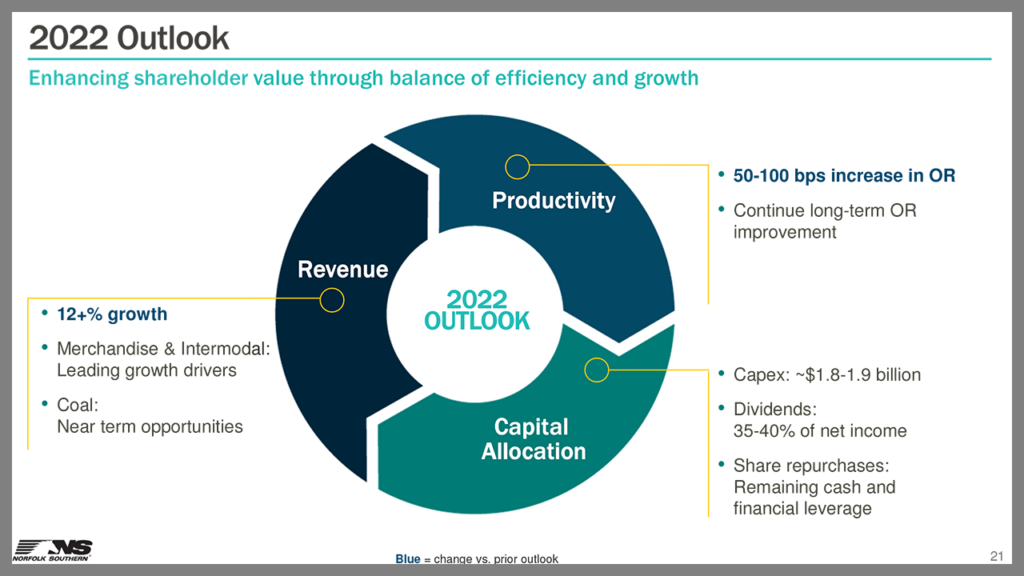

- On the expectation of gradual sequential fluidity improvements (leaving volumes flat on a y/y basis) and higher than anticipated fuel expenses, management increased (worsened) OR guidance for 2022 anticipating a 50-100 bps deterioration despite 12% y/y revenue growth. Management also guided that other income typically nets to $15MM per quarter, and we model this directionally. We come in on the low end of management’s guidance for 2022 and lower our estimates. We remain cautious on demand conditions into 2023 while acknowledging that efforts to improve fluidity will materialize toward the end of the year and into 2023, allowing modest y/y margin improvements.