NS Reports 4Q, Full-Year ’21 Financials, Board Changes

Written by Marybeth Luczak, Executive Editor

“Our team continues to deliver long-term value to our shareholders and customers, and we are in an excellent position to build on these results moving forward,” NS Chairman and CEO James A. Squires said during a fourth-quarter and full-year 2021 earnings announcement on Jan. 26.

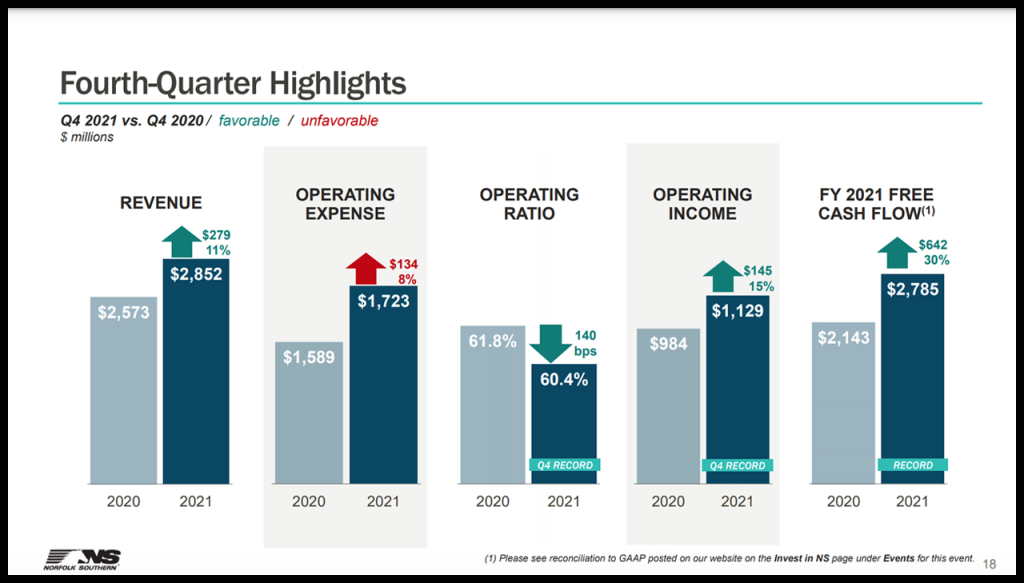

Norfolk Southern (NS) on Jan. 26 reported fourth-quarter 2021 results, including net income of $760 million, up 13% from the same period in 2020; diluted earnings per share of $3.12, up 18% from 2020; and an operating ratio of 60.4%, a fourth-quarter record, down 140 basis points from the 2020 period. The Class I also named Amy E. Miles Non-Executive Board Chair, effective May 1.

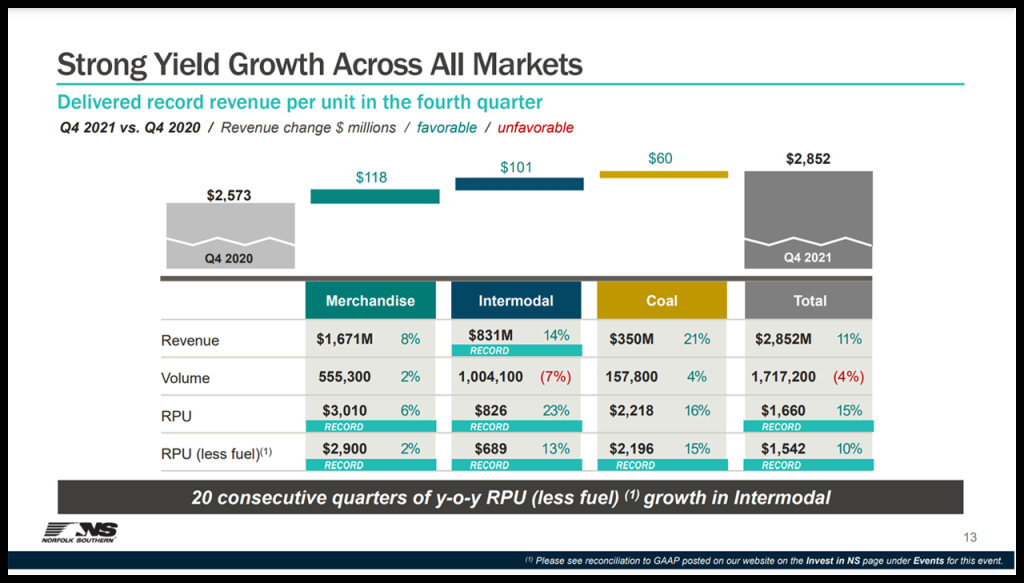

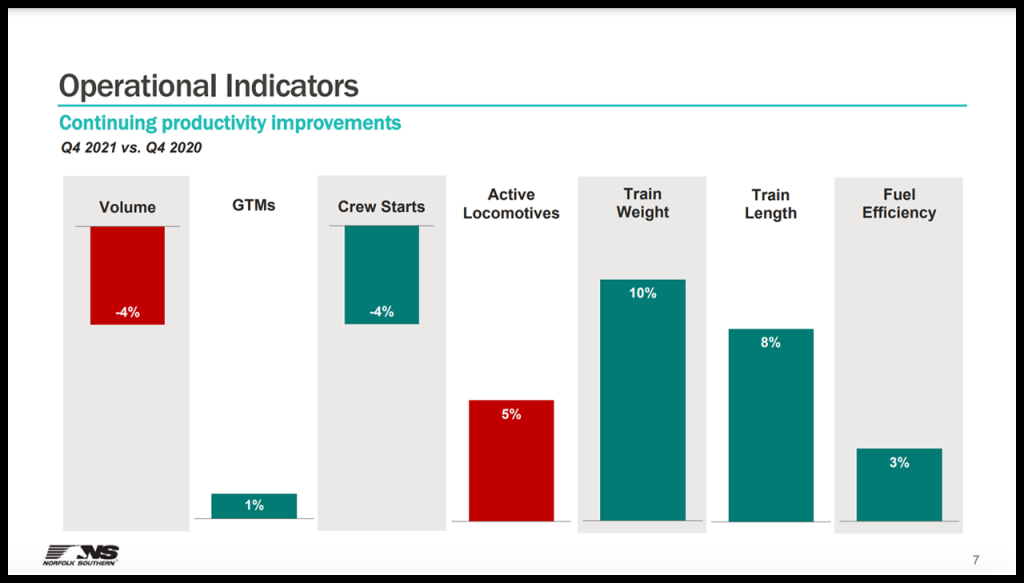

For the three-months ending Dec. 31, 2021, NS posted railway operating revenues of $2.85 billion, an 11% increase over the same period in 2020, which the Class I railroad attributed to a 15% increase in revenue per unit. Total volumes for fourth-quarter 2021 were down 4% from fourth-quarter 2020. Merchandise volume was up 2%; intermodal volume, down 7%; and coal volume, up 4%.

Railway operating expenses were $1.7 billion, an increase of 8%, or $134 million, compared with the 2020 period, due to higher fuel and purchased services expenses, NS said.

Additionally, income from railway operations was a fourth-quarter record of $1.1 billion, an increase of 15%, or $145 million, year-over-year, according to NS.

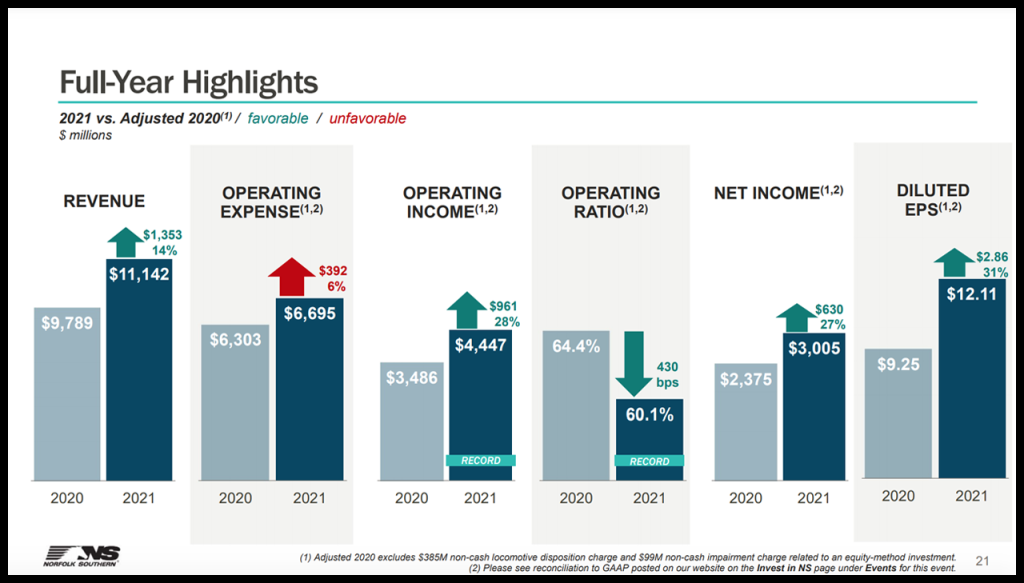

Full-Year 2021 Vs. Adjusted Full-Year 2020 Highlights

• Railway operating revenues of $11.1 billion improved 14%, or $1.35 billion, “reflecting an 8% increase in revenue per unit and 5% higher volume versus a year ago,” NS reported. Volume increased in all major commodity groups.

• Railway operating expenses were $6.7 billion, a decrease of 1%, or $92 million, compared with 2020. “Last year’s results included a $385 million non-cash locomotive rationalization charge and a $99 million non-cash impairment charge related to an equity-method investment,” NS reported. “Excluding those charges, operating expenses were up 6%, or $392 million, compared with adjusted operating expenses in 2020, driven by higher fuel, purchased services and compensation and benefit expenses.”

• Income from railway operations was a record $4.45 billion, up 48% or $1.45 billion, according to NS. “Excluding the effects of the locomotive rationalization and impairment charges in 2020, income from railway operations was up 28%, or $961 million, on a year-over-year adjusted basis,” the railroad reported.

• NS’s operating ratio was 60.1%, an “all-time record” and an improvement of 920 basis points over 2020, the railroad said. “Excluding the effects of the locomotive rationalization and impairment charges in 2020, the operating ratio improved 430 basis points over the adjusted results for 2020,” it noted.

2022 Outlook

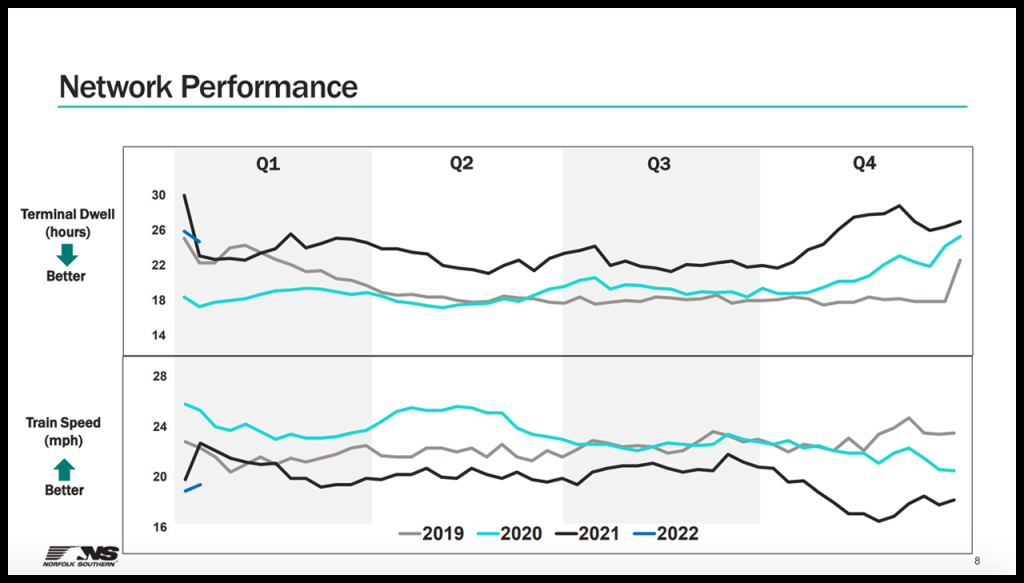

Looking ahead, NS reported that it expects “upper single-digit year-over-year growth” in revenue, with merchandise and intermodal as the “leading growth drivers.” Coal, NS said, will continue its “secular decline.” Additionally, the Class I expects a 50-100 basis point improvement in operating ratio, and plans capital expenditures of $1.8 billion to $1.9 billion.

The NS Investor Relations page provides more details.

“The fourth quarter marks the successful completion of the ambitious three-year strategic plan we launched in 2019,” NS Chairman and CEO James A. Squires said. “We achieved significant additional improvement in productivity while overcoming the headwinds associated with the pandemic and global supply chain disruptions. Our team continues to deliver long-term value to our shareholders and customers, and we are in an excellent position to build on these results moving forward.”

NS Board Changes

The NS Board of Directors has named Amy E. Miles, a Board member since 2014, as Non-Executive Chair, effective May 1. Miles served as CEO of Regal Entertainment Group, Inc., from June 2009 until its acquisition in March 2018. She has been a director of Gap Inc. since April 2020 and Amgen since July 2020.

Additionally, Alan H. Shaw, who was appointed company President in December 2021, will join the Board when he assumes the role of CEO on May 1 in connection with the planned retirement of Chairman and CEO Squires. Squires, who was elected to the Board in 2014, will remain a Director following his retirement. As a result, NS said its Board will increase to 14 members from 13. Both Shaw and Squires will stand for Board re-election at the company’s annual meeting on May 12.

“Amy’s leadership as a senior executive, deep financial expertise, and service as a director at several companies make her a natural fit to chair Norfolk Southern’s Board of Directors,” said Steven F. Leer, Lead Director of the NS Board. “The strength of the company’s Board, both in terms of broad experience and diversity, are critical to working with the company’s management team and driving solid returns for shareholders. We are confident that all Norfolk Southern stakeholders will be in good hands with the leadership of Amy Miles, Alan Shaw, as well as the dedicated Board and management team.”

Leer will continue on the NS Board as an Independent Director once Miles assumes her new role, NS reported. Additionally, Board Director Marcela Donadio will become Chair of the Audit Committee, effective May 1. Donadio, who has served on the Board since 2016, is a former Partner at Ernst & Young, where she was the leader of the firm’s Americas Oil & Gas Sector.

“Norfolk Southern’s shareholders and employees are fortunate to have a collaborative Board of Directors and management team,” Shaw said. “With Amy’s leadership and the wise counsel of our entire Board, I look forward to delivering improved service for our customers, as well as driving opportunities for enhanced productivity and future growth.”

The Cowen Insight: “Pricing Leads the Way Yet Again”

“Similar to the rest of the Class I’s that have reported earnings, NSC’s 4Q was a pricing story that drove a top and bottom line beat,” noted Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “Pricing should grow through 2022 as volumes begin the year challenged due to congestion across the transport network. The outlook is better for 2H22 for both volumes and margins. We increase our PT to $321 from $301 and reiterate our Outperform rating.

“4Q adjusted EPS of $3.12 beat our estimate of $3.02 and the consensus figure of $3.04. Revenue growth of 11% came in above expectations as a 3.6% decline in carloads was more than offset by 15% in revenue per carload, highlighting the robust pricing environment in 4Q. Recall last quarter NSC highlighted that it expected to re-price ~50% of its book over Q4 and Q12022; we expect pricing in Q1 to outpace Q4 pricing based on call commentary and the continued supply/demand imbalance. Chemicals was the best performing segment in terms of volumes, brought down by a 9% volume decline in automotive, and 7% volume decline in intermodal. As we think about 2022, we model a 2H weighted rebound for both of these segments that management expects as congestion works to normalize. The 60.4% adjusted OR was a fourth-quarter record and above our forecast.

“Looking into 2022, management expects the first half of 2022 to look similar to the back half of 2021 (from an OR standpoint) and noted that the robust demand environment should continue through the year. NSC expects OR improvement between 50-100 bps in 2022 (off a 60.1% OR in 2021). Revenue is expected to grow by high-single-digits this year driven by merchandise and intermodal, which will be more of a 2H story. Driven by a robust consumer economy, continued inventory replenishment, and tight truck market, intermodal is poised to rebound despite near-term challenges. Management calls for a cautious coal outlook (despite strong coal demand currently playing out and a likely tailwind in the near term).

“Free cash flow increased 30% to $2.8bn in 2021. Property additions fell ~$100MM short of management’s $1.6bn guidance, which will be carried into 2022. In 2022, capex is expected to be in the range of $1.8bn to $1.9bn. NSC had two dividend increases in 2021 and doubled its share repurchase spend. In 2022, NSC targets dividends of 35%-40% of net income. Remaining free cash flow will be used for continued repurchases; we model buybacks in line with 2021 levels.

“We increase our 2022 EPS estimate to $13.95 from $13.70 and introduce our 2023 EPS estimate of $15.30 as we roll our model forward. We bring our multiple down a turn to 21x to be more in line with its historical average, and using our new 2023 EPS estimate, arrive at our new price target of $321 and reiterate Outperform.”