NS: ‘A Franchise Built for Growth’ Says Shaw

Written by Marybeth Luczak, Executive Editor

Alan Shaw, President and CEO, Norfolk Southern

Norfolk Southern’s (NS) growth strategy was laid out at its Dec. 6 Investor Day, the first under new President and CEO Alan Shaw. Not a “grow-at-all-cost strategy,” Shaw said the Class I will balance three key elements: “Reliable and resilient service; continuous productivity improvement; and smart and sustainable growth.” Cowen and Company and Susquehanna Financial Group (SFG) weigh in.

Following is a Railway Age roundup of the event, taken from transcripts (downloadable below, along with a slide presentation).

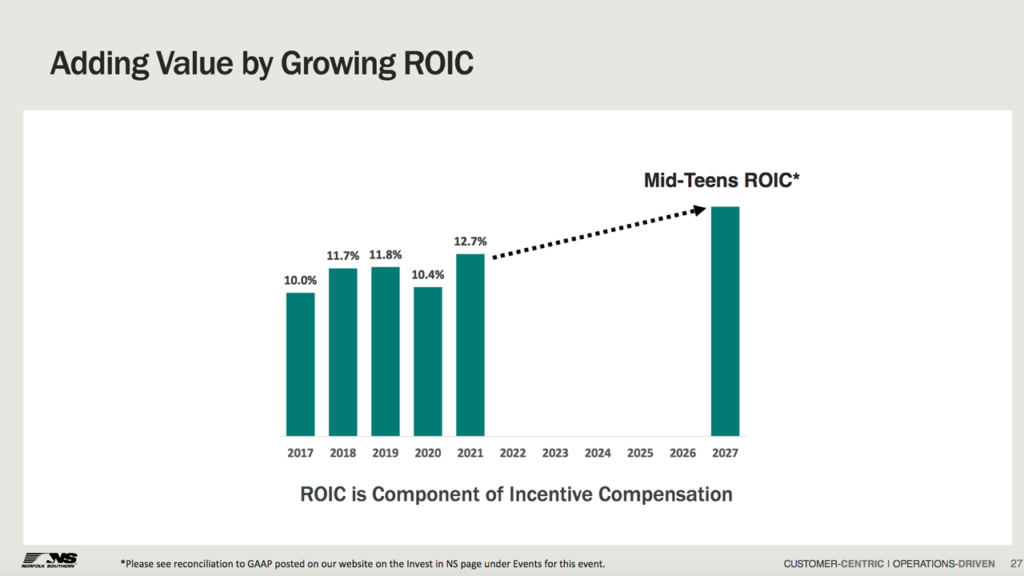

Shaw, who was appointed to the top job in December 2021, reported that with NS’s PSR-based operating plan, TOP21, the railroad “delivered consistently strong results for our shareholders since our last Investor Day in 2019. In the succeeding three years, we improved OR by 530 basis points. We grew EPS by 27% and we produced total shareholder return of 110%. And we also delivered approximately $10 billion in shareholder distributions.”

The Class I is now taking the next step with its new TOP | SPG, PSR-based operating plan, which Shaw said “balances service, productivity and growth. This is an essential point, and I want to explain exactly what we mean. Our entire organization is aligned around delivering continuous productivity improvement. We mention PSR frequently—but this is a different kind of PSR. Reducing operating ratio is not our singular focus. We strive for more. Our pursuit of margin improvement will be balanced with other important financial measures, such as earnings per share, Return on Invested Capital, and revenue.”

How will that be achieved? Shaw said NS will “deliver a reliable and resilient service product that allows us to pursue smart and sustainable growth. Now, we call it ‘smart and sustainable growth’ because it is not a ‘grow-at-all-cost’ strategy. We know that doesn’t work. We’re going to target business where we and our customers can be mutually successful, because we know that when we onboard business that we serve well, it enhances our reliability and our efficiency for all of our customers. We also know that the greatest growth opportunities for Norfolk Southern are in that massive $860 billion truck and logistics market that, frankly, our franchise was built to serve.”

Driving ‘Sustainable Growth’

NS is a “franchise built for growth,” Shaw told investors. The railroad, he said, intends to leverage its network, which includes “a robust, well-designed route structure that links major population centers in the East and an unmatched placement of intermodal terminals near the heart of the U.S economy. It includes more short line partnerships than any other railroad in North America that extends our reach and gives our customers more markets to serve. It includes partnerships with East Coast ports, giving us a global scale. And we know that those East Coast ports are growing faster than their Western counterparts.

“It includes trusted longstanding relationships with a desirable portfolio of customers who are also leaders in their own industry, and that allows us to collaborate on innovative supply chain solutions. And included in that customer base are the best channel partners in the intermodal industry. That includes J.B. Hunt and the Hub Group. And collectively, we’re able to able to offer a seamless, customer-oriented experience to our mutual customers and invest in our shared growth.”

Shaw stressed that NS serves “dense population centers separated by moderate distances,” which positions it to compete for “flexible freight, business that can easily shift between highway and rail, the fastest-growing segment of the $860 billion U.S. truck and logistics market. That is what we mean when we say we have a franchise built for growth.”

NS Opportunities

Looking at opportunities over the next few years, Shaw said the NS sees “more than the cyclical challenges of inflation and an economic slowdown. We see enduring market trends that play to our strengths.” Among them:

- An “indisputable shift in consumption habits to e-commerce, which is four times more intermodal intensive than traditional brick and mortar retail,” said Shaw, noting that NS’s “intermodal franchise is a strategic strength.”

- A “shift from just-in-time to just-in-case inventory strategies—a willingness by customers to hold more inventory and maintain more inventory. That plays to the benefit of rail because we have the capacity to help our customers build and maintain inventory.” A “forward positioning of inventory next to the ultimate consumption markets. That’s what we serve,” Shaw said.

- An “acceleration of onshoring” as a response to geopolitical and energy risks. “And that allows us to leverage our best-in-class Industrial Development team,” Shaw said.

- Sustainability. This “wasn’t that big of an issue in 2019 at our last Investor Day, [but] has become more and more of an issue for our customers and their customers,” according to Shaw. “Again, that plays to the strength of rail because rail’s carbon footprint is four times more efficient than truck.”

“And even within the economic headwinds, there’s a potential silver lining because it creates powerful incentives for cost-conscious customers to shift business from highway to more efficient rail,” Shaw summed up. “All these trends are good for rail, [and] great for Norfolk Southern.”

To deliver results, Shaw said the railroad will be “a customer-centric, operations-driven service organization.”

Resiliency

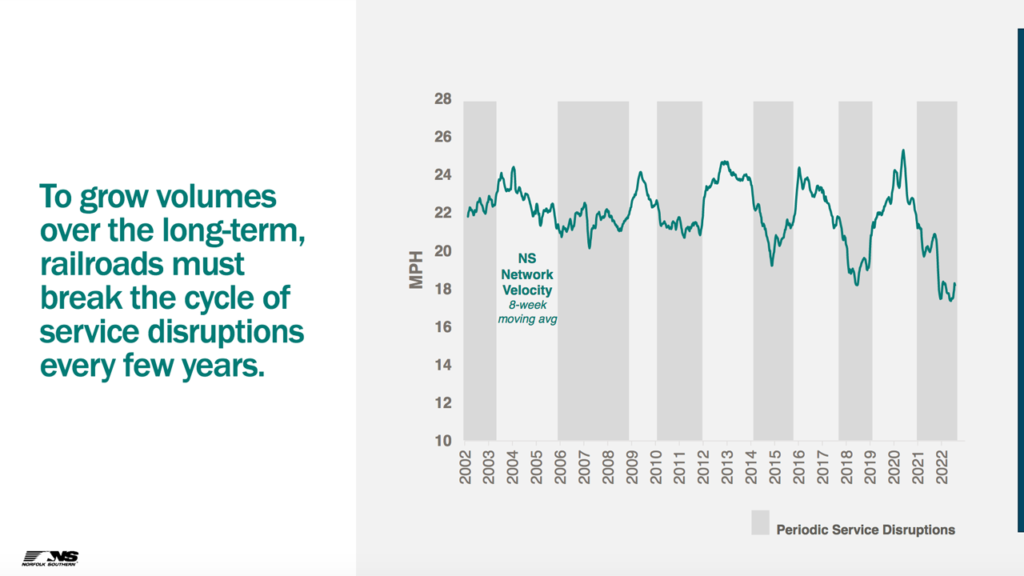

Resiliency is a key part of NS’s strategy, according to Shaw. “Rails deal with service disruptions, frankly, almost every day and it can be a weather event like a wash out,” he said. “It can be crew shortages over the weekend or Super Bowl Sunday or an open deer-hunting season. And it can be acute equipment shortages. That’s a routine part of business. And frankly, rails deal with that really, really well.

“However, we were all unprepared in the past two years with the sudden drawdown in demand, and then sudden resurgence in freight. At the same time, labor force participation rates continued to decline. And when the time came to rebuild our ranks and we recalled furloughed employees, we couldn’t get enough people. And frankly, two years later, right now, we still have about 25% of our crew locations that are understaffed. Now, we’ve made a lot of progress in our service product, but we’re not near where we need to be yet.”

NS’s “slower network,” Shaw said, “costs us about $40 million a quarter in additional operating costs. It also means that we’re not participating in all the demand that’s out there for our customers. In the long term, that pattern of service disruptions erodes the confidence customers need to structurally choose rail over truck.”

According to Shaw, “Although some have spoken about resilience in terms of furlough avoidance, we believe long-term resiliency is about much more than furloughs. It is a broad set of balanced management approaches that include alternatives to traditional furloughs. It is comparable to our balance between service, productivity and growth. It is a balanced, consistent targeted investment in strategic projects, reducing the volatility of investments in assets of long-term strategic value including locomotives, track, intermodal terminals, and technology, as well as investment in our people.”

People

“Our new workforce management strategy will create resilience through economic cycles and a better culture,” Shaw said. “We have a vision of moving conductors off the road and giving them fixed work locations with predictable schedules. We’re harnessing mobile technologies to empower our workforce and make routine administrative functions roles easier. We are leveraging technology that will one day mean our people won’t need to walk the length of a mile-long train, at night, in Chicago, in the winter, inspecting for potential defects.

“The best part of my day is when I get to be out in the field talking with our craft colleagues. I have immense respect and appreciation for what they do, and I know that when we are successful, it is because they are getting the job done.”

Other Investor Day Takeaways

• NS Executive Vice President and Chief Financial Officer Mark R. George reported that 2023 capital spending is expected to be roughly $2.1 billion, with 55% to 65% “associated with maintaining a safe, resilient and reliable infrastructure.” The “remaining 35% to 45% of our capital budget will be focused on investing in strategic initiatives to drive growth and productivity,” George said. “Examples of spending in this category include intermodal terminal expansions to handle our projected growth; longer sidings to accommodate longer trains, which will also help us maintain fluidity on our network; and, of course, the DC to AC locomotive conversion program, which is several years old and will continue for several more. That’s a great example of an investment to help us accommodate growth but also drive productivity or fuel efficiency in this case.”

• NS Chief Strategy Officer and Senior Vice President Michael R. McClellan said that NS has “been very deliberate in bringing our terminals close to customers, as we did in Greer, South Carolina, [at the Greer Inland Port], which is right next to the BMW plant. … And this is important because the highest cost component of an intermodal move is the first-mile, last-mile trucking, right? And the closer we can bring our facilities to the customers and vice versa, the lower the total cost of our customers in doing business with us.”

• NS Vice President-Business Development and Real Estate Kathleen Smith said NS has “placed about 500 acres of land that we own into warehouse development projects that are scheduled to open within the next several years. Together, these will bring over 5 million square feet of new capacity near our intermodal terminals in huge markets like Atlanta and Philadelphia and along the I-85 corridor in North Carolina.”

Additionally, “Last year, 100 businesses opened or expanded plants along Norfolk Southern or one of our short line partners,” she told investors. “Together, these projects are expected to generate $250 million in annual revenue for Norfolk Southern at full ramp up.”

• NS Chief Transformation Officer and Executive Vice President Annie Adams said that NS is “going to take a balanced approach to service productivity and growth, which will result in more consistent staffing levels over time. And that approach will drive engagement and retention as we build stronger relationships with our craft workforce. So what’s that look like in practice? In relatively short economic downturns, we’re going to take the opportunity to provide additional training and development to our craft workforce. Examples include qualifying our people over additional territories, as well as investing in our employees by training them to become locomotive engineers, a process which takes about six months. This will improve our operational flexibility and the productivity of our workforce. Of course, there’ll be economic downturns that may be so severe that staffing reductions have to come into play. But in those cases, we will explore alternatives to traditional furloughs that enable us to maintain a connection within our—with our employees, and that incentivizes them to return when volumes pick up. The goal in all of these scenarios is to ensure that when business rebounds, and it always does, we’re positioned to quickly redeploy a more skilled, engaged and productive workforce so that customers have the confidence to tightly integrate us into their supply chains, so that we’re positioned to take full advantage of the profitable volume opportunities that come in the early stages of economic recovery.”

Cowen Insight

“We attended NS’s Investor Day and came away with incremental conviction that rail service should continue to improve into next year, while anticipating long-term tailwinds associated with nearshoring and new production plants on the East Coast,” Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl wrote in a report. “Near term we continue to believe margins will remain pressured from inflationary labor costs and a weakening economy.”

On resilient service, Seidl reported that NS “emphasized improving resilience in quality of service as the focal point of the company’s long-term strategy and the key lever in affecting truck to rail conversions and volume growth. Service disruptions were estimated to add $40 million per quarter in costs as they placed pressure on operating efficiency and had the company playing catch up to properly staff operations. The implications for the top line are even greater with an estimated 5% of volumes amounting to $600 million in business lost to service problems (in line with the 3%-5% volume loss highlighted to us at our recent rail happy hour).

“NS’s plan appears to involve less aggressive furloughing in economic downturns in order to be better prepared for the recovery from a resourcing standpoint. In our view, this will allow NS to participate more fully in economic recoveries in the future, although margins during weak economic conditions may be challenged. That said, it will likely add more costs while in a downturn.”

Regarding onshoring, Seidl reported that “[i]n line with our view, NS anticipates tailwinds to long-term volumes from nearshoring activity (see our recent Ahead of The Curve report for a detailed discussion). The shift to just-in-case inventory management has begun supporting manufacturing facilities in North America with NS emphasizing that nine out of the top 10 states for ease of doing business fall in their network. Per management, 125 new industries and expansions are presently starting up potentially involving $3 billion in expenditures, 3,500 jobs and tens of thousands of rail shipments. Management confirmed that this activity comprises largely advanced manufacturing including EV batteries and renewable energy production. …

Seidl reported that NS “continues to lean into intermodal as its largest growth driver over the next several years (2x GDP), though mix shift should negatively affect margin. Management emphasized that e-commerce is 4x more intermodal intensive than storefront retail, positioning the segment for growth in the future. Hub Group and J.B. Hunt continue to serve NS as intermodal partners and are poised for growth as ‘flexible freight’ chooses rail for a cheaper and cleaner alternative; we see the largest challenge to win the flexible freight being poor rail service over the past two years, which is finally showing real signs of improvement. NS currently has 54 intermodal terminals and serves over 50 ports; we estimate that approximately 10% of the freight that shifted from West to East over the past two years will stay, according to our analysis for our Ahead of the Curve report.”

SFG Insight

“We agree with the strategy to invest in resiliency and service to drive growth and believe CEO Alan Shaw has a real opportunity to drive culture change that benefits NS investors over time,” SFG Analyst Bascome Majors wrote in a report. “That said, we still see cyclical risk to earnings and shares into first-half 2023 and remain on the sidelines looking for better long-term entry points.”

According to Majors, “We firmly agree with the themes of service improvement, network resiliency and customer-centrism as the rational path forward for Class I railroads from here, despite the near-term operating cost of building that resiliency by continuing to invest in headcount. From several sidebar conversations, we also got the sense that culture change at NS under Mr. Shaw is real and could drive a more customer-oriented growth mindset grounded in collaborative tension between sales/marketing and operations. That said, we also expect investors to adopt ‘show me’ skepticism toward ‘pivot to growth’ strategies from NS and other Class I rails near-term, given a very short list of industry successes in this department and cyclical headwinds beyond management control (downside volume/revenue risk into continued service investment during first-half 2023). Net-net, we see a path to long-term value at NS, but remain on the sidelines as cyclical risks to earnings and sentiment play out nearer-term. …”

According to Majors, “The more detailed long-term financial buildup … arrive at a tops-down management plan to grow revenues mid-single digits annually over time, operating income in the upper single digits (accretive incremental margin, but not quantified), and EPS up low double digits, eventually reaching an ROIC in the mid-teens by 2027.”