North American Volume Flat Through Week Five, AAR

Written by Marybeth Luczak, Executive Editor

(BNSF Photograph)

Through the first five weeks of 2023 (ending Feb. 4), total North American carload and intermodal traffic was virtually flat (-0.9%) with same point last year, according to the Association of American Railroads’ (AAR) Feb. 8 report. Both the U.S. and Mexico experienced decreases, while Canada saw growth.

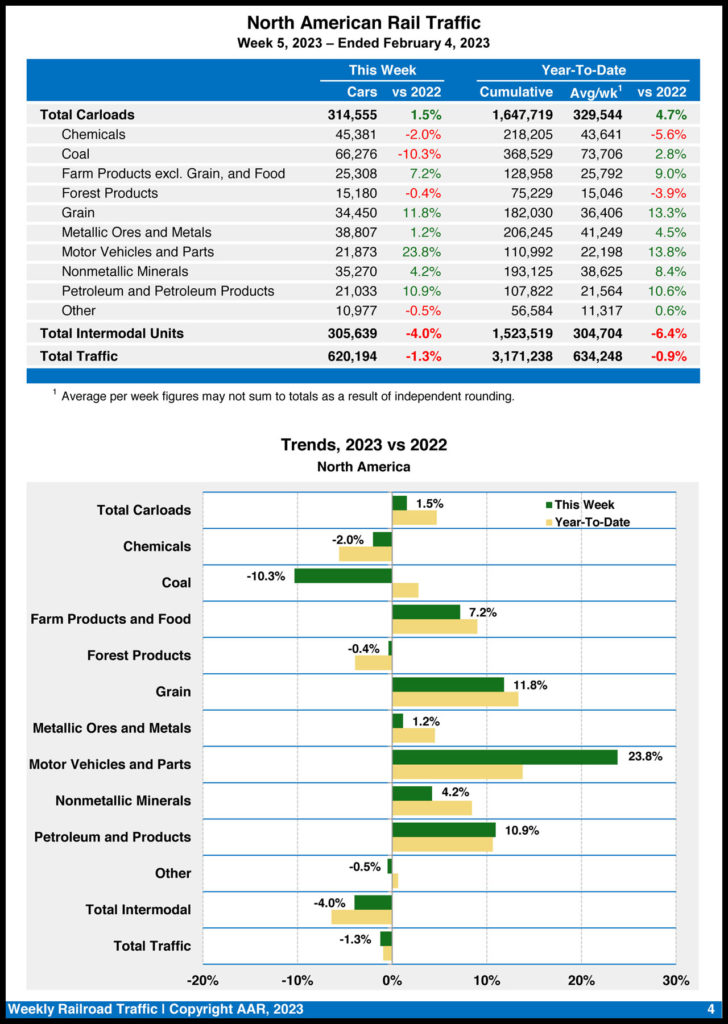

North American rail volume for the first five weeks of this year (ending Feb. 4) on 12 reporting U.S., Canadian and Mexican railroads came in at 3,171,238 carloads and intermodal containers and trailers. Cumulative volume in the U.S. was 2,293,210 carloads and intermodal units, down 3.0% from 2022; in Canada, 693,084 carloads and intermodal units, up 6.2%; and in Mexico, 184,944 carloads and intermodal units, down 0.1%.

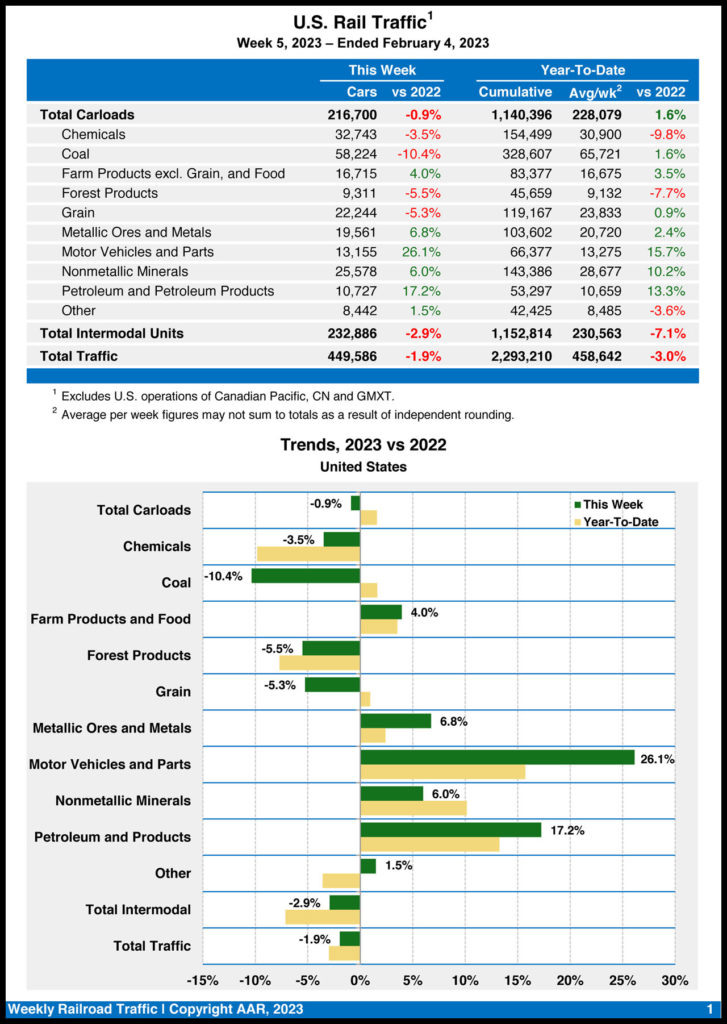

According to AAR, for the week ending Feb. 4, 2023, U.S. Class I railroads hauled a total of 449,586 carloads and intermodal units, falling 1.9% from the same week in 2022. This comprises 216,700 carloads—down 0.9% from the prior-year period—and 232,886 containers and trailers—down 2.9% compared with 2022.

“The four-week trend for Class I intermodal volume was down by 14% compared with 2019, according to Susquehanna Financial Group Analyst Bascome Majors,” commented Railway Age Contributing Editor and independent economist Jim Blaze. “Not a good start for 2023. If we look beyond the four-week trending statistics for intermodal against the currently-behind loaded containers on ships out of China and Asia for the U.S. market, there is a clear risk that the western-railroad inland container train volumes might be significantly lower than either 2019 or 2022 volumes through the first quarter of 2023 and possibly into the second quarter of 2023. This suggests uncertainty as to how many new or replacement intermodal cars might be ordered over the next three quarters.”

(For more on 2023 intermodal results, read “AAR: ‘The Worst January for Intermodal Since 2013.’”)

According to AAR, six of the 10 U.S. carload commodity groups posted an increase for the week ending Feb. 4, 2023 vs. the same week last year. They included motor vehicles and parts, up 2,725 carloads, to 13,155; petroleum and petroleum products, up 1,578 carloads, to 10,727; and nonmetallic minerals, up 1,445 carloads, to 25,578. Commodity groups that posted declines included coal, down 6,723 carloads, to 58,224; grain, down 1,236 carloads, to 22,244; and chemicals, down 1,182 carloads, to 32,743.

For the first five weeks of 2023, U.S. railroads reported cumulative volume of 1,140,396 carloads, up 1.6% from the same point last year; and 1,152,814 intermodal units, down 7.1% from last year.

North American rail volume for the week ending Feb. 4, 2023, on 12 reporting U.S., Canadian and Mexican railroads totaled 314,555 carloads, a 1.5% rise over the same week last year, and 305,639 intermodal units, a 4.0% fall-off from last year. Total combined weekly rail traffic in North America came in at 620,194 carloads and intermodal units, down 1.3%.

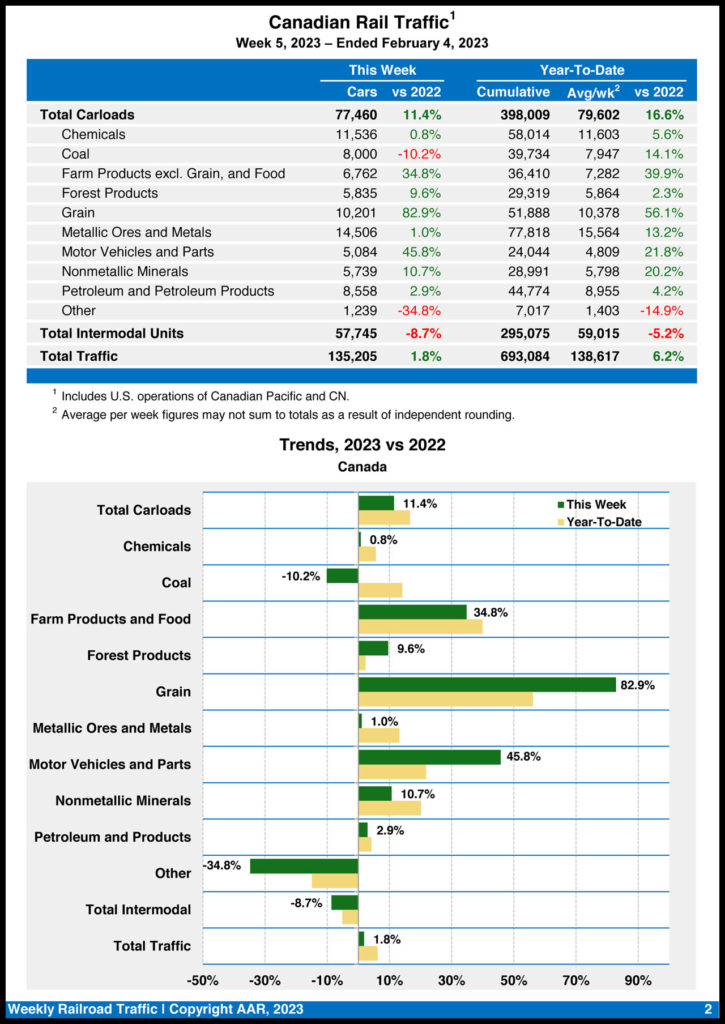

Canadian railroads reported 77,460 carloads for the week ending Feb. 4, 2023, increasing 11.4%, and 57,745 intermodal units, dropping 8.7% from the prior-year period.

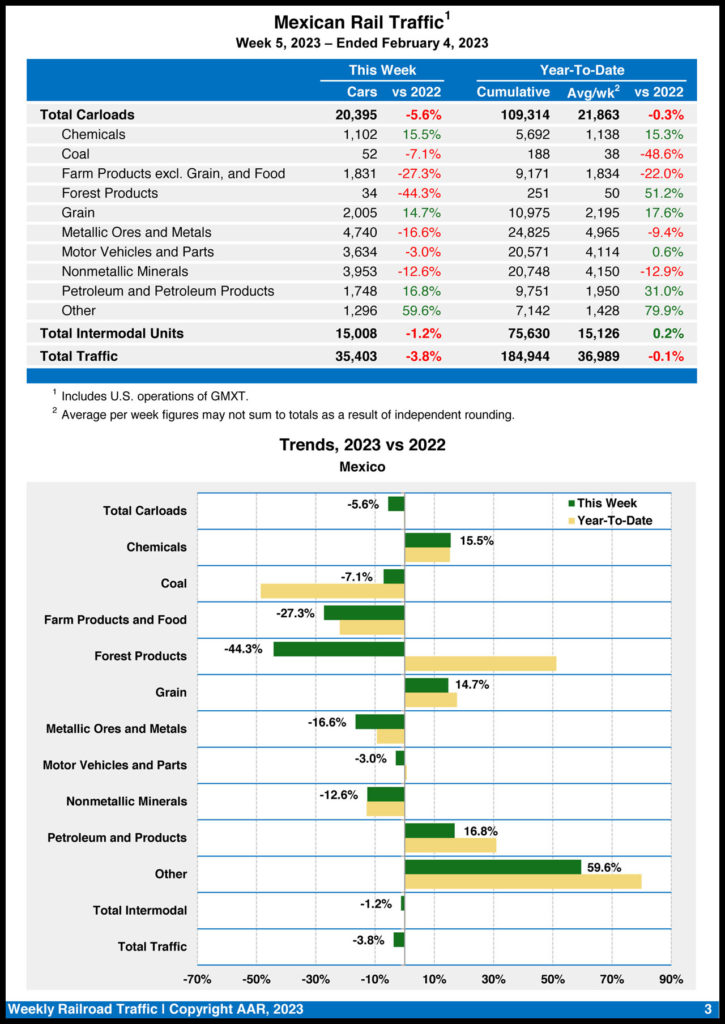

For the week ending Feb. 4, 2023, Mexican railroads reported 20,395 carloads, declining 5.6% from the same week in 2022, and 15,008 intermodal units, dipping 1.2%.