North American Rail Volume Down Through Week Six, AAR

Written by Carolina Worrell, Senior Editor

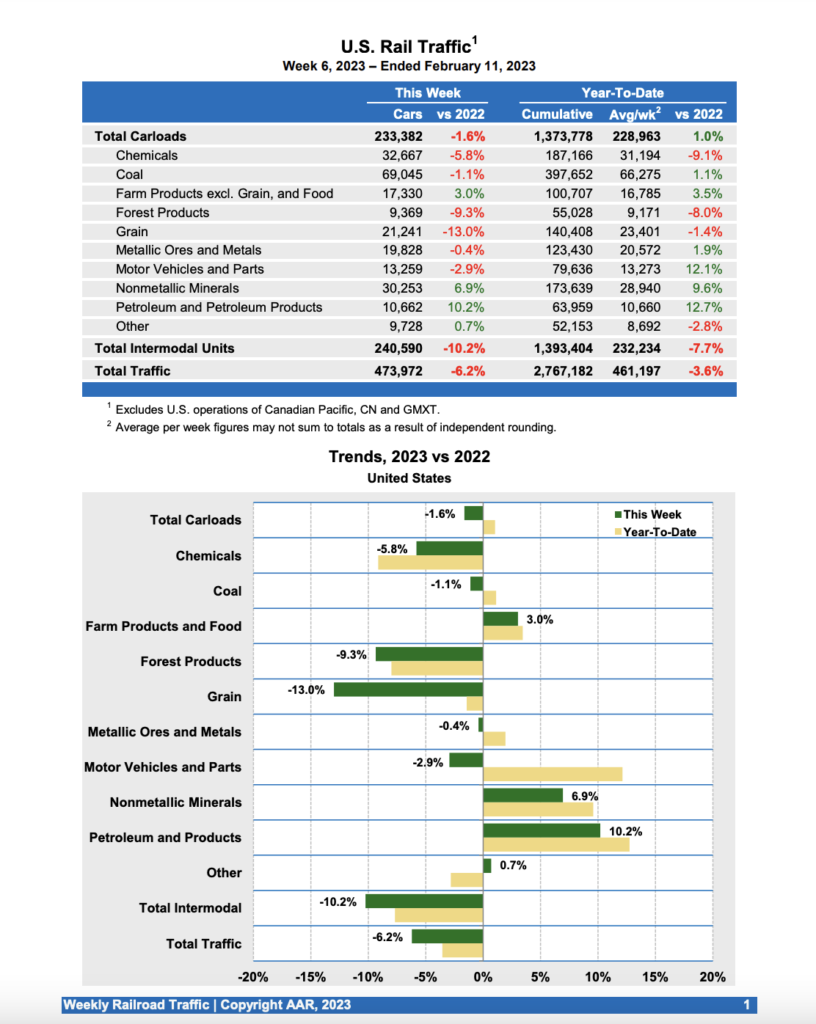

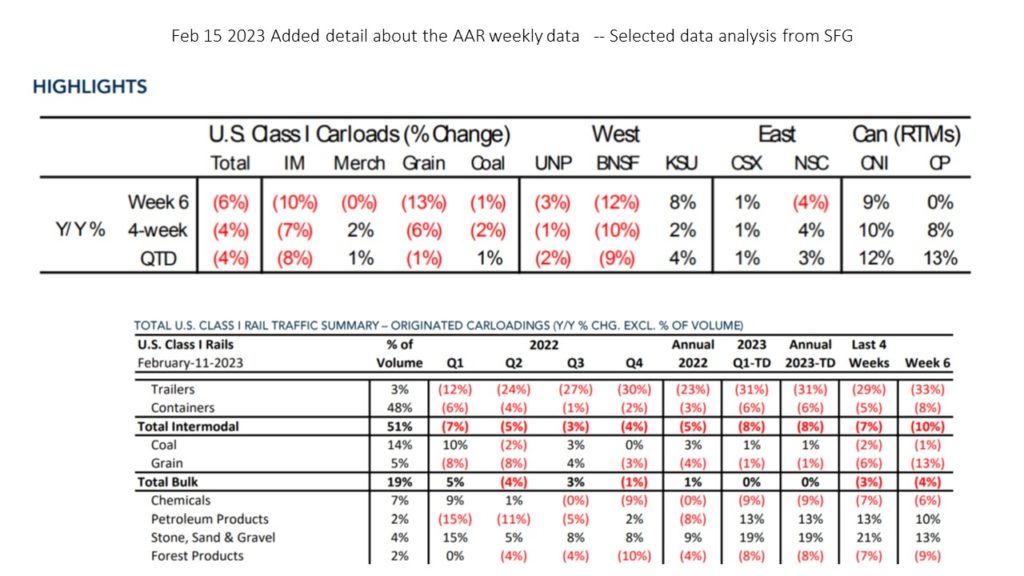

For the first six weeks of 2023 (ending Feb. 11), total U.S. weekly rail traffic was down 6.2%, compared with the same week last year, according to the Association of American Railroads’ (AAR) Feb. 15 report. Both the U.S. and Mexico experienced decreases, while Canada saw an increase.

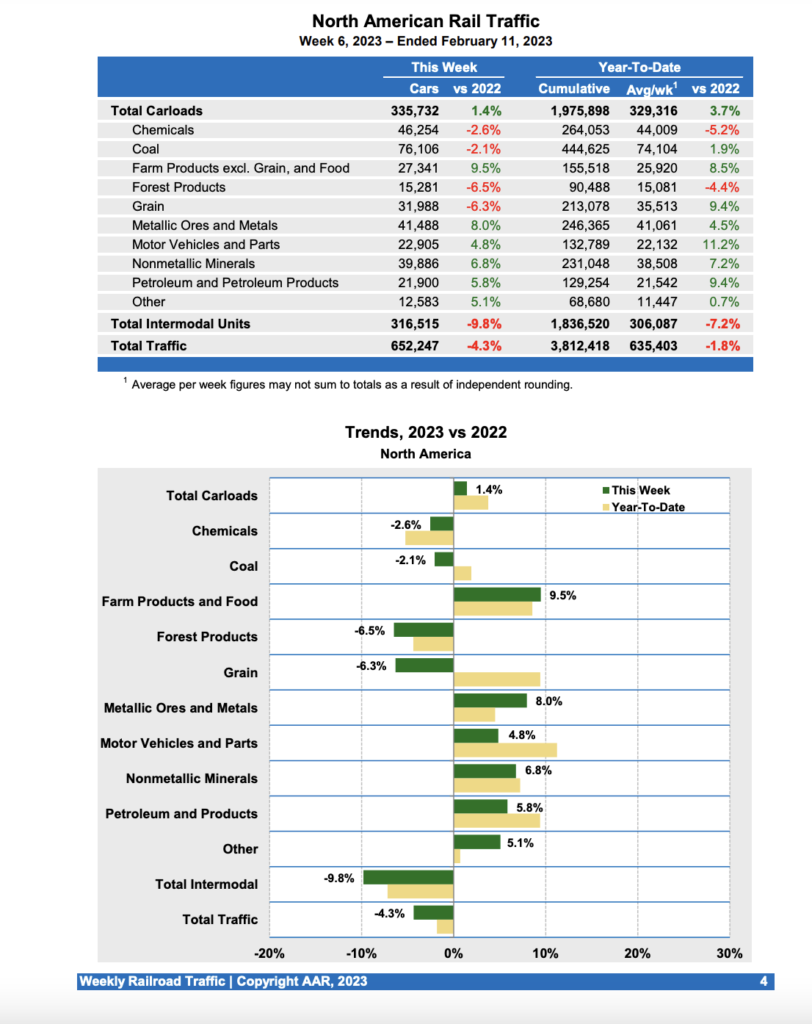

North American rail volume for the first six weeks of this year (ending Feb. 11) on 12 reporting U.S., Canadian and Mexican railroads came in at 3,812,418 carloads and intermodal containers.

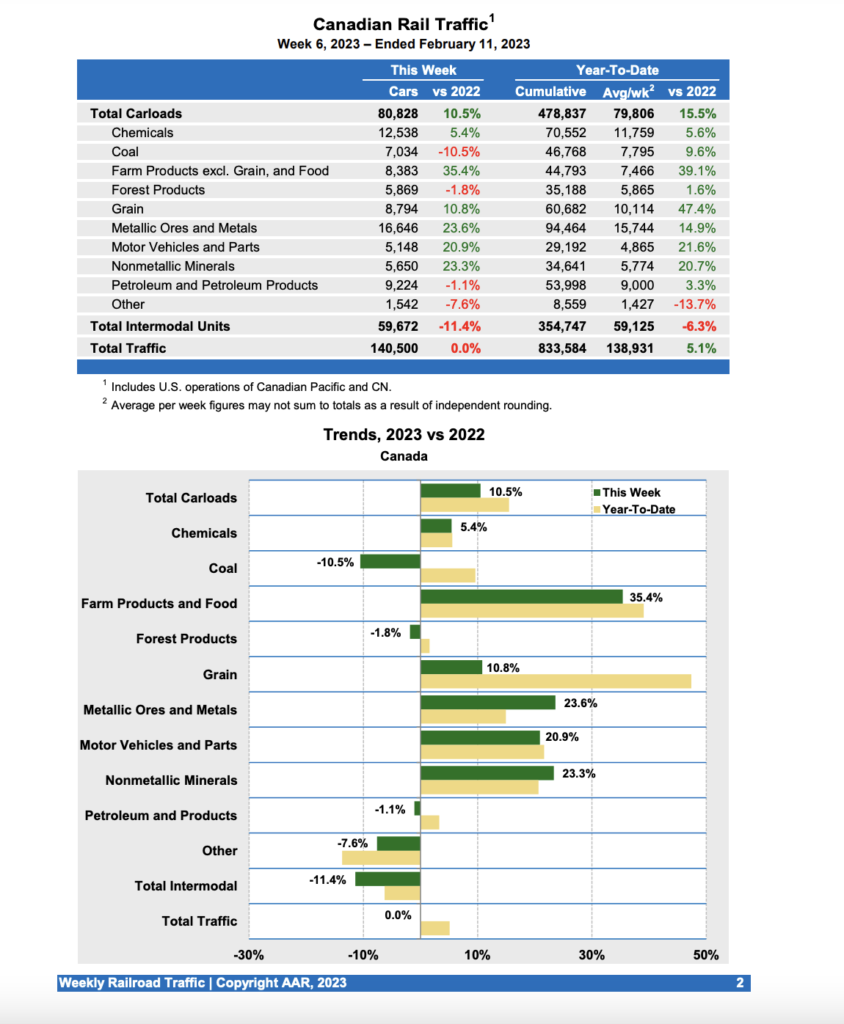

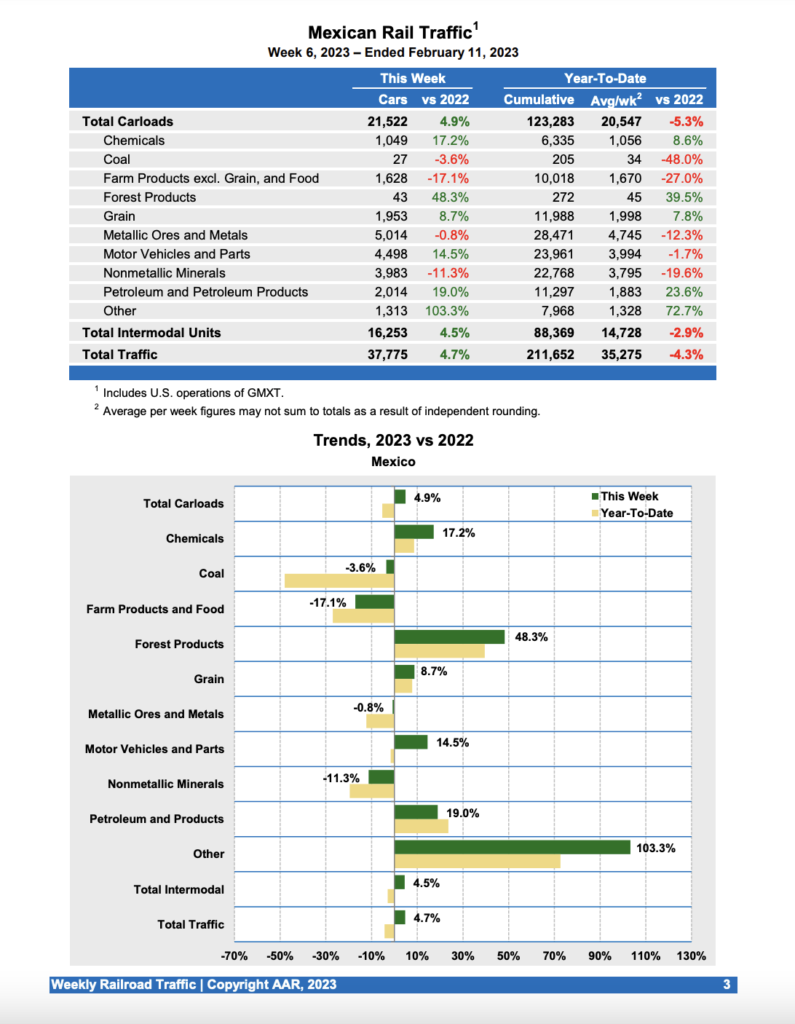

Cumulative volume in the U.S. was 2,767,182 carloads and intermodal units, down 3.6% from 2022; in Canada, 833,584 carloads and intermodal units, up 5.1%; in Mexico, 211,652 carloads and intermodal units, down 4.3%.

According to AAR, for the week ending Feb. 11, 2022, U.S. Class I railroads hauled a total of 2,767,182 carloads and intermodal units, a decrease of 3.6% compared to last year. This comprises 1,373,778 carloads, up 1.0% from 2022; and 1,393,404 intermodal units, down 7.7% from the prior-year period.

Four of the 10 carload commodity groups posted an increase compared with the same week in 2022. They included nonmetallic minerals, up 1,963 carloads, to 30,253; petroleum and petroleum products, up 987 carloads, to 10,662; and farm products excl. grain, and food, up 510 carloads, to 17,330. Commodity groups that posted decreases compared with the same week in 2022 included grain, down 3,173 carloads, to 21,241; chemicals, down 2,015 carloads, to 32,667; and forest products, down 966 carloads, to 9,369.

North American rail volume for the week ending Feb. 11, 2023, on 12 reporting U.S., Canadian and Mexican railroads totaled 335,732 carloads, up 1.4% compared with the same week last year, and 316,515 intermodal units, down 9.8% compared with last year. Total combined weekly rail traffic in North America was 652,247 carloads and intermodal units, down 4.3%. North American rail volume for the first six weeks of 2023 was 3,812,418 carloads and intermodal units, down 1.8% compared with 2022.

Canadian railroads reported 80,828 carloads for the week, up 10.5%, and 59,672 intermodal units, down 11.4% compared with the same week in 2022. For the first six weeks of 2023, Canadian railroads reported cumulative rail traffic volume of 833,584 carloads, containers and trailers, up 5.1%.

Mexican railroads reported 21,522 carloads for the week, up 4.9% compared with the same week last year, and 16,253 intermodal units, up 4.5%. Cumulative volume on Mexican railroads for the first six weeks of 2023 was 211,652 carloads and intermodal containers and trailers, down 4.3% from the same point last year.

Blaze Weighs In

While SFG sees few bright spots in the 2023 volume outlook for U.S. Class I rails, automotive should be an area of brightness underpinned by continued strength in N.A. production to replenish dealership inventories through 2023.

What does the SFG’s detailed examination mean for rail volumes? Benefiting from increased finished vehicles so far show that YTD automotive carloads are up double-digits Year over year (Y/Y), with easy comparables likely through 1H23.

However, even as rails cycle more difficult comps in 2H23, the auto selling market faces weakening consumer and higher borrowing costs headwinds>

Despite being only ~5% of total volumes for U.S. rails, automotive revenue makes up 8 to 10% of total rail freight revenue (as of FY22) as it is a high value / high service product (and hence high revenue per carload). SFG We expects automotive volumes to offset some of the other volume headwinds that the rail industry faces in 2023.

Overall, SFG continues to see downside risk to volume estimates for the U.S. rails into the second quarter of 2023. Jim Blaze as a Rail Economist agrees.