CSX: ‘Strong Earnings’ Delivered in 4Q22 (UPDATED, Cowen)

Written by Carolina Worrell, Senior Editor

“The ONE CSX team made great progress this quarter, delivering strong earnings as our network performance continued to gain momentum,” CSX President and CEO Joe Hinrichs said during a Jan. 25 earnings announcement.

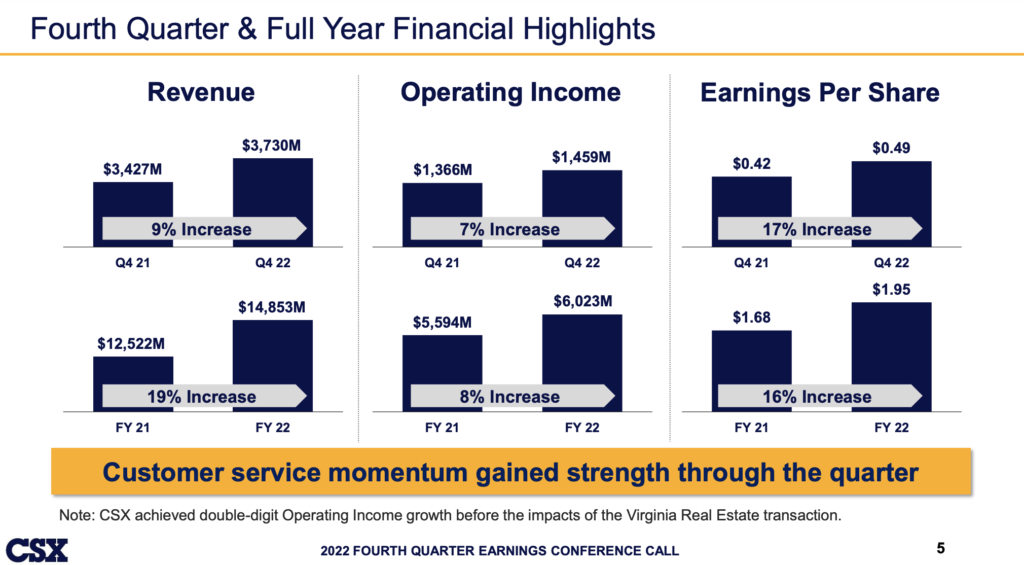

For CSX, fourth-quarter 2022 operating income was $1.46 billion compared to $1.37 billion in fourth-quarter 2021, while net earnings were $1.02 billion, or $0.49 per share, compared to $934 million, or $0.42 per share, in the same period last year, the Class I reported Jan. 25.

For the full-year 2022, CSX operating income of $6.0 billion was up 8% from the previous year and included $144 million in gains from “property sales recognized from the 2021 agreement with the Commonwealth of Virginia.” Full-year 2021 operating income included $349 million in gains from this same transaction, CSX reported. Net earnings for the year were $4.17 billion, or $1.95 per share, compared to $3.78 billion, or $1.68 per share, in 2021.

Among other fourth-quarter highlights:

- Revenue reached $3.73 billion, increasing 9% year-over-year, driven by “higher fuel surcharge, pricing gains, and an increase in storage and other revenues.” Severe winter weather in late December modestly reduced volumes and revenue for the quarter.

- Operating income of $1.46 billion increased 7% compared to the prior year, with an operating ratio of 60.9%.

- Diluted EPS of $0.49 increased 17% from $0.42 for the fourth quarter of 2021.

Among other full-year 2022 highlights:

- Revenue reached $14.9 billion for the year, increasing 19% compared to the full year 2021.

- Operating income of $6.0 billion increased 8% year-over-year, including the effect of lower gains from the Virginia property sale. Operating ratio was 59.5% for the year.

- Diluted EPS of $1.95 increased 16% from $1.68 for the full year 2021.

“The ONE CSX team made great progress this quarter, delivering strong earnings as our network performance continued to gain momentum,” said CSX President and CEO Joe Hinrichs. “With the right resources now coming into place, we can turn our full attention to the opportunities ahead in 2023 and beyond. Going into the new year, our entire company remains focused on providing exceptional customer service that will enable us to win share from trucks and drive profitable growth over the long term.”

More information is available on CSX’s Investor Relations page.

DOWNLOAD THE FULL FOURTH-QUARTER 2022 REPORT BELOW:

The Cowen Insight: 4Q Beat, 2023 Outlook Cloudy

“CSX came in above our forecast and consensus expectations in 4Q but offered cautious outlook for 2023 (similar with the other rails that have reported), refraining from suggesting earnings growth,” reported Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “Merchandise and coal growth should support carloads though international intermodal will be a headwind and demurrage fees should wane. PT to $35 as we roll our model forward. Reiterate Market Perform.”

Key Cowen Takeaways:

- “4Q EPS of $0.49 came in slightly above our estimate of $0.47 and the consensus estimate of $0.48. Results included a $144MM gain from the sale of Virginia property that was well understood by investors. 4Q OR of 60.9% deteriorated 80bps y/y driven by fuel and labor inflation and includes impacts from the Quality Carriers acquisition.

- “Like the other Class Is that have reported this week, CSX saw soft intermodal volumes in 4Q (down 4.5% y/y) but benefited from strength in automotive and coal volumes. These trends are expected to persist into 1H23. International intermodal should produce weak volumes in 1H as import demand remains low. Weakness will be partially mitigated by strong coal demand as CSX laps mine and terminal issues in ’23.

- “Management set cautious volume expectations for ’23 guiding a full year increase greater than GDP growth at 0.5% y/y, citing truck conversion opportunities and service improvements, largely in line with conservative guidance offered by the rest of the group. We are once again cautious on ’23 volumes given uncertain macro conditions and a lack of consensus on the timing of a TL rate bottom, though we acknowledge that CSX was spotlighted as having significantly improved service in our conversations with shippers at our last railroad happy hour (see note here)

- “Like their peers, CSX management reiterated a commitment to pricing above inflation but emphasized notable headwinds on the horizon. Assessorial revenues are expected to decline by ~$300MM in ’23 though the impact of this draw down on margins will be mitigated somewhat by cost benefits accruing from improved network fluidity. Coal RPUs also face tough comps particularly in 2H.

- “Persistent inflationary pressures should generate near-term margin pressure with relief from improved service metrics expected to materialize in 2H. We anticipate sticky labor inflation throughout ’23 in the aftermath of recent collective bargaining negotiations, partially mitigated by a y/y step down in incentive compensation that management highlighted on the call.”