CSX 4Q21: Revenue, Earnings, OR Up (UPDATED)

Written by Marybeth Luczak, Executive Editor

“As we enter 2022, we remain committed to providing our customers high-quality service and creating additional capacity to help them address current supply chain challenges through the increased use of rail,” CSX President and CEO James M. Foote said during a Jan. 20 earnings announcement.

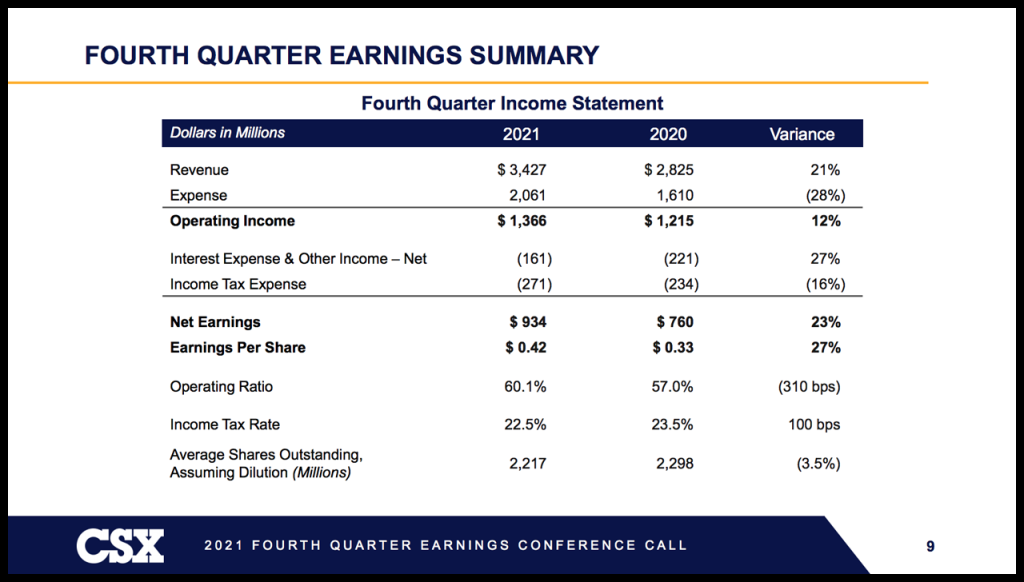

CSX was the second Class I railroad to report fourth-quarter 2021 financial results on Jan. 20; it posted net earnings of $934 million (or $0.42 per share), a 22% boost from the prior-year period’s $760 million (or $0.33 per share).

For comparison purposes, CSX noted that fourth-quarter 2020 results include “a pre-tax charge of $48 million within other expense, or $0.02 per share after-tax, related to the early retirement of debt.”

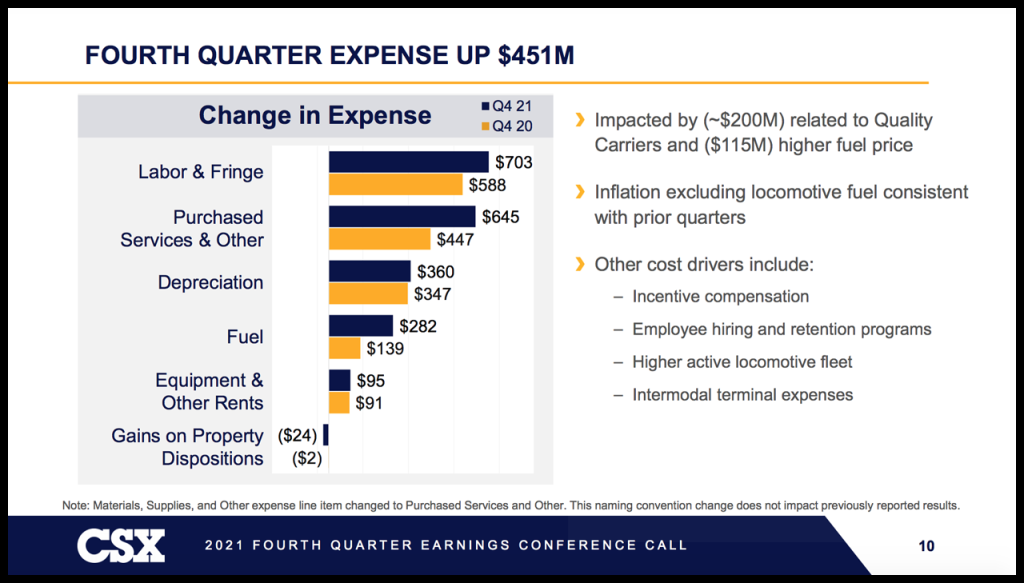

For the three months ending Dec. 31, 2021, revenue came in at $3.427 billion, up 21% from $2.825 billion in fourth-quarter 2020. This was “driven by growth across all major lines of business [led by coal, up 39%, and intermodal, up 16%], increases in other revenue, and the inclusion of Quality Carriers’ results,” according to CSX.

Volumes were 1,570K for the quarter, down 2% from fourth-quarter 2020.

The railroad’s operating income of $1.366 billion improved 12% over fourth-quarter 2020’s $1.215 billion.

Its operating ratio was 60.1%, a 310 bps increase over the 2020 period’s 57.0%.

2022 Outlook

Looking forward, CSX expects volume growth that’s “driven by economic expansion and supply chain recovery.” It is targeting “full-year volume growth in excess of GDP,” with momentum building “sequentially throughout the year.” Additionally, full-year capital expenditures are projected at approximately $2 billion.

“I would like to thank all of CSX’s employees for their hard work and dedication to our customers this quarter and for the entire year amidst the ongoing impacts of the pandemic and persistent global supply chain disruptions,” CSX President and CEO James M. Foote said. “As we enter 2022, we remain committed to providing our customers high-quality service and creating additional capacity to help them address current supply chain challenges through the increased use of rail.”

The Cowen Insight

“CSX finished the year with a top and bottom line beat as a decline in carloads was more than offset by a strong pricing environment, similar to what we saw with UNP,” notes Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “Quality Carriers appears to be integrating well and drove growth in 4Q21. Management refrained from setting 2022 expectations; we model modest volume growth along with strong pricing. We roll our model forward and increase our Price Target to $38.

“Adjusted 4Q21 EPS came in at $0.42, beating our forecast and the consensus figure by a penny. Revenues came in above consensus by 3% as gains across most business lines were aided by strong pricing. Coal led the charge (+39%), partially offset by a challenging auto market. Quality Carriers appears to be going well, based off commentary from the call, although management lumps the business into its ‘other’ segment.

“Total carloads declined 2% in the quarter, which was primarily dragged down by a 23% decline in its automotive segment. The semiconductor shortage continues to impact the rails, and similar to UNP’s commentary, management expects autos to be a 2H22 story, and we model as such. Despite intermodal volumes declining slightly in 4Q, revenues increased 16% as strong pricing (both base pricing and ancillary surcharges) aided results in the quarter. Inventory replenishments and high volume coming from the ports should support a strong intermodal market, particularly in 2H22 if congestion eases. Coal increased 39% in the quarter due to export volume growth and higher natural gas prices, causing increased demand in this segment. Similar to UNP (Outperform, $242.07), we now model growth for coal in 2022 and normalization (reverting to a secular decline) in 2023.

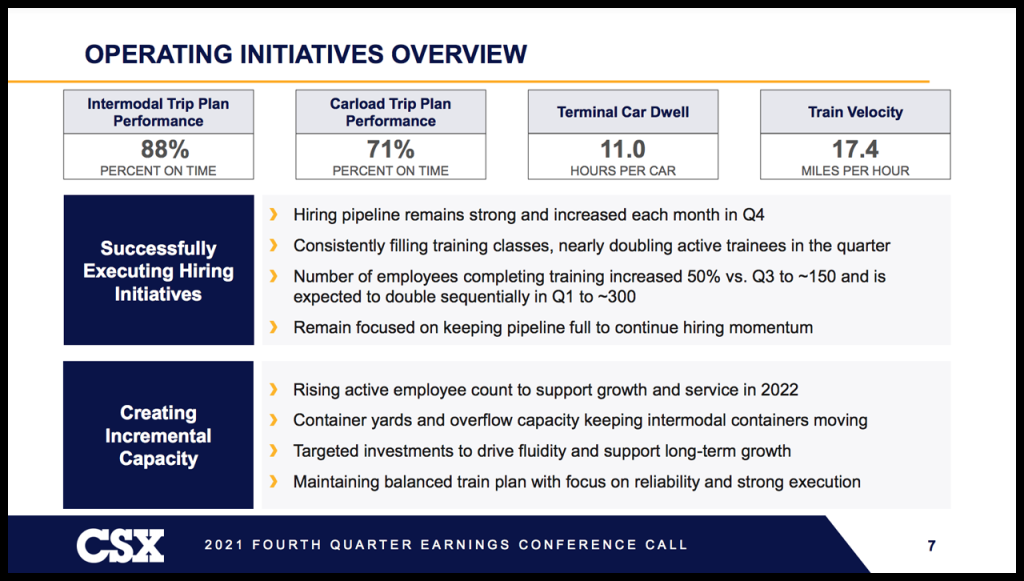

“Intermodal trip plan performance in 4Q was 88% while carload trip plan performance came in at 71% (eclipsing the 70% mark for the first time in 2021). CSX, along with the rail industry, was impacted by COVID, which resulted in a notable number of employees missing work later in the year. CSX has leaned into its hiring pipeline and increased hiring in each month of 4Q21, roughly doubling the average trainees in the quarter. ~150 employees moved to active status in 4Q21, and that is expected to double in 1Q.

“Management painted a broad picture in terms of 2022 expectations, although calling for volume growth in excess of GDP. Given the current backdrop, it was hard for us to blame them. We note our expectations for 2H22 volumes to outpace 1H22 volumes as supply chain congestion begins to ease. We expect strong contract renewal rates to continue throughout the year. Capex guidance of ~$2bn is up ~200MM off 2021, and roughly half will be allocated to growth investments.”

CSX’s Investor Relations page provides more details.