Creel: Following ‘Difficult’ 1Q22, CP ‘Building Momentum’ (UPDATED, Cowen)

Written by Marybeth Luczak, Executive Editor

“I’m proud of the way CP’s team of professional railroaders managed the difficult operating environment they faced in the first quarter of 2022,” CP President and CEO Keith Creel said during an April 27 earnings announcement.

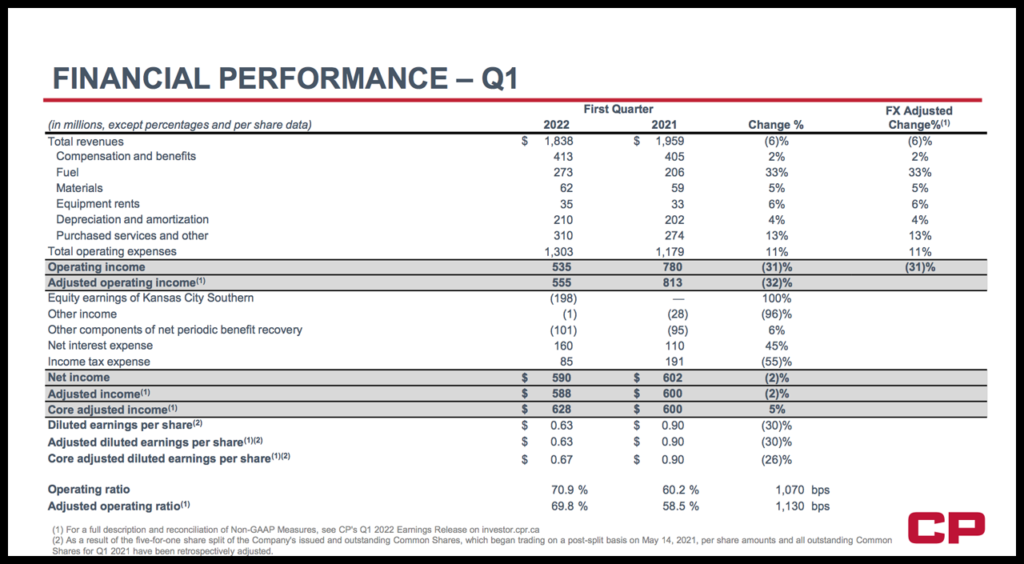

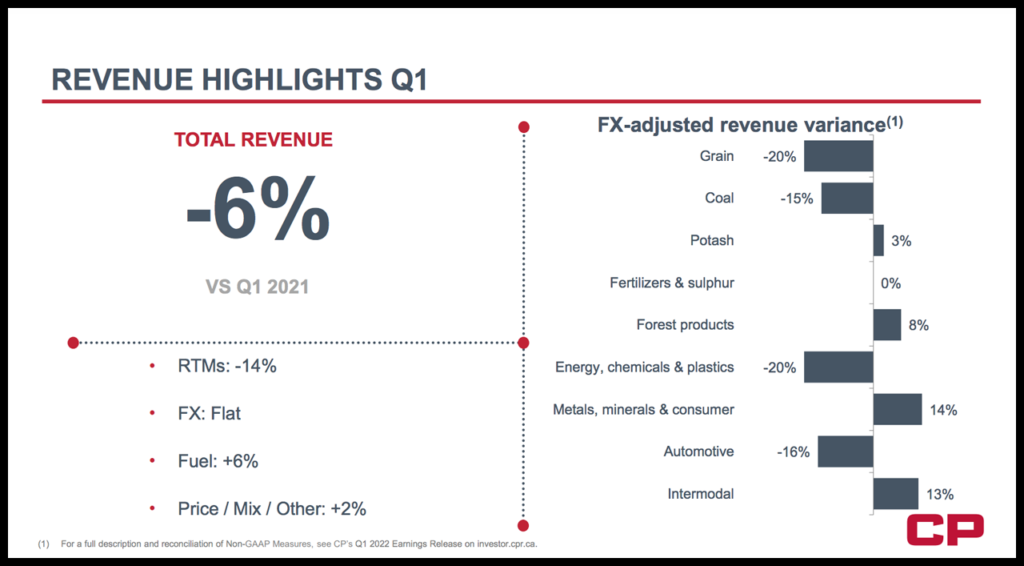

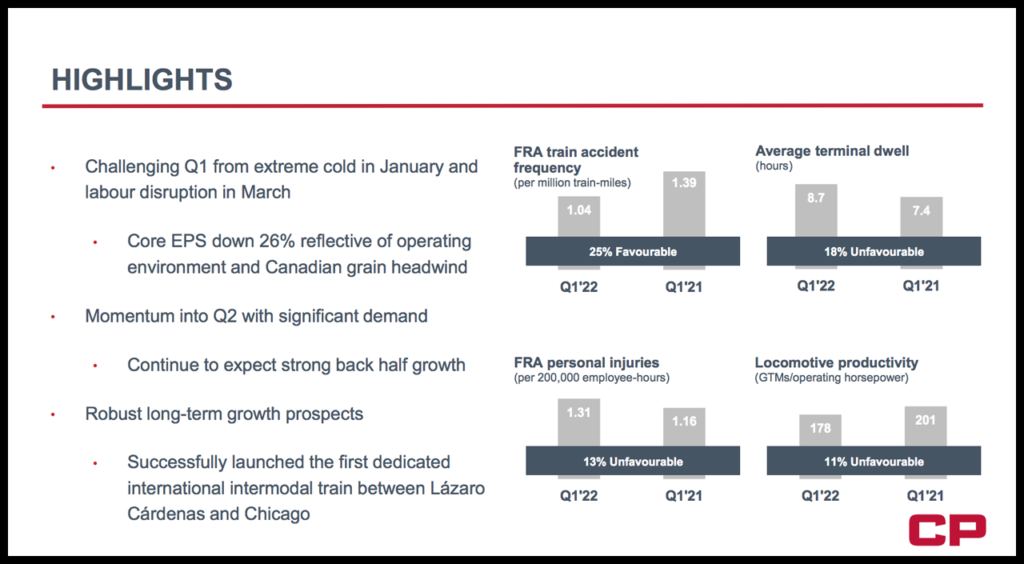

Canadian Pacific’s (CP) first-quarter 2022 results—including revenues that fell 6% and a reported operating ratio that deteriorated by 1,070 basis points from first-quarter 2021—“reflected the impact of last year’s drought on Canadian grain volumes, harsh winter operating conditions and the effects of a work stoppage,” President and CEO Keith Creel said.

Late on April 27, CP reported that revenues for the first three months of 2022 came in at C$1.84 billion, a 6% decline from the same point last year (C$1.96 billion). The quarterly operating ratio was 70.9% vs. 60.2% in 2021; adjusted, it was 69.8% vs. 58.5% last year. Additionally, reported diluted EPS was C$0.63, a 30% decrease from 2021; core adjusted diluted EPS, “excluding significant items and KCS purchase accounting,” was C$0.67, according to CP.

The Class I railroad noted that it is “reporting additional financial metrics, including core adjusted income and core adjusted diluted earnings per share (EPS),” due to the “financial complexity of acquiring Kansas City Southern (KCS) into voting trust on Dec. 14, 2021.” (The CP-KCS merger, under review by the Surface Transportation Board, proposes to create Canadian Pacific Kansas City, a single-line railroad linking the United States, Mexico and Canada.) “These metrics have been added to provide more transparency by isolating for the impact of KCS purchase accounting,” CP said. “KCS purchase accounting represents the amortization of the difference in value between the consideration paid to acquire KCS and the underlying carrying value of the net assets of KCS immediately prior to the acquisition by the company.”

CP also reported KCS’s first-quarter 2022 results, which included revenues of $778.2 million, up 10% from the prior-year period’s $706.0 million; carloads/unit of 575.2K, a 4% improvement from last year’s 555.4K; a reported operating ratio of 62.6% vs. 64.2% in 2021; and an adjusted operating ratio of 60.9% vs. 61.4% last year.

“The demand for North American goods and commodities only continues to grow and highlight the need for new single-line routes and outlets to reach global markets,” Creel said. “Our excitement about the opportunities ahead with the combined companies continues to grow.”

CP Quarterly Operating Performance

For the first quarter of 2022, CP reported an average train speed of 21.2 mph, up from first-quarter 2021’s 20.9 mph. Average train length was 8,050 feet vs. 7,972 feet for the year-ago period, and average train weight was 9,757 tons, flat with last year’s 9,795 tons. Average terminal dwell time of 8.7 hours was up 18% from 7.4 hours in first-quarter 2021, and locomotive productivity was 178 GTMs/operating horsepower, down 11% from 201 GTMs/operating horsepower last year.

2022 Outlook

Looking ahead, CP said that it expects: “normal Canadian grain in the back-half of 2022”; “record U.S. grain volumes, as we create new market solutions”; “significant potash demand, driven by record commodity prices”; “increased drilling activity driving frac sand volume growth”; and “continued strength in international intermodal, driven by market share wins.”

“CP continues to see a strong, supportive macroeconomic environment and is focused on providing customers with creative service offerings,” Creel summed up. “With a difficult quarter behind us, we are building momentum, which I fully expect will continue to carry through the remainder of 2022.”

For more details, visit the CP Investor Resources webpage.

The Cowen Insight

“CP reported a top and bottom line miss as severe weather (much like CN’s first quarter) and labor challenges (CP had a short strike in the first quarter) resulted in poor operating performance and increased costs,” said Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “We are already seeing a sharp rebound in the second quarter and expect much better results in the coming quarters. Early KCS cross-border runs showing much promise. We lower outlook but would use a pullback as a buying opportunity.”

Key Cowen takeaways:

• “Adjusted EPS in the quarter of $0.63 CAD (including KSC’s purchase accounting core adjusted EPS was $0.67) fell well below our estimate of $0.80 CAD and the consensus of $0.73 CAD. A revenue decline of 6% in the quarter fell short of our estimates, and an adjusted operating ratio [OR] of 69.8% missed our estimate of 62.2%.

• “The nearly 70% OR is unlike CP; the decline in volumes due to weather added nearly 500bps to OR, increased fuel added 140bps, and the employee strike added 120bps in the quarter. The strike and winter weather are behind CP and fuel impacts thus far have leveled off. Hence, were are expecting significant sequential improvement in the second quarter.

• “On the CP/KCS transaction, the procedural schedule, which has been paused as CP clarifies some data, is expected to be restarted soon. We continue to expect the STB to clear the transaction by the end of 2022 or early 2023. In the quarter, CP launched its first interline service from Lazaro to Chicago with a seven-day transit time; we see this line as a potential long-term needle mover that has the potential to create a new marketplace. If CP can maintain consistent service, this could place Lazaro in a position as an alternative to West Coast U.S. ports, which was one of the original intents for the Mexican based port. Also, we see potential for intermodal service coming into the Southeast from Mexico utilizing the KCS joint venture with the NSC.

• “Grain volumes were down 26% in the quarter, with revenues down 20% as the weak grain cycle plays out through the first half of this year, and will linger into the back half of the year until the fourth quarter when we model some real growth given the new crop cycle. The impacts of the war in Eastern Europe are surging demand for potash, which positions CP well and management expects double-digit growth in this segment.

• “We adjust our 2022 and 2023 EPS estimates to $2.77 from $3.15, and $3.75 from $3.90. Continuing to use our 22.5x multiple and our 2023 EPS estimate, our price target goes to $84 from $88. We would use any material weakness as a buying opportunity for large cap transport exposure. Reiterate Outperform.”