CP’s Creel: 2022, ‘A Tale of Two Halves’ (UPDATED, Cowen)

Written by Marybeth Luczak, Executive Editor

(Photograph Courtesy of CP via Twitter)

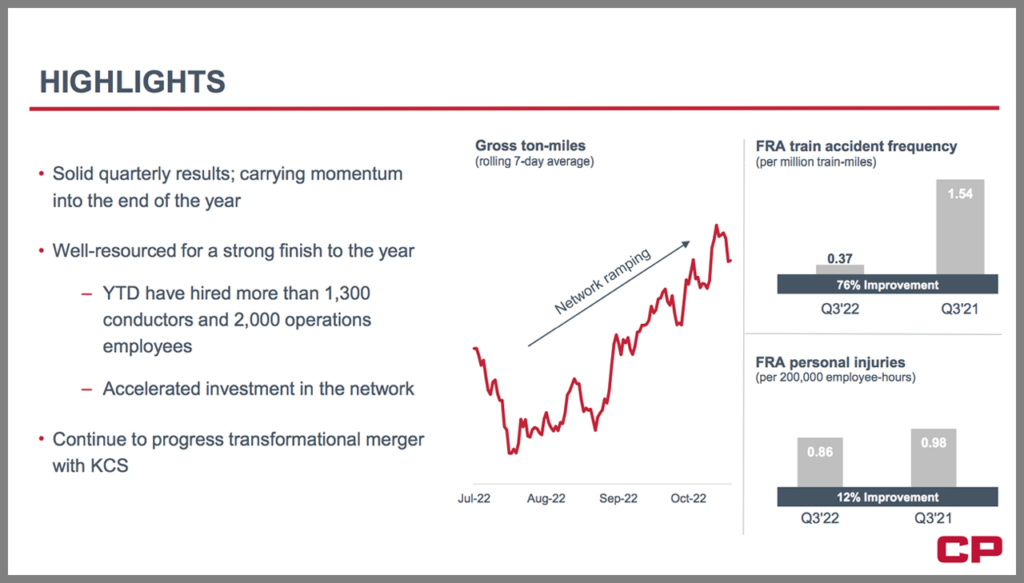

“Throughout the year, we have said 2022 would be a tale of two halves and that is exactly how it is unfolding,” Canadian Pacific (CP) President and CEO Keith Creel said on Oct. 26. “The third quarter saw strong demand in potash and intermodal that we anticipated, and CP was well-resourced to handle the volume increases we have seen.”

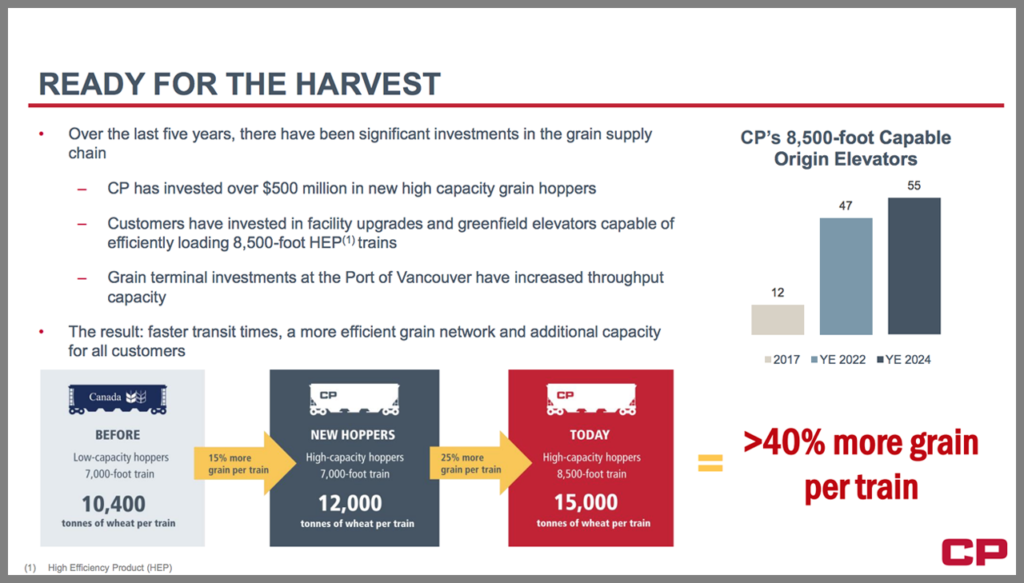

“CP’s unique growth initiatives coupled with a robust Canadian grain harvest provide a strong volume backdrop as we finish the year,” Creel continued. “We are well-positioned to carry the momentum we gained in the third quarter through the rest of the year and beyond.”

Among CP’s third-quarter 2022 highlights:

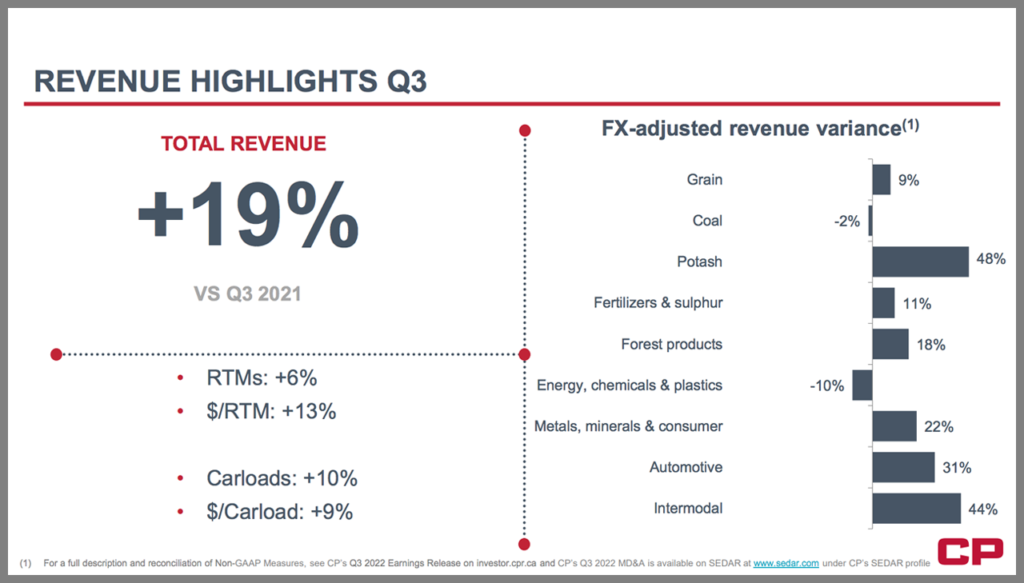

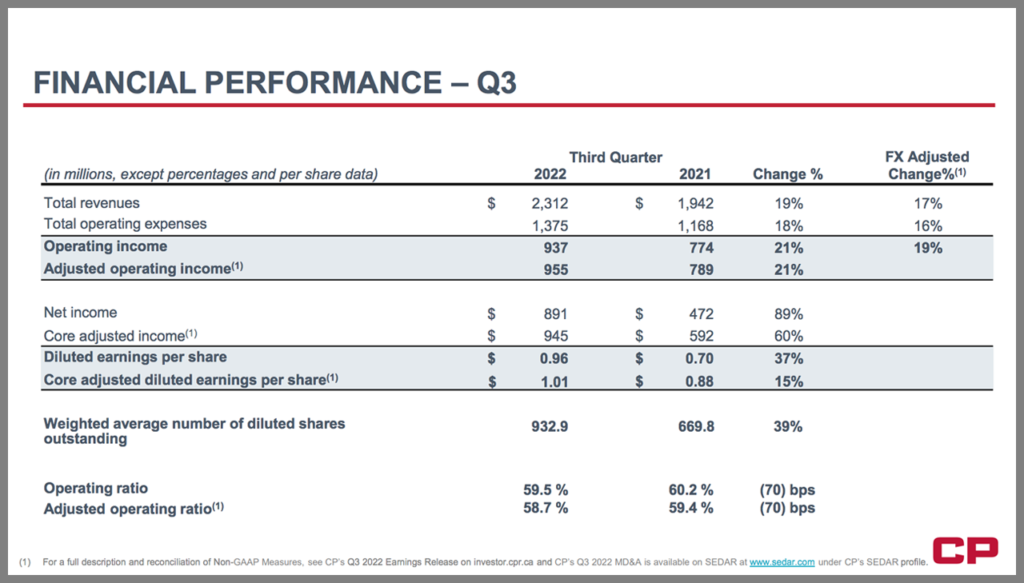

• Revenues of C$2.31 billion were up 19% from the prior-year period’s C$1.94 billion.

• Diluted earnings per share (EPS) was $0.96, rising 37% from last year; and core adjusted diluted EPS, excluding “significant items and Kansas City Southern (KCS) purchase accounting,” was $1.01, a 15% increase from last year, CP reported.

• Operating ratio came in at 59.5%, a 70 basis-point improvement over third-quarter 2021’s 60.2%; adjusted, it was 58.7%, a 70 basis-point improvement over third-quarter 2021’s 59.4%.

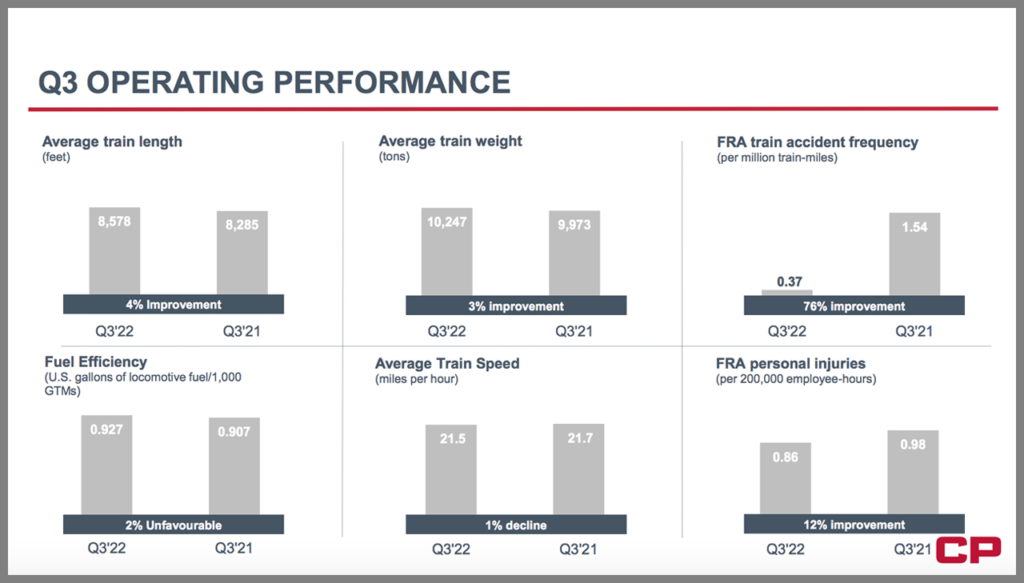

• Federal Railroad Administration (FRA)-reportable train accident frequency fell 76% to what CP described as a “record-low” 0.37, from 1.54 in third-quarter 2021. Additionally, FRA-reportable personal injury frequency decreased 12% to 0.86 from 0.982 in the prior-year period.

CP reported that it is continuing “to progress toward creating the first single-line rail network linking the U.S., Mexico and Canada” by merging with KCS, subject to Surface Transportation Board approval.

“We’ve successfully demonstrated how our proposed combination with KCS will connect customers to new markets, enhance competition in the U.S. rail network, take trucks off the roads, and drive economic growth across North America,” Creel said. “Our excitement grows each day we progress toward this transformative combination.”

For more financial results, visit the CP Investor Resources webpage.

The Cowen Insight: ‘Strong Momentum Up North’

“CP posted in-line results in the third quarter as high expectations were met with operational execution, durable volume growth (highest among the Class I group) and strong pricing momentum that should set CP for a strong finish to 2022,” reported Cowen and Company Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “Similar to its Canadian peer, we see strong inelastic bulk volumes sticking next year and the KCS merger on track for first-quarter STB approval. Price target to $81 and reiterate Outperform.”

Key Cowen Takeaways:

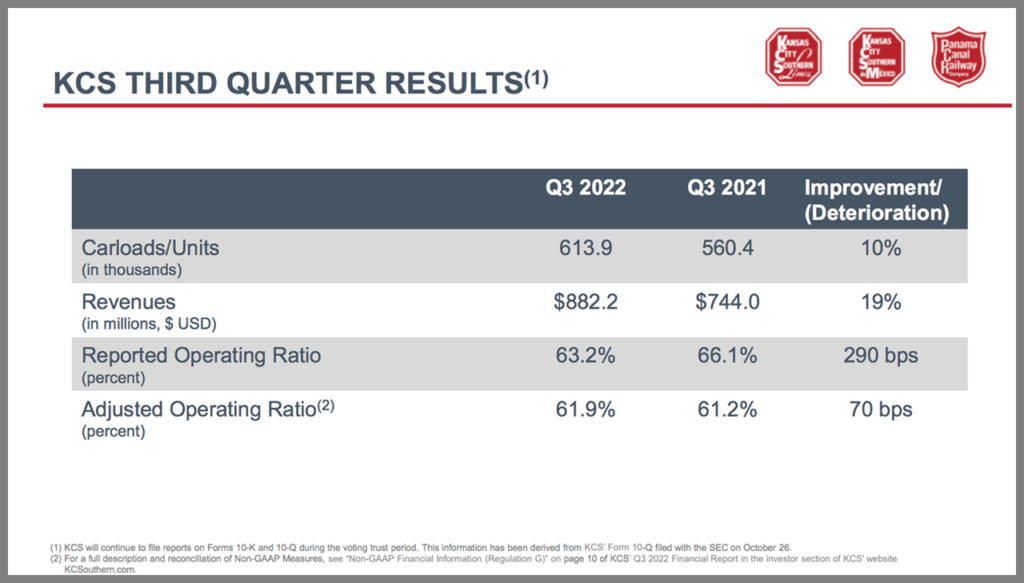

• “CP posted a top- and bottom-line beat in the third quarter with adjusted EPS of $1.01 CAD above our estimate of $0.98 CAD and in line with consensus as the company outperformed on both volumes and pricing, particularly in intermodal. Thrid-quarter adjusted operating ratio (OR) improved approximately 120 bps year-over-year (y/y). Results from KCS were also robust with revenues growing 19% y/y although OR deteriorated slightly on impact from rail labor negotiations. We note that CP was not materially impacted by the dispute as it is not part of collective bargaining in the U.S.

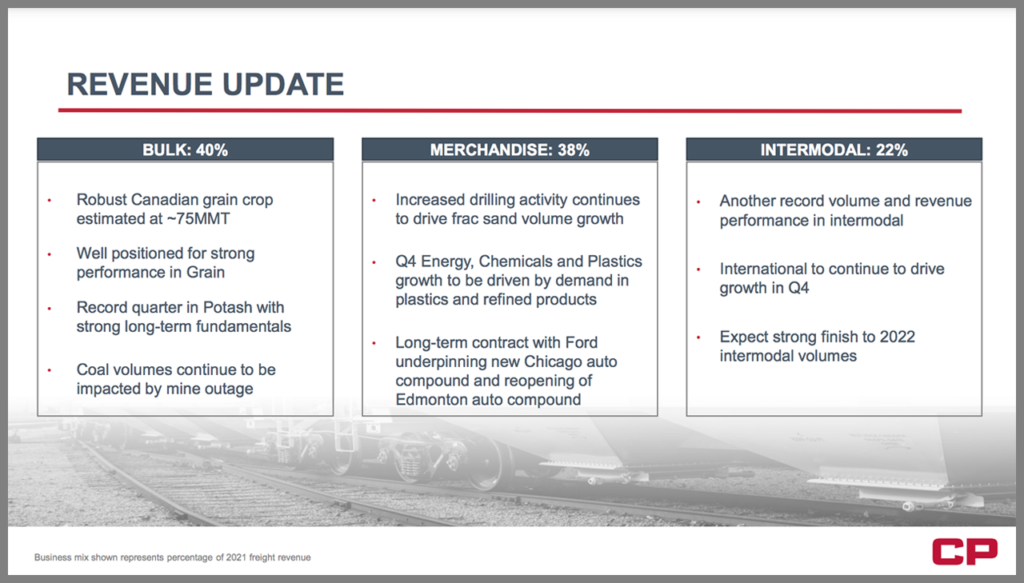

• “In stark contrast to the other Class I’s, intermodal led the charge in the third quarter with volumes up 20% y/y. CP’s new operation at the Port of St. John has reaped clear dividends with international intermodal up 30% y/y. The volumes coming out of the port are better than the company’s expectations and Canadian rail operational fluidity is in much better shape than the U.S. Management emphasized that they see little sign of weakness in intermodal as the Canadian franchise remains robust even as U.S. volumes are wavering. Intermodal pricing was strong as well in the third quarter and renewal pricing is expected to hold in the fourth quarter. Strong intermodal performance in the fourth quarter and 2023 is in line with our previous estimates.

• “We expect volume growth to continue in the fourth quarter and are confident that we should see growth again in 2023 given management’s bullish commentary. CP continues to see volume strength in grains owing to bumper crop (one of the top five all time) in Canada and highlighted that the harvest will produce favorable comps in first-half 2023. Low water levels in the Mississippi will produce a NT tailwind to grain volumes as they force truck to rail

conversions. The KCS merger will also serve as a volume tailwind; auto and intermodal volumes were up 52% and 17% in the third quarter.

• “Management expressed confidence on the pricing front noting that it secured ‘high single digit’ contract renewals in the quarter. We remain confident that positive pricing power should stick irrespective of the economic outlook for CP and the rest of the rail group heading into 2023. Fourth-quarter yield is anticipated to be approximately in line with the third quarter (largely due to the fuel component) and we model accordingly, resulting in a significant step up in our fourth-quarter pricing assumption.

• “The company gave an update on the CP/KCS merger and expressed confidence on a positive outcome from the STB in the first quarter of 2023. Recent hearings in D.C. were longer than expected, but management commended the STB’s (who was no doubt listening to the earnings call) detailed approach to reviewing the transaction. KCS continues to make progress in Mexico, highlighting a second bridge in Laredo that could support volume growth in the coming years (52% growth in autos volume in the third quarter support positive export momentum).