Cowen: Adjusting the Tracks for 2Q22

Written by Matt Elkott, Jason Seidl, Bhairav Manawat and Elliot Alper, TD Cowen

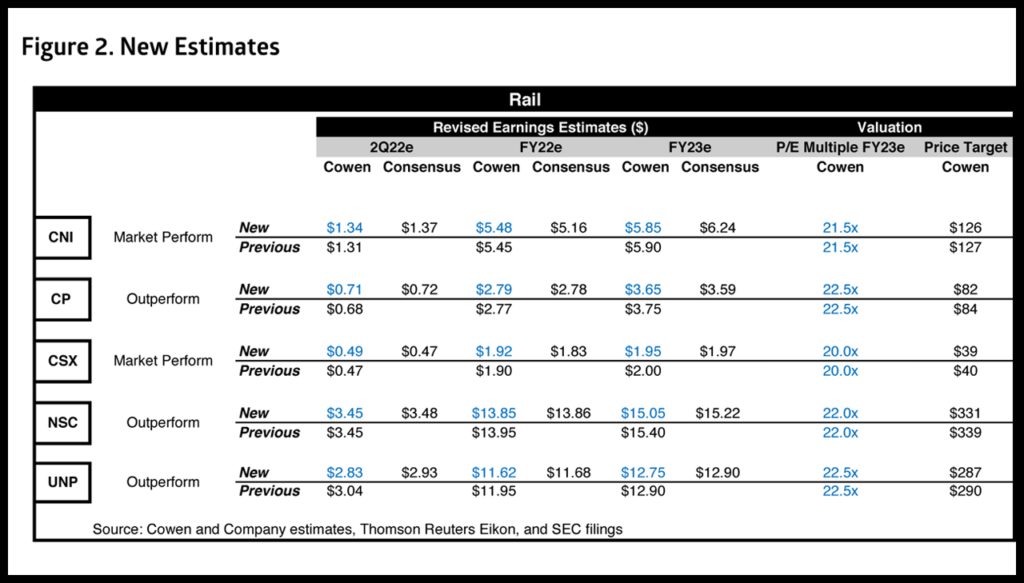

At Cowen and Company, we are adjusting our railroad estimates ahead of second-quarter 2022 earnings. Continued rail congestion is hindering volume (still below 2019 levels), while pricing is expected to be on par with first-quarter levels.

Diesel prices lower our operating ratio assumptions in the near-term, along with an elevated cost environment (hiring is ramping up). We see tailwinds associated with modal shifts that are driven by energy pricing, and we are cautious on near-term network challenges.

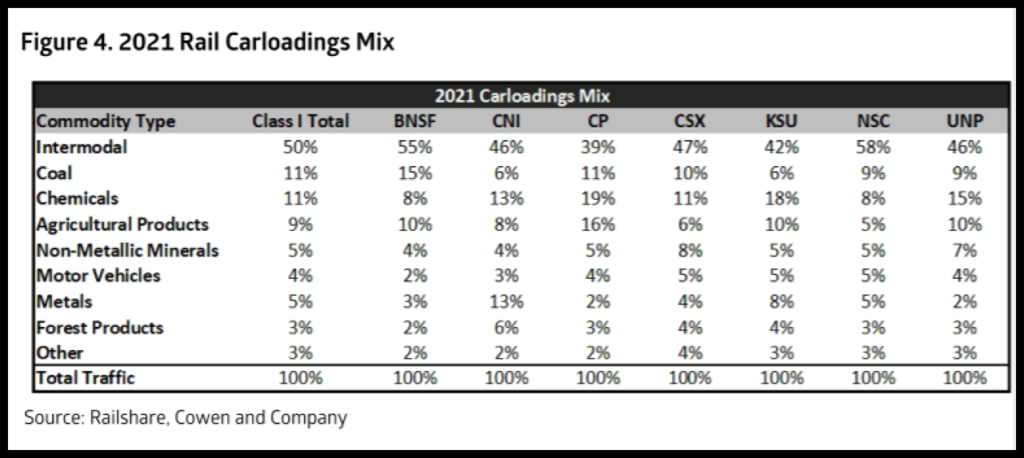

Fluidity continues to be challenged in the second quarter, though slightly above our conservative prior volume estimates. Quarter-to-date, North American carload volumes are down 2.3%—and down 2.5% year-to-date—still tracking below 2019 levels (pre-COVID-19). The largest decliner quarter-to-date: Agricultural products (–7.9%), largely due to a 42% decrease in farm products. We note that the winter wheat crop was worse than anticipated due to weather impacts. Intermodal volumes are –3.8% quarter-to-date as significant bottlenecks near the ports persist. As we heard on our recent State of the Ports call earlier this month, the largest bottleneck over the coming weeks and months will be the rail network. The rails have struggled to keep up, particularly on the West Coast (despite a hiring frenzy), and both equipment and labor continue to challenge the network. In our view, this may come at the expense of near-term intermodal growth, as severe delays are putting shippers in a bind.

That said, U.S. on-highway diesel continues to stay elevated, which we believe will ultimately benefit the railroads and the IMCs (intermodal marketing companies). Weekly on-highway diesel prices are up nearly 60% year-to-date, and were sitting at $5.72 per gallon as of the week of June 19. Diesel prices are passed on to the shippers via fuel surcharges. These surcharges are normally linked to an index (typically the U.S. Energy Information Administration’s weekly on-highway average). Truckers have a small lag (about a week), while railroads see an approximately 60-day lag in recovery (we note that domestic intermodal is about a one-week lag) based on how contracts are written. In general, higher diesel prices widen the gap in total landed prices between trucking and rail moves. This is because railroads are roughly three to four times more fuel efficient than their trucking counterparts. Even if a shipper can switch some of its freight to intermodal, apparent network challenges may hinder the modal shift opportunity in the near-term, as the railroads continue to ramp up employee count and improve service metrics.

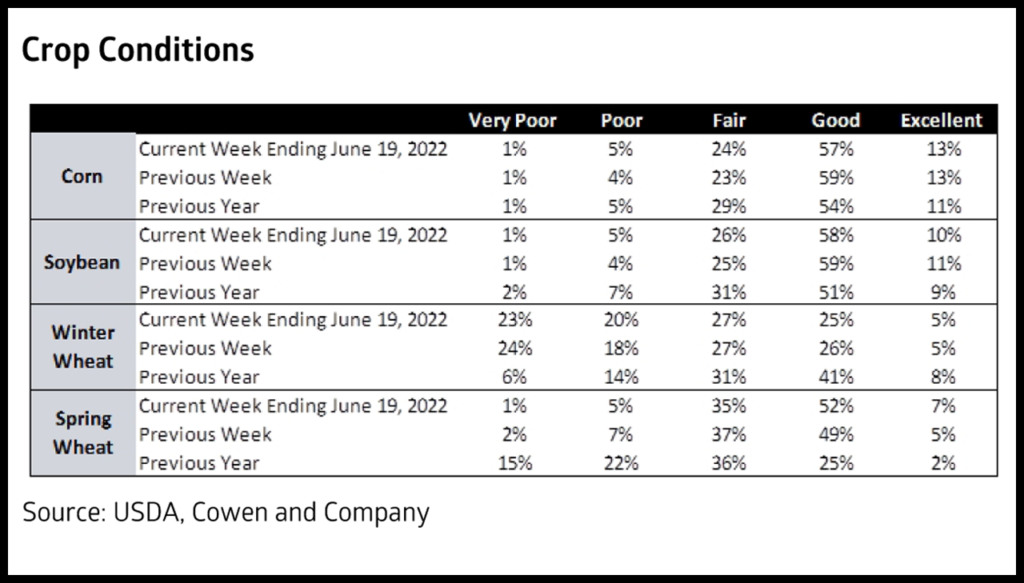

We will be listening to commentary regarding ag volume expectations during the second-quarter earning reports. Headlines surrounding a weak harvest season have caused skepticism about the state of the U.S. ag sector. According to the U.S. Department of Agriculture, crop conditions for winter wheat were well below levels seen last year; spring wheat, however, appears much better than last year, which may offset weak wheat winter crop conditions (as seen in the chart above). Corn, soybean and wheat planting all appear to be on or ahead of schedule when compared with historical averages. While weather conditions affected the Canadian crop last year, which drove significant declines in Canadian grain, we continue to monitor the U.S. ag sector, which for now appears to be faring better than headlines suggest. In 2021, ag carloads accounted for 9% of total Class I railroad volumes, according to our data (see below).

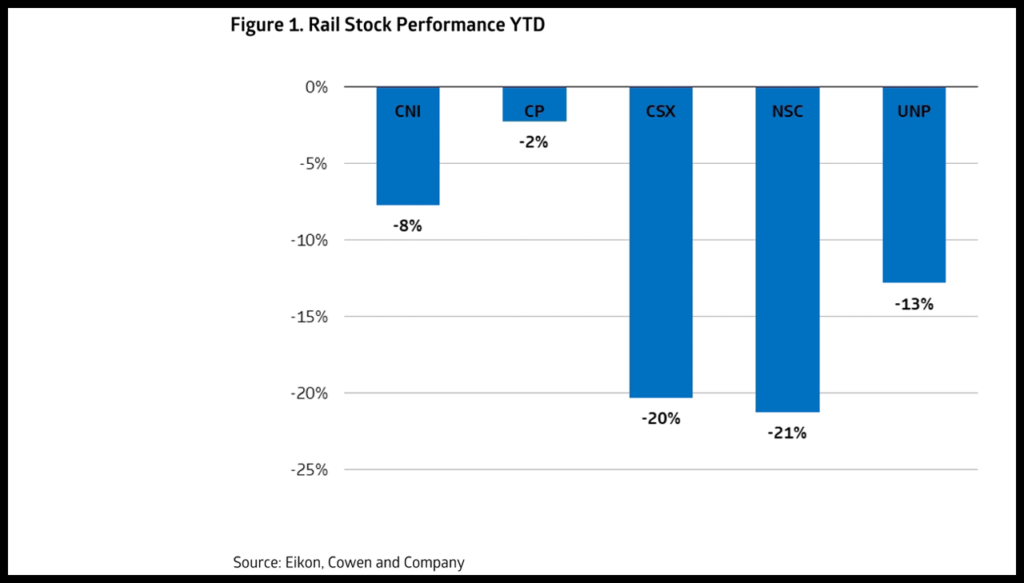

We modestly adjust our 2023 rail EPS estimates, while maintaining our multiples for the group. The modest adjustment downward comes primarily from our conservative ag volume assumptions in 2023 (approximately flat year-over-year). After catch-up calls with management teams across all the Class I’s, the railroads appear to be in better shape and confident in the improvements discussed during first-quarter earning reports. We adjust our Union Pacific (UNP) estimates lower, due to management commentary at a recent conference in which they revised guidance downward, citing cost pressures from fuel prices as well as other high network costs. The railroads continue to be on a hiring binge to improve service, which the Surface Transportation Board has been attempting to address. Despite the network challenges, the railroads have continued to outperform the market year-to-date, down an average of 13%, compared with the S&P decline of 19% year-to-date (as of June 24). As our top rail picks, we continue to favor Canadian Pacific (CP) for the longer-term benefits we see from the pending Kansas City Southern transaction, and Norfolk Southern (NSC) for a recovery in the company’s ability to handle more intermodal freight out East.