Trinity 1Q22: ‘Clear Line of Sight to Improved Conditions’

Written by William C. Vantuono, Editor-in-ChiefTrinity Industries, Inc. reported first-quarter results “highlighted by strong orders and deliveries,” according to President and CEO Jean Savage.

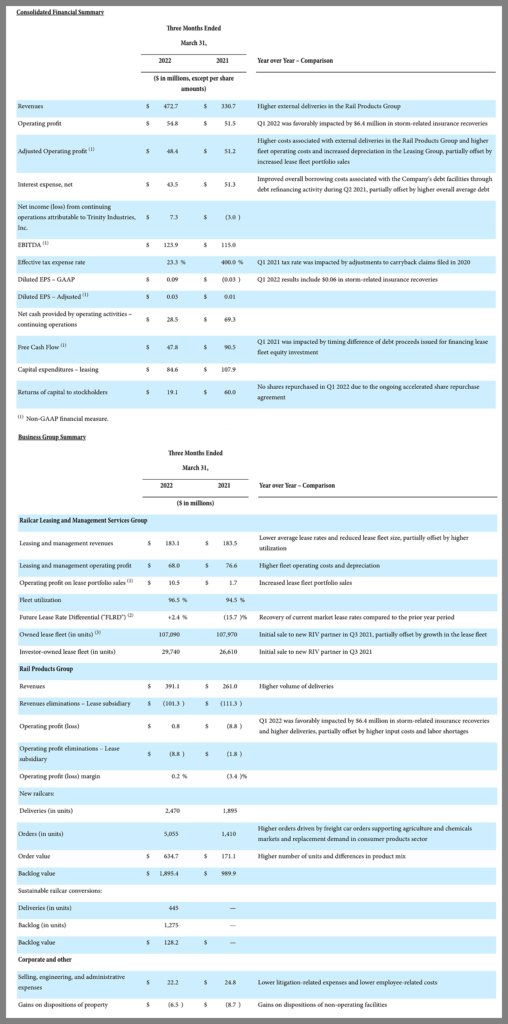

Trinity reported 1Q22 total company revenues of $472.7 million, a 43% increase from the prior year period’s $330.7 million. Quarterly GAAP income from continuing operations per common diluted share (EPS) was $0.09, compared to 1Q21’s –$0.03. Quarterly adjusted diluted EPS of $0.03 improved from 1Q21’s 0.01.

The lease fleet utilization was 96.5%, improved from the prior-year period’s 94.5%, and the Future Lease Rate Differential (FLRD) improved 2.4% at quarter end. Most significant, Trinity booked new railcar orders of 5,055 units worth $634.7 million in the first quarter, nearly quardruple 1Q21’s 1,410 units worth $171.1 million , and delivered 2,470 railcars, compared to the prior-year period’s 1,895. At the end of 1Q22, the railcar backlog was valued at $1.895 billion, about double that of 1Q21’s $989.9 million

Trinity’s year-to-date cash flow from continuing operations and total free cash flow after investments and dividends (Free Cash Flow) were $28.5 million and $47.8 million, respectively, compared to 1Q21’s $69.3 million and $90.5 million, respectively.

Trinity’s 2022 guidance includes industry deliveries of 40,000 to 50,000 railcars, net investment in the lease fleet of $450 million to $550 million, manufacturing capital expenditures of $35 million to $45 million, and EPS of $0.85 to $1.05, excluding gains on insurance recoveries and other items outside of core business operations.

“Trinity’s first quarter results are highlighted by strong orders and deliveries evidenced by a book-to-bill ratio of 2.0x in the quarter,” stated Jean Savage. “Though labor and supply chain challenges persist, we are confident that deliveries in 2022 will be strong and represent a broad-based industrial recovery for North America. In our Railcar Leasing and Management Services Group, utilization continued to improve, and our Future Lease Rate Differential once again improved sequentially and is now a positive 2.4%, a strong leading indicator of demand and future revenue growth. Furthermore, we ended the quarter with a fleet utilization of 96.5%, at pre-pandemic levels, which supports our internal estimates for lease fleet investment in the year.

“In our Rail Products Group, we were especially pleased by the volume of orders and deliveries in the quarter. IWe delivered orders taken at the bottom of the cycle and managed persistent labor and supply chain challenges, which pressured near-term segment margin. However, we expect to see results in this segment improve in the second half of the year based on the quality of our backlog and strong demand. As we exit the first quarter, we have a clear line of sight to improved operating conditions and expect the financial results in the second half of 2022 and beyond to reflect these trends.”