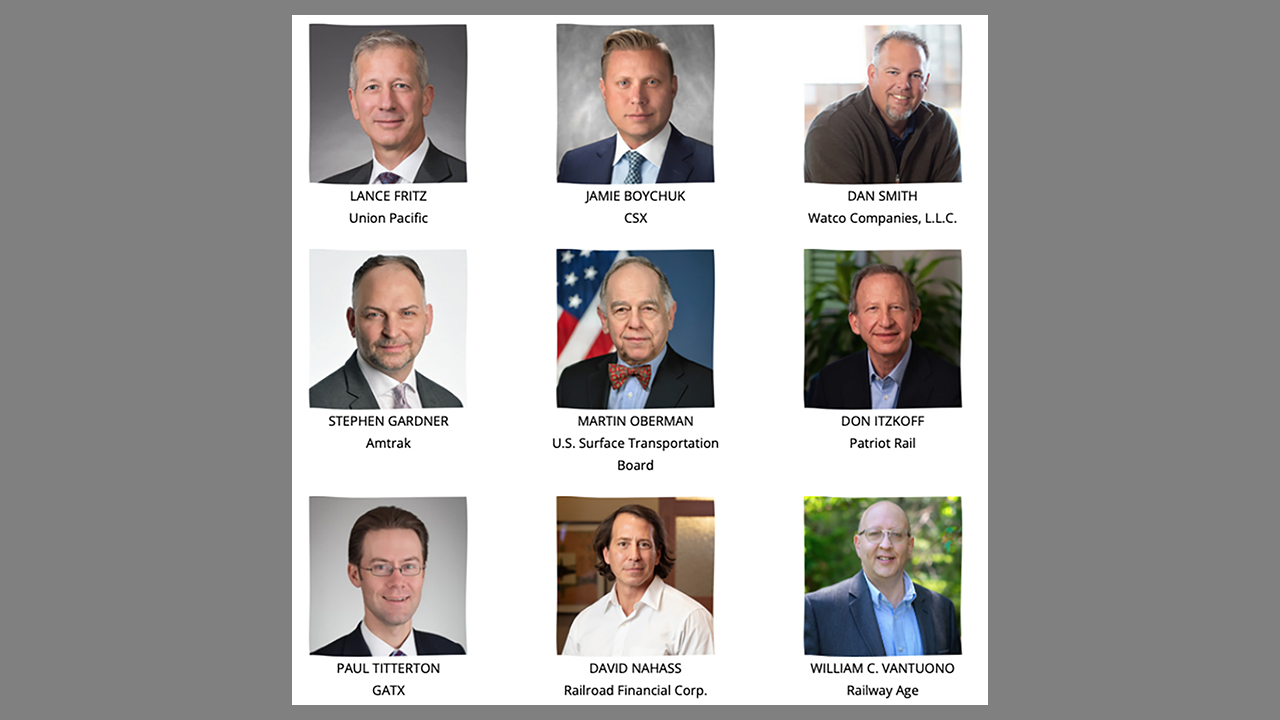

Rail Insights 2022 Conference: Key Takeaways From Key Industry Leaders

Written by David Nahass, Financial Editor

FINANCIAL EDGE, RAILWAY AGE JULY 2022 ISSUE: At Railway Age’s Rail Insights 2022 conference, there was a key set of industry stakeholders talking about the state of North American rail.

Lance Fritz, CEO of Union Pacific, discussed the service recovery plan to handle UP’s current problems and to address future growth. Fritz described UP’s plan to reduce car supply to break congestion and improve service. Key Performance Indicator: UP reduced the number of cars on line by roughly 10% and increased velocity by more than 10%. Fritz also discussed a plan to reduce dwell times, which would also show a concomitant increase/improvement in network fluidity and service, and said UP feels confident in the hiring and employment pipeline it has created for bringing on, graduating and maintaining more staffing. He was bullish on the impact of AI (artificial intelligence) on rail technology and the future.

Eric Marchetto, CFO of TrinityRail, highlighted improvements in overall railcar demand and the need for improving the value proposition for rail. In a high-fuel-cost, environmentally friendly environment, rail “should win all day long.” Marchetto acknowledged that rail growth faces service challenges. He noted railcars have increased in price by 30%, mostly as a result of input costs. Steel price increases have become increases in specialty component costs. Marchetto sees lease market inflationary pressure due to increases in the cost of railcars, in demand and in interest rates.

STB Chairman Martin Oberman led his discussion with Railway Age Contributing Editor Don Itzkoff by stating that the railroads have made short-term decisions that have negatively impacted service and brought it to an incredibly low point. Armed with primary source material, Oberman took aim at the “platitudes” provided by the railroads about their ability to respond to the post-pandemic traffic surge and the reality of today’s low service levels. He drew a contrast between the Class I and short line perspectives on hiring and maintaining employment. He also denounced the transfer of wealth from rail customer to railroad shareholders, noting essentially that even at current revenue levels, a railroad that is unable to provide service to a shipper loses profits from that shippers losses.

Paul Titterton from GATX discussed the leasing market with me. He indicated that current railcar tightness is not due to demand but to extraneous factors such as high scrap steel and new car prices, and slower velocity times. He feels there could be continued strength as long as the economy does not contract as velocity improves. Titterton noted that new railcar prices are being impacted by the price of specialty components, not just the price of raw materials such as steel. GATX tracks a metric, “core carloads.” Current statistics suggest that carload volumes have room to grow and that demand for growth exists. GATX is looking for a pivot to growth in North American rail. Sadly, Titterton also reported that progress on reforming the car-hire system has slowed or stalled.

Watco CEO Dan Smith discussed his company’s ability to work with its customer partners to develop growth solutions, helping them become better managers of their Class I partners. In a time of great Class I stress, Smith sees short line railroads as shipper partners that ease congestion at locations like port terminals and alternatively create a pivot to growth. Watco’s work in the terminal market has seen growth in the past decade as customers used Watco as a logistics supplier integrated into their supply chain. Using the examples of a soybean crushing plant and a multi-use warehousing/industrial space in Houston, Smith articulated how a short line railroad is a multi-use tool for industrial growth. On hiring, Watco has been able to use creative strategies to promote retention and continue to develop its workforce.

Amtrak CEO Stephen Gardner promoted the need for a successful 21st century passenger rail system. Amtrak will use much of its $22 billion from the recent infrastructure bill to improve and modernize the successful Northeast Corridor. Gardner wants to expand the franchise and improve corridors where there is demand for sustainable service. He wants to bring more people onto Amtrak lines. With higher gas prices, people want more public transportation service. To do so, Amtrak will continue to need bipartisan political support.

CSX COO Jamie Boychuk focused on the need to maintain best-in-class staffing to promote a complete level of success at CSX. Creating a sense of value and opportunity is elemental to success in delivering on that promise. That means adopting modern employment strategies to attract and retain a high-quality employee base. CSX is working to use technology that will assist employees in scheduling. The aim: to improve lifestyle, including commitments to their job and their families. Boychuk believes that by working more closely with local union reps and employees directly, the success of the railroad can be improved. On the service side, CSX is looking at improving schedules for bulk commodities to improve service overall.

Incredible industry content at the eighth annual Rail Insights Conference! Don’t miss the ninth.