Multi-Edged Difficulties

Written by David Nahass, Financial Editor

William C. Vantuono photo

FINANCIAL DESK BOOK, RAILWAY AGE OCTOBER 2022 ISSUE: Welcome to the 2023 Railroad Financial Desk Book. The North American rail drama meter has finally backed off from the red line down to a more tepid level of yellow.

Granted, North American rail never approached the hyper-intense drama of a titanic battle like Elon Musk vs. Twitter, but the threat of a nationwide rail strike garnered national news coverage and attention for three or four days. Every industry veteran and transportation manager answered the probability question at least a dozen times. Want to talk about lost productivity? Think of the number of hours spent developing and sketching out contingency plans by companies providing essential services or running facilities that “can’t” (whether due to cost or necessity) be shut down. All for naught! Console yourselves—at least you’re prepared for the next time!

Let’s cut to the bare metal: There never was going to be a strike. Whether you believe the Executive Branch added value or just grabbed the headlines and the credit, the railroads and the unions would have been sent back to the bargaining table until they found a way to get along. Two words: midterm elections.

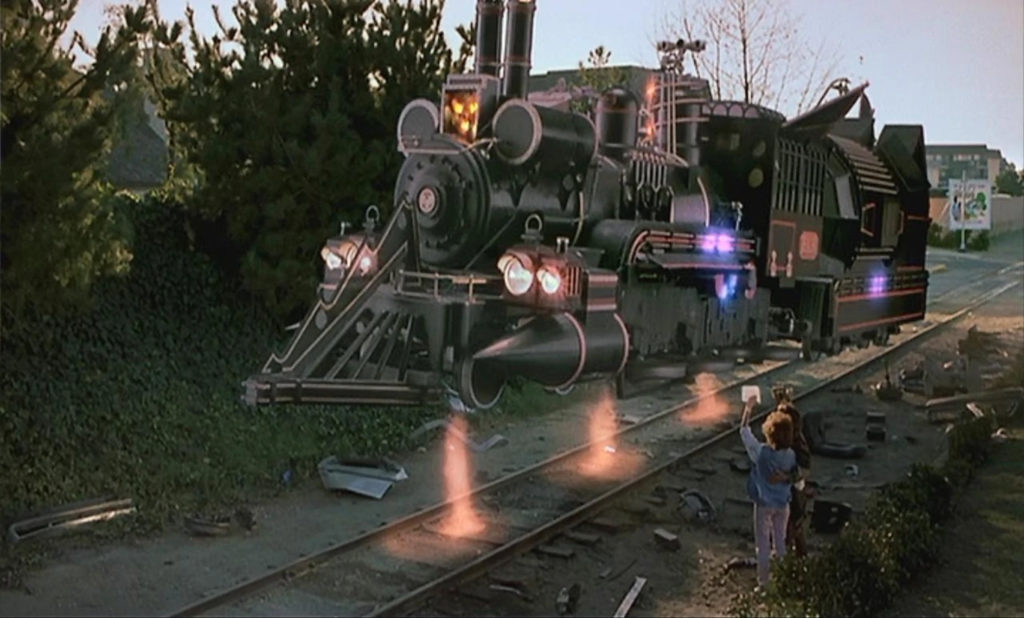

Given enough time, a reach out to Dreamworks studios to see if they could get some advanced technology on the flying locomotive from “Back to the Future 3” was probably a likely scenario.

The Biden Administration milked the preparation for rail Armageddon shamelessly, going so far as to suggest that they were looking at contingency plans to transfer freight from rail to other modes (as if, “Okay, Joey, just back up that barge to the edge of this rail yard. Yeah, I know there’s no water—just do it!”). There were rumors that calls were placed to Starfleet Command to see if freight could be “beamed” from location to location to pick up the slack that would have been created by the strike. Given enough time, a reach out to Dreamworks studios to see if they could get some advanced technology on the flying locomotive from “Back to the Future 3” was probably a likely scenario.

Unfortunately, the soap opera around the labor drama became another opportunity for a dog pile on the railroads. Late night talk shows had a field day. Jimmy Fallon weighed in on Biden’s political success, The New York Times joined in, and The Wall Street Journal took issue with the strike and with the publicity grab. It’s tough being the butt of the joke.

Of course, this all assumes that the proposal is ratified by the unions. That is not a guarantee. However, certain circumstances bear considering for the post-strike look at North American rail. Jason Kuehn, Vice President at Oliver Wyman and perennial Rail Equipment Finance speaker, suggests that North American rail’s labor troubles might not end after ratification.

Start with this: Railroad union employees are set to receive a retroactive “catch-up” payment of back pay going back to Jan. 1, 2020. The current estimate for that payment is an average of $11,000 per employee, including an immediate wage boost averaging more than 14%, plus $1,000 per year in bonus payments. Kuehn raised the question of how many employees have been hanging on for that catch-up payment, and now that the labor war of attrition has come to a close, he wonders how many of the freshly compensated union employees might step up and take the short walk to the exit.

Don’t act all surprised about this. That result would not separate rail from any other industry in a similar position. The question is how senior are the employees that may leave and how many may leave in total. Any statistically relevant number would impact whatever progress the railroads have made in resolving their current issues.

Kuehn also points out that a national wage agreement being proposed between railroad and labor creates another potential issue. He notes, “Many of the staffing issues, as we have heard from the railroads, are not systemwide but are location-specific. A national agreement is not a solution that allows carriers to modify pay locally other than things such as one-time hiring bonuses.”

This is a key issue as it relates to improving service in these areas. Kuehn sees it as a critical factor. From recent presentations at Cowen’s annual Transportation Conference, he recounts CSX noted “that they are facing challenges in New York state” and that Norfolk Southern “called out specific geographical areas where staffing is an issue.” He notes Union Pacific and BNSF have had issues centered in California, which is known for higher-than-average wages and cost of living.

Tired yet? Kuehn is concerned there will still be a disconnect when wages are measured against the cost of living in specific locales. These concerns, he notes, “are increasingly becoming problematic in areas where housing prices (and other cost of living categories) are very high.” Like with the wage-related inconsistencies, a national wage agreement is not tooled to handle these idiosyncrasies.

As you contemplate the bumps in the road, console yourselves with the hopes that it may be another four years before the rail industry needs to deal with this again.

Railroads, Railcars and Inflation

The railcar market is tight, and prices for those that lease cars are, in many cases, higher than they’ve been in the past 20 years (see “Around the Market” in this Desk Book, p. 16). Railcar lease rates are high on everyone’s list of interesting topics on the fall conference circuit, along with inflation and its impact on new railcar prices.

Another topic of great concern to those that lease and own cars ties back to rail service and the ability of the railroads to originate more carloadings both to serve more customer needs and to grow revenue and strengthen the role of the rails in North America.

Here’s one double-edged problem created by railroad service issues: On one side, it feels like there aren’t enough cars to meet demand. On the other side, there aren’t enough crews, and service on the railroads isn’t good enough to meet the needs of those customers that want to ship by rail.

Service disruptions are causing some modal shifting of rail loads. It could be a shift to other forms of transportation (most likely truck). In power generation, it could cause a decrease in (or put a cap on) the maximum tons of coal that power generators are able to ship by rail. As a result, the volume of coal being burned for consumer or industrial consumption is being reduced in favor of higher priced (today at least), pipeline-delivered natural gas. These modal shifts create a gap in opportunity cost for a consumer of rail traffic. Ultimately, that cost gets passed on, directly or indirectly, to the consumer, and that becomes an inflationary pressure.

John Ward, National Coal Transportation Association (NCTA) Executive Director and Rail Equipment Finance speaker, notes that in a 2022 NCTA member survey, “More than 80% of respondents reported that they had curtailed power generation to conserve coal; that coal supply commitments for the year were not met; and that coal inventory levels were reduced below target levels.”

For consumer and industrial products manufacturers, those price increases may not be passed on to their customers until six months to a year after the impact starts being felt at the producer level. There is a negative arbitrage period during which the producer carries the additional expense before it gets passed to the next company in the supply chain and on to the consumer. These price impacts might lag inflationary reporting during this negative arbitrage period. In consumer energy markets, the pass-through of lost opportunity is more immediate. On the producer level, the impact is the same timewise as transportation modal shifts. Congestion on the rails and increasing lease costs due to inefficiency also weigh on these price increases, even as the industry enters its second year of increasing lease costs.

Cost transfer from service disruptions also happens when facilities that are only rail-served have to temporarily shut down when they cannot receive feedstock or move product to customers. Eamon Monahan, Vice President for Environmental Affairs and Workplace Safety for the Corn Refiners Association (CRA), which represents refiners of corn that serve the food and animal feed markets (not including ethanol), notes that CRA’s member companies are operating at maximum capacity. When rail-served facilities are forced to shut down, for however short a duration, that capacity is lost and is not recoverable. Additionally, facilities are not light switches; a shutdown can turn into a multi-day expensive turn of events. Shutdowns stress infrastructure and increase maintenance costs. This additional level of lost opportunity cost is passed down the line and is difficult to measure.

There is no direct measurement of the inflationary impact of these modal shifts that result from railroad-related service disruptions. Clearly this is not the only factor influencing inflation. Its significance rests in the undocumented and unmeasured potential impact. It is important to remember, as Todd Tranausky, Vice President for Rail and Intermodal at FTR Transportation Intelligence, notes, today’s inflationary cycle was driven first by demand, and that these expenses can’t be passed through as easily when the demand does not exist like it does today.

In many cases, the individual consumer won’t see the impact of these forces in the CPI (Consumer Price Index) until those prices have been thoroughly incorporated at the retail level (six to even 12 months in some cases). It is one of the challenges behind measuring the impact.

An interesting pandemic-era parallel is supply chain shifts that may have come up as a result of port congestion on the West Coast. It is still unknown if freight that was shifted from the West Coast to the South or East Coast or that was near-sourced (vs. being sourced in China, for example) will get returned to previous points of origin and destination once congestion eases. Once modal shift has occurred and those supply chain costs are being recovered from the consumer, will companies prevent a shift back to rail (or back to China)? Generally, memories are short, and profit seems to trump all (geez, where have you heard that before?), so a cycle of opportunistic offshoring and modal shifting back to rail is probably available again at some time in the future.

Around the Market

Leases rates continue to torture lessees and bring smiles to the faces of lessors. There are so many factors driving what is happening in the lease market. It’s service related; it’s being impacted by raw material pricing; and it’s part of the overall economic demand cycle. However, one factor is quickly becoming the straw that stirs the drink. Interest rates, backed by the Federal Reserve’s need to rein in inflation, have been on the rise. It’s pretty stratospheric. How crazy is it? In May 2021, the one-year Treasury was 0.05%. On Sept. 22, it hit 4.11%. For the 10-year Treasury, it was 0.67% in May 2021 and on Sept. 22 it hit 3.55%. Ouch! That’s a stinger.

Raw material prices, especially hot rolled coil steel, are trending downward. This may provide some relief on new railcar prices, but plate steel continues to trend at high levels. Component-related supply chain issues, especially those that may have been sourced in Russia, continue to be impact factors that affect pricing on all car types.

With scrap sitting in the mid-$200s per ton ($260 as of this writing), the above-average numbers of cars being scrapped has slowed. Longer term, as service improves, expect this to help push down lease rates when car supply frees up a bit.

Back to interest rates: Even after the September 75-basis-point increase in the federal funds rate, the Federal Reserve continues to remain hawkish on further rate increases, and the end of the road does not seem near. The 10-year Treasury, which hasn’t been above 4% since 2008, seems headed there quickly. There’s no easy metric to determine the impact of rising interest rates on lease pricing, as lease rates are a mélange of several factors, but it would be fair to say that the full impact of rising rates has not yet been felt by railcar users. Table set. Gruel served.

Here is what is going on in the lease market:

Covered Hoppers: Grain shipments are down 4.3% YTD, but you wouldn’t know it from lease rates, which are different degrees of high right now. For 4,750cf cars, expect to pay high-$300s ($400s if you don’t mind making enemies on the way up) full service (f/s). For 5,200cf cars, expect numbers to start with a six. Leases are five years f/s. Looking for super jumbos for DDG service? Expect to pay in the low-$700s right now.

Covered Hoppers for Plastic Pellets: “Good luck finding one,” one lessor noted during a recent conversation. High-$600s to low-$700s are likely numbers. New cars are being built and continue to be expensive.

Pressure Differential Covered Hoppers: Looking for newer 5,660cf PDs? Expect to pay mid-$800s f/s with terms of five years. Numbers for more out-of-favor smaller cars of 5,200cf capacity are not much better in the high-$600s or low-$700s.

Covered Hoppers for Sand and Cement: The Renaissance continues! The problem with a market with so much extra capacity is that the marginal cost of bringing cars into service can occasionally thin out the pool of available assets. This could be the case for the divergence of rents heard in the market on these cars. The range is from low-$300s to less than $100 f/s, with the majority landing in the mid-$200s.

Tank Railcars: This is probably the segment showing the weakest impact of current market tightness. Pressure tank railcars are still seeing some cars in storage and rate in the high-$500s to low-$600s with a fall pickup expected. 25Mg GP tanks are available in the market, and prices have not moved much above the mid-$600 range f/s. Crude oil tanks (117Js) are the best performers, with rates in the $800s. The May 1, 2023 transition date for using DOT111A cars in Ethanol service is approaching fast. According to the Railway Supply Institute, as of Dec. 31, 2021, roughly 7,200 DOT111s remain in ethanol service. So expect some jockeying on that front in the near future.

Mill Gondolas: There’s tightness here as well with the shorter 52-foot cars leasing for mid-$600s f/s. If you’re looking for a 66-foot car, expect to pay $700-plus. Some new cars are being built to address demand, but as this is one of the older fleets, expectations for improvement are marginal, even with low-scrap rates.

Coiled Steel Gondolas: There’s also some building in this segment. New cars in the $130,000 range have lease rates at higher levels. Expect high-$700s to low-$800s for this car if you can find one available right now. For a smaller total fleet, service-related impacts on car supply are amplified.

Centerbeam Flat Cars: There’s some availability in the market for these cars. There is an expectation that the downturn in housing starts may improve availability, but as Dan Anderson from TrinityRail noted at the FTR conference, cars with risers continue to fall further out of favor, even in this tight market. Expect to pay high-$400 to low-$500 per car f/s.

Coal Cars: Coal loadings although up YOY are not as high as they could be. That hasn’t held down lease rates at all for these cars. Lease rates for aluminum gondolas continue to move in the $300s f/s. As with small-cube covered hoppers, rates are all over the place, with numbers ranging from high-$300s net to the low-$200s f/s. Car availability is an issue here as well. Looking for rapid-discharge cars? Expect the possibility of a slight premium to gon pricing. That is not guaranteed. Availability is scarce here as well.

Boxcars: Tightness in this market continues with high-$600s to low-$700s for both 50- and 60-foot cars. Cars are few and far between, so don’t expect much inventory available. New cars are in the pipeline, but expensive, so expect new car leases to begin with something that looks more like an eight.

It’s clearly a lessor’s market, and it’s expected to remain this way for the remainder of the year into the second half of 2023.