Matt Elkott: Increased interest in lease fleets, improved frac sand outlook favorable to ARI

Written by William C. Vantuono, Editor-in-Chief

Cowen and Company analyst Matt Elkott has upgraded American Railcar Industries (ARI) to Outperform from Market Perform, “as earnings and fundamentals have not only remained stable but improved further on the frac sand front. Our confidence in our above-consensus estimates has grown, and our channel checks suggest rising interest in lease fleets. Meanwhile, valuation has compressed over the same period. Our new PT is $45 (16.5x our 2018 EPS estimate) vs. $44 previously.”

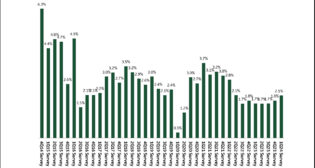

“A disconnect between fundamentals and valuation has emerged,” said Elkott. “ARI reported fairly solid results given the sluggish environment, and its lease fleet continues to grow, now contributing more to operating income than the manufacturing segment is. The growth of the lease fleet should expand valuation due to its intrinsic value and the earnings stability it provides. As far as order activity in the manufacturing segment, it has improved in the current quarter over 4Q16. On two other fronts, our channel checks suggest rising interest in lease fleets, and outlook for frac sand demand has improved even further in recent weeks. Meanwhile, following a 19% decline since its earnings results, ARI is trading at roughly 14.5x our 2018 EPS estimate, compared to the current average of Trinity and Greenbrier, ARI’s closest peers, of 17x. We believe this discount is not fully warranted given ARI’s modest historical premium. ARI’s aforementioned 19% decline compares to the 5% decline of the broader peer group.

“In our recent conversations with industry contacts and investors, we have noticed increased interest in leased railcar assets. This comes in the months following Japanese bank Sumitomo Mitsui’s announced deal to buy ARL’s (ARI sister company American Railcar Leasing, wholly owned by Icahn Enterprises) lease fleet for roughly $97,000/unit, a rich valuation that may not be indicative of future valuations but may bode well for owners of cars with attached leases. Applied to ARI’s lease fleet of 11,300 railcars, the purchase price would translate to just over $1 billion. We believe other interest in ARI as a company could come from other OEMs (excluding Trinity but including private OEMs) seeking external growth and a more robust leasing presence.

“Frac sand demand outlook has improved further in recent weeks. In his March 15th report, Onshore Completion Update, Cowen oilfield analyst Marc Bianci notes that proppant demand could more than double the 2014 peak with just 850 horizontal rigs. A recovery in frac sand cars could have an outsized benefit for the company relative to peers. Our confidence in the 16,000 frac sand cars currently in the industry backlog has grown. It is still unlikely that meaningful new orders for small-cube covered hoppers could occur in the near term, but we now believe this could happen before year end.”