Get Used to Higher Railcar Prices and Lease Rates

Written by Robert H. Cantwell, Contributing Editor“Rational” and “Disciplined” are words rarely used when talking about freight railcar supply. But perhaps this time is different.

Since 2019, freight railcar builders have struggled to return to double-digit gross margins. This is about to change (and just changed with Greenbrier’s Q4 earnings release).

Navigating through COVID created lots of challenges, especially coming off of a recent record high build rate in 2016. It is remarkable that the supply industry was able to produce 29,000 railcars during peak COVID. Recovery since then has been challenging, but things are changing rapidly for the carbuilders. Here’s why.

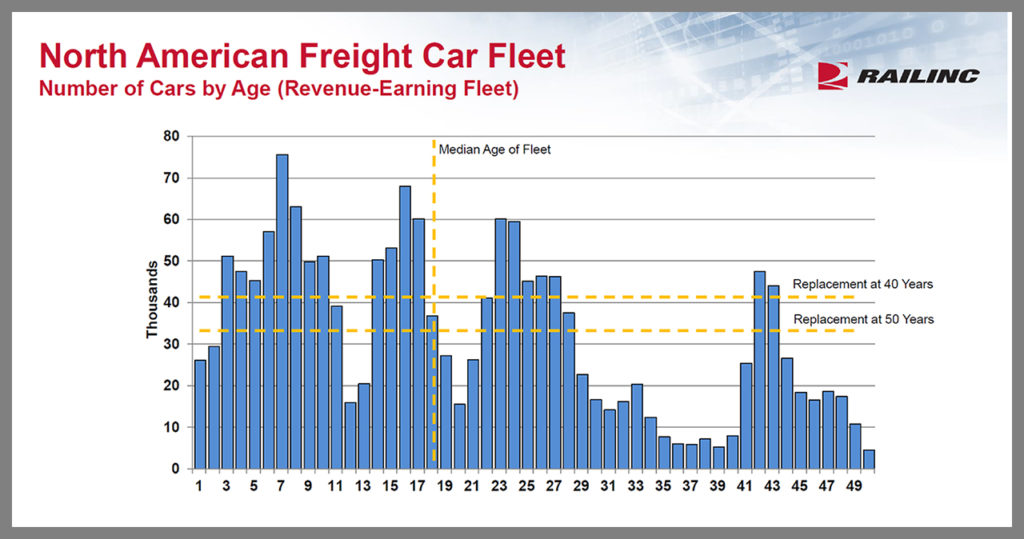

Looking at this from a demand/supply perspective reveals the following: Demand for new railcars can be complicated by spikes in certain car types (for example, tank car demand spiked to 37,000 in 2015, driving deliveries and builders’ margins to record highs). Factoring out market demand spikes, it has been demonstrated by Dr. David Humphrey of Railinc that the normal replacement demand is 42,000, based on a useful life of 40 years. I believe a 40-year economic life is indeed generous, given the many improvements to modern railcars, along with the negative impact that older cars have on rail infrastructure.

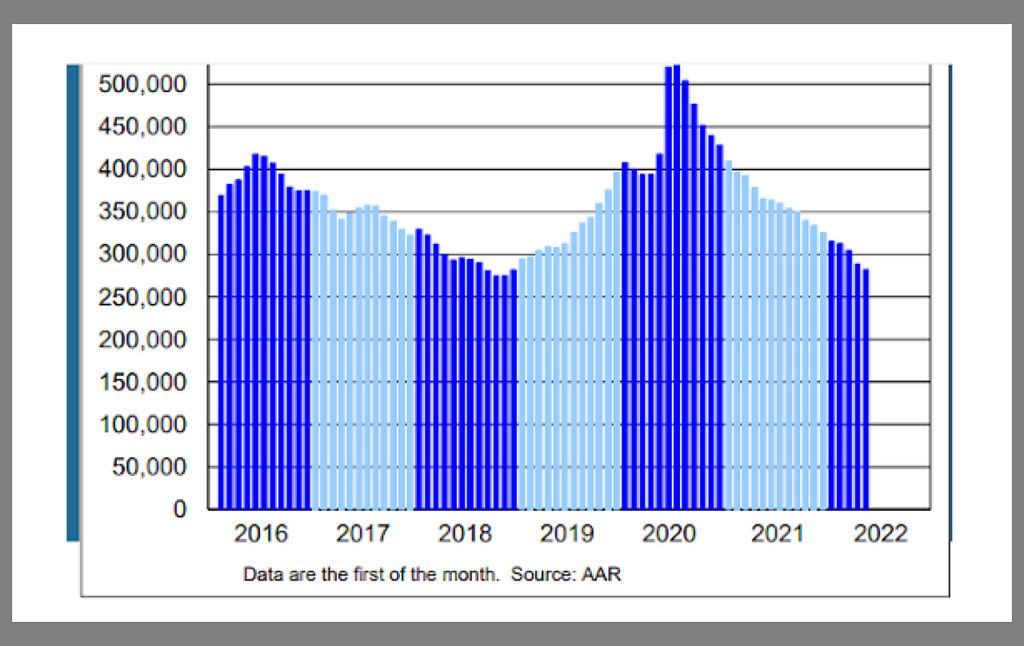

With 42,000 as a baseline, any growth from the railroads will be additive. Adding growth to replacement demand might drive normalized railcar demand to 50-53,000 cars annually. Further supporting this outlook is the downward trend in cars-in-storage:

The “Rule of Thumb” for cars-in-storage has been that 15% of the fleet is normal. Given the car types and ages of cars in storage, and the highly distortive impact that tank cars have (100,000 in storage), it is likely that far fewer than 15% of the cars-in-storage will return to service. Coupled with elevated scrap steel prices and storage costs, owners of older cars in storage are incentivized to scrap, rather than store. This is best evidenced by the past three-year scrap rate exceeding the build rate by a wide margin. Note that cars-in-storage are currently down to 16.5% from 21.5% a year ago, a level not seen since 2015. Also impacting the decline in railcars-in-storage is the repurposing and conversion of certain designs into useful designs that are marketable. Of course, any improvement in rail velocity and dwell times might impact the need for so many cars on line, but we’ll see.

Improvements to railcar design and construction techniques add further fuel to the scrapping decision. A railcar produced today is far better than one produced 20, and especially 40, years ago. Many improvements have been made to the carbody, the trucks and the brake systems. With the implementation of AAR S-286/M-976 specifications in 2004, railcars produced since then are much safer, more track- and wheel-friendly, and have lower rolling resistance than previous designs. Combined with modern manufacturing methods such as robotic welding, laser cutting, computer-controlled bending and rolling, today’s railcar quality is superior to those produced 20 years ago. Utilizing powerful computer design and structural analysis software combined with robust dynamic modeling capabilities has yielded lighter railcar designs that haul more and impart less harm to the track.

Of course, economic factors drive the decision to run 40-plus-year-old railcars: Fully depreciated cars are cash cows for leasing companies, and higher priced new equipment doesn’t offer the same returns unless lease rates are commensurate.

New Railcar Supply

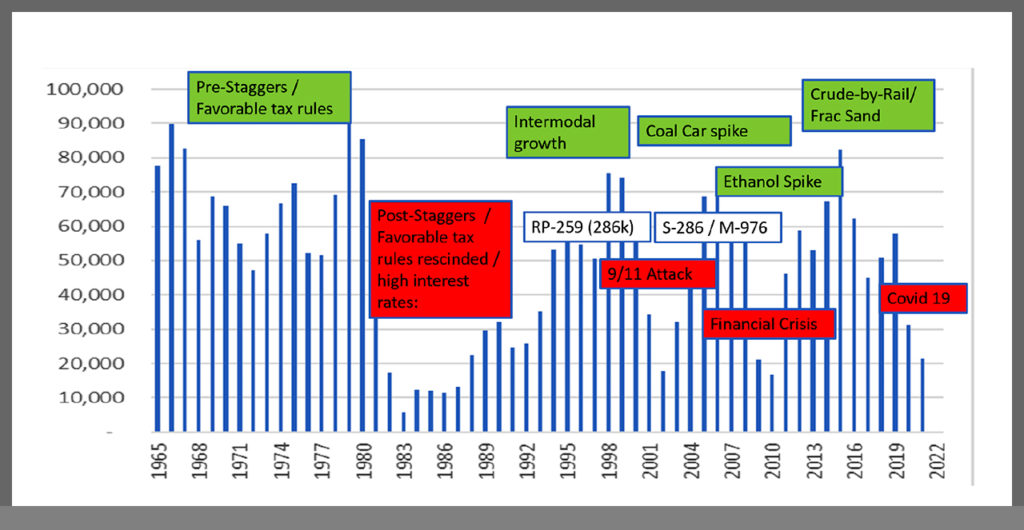

Looking at the supply side, there have been many changes over the years, and even more recently since the 2015 spike of 80,000. (Tank cars represented 37,000 of this number in 2015, and with the current backlog of tank cars at 11,000, there is no tank car spike on the horizon.) Looking at car builds over an extended period reveals that carbuilding is very sensitive to external events:

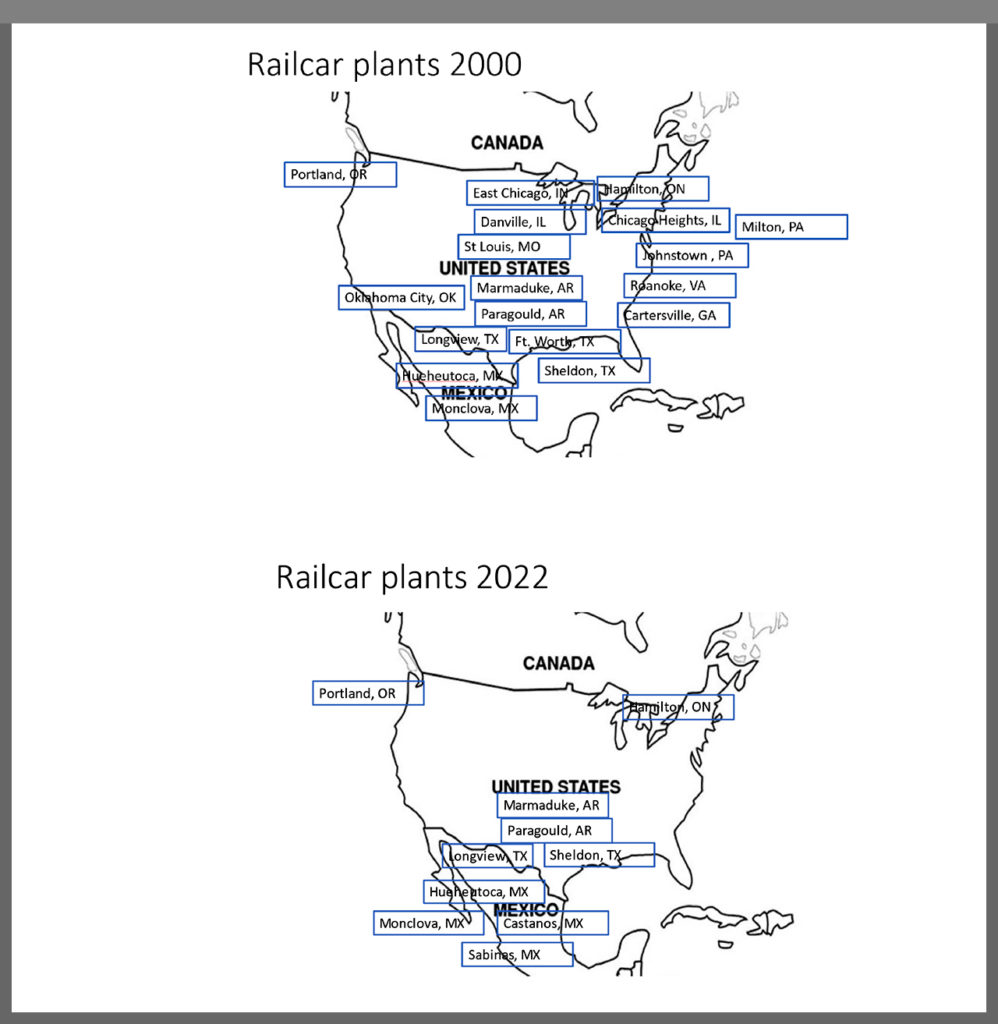

Each of these major events causes huge swings in production costs, and the railcar industry has had to react and adjust quickly. Below is a comparison of railcar production facilities in 2000 compared to today. More than 80% of railcar production now occurs in Mexico!

With this shift in production has come capacity rationalization. There is a lot less tank car capacity today than there was a few short years ago. It’s hard to imagine that FreightCar America at one time delivered more than 18,000 cars (in 2006). Since then, they transitioned to the Shoals plant in Alabama with stated capacity of 10,000 cars, but subsequently relocated to Mexico with capacity plans of 4-6,000. Altogether, it is estimated that industry capacity is 52-55,000 railcars today, depending upon mix. This is a far cry from the 80,000 in 2015. Besides, even if there were a spike in demand, are there enough people available to produce a higher number of railcars?

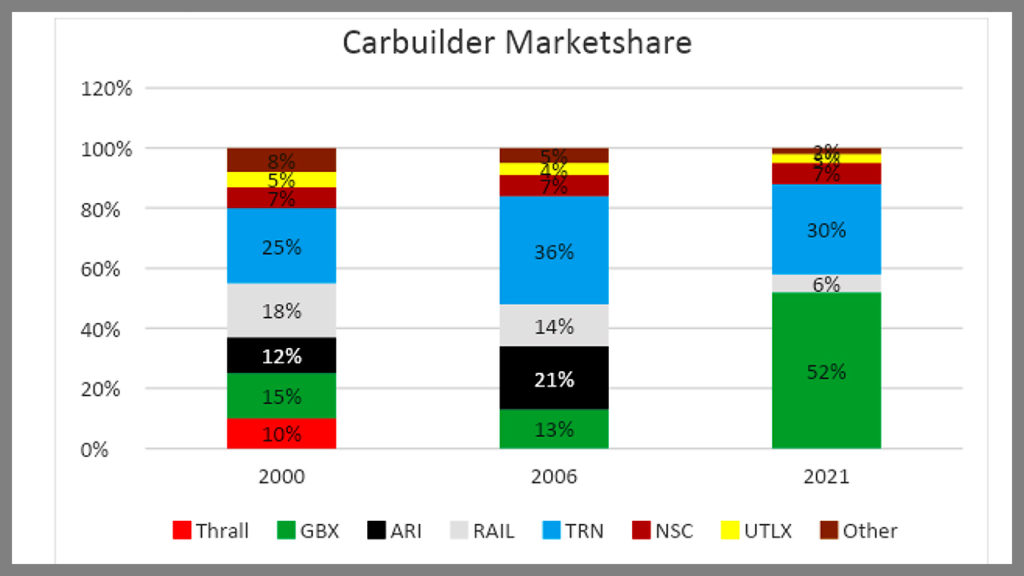

Since 2000, railcar builders have consolidated. Trinity purchased Thrall Car in 2001. More recently, Greenbrier purchased American Railcar Industries in 2017. This too has driven capacity rationalization:

While Class 8 truck manufacturers have been on a tear over the past two years, railcar production has been more subdued, and in fact has been called “rational,” with very little speculation or hedging. Fewer leasing companies are speculating on car builds, and almost all current production is placed directly into service. Gone are the days of putting newly built cars directly into storage.

What Lessors Say About Higher Railcar Prices

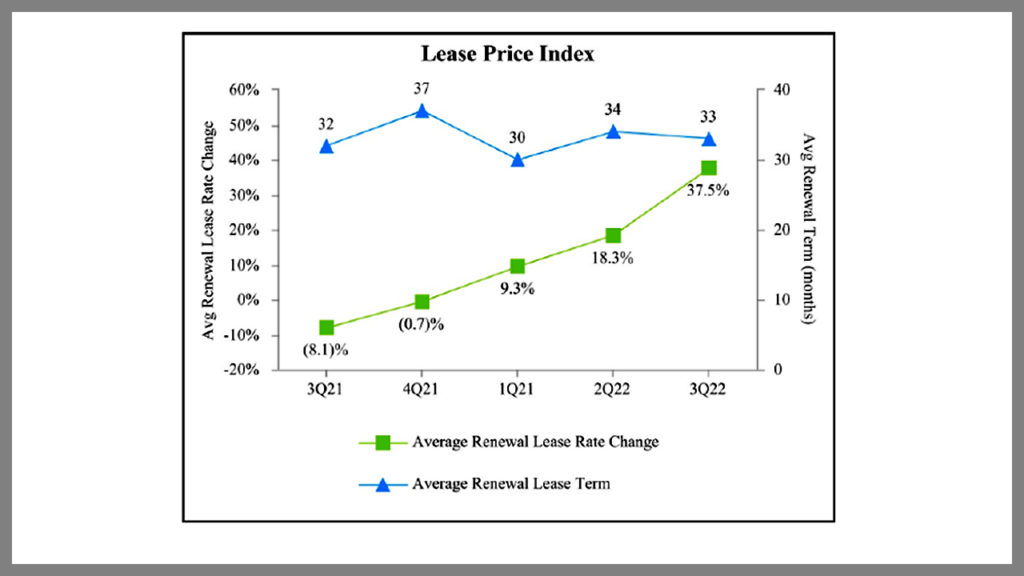

Lease prices have accelerated rapidly during the past 12 months, with longer lease terms following suit. Certain car types have tight availability, resulting in lease rates growing commensurately. Despite higher lease rates, lease renewal rates remain high:

The impact of higher interest rates provides further fuel to higher lease rates and discourage speculation.

Perhaps the best bell weather for the direction of railcar prices is the recent announcement of a 15,000-railcar order over the next six years by GATX, who has a history of “buying the dips” in railcar prices through the notoriously cyclical railcar build. If GATX foresaw lower prices for railcars, it sure wouldn’t go out six years with an order. In fact, it’s likely looking at it the other way: Prices will likely go higher from here, so lock in now.

Component Supply

While much attention is given to the impact of higher steel prices on new railcar costs, specialty components represent 40%-plus of a railcar’s cost. With global geopolitical events impacting supply chains around the world, specialty component capacity has been impacted as well. With the advent of the Russia- Ukraine conflict, sourcing wheels, side frames and bolsters from Russia is no longer an option.

China has shifted from a market-driven economy to a state-driven economy. Many of its industries now fall under the direction of the PRC (People’s Republic of China) government. Railway supply, as outlined in previous articles, is a critical component of China’s strategy to project influence globally. The best example of this is China’s “One Belt/One Road” strategy of building ports in developing countries. With each port, there are rail systems. With each rail system, there is CRRC, a major SOE (state owned and directed enterprise) supplying the railcars and locomotives. Coincidentally, many component suppliers belong to SOEs that fall under the direction of the PRC’s initiatives. Almost all China rail component suppliers are beholden to CRRC, as CRRC is their largest (and likely only) customer. Any purchase of rail components from China supports their strategy.

Supply Chain Risk

In addition to the geopolitical issues, recent supply chain issues highlight the risks of relying on imported products to feed production lines. Delays and elevated shipping costs have had a profound impact on railcar builder margins, not to mention the impact imports have had on elevated inventory levels in the form of “safety stock.”

Adding to the global supply and associated shipping risks, it was recently announced that India is seeking to add 100,000 freight railcars over a three-year period. This equates to more than 30,000 railcars annually in a market that has never supplied more than 15,000 in any given year. Local Indian rail supply companies will become very busy if this tender is executed, making available exports scarce.

The bottom line is that specialty component industry capacity is likely to be 55-60,000 cars annually, in line with railcar production capacity. The options to “spike capacity” during periods of high demand have indeed diminished.

Summary

Railcar deliveries in 2022 will likely come in around 42-44,000, while 2023 is projected to deliver 47-50,000 railcars. From my perspective, this is bumping up against industry capacity, and in fact, carbuilders are now reporting order books extending into 2024. Despite the urge to boost production and move some demand from 2024 into 2023, Greenbrier has issued fiscal year 2023 guidance of 22-24,000 cars, inclusive of 1,000 cars in Brazil.

Elevated railcar prices should not deter one from purchasing, given the impact geopolitical events have had on specialty component capacity combined with the many actions the builders have taken to rationalize their own capacity. Even facing a recession, carbuilder backlogs remain strong and long at current production rates. Waiting for prices to come down may take a while, if much at all, given the many structural changes in global and domestic capacity. If the GATX order is any proxy, railcar prices going forward will remain elevated, and carbuilders and leasing companies appear to be far more “disciplined” and “rational” this time around.

Principal of Rail Supply Chain Associates, Robert H. Cantwell spent more than 40 years in executive positions in the rail supply industry. He spent the first 26 years of his rail industry career growing a successful company, Hadady Corp., a designer and manufacturer of truck (bogie) components and systems for locomotives and transit railcars. Following the sale of his business, Bob helped transform Amsted Rail, holding various executive positions for 16 years. He has been active in the Rail Transportation Division of the ASME (American Society of Mechanical Engineers) and is past Chairman of the Division. Bob holds degrees in Mechanical Engineering from the Georgia Institute of Technology and an MBA from the University of Chicago. He possesses a unique perspective on the rail supply industry, combining his engineering experience along with robust economic and financial acumen. As an active investor in the rail industry, he has a vested interest in the success of the industry. He has also actively advocated with members of Congress in support of the rail and rail supply industry. The opinions expressed here are his own.