Cowen Insight: 4Q22 Shipper Surveys Say …

Written by Jason Seidl, Matt Elkott, Elliot Alper and Uday Khanapurkar, TD Cowen

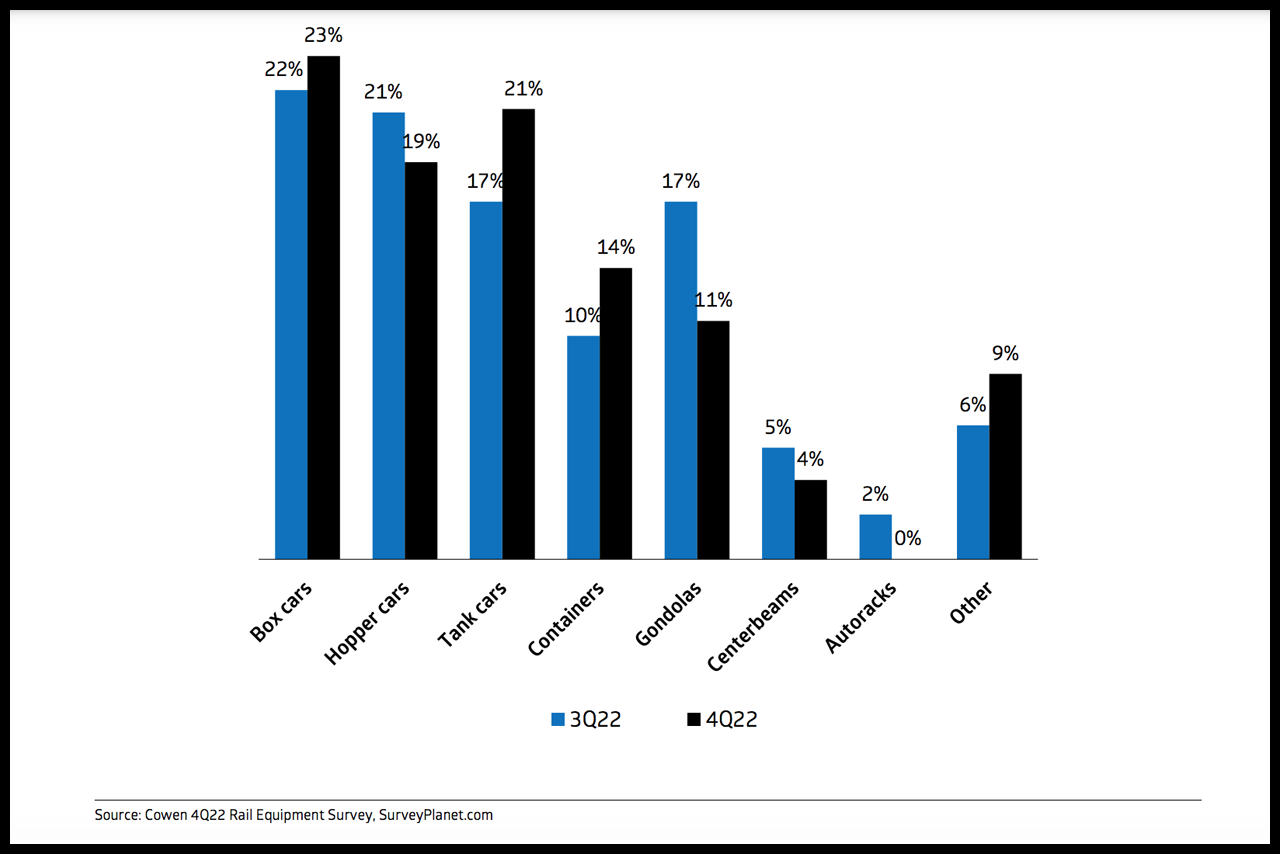

Within the 49% of total shippers who are contemplating railcar orders in the next 12 months, 58% said “yes,” they plan to place orders, versus 54% in third-quarter 2022, and 42% said “maybe,” compared with 46% in third-quarter 2022. This could mean an increased level of certainty about ordering within the total shipper group relative to last quarter. Box and tank cars saw demand improvement relative to third-quarter 2022. Hoppers, gondolas and centerbeams declined relative to third-quarter 2022.

According to Cowen and Company’s recently conducted fourth-quarter 2022 Rail Equipment and Rail Shipper surveys, the demand for railcars remains strong, and rail-shipping pricing expectations ticked up sequentially. Details follow, plus insights on the Class I railroads, ahead of earnings.

The order outlook by the shipper sub-group of railcar buyers strengthened modestly in our fourth-quarter 2022 survey. After our cautious near-term view on The Greenbrier Companies into the print, we continue to favor the stock along with Trinity Industries Inc. and GATX. We also favor Wabtec, but are cautious in the short-term into the print.

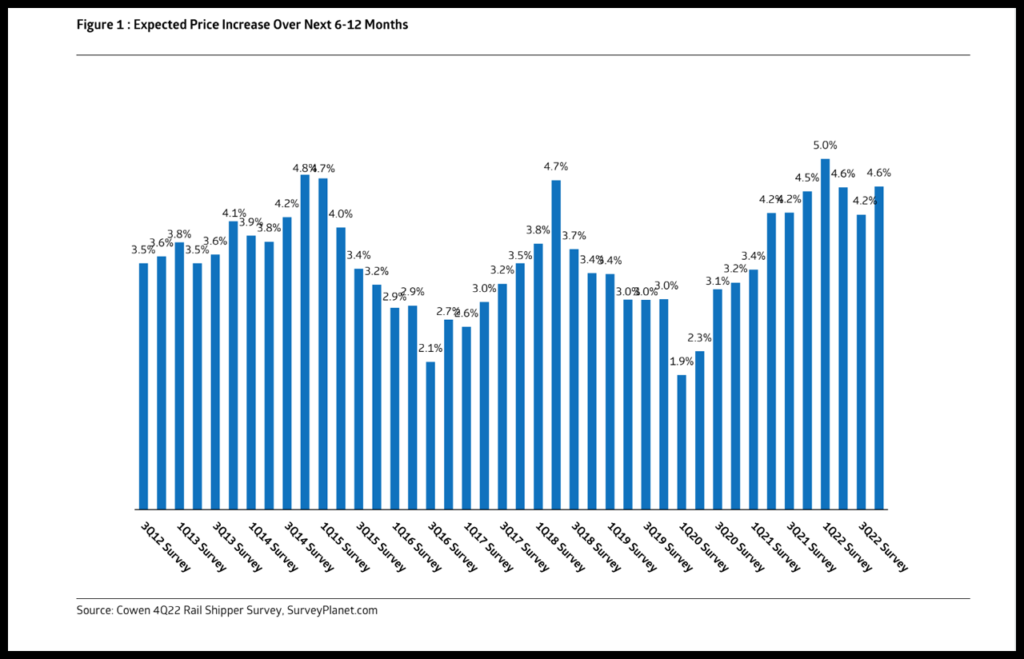

Expected price increases were +4.6%, up 40 bps sequentially this quarter and above our rail shipper survey’s five-year average. Business growth expectations ticked up marginally in fourth-quarter 2022, and economic confidence improved slightly. Some 24% of shippers stated ESG targets are a part of their decision-making. Survey results suggest a slight positive for the rail group; we continue to favor Canadian Pacific (CP).

What the Rail Equipment Survey Results Tell Us

When it comes to order activity, we consider four key metrics: (1) The percentage of “all participating shippers” who will or may order railcars. (2) The conviction level about ordering (the split between “yes” and “maybe”) within this “all participating shippers” group. (3) The percentage of “same shippers” who will or may order railcars. (4) The conviction level about ordering (the split between “yes” and “maybe”) within this “same shippers” group.

In our fourth-quarter 2022 survey, the first metric deteriorated slightly, while the second, third and fourth metrics improved. Additionally, among the shippers who said they do not plan to order railcars in the next 12 months, the percentage who said it is because they do not have incremental equipment needs decreased to 58%, from 65% in third-quarter 2022. Overall, the survey results point to continued strength in demand for railcars.

Roughly 49% of all shippers surveyed said they will or may order railcars in the next 12 months, down slightly from 52% in our third-quarter 2022 survey. Within the 49% of total shippers who are contemplating orders in the next 12 months, 58% said “yes,” they plan to place orders, versus 54% in third-quarter 2022, and 42% said “maybe,” compared with 46% in third-quarter 2022. This could mean an increased level of certainty about ordering within the total shipper group relative to last quarter.

On a same-shipper basis, about 45% of same respondents in fourth-quarter 2022 said they will or may order railcars, compared with 43% in our third-quarter 2022 survey. Within the 45% of same shippers who are contemplating orders in the next 12 months, 63% said “yes,” they plan to place orders (54% in third-quarter 2022), while 38% said “maybe” (46% in third-quarter 2022). This could mean an increased level of certainty about ordering within the same-shipper group relative to last quarter.

What the Rail Shipper Survey Results Tell Us

Shippers anticipate rail prices to increase by 4.6% over the next 6-12 months, up another 40 bps compared with our third-quarter 2022 survey, and flat compared with our second-quarter 2022 survey (see chart below). The 4.6% result is above the survey’s five-year average of 3.7% and above the survey’s long-term 10-year average of 3.7%. We view the sequential increase in pricing as positive for the group, though we are cautious on the magnitude Class I’s will be able to price above rail cost inflation. New labor costs and inflationary pressures will likely ultimately be passed onto shippers, though it will take some time given long-term contracts (approximately three years on average) and pace of re-pricing their book of business (roughly 50% is re-priced every year).

Business growth expectations increased 10 bps sequentially to 1.8%, but still remained below the survey’s seven-year average of 2.5%. The percentage of shippers expecting their employee counts to increase over the next 12 months decreased sequentially for the third quarter in a row, down six points from last quarter’s response, and down nearly 30 points compared with first-quarter 2022. Some 21% of shippers answered that they are more confident in the direction of the economy today than they were three months ago, a step up from last quarter, while still notably below the survey’s 43% average.

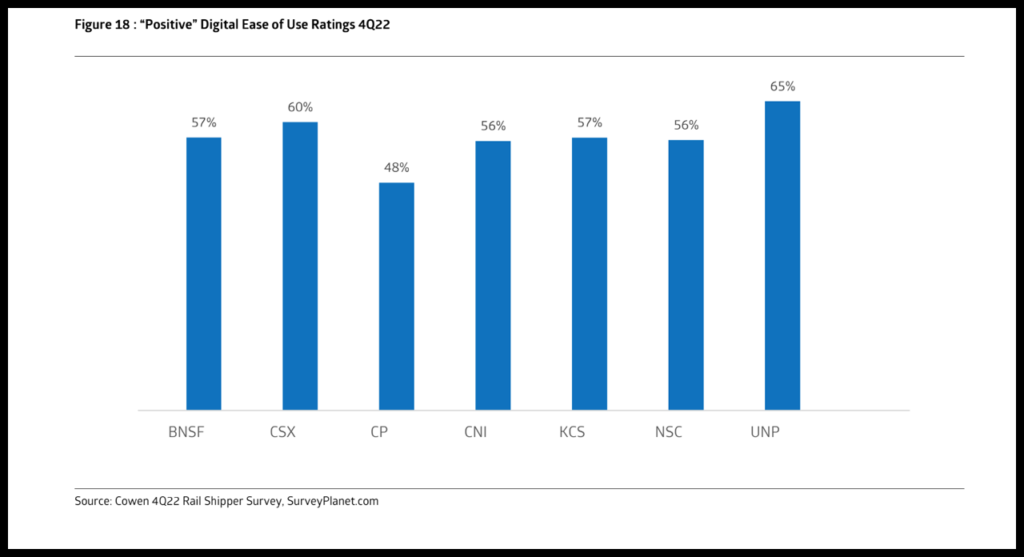

For the first time, we asked shippers to rate the Class I’s by digital ease of use and freight visibility as technology becomes an increasingly central part of rails’ efficiency strategies (see chart below). The average “positive” (excellent or good rating) rating of Class I’s digital ease of use was 57% with Union Pacific (UP) leading the group with a 65% score.

We again asked participants if their inventory holding strategy has changed due to pandemic-related disruptions. Some 45% of respondents said they are holding more inventory, down from 49% last quarter and below the 58% seen in our first-quarter 2022 survey. With a tick up in shippers that have not changed their inventory strategy, this may suggest that pre-COVID supply chain norms are reverting back toward the mean.

Insight on Rail Stocks Ahead of Earnings

We published updated rail estimates in December to adjust our assumptions for quarter-to-date volumes as labor negotiations dampened volumes into a muted peak season. With strike fears and poor network fluidity mostly in the rearview mirror, we look into 2023 as a tale of two halves. We believe that rail contracts will take some time to adjust to the current cost environment and may put downward pressure on near-term margins given costs are sticking; while rail contracts, though management teams have been confident at pricing above rail cost inflation, will have slightly less bargaining power given loosening capacity on both rails and over-the-road transportation. Second-half 2023 should come with easier comps for the U.S. rails, lapping some cost implications (labor).

We adjusted our fourth-quarter estimates downward to account for quarter-to-date volume trends using our rail-share data, diesel pricing, and other model adjustments largely on the cost side. U.S. rail volume expectations came in below our forecasts and consensus expectations, as a looming rail strike impacted volumes in the fourth quarter. Rail service metrics are beginning to see a rebound, which we attribute to: (1) rails inching closer to being properly staffed and employees ramping to increase productivity and (2) declining volumes (still below 2019 levels), which is likely assisting fluidity in the rail network.