2022 Guide to Equipment Leasing: Railcars Join the Sports Car Set

Written by David Nahass, Financial Editor

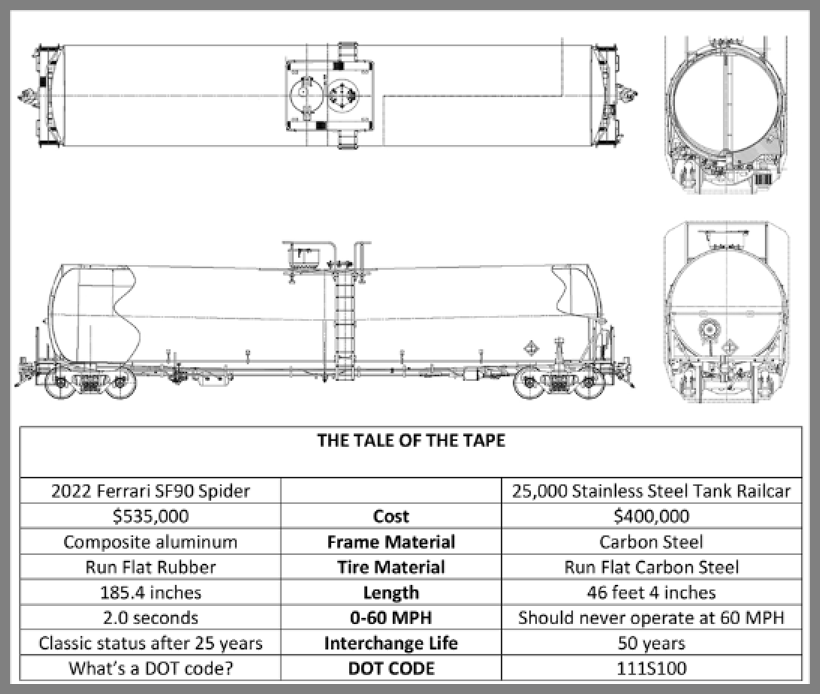

Ferrari SF90 or stainless steel tank car? Each costs roughly $400,000.

RAILWAY AGE, JUNE 2022 ISSUE: Car shopping has become one of the more unpleasant pandemic chores.

It was, frankly, bad enough when inventories were high. But now, in year three (or three thousand—frankly, it’s pretty damn difficult to remember what life was like before anyone ever heard of Severe Acute Respiratory Syndrome Coronavirus 2, a.k.a. SARS CoV-2) of the COVID-19 pandemic, it’s downright absurd. It is worse still for those blessed with the means to purchase automobiles at the higher end of the spectrum. Imagine the tension of having to decide whether to buy a 2022 Ferrari SF90 Stradale (0-60 in 2 seconds), a similar but slightly more expensive Spider convertible, or alternatively having to take that cool near-half mill and use it to buy a 2022 $400,000 stainless steel tank railcar (50-year interchange life). No, no typos here—not today! Elitism has taken on a new target: railcar pricing.

It is a convoluted road that has led to dramatic increases in the price of railcars and the lease rates that go along with it. Russia’s invasion of Ukraine has impacted energy prices, steel prices, scrap prices and—you guessed it—the price of stainless steel. The continued supply chain disruptions (given a booster charge by the recent COVID-related shutdowns in China) impact components and domestic availability of raw materials. The disconnected labor market upends stable pricing models that have been reliable for decades. All of this mixes together to create one volatile cocktail.

Not crazy enough? Add into the mix the service-related problems impacting all of North American rail. And because insult always loves to join forces with injury, add what seems like an incredible ambivalence by the largest seven railroads in North America about the overwhelming need to grow their franchises and increase traffic.

Average velocity in 2022 continues a declining trend. In 2020, Class I railroad average system velocity was 26.1 mph; in 2021 it was 24.3 mph. In the first five months of 2022, velocity has decreased to 23.3 mph. Meanwhile, total railcar and intermodal loadings are 3.5% lower year-over-year (YOY) through the week of May 14. The number of railcars in storage has continued to decline to below 300,000 from a 2020 pandemic peak of more than 550,000. Some of that decline may be attributable to scrap prices, which peaked north of $500 after the war started. Slower trains moving the same number of loads is never good.

What is happening in North American rail right now is a volatile mix: There is a need for additional railcars to handle service and velocity problems. Interest rates, fed by the Federal Reserve’s need to combat inflation, have been on the rise, increasing borrowing costs for shippers and lessors alike. Add to that new railcar pricing at historically high levels. This has led to an increase in lease rates across just about every car class, even for cars whose rebound in price and demand was expected to be years away or even nonexistent. For the first time in more than a decade, lease rates are on the rise, demand is outpacing supply and the advantage is with the car owner. As one lessor recently said, “It’s finally our time.”

Railcar leasing has always been a tough business and a war of attrition. So it is not surprising that railcar lessors often benefit from following the teachings of The Art of War, Sun Tzu’s military treatise from the 5th century B.C.: “In the midst of chaos, there is also opportunity.” More recently, friends of the late Tony Kruglinski, my predecessor in this space, may often recall his predisposition to referring to Tony Curtis’ famous line in the movie Operation Petticoat: “In confusion there is profit!” There probably should be some flower bouquets or fruit baskets making their way from the lessor community to Class I executive offices (wink wink).

The next obvious question: Where do we go from here? Will lease rates and car prices stay at these lofty levels if interest rates do not come down? Will car prices respond to changes in commodity prices? What about if car supply increases? The obviousness of the question is obscured only by the difficulty of coming up with an obvious answer. The difficulty, in part, is based on the plethora of perspectives from the players in the drama of railcar leasing. Let’s break it down:

Railroads: As covered in last month’s Financial Edge and throughout Railway Age, Class I railroad executives are under intense scrutiny at the moment. And they’re not laying down either: Watch CSX’s Jim Foote bristle at the Surface Transportation Board (STB) during the April 26 hearing (it starts at eight minutes into the ninth hour). There is mad empathy for the logistical challenges of running a finite system of interconnected rail track that spans a continent. As a nation, we are happy to complain from a distance, but from surveying the available perspectives from the customer to the consultant, it is difficult to follow the C-suite playbook here. Industry observers are waiting to see whether the industry pivots to growth or if the STB forces the railroads to make concessions to increase loadings and competition. Meanwhile, having your railroad manage your business by controlling car supply continues to be the least preferred version of railroad roulette.

So ask yourself, with velocity down and loadings stagnant/decreasing what do the railroads want from car supply today? Railroad problems extend beyond issues of railcar cost. So other than the absurdity of something such as railcars for free forever, it is vexing to be unable to easily answer that question.

Railcar Owners: In its April earnings release, GATX Corp. reported fleet-wide utilization (ex. boxcars) of 99.3% and an increase in renewal lease rates of 9.3%. Bazinga! That is the turnaround and price improvement that makes owning a railcar over a long period of years exciting and economically attractive. Alas, while the improvement is a great reward for car owners that have suffered through a lean period of low rates and intense competition, the stability of the upward trajectory in lease rates is destabilized by the tepid loadings growth. For the car owner, increases in interest rates increase capital costs. Passing through those additional costs to a lessee works in the market today, but will it work in the market of tomorrow? Ditto for the cost of new cars. If new car prices have increased by 20%-25% LTM, how will today’s new cars compete in the lease market against yesterday’s used cars?

With velocity down and loadings stagnant or decreasing, what do railroads want from car supply?

What the railcar owners and the railcar manufacturers want today is to see a sustainable increase in total traffic volumes that will continue to support a need for investment in a newer railcar fleet and lease rates that support investment in a rising interest rate environment. Right now, that’s a tall order.

Shippers: What do the shippers want? Many would say consistency. When prices spike and service is disrupted, supply chains are thrown into disarray. When a railroad tells you to lay down cars (a.k.a. move less product) or won’t allow a shipper to bring cars on line, it is disruptive. When velocity decreases and increasing dwell times require car users to add more assets, it is frustrating. When truck prices are otherworldly and railroad service failures require a pivot from rails to road (the opposite of what traffic flow should be), it is economically detrimental. When lease rates increase by as much as a 2x multiple YOY, it is the great sucking sound of profit being taken from your company’s balance sheet to pay the high price of expenses gone wild.

Generally, when these moves happen quickly, a shipper cannot adjust commodity pricing to reflect the rapid pace of increases in the cost of transportation and has to eat the change in cost. So while in some cases price increases for an item like fuel might be able to be passed through to a customer, when it comes to lease rates or an increase in the cost of moving your product by truck over rail, those costs cannot be passed on and the owner of the product eats the loss.

Furthermore, many shippers work in thin margin businesses (think plastics and paper products). Abrupt changes in lease rates combined with the already preexisting service-related supply chain stress can erode those margins quickly, making rail even less attractive.

So the typical tension builds. The answer to the question of where do we go from here is the ongoing unknown: Will interest rates continue to rise or fall? Will inflation go from above 8% (mostly driven by food and energy costs) back to the pre-pandemic 2%? Will there be a recession?

Many shippers work with thin margins. Abrupt lease rate changes erode those margins quickly.

Want the situation to be a little more unsettling? More than a few people across all segments of the industry are starting to wonder if now is the time to start pulling back in advance of the recession that almost seems inevitable right now. So when you turn to the “Around The Market” segment of the broadcast, put it in this context: On balance, if the shippers start to balk at the mix of term and rate and think they could “get by,” the peak of the market might be just around the corner.

Around The Market

If you have the time, compare this section to the rates in the 2021 version report and be enraged (or illuminated) by the fact that hindsight is always 20/20.

The lease market has exploded and rates are up on just about every segment. But it’s not just rates. Car owners, sensing the market advantage and after years of fighting for table scrap lease rates, are pressing the advantage in rate and in term length. Here’s what is happening around the market:

Grain Covered Hoppers: Wow, just WOW! Who could have imagined an almost doubling of these lease rates from over a year ago. Jumbo hoppers greater than 5,100cf are leasing for high-$600s full service (FS) with term lengths of greater than five years (and some industry sources suggest that is not the top of the market). Want to economize both in size and cost? Try again: 4,750cf hoppers are in the mid-$400s FS for three to five years.

Sand and Cement Covered Hoppers: If you didn’t believe in resurrection before, the change in this market just might change your mind. Rates on small-cube hoppers have tripled up into the mid- to high-$200s FS. The rates can go higher depending on who is footing the freight (as most of these cars are coming out of storage). There is some term being achieved here as well. Kudos to those who locked in at sub-$80 net rates. That number may return, but with $100-plus per bbl. Oil, don’t go banking on it anytime soon.

Plastics Covered Hoppers: Inventory on these cars has dwindled to the bare minimum, especially on 6,200cf jumbo cars. Rates on new cars are being quoted above $700 FS but can be found for less. However, the real piece of information here is that new cars are north of $120,000. Inventory on the smaller 5,800cf cars is also slim, with rates in the mid-$400s FS.

PD Hoppers: This market generally doesn’t get overbuilt, so when service slows, rates tend to increase. For the smaller 5,125cf car, expect rates in the mid-$600s, and for the jumbo, more modern 5,660cf car, think high-$700s possibly turning into $800s. Most of these cars are leased FS.

Mill Gondolas: This market had been ambling along and then recently exploded with newer 286K GRL six-foot-side gons jumping up to the mid- to high-$600s FS for five years. Older 263K GRL cars are in the mid-$400s. Scrap is coming back to earth, so some relief may be in sight.

File the coal car market not under resurrection per se, but maybe under the level of Lazarus.

Boxcars: 50- and 60-foot plate F boxcars are in demand, and rates have remained at high levels. Expect numbers in the high-$600s FS for both sizes and limited availability of cars for lease. On the new side, look for rates in the $800s. Relatively speaking, the value is there as new cars are being quoted at $140,000 per car.

Coal Cars: File this market not under resurrection per se but maybe under the level of Lazarus. In spite of the set management skills of Class I railroads, coal cars have been moving into service and rates have been on the rise, reaching their highest levels since 2012. Want some gondola cars? You’ll be paying more than $525 FS for a three-year term. Want some rapid discharge hoppers? Expect the same result as the gons. If you’ll take them for longer term, you might see a slight discount. Don’t expect relief here anytime soon. High natural gas and oil prices are supporting the increasing coal burn, and some utilities are slowing down plans to decommission plants as they wait for additional renewable capacity to come on line. Through the first five months of 2022, coal loadings are up 6% YOY and that is on top of a robust 2021.

Tank Cars: Always divergent and interesting, tanks have picked up strongly but also have some markets, mostly due to regulatory issues, that continue to flounder. Food grade tanks around the 20,000-gallon range are in the mid-$800s FS depending on age with term. In general, the 20,000-gallon tank market is in short supply. Pressure cars for propane and butane (112J340s) are in the low- to mid-$700s with term and are heading higher as inventory there is limited. 117J 23,000- and 25,000-gallon tanks are also in short supply and rates are in the $800s as well. Tanks for crude oil have also been active with limited availability and rates in the mid- to high-$700s for used cars. For new cars, don’t expect anything that starts lower than $900. In the retrofit market, FS lease rates are have risen to just over $700. Plain vanilla DOT111As in ethanol service will be obsolete in a year, and that oversupply and threat of obsolescence is hurting that market with lease rates in the high-$200s.

Aggregate Cars: Another market that has just continued to maintain strength and stability through the pandemic. Ag hoppers that are 286K GRL have moved up into the mid-$600s FS; I expect that will be the case for near-to-medium term.

Got questions? Set them free at [email protected].