A Journey Into the Telematics Universe

Written by Jim Blaze, Contributing Editor

Over the past year and a half, I have been interviewing many of the people and companies that are in the business of trying to improve what is normally called “track and trace” and condition reporting of railway cargo and railway rolling stock equipment. Today, it’s called “telematics.”

I was first engaged in the telematics business back in the early- to mid-1990s as Chairman of Amtech Logistics, an early joint venture of Norfolk Southern, Union Pacific, Conrail, Amtech Corp. and APL, the maritime carrier. That effort involved assistance from Dr. Kant Rao of Penn State’s Logistics School and Dr. Marvin Manheim of Northwestern University.

Following are two business-use interviews in the current era of railway-capable telematic functionality. The first is with TrinityRail’s Trinsight™ technical group. The second is with Cando Rail & Terminal’s Quasar group. Amsted Rail Digital Solutions and IntelliTrans are among other major stakeholders in telematics. (There is a link to an article by Amsted at the conclusion of this piece.)

What Is Telematics?

Linguistically, telematics is a term combining the words telecommunications and informatics (the study of computational systems, especially those for data storage and retrieval). Think of telematics as broadly describing the integration of communications and information technology hardware together with specialized software. When coupled with GPS location information, telematics serves the purpose of collecting critical status and movement event data with changing geographical position, and then on demand and in real time or fixed time periods, transmitting that data to a dedicated storage location.

At computer servers, the collected data can be warehoused (stored) with specialized software used to sort, test, data set match, compile and analyze, and then packaged into specific intelligence sets. It can track the moving container or railcar or truck as well as the commodities inside such assets.

Multiple vendors compete to provide such services, hardware software, and communications telematics under unique tradenames. Carriers or shippers can buy such packages or portions thereof or sometimes lease the services. Some carriers develop their own packages by using selected vendor or proprietary parts of the telematics functions.

The better telematics systems offered will integrate digitally with freight shipper and/or receiver inventory managements systems that are often described as Transportation Management Systems (TMS) or perhaps as Logistics Systems, Warehouse Systems or Billing Systems. The top-performing integration telematic offerings can even feed or use some non-digital information that is essential data matching for customer use.

Trinsight™ and RailPulse™

TrinityRail is a founding member of the North American railroad RailPulse™ consortium, announced in the autumn of 2020, that is trying to promote business use standards for the railway freight sector across North America. The founders have issued an “open to all” call to other parties to join with the original group, whose members include Norfolk Southern, Watco, GATX, Genesee & Wyoming and Trinity. The Greenbrier Companies have signed on. NS Vice President Strategic Planning Mike McClellan is serving as chief executive of the RailPulse rollout

Daniel Anderson is TrinityRail Vice President, Strategic Marketing and Product Development. Jim Pang, Vice President Services Expansion and Innovation, is the technical expert. We had an open discussion at the deep technical level about their unique method of taking the health pulse of a railway freight car or other mobile rail equipment and making that information useful to shippers, receivers, the handling railroads and the rail car lessors and lessors. Both were asked to describe the technical details of their company’s unique approach toward offering their version of rail freight telematics, the functions that customers can expect from Trinsight.

RAILWAY AGE: What makes Trinsight a unique offering?

TRINITY: Trinity’s approach to offering solutions for the telematic market is based upon our company’s unique hands-on business experience on the railroad equipment and manufacturing, repairing and leasing/sales sector. Trinsight functionality is based upon Trinity’s deep understanding of rail data and railroad operations here in North America. That background helps us when we build easy-to-read dashboards and tools that highlight trends and patterns that lead to correctable operational inefficiencies.

As an owner and operator of one of North America’s largest private railcar lease fleets, Trinsight’s approach to monitoring the pulse health of such assets comes from all we have learned in lowering over the years the total lifetime cost of ownership of our railcar assets. That helps our customers and equipment users optimize their rail freight supply chain.

Our technical team, led by Jim Pang, has been engaged in developing and testing a variety of software that is capable of collecting, retrieving remotely, and then compiling and scrubbing essential health and movement data. Our Trinsight team had done the work of connecting the data sets and measures and then applying and testing various Artificial Intelligence tools, machine learning techniques, and then using predictive analysis so that Trinsight customers can select the right mix of functions that help them make better decisions from a business requirements point of view.

Our central technical group is continually refining the algorithems with the objective of improving overall accuracy and predictive analytic results. It’s central to our team’s effort of developing standardized across-the-industry tools that work regardless of which railroad cars are moving across, yet also delevloping custom movement and condition insights from the customer’s perspective.

For those looking for customized dashboard data analysis views from their various other data sets that should be integrated with railcar flow data, Trinsight can help execute such deliverable results. Trinsight as a RailPulse standards early innovator is open for business. We are, in effect, an integrator, not just as an innovator.

RA: How would you describe a sucessful use of Trinsight?

TRINITY: A critical measure of sucess is when we at Trinsight can demonstrate that we have added value by extending a customer’s existing investment in equipment and other data management systems to their value chain. We will deliver supporting semaless integration of Trinsight to all of their data sets.

RA: How is Trinsight different from what the other initial founders of RailPulse might eventually offer as their service? So far there has not been a lot of differentiation about how the various RailPulse founding members will deliver their actual functional capabilities.

TRINITY: Let’s start by explaining why all of the RailPulse members are united. We all are focused upon offering users a robust Vehicle Tracking System. We are united at developing industry-wide railway use standards for the pulse-taking mission. Together, RailPulse founding parties have a collective vision to advance the railroad freight sector telematics business capability. We are now engaged in driving the RailPulse service with open-source interoperable capabilities, regardless of which North American railroad the customer is using.

Open source means that multiple independent parties can provide hardware, software, and even communications devices or services. For example, RailPulse itself within Trinity’s Trinsight offering is not dependent upon using a specific sensor device. So working together, the RailPulse members are inviting innovation. Put another way, RailPulse would in someways become like a “data lake.” Some might use the term data pool. But today’s digital data sizes are a lot bigger than a pool descripton would suggest.

This open approach, Trinity believes, will facilitate specific types of raw data availability for railway freight users. Here is the key: Regardless of your RailPulse member-selected vendor company, specific types of raw data that the freight user needs can be made available.

RailPulse members have been busy over the past 14 months laying the groundwork for our more-public accomplishments planned for 2022:

- Discussing the RailPulse vision with other railcar owners.

- Building a network in the telematics and rail industry data community.

- Assessing available technologies.

- Refining our collective vision.

- Recognizing collectively that telematics technology is becoming ubiquitous in our competitor modes (e.g., truck, marine, etc.).

We all are in agreement. We have to be part of this logistics trend.

RA: Are you saying that Trinsight has not adopted the use of a unique set of sensor hardware? That the selection of car pulse recording sensors is an architecture option to be selected by customers?

TRINITY: Yes, Trinity has adopted open-source architecture, and Trinsight customers will find our experts today working with a wide variety of hardware OEMs, with the back-end-connected API’s (application programming interface) capability for linking digitally to the customer’s internal controls systems and software. Trinsight customers have the flexibility to bring their own devices (sensors), and the option to have Trinity provide turnkey IoT (Internet of Things) packaging that fits each customer’s unique commodity and shipment needs.

RA: Has Trinsight set into place a unique communications access protocol or portal?

TRINITY: Trinsight will connect to various GPS devices, different OEM sensors, and TMS customer internal supply chain systems. Trinsight’s team has the experience to help each customer by providing those capabilities. Trinsight has a rich working library of API capabilities that rail customers, 3PL/4PL and other rail service providers can use to connect and source relevant data.

RA: Is the current Trinsight market offering a beta-test version? Or a second-generation service offering? Customers will seek informnation as to tested reliability.

TRINITY: Trinsight’s deliverable right now is built with an agile technical approach. We use three- to four-week work sprints that continue to roll out enhancements. We have been doing this for quite some time, throughout 2021, by working with our subscription users to enrich and customize to their unique supply chain needs. As such, some features have evolved to second- and third-generation with refined ease and utility. This includes features like pipeline management tools, landing page widget customization, and asset health combined with shipment historical analytics. Some features are continuing to push modern design boundaries with the intent to pilot and reflect the customer’s “voice of need”—AI/Machine Learning ETA, Savings Calculator, mobile apps.

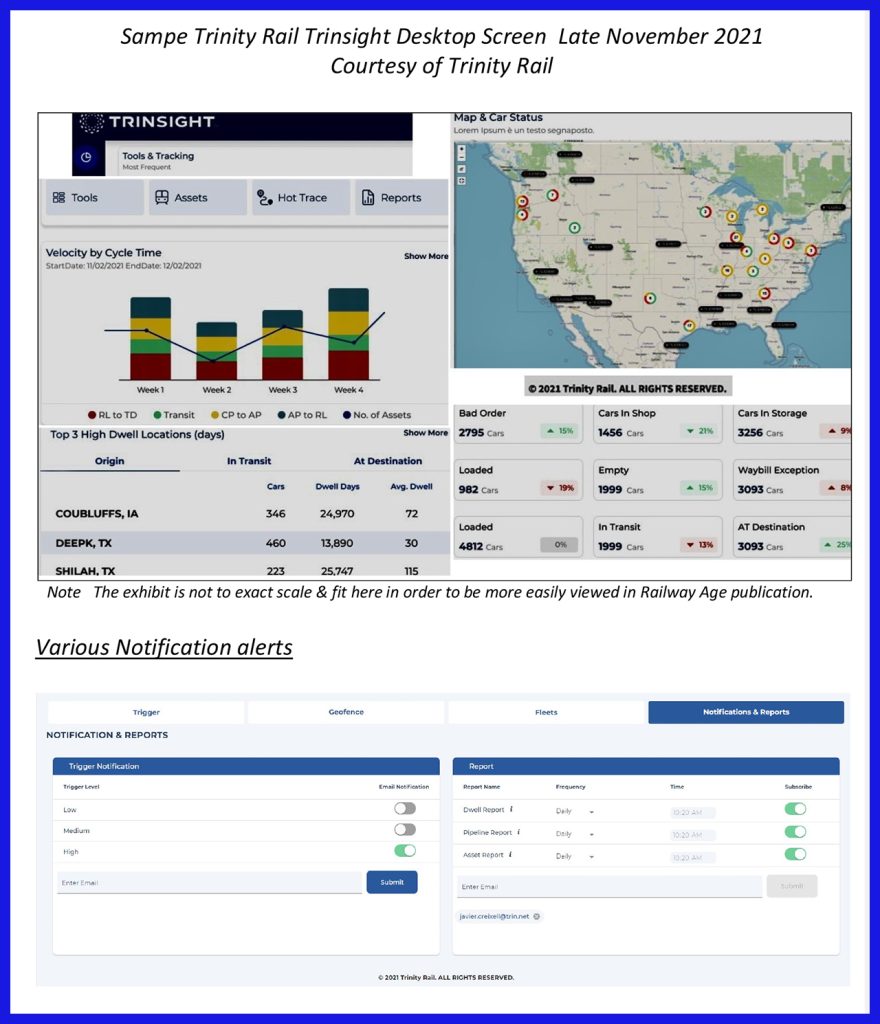

Jim Pang took me on screen-by screen tour of the basics associated with different data layers and a variety of customized screens. The data management and diagnostic report screens I reviewed were in their sixth generation of customer-specific testing and reformatting. That’s part of the previously described continuous improvement process within Trinsight’s team. The clear examples of segmentation and reporting screens reflected a great deal of thought and adaptation to reporting and key exception reporting that’s been a custom requirement, reformatted for their early adaptor clients.

There’s a lot more detail that these Trinsight insiders could have shown me. It appears that it’s time to connect with Trinsight’s development and customer service. They are open for business and ready to hear about visibility requirements. They have a product that’s pretty well vetted. Buyers need to have a checklist of nice-to-have to essential-to-have items prepared.

We did not review the functionality of the Trinsight system’s warehousing, logistics and cargo ordering aspects of its track-and-trace instrumented railcars. That capability does exist within the Trinsight platform.

Looking for the business case? In the end, freight car users will have to decide buyer approach and cost/benefit point of view as to essential deliverables. What’s nice to have as functions and at what affordable cost?

What can this visibility business process improvement change mean to a company in dollars of efficiency gained and lower costs? Perhaps much lower forward inventory on-hand costs when using rail?

As a starting point for proving a business case as a visibility buyer, there is a way to calculate the value of movement time delay for both the expensive car capital cost (per day) and also the calculated typical daily delay costs of different commodity types in railcars.

We examined a theoretical chemical shipment. Considering the sorted data sets from a Trinsight screen, the my economist’s ears perked up, because such captured time and movement values do identify clear time and utilization business solution benefits that can be monetized into a payback scene that more than covers the installation and setup costs of a superior pulse of the rail movement capture. Chief financial officers will want to see those business case numbers. But regardless of which RailPulse or other vendor of remote sensor telemetrics monitoring is selected, the buyer will need to create a business-case spreadsheet. Trust me, that’s not hard to do.

Quasar

What’s behind the railway moving asset and cargo monitoring services offered by Quasar, which is not a RailPulse member but might actually work with some RailPulse providers? The following is an interview of Cando Rail & Terminal’s Quasar telemetric offerings held with Corrie Banks, General Manager, Quasar Platform; Julie Pomehichuk, Director, Marketing & Communications; and telematics expert Cam Yeow.

RA: Who is Quasar and where are you located?

QUASAR: We are a telematics service provider helping to link up rail freight traffic and asset movements across North America’s rail freight network. Quasar provides an end-to-end supply chain visibility platform developed by Brandon, Manitoba-based Cando Rail & Terminals.

RA: How do you define yourself and your market?

QUASAR: The digital Quasar Platform set out originally to become a rail supply chain management and optimization platform. The purpose was to provide a real-time data universe to freight rail shippers and operators, as well as to the railroads if they needed that. We did this by combining real-time asset visibility with commodity monitoring capability, cost center or geographic definition and revenue data analytics. The Quasar Platform provides customers with what we see as an unparalleled ability to optimize their operations and to manage their logistics and rail costs on demand with reduced manual effort. We the manual and time delay work effort by automating a great deal of track-and-trace and subsequent database match functions.

At a high-level description, we think of our market as helping our customers in three ways:

- Quasar provides rail shippers with a digital twin of the North American rail network.

- Quasar ingests large volumes of data on railcars, goods in-transit and freight costs from various sources including sensors, waybills, Class I manifests, etc.

- Quasar uses data aggregation and integration techniques

,that enable advanced analysis of data including predictive ETAs, bottlenecks, congestion and business case economic analysis.

RA: How far along is your current integrated software/communications/hardware and sensors and customer intel analytics?

QUASAR: The Quasar Platform was created in 2017 when Cando Rail & Terminals invested $250,000 to develop a cloud-based yard management application and then perform device trials of GPS sensors on railcars with a select customer user group. The Quasar team, led from the start by Corrie Banks, built a simple platform for its user group to be able to track railcars and visualize them on a map. The user group consisted of about 15 different freight rail shippers including a Class I rail carrier, all of whom provided feedback on what features created business value for their organizations.

We are an integrator in today’s age. Our Quasar Platform has evolved into a very large data collector and aggregator service. The platform gets data from various places and uses that data to power its applications and analytics. Quasar calls this multiple data input function its “Dataverse.” The Dataverse function provides more than 70 possible data connections, including data from 5 different GPS location sensors, 4 railcar health sensors (handbrake, impact, open/closed hatch, and freight car temperature), different rail yard site metrics, different shippers’ inputs, and inputs from any of the major North American Class I railroads. Other data feeds include sources like AEI tag readers, emails, and even PDF record files. From that collection of sources, Quasar screens and evaluates the records to provide the insights into all of that data in one platform. We are well down the path of vetting the combination of GPS geospatial data with different types of industry data, and data that can be enriched with such geospatial data.

In effect, our Quasar team built a bridge for our telemetric customers to support their transition from legacy computer and paper-based systems to digital systems. That bridge ensures that all the data available for a shipper (or a receiver) from the Class I car location messages to the railcar’s on-board health (the car’s pulse) is available both visually and in set data structures for mixed database reporting. These integrated visibility and alert applications are already in the field working for more than 10 customers ranging from industry-leading rail shippers to Class I and short line railways.

The Quasar Platform’s application consists of five different yet integrated program “suites.” They include Yard Management, Shipment Management, Activity-Based Costing, Quasar’s unique Dataverse(analytics), and Fleet Management. This telematics package is completely scalable and addresses the unique operational needs of freight rail shippers and receivers. Within each of the five integrated sets identified above, there are basic Quasar utilities:

- Cycle time analysis.

- Inbound Pipeline analytics.

- Data Integration and Professional Services as an expert service.

- Choice of GPS Location Sensor and Railcar Health Sensor Hardware Solutions.

- Inventory Management Solutions as part of warehousing and supply chain tools.

- Across mode Trailer/Container/Car Tracking.

- Vehicle Tracking Solutions.

- Locomotive Tracking Solutions.

RA: Are you competitors to RailPulse, or possible collaborators?

QUASAR: The Quasar Platform foundation is a focus on collecting large volumes of data, regardless of the source or the hardware or the portal (data communication access process). Therefore, we at Quasar always think of ourselves as a collaborator in the industry. The Quasar team works with so many data sets and sensor products that we see ourselves as a “consumer of industry data.”

Here is a North American specific railroad business example: Quasar’s telematics platform has a unique partnership with Railinc that enables us to bring in data from Railinc and other sources that other telematics systems might be missing. In partnering or subscribing to use other sources of locational referenced data sets, this describes how the Quasar approach is a consumer (or user) of other data. This means that railroad customers across North America using the Quasar system will no longer need to go to different websites, customer portals, ocean or intermodal ports and terminals or to transloading facility locations in order to track their Quasar-followed rail assets. The same is true for following their valuable goods inventory inside or upon those hard railway or other mode assets (cars, containers, trailers or even vessels).

Real-time updates and data indexing smart IT processing means that Quasar telemetric customers always have the most recent data record, no matter what the source. This means non digital records, too. Quasar applications can capture into our digital records various text and PDF-like records that are often critical pieces of information about “where is my stuff.”

- Get the Data. In a real-time, automated way, get the operational and financial data, and get it from any source: IoT, CLM, email, fax, spreadsheet, API, workflow engine, data entry applications, FTP, EDI. Get as much data as you can via our Dataverse tool. Result: no spreadsheets, no multiple locations to acquire data. There is one data stream for everything, and our application processing makes that data accessible via the cloud so that it can be accessed by anyone via a secure access portal, anytime, and almost from anywhere.

- Process the Data with a blend of standard and customized applications. Turn all the data you collect into Dataverse and data domains that create data stories and data meaning. Result: Automate KPIs (critical process index measures) including dwell, cycle time and corridor analytics so that time is spent assessing the supply chain rather than time previously spent acquiring and sorting the data.

- Visualize the Data. Create data stories. Result: provide as near as possible real-time visibility to supply chain operations and financials. This allows for management actions that can balance inventory flow across the system and the various networks.

RA: Explain in business terms why your initial development approach was different.

QUASAR: Our approach is somewhat different than perhaps some of our competitors. The initial Quasar process design was in part largely focused upon thinking like warehouse experts, not just railcar or railway equipment asset managers. .Our platform has evolved significantly past simply tracking railcars into a logistician’s supply chain optimization tool set. Our company truly believes that getting supply chain data that encompasses every operating and financial activity, segment, and process within the supply chain is critical to supply chain optimization and success. Quasar uses operational data that provides end-to-end visibility including origin, destination and in-transit location, dwell and cycle time as the keys to rail industry success.

Older track-and-trace technology tracks railcars that are on the Class I main lines. But, in reality, a rail supply chain connects with hundreds of partners and players on a daily basis that operate across the much wider origin, destination, short lines, ports and terminals, as well as all shipper, consignee and transload locations. For the railway freight sector, we at Quasar believe that the opportunity currently before the industry begins with collecting more reliable data at a faster pace through the IoT (Internet of Things), using secure things like cloud applications and data processing engines.

The experts at Quasar believe that, operationally, 2022 rail supply chains still work in a multiple-silos world. That entire process needs to become more of a unified, connected system that bridges the silos. In addition, the financial measures attached to these valuable supply chains and the assets that move them are lagging. This financial impact analytics has to be strengthened. We spent considerable time trying to improve this economic analysis capability within our Quasar applications.

This all speaks to the business case. The current Quasar platform is trying to help our customers and collaborators so that the capture of the rail pulse can 1) generate more revenue by turning assets faster, and 2) suggest the means to reduce costs by eliminating one or more of what we call the seven supply chain wastes: 1) overproduction, 2) defects, 3) inappropriate processing, 4) direct and indirect transportation costs, 5) way too much inventory, 6) unnecessary motion, and 7) waiting. Our experts and our Quasar tools can assist our customers with correcting those supply chain wastes.

We believe we are unique in that we focus on “how to change.” According to our Quasar Platform experience, it’s a three-step process. Railroad freight is no exception:

RA: What’s the critical functionality that your market research sees as customer essentials?

QUASAR: When a rail shipper has realized that it needs to change how it is visualizing its supply chain and starts looking for a railway sector solution, this is when the Quasar Platform can help by introducing six functions into an existing TMS inventory transport management systems:

- Start using fully integrated GPS location sensor data with industry car location messages and status.

- Creative data integrations to enable data capture, storage and analytics using data typically provided in email, spreadsheets and PDF files.

- Visualize real-time Inbound Pipeline reports that include shipper railcars, shipper customer railcars or inbound ingredients railcars by group or fleet.

- Sort the real-time railcar and commodity inventory reports by commodity and by configurable group or fleet, thus helping manage supply and demand for railcars and commodities across the supply chain.

- Configure the data set for fleet, railcar status, inventory, groups to customize reports to meet organization management systems.

- Automated metrics for supply chain activity (inbound, in-transit, outbound), bad order, switching, storage, inventory, railcar supply, dwell, cycle time and network performance.

Those looking for a telemetric solution can use the Quasar Platform for these features. That is regardless of the hardware (sensors) they already might be using, or want to use. Today. Quasar already integrates as many as 70 different data sources including Railinc, 5 GPS Location Sensors, 4 Railcar Health Sensors, AEI readers, EDI, and Class I APIs. It processes and transforms data into metrics and analytics in real-time; creates supply chain visibility end-to-end, and calculates supply chain costs and revenues real-time. For example, our supply chain experts use a value calculator to identify where opportunities to improve supply chain performance will arise. Using either increased revenue opportunities or decreased cost, or perhaps a mixture, the Quasar team works with our clients to identify supply chain improvements. We have in our several years of operational use helped some of our customers achieve as much as a four-times ROI from their telemetric investment after implementing the Quasar Platform.

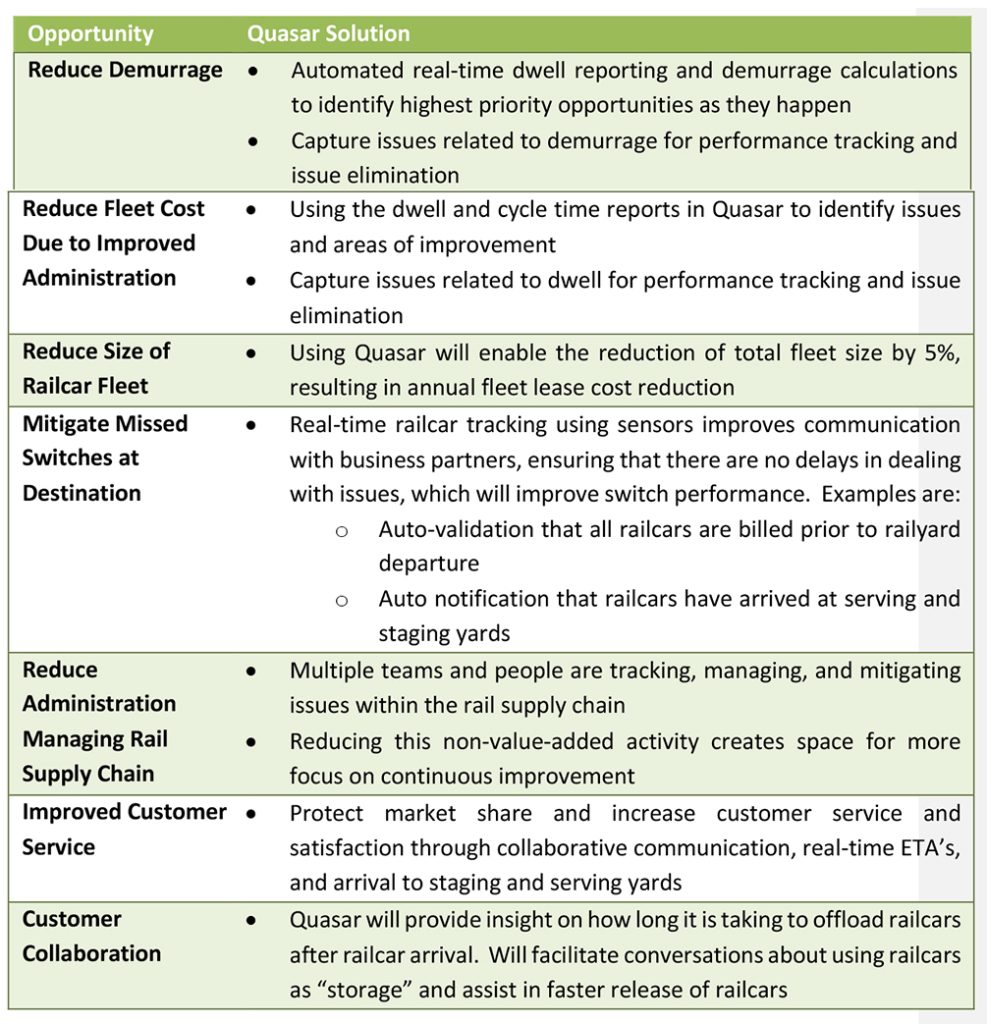

Here is a business sample in table format of how Quasar creates a business case value that impacts an income statement and balance sheet, improving warehouse and other supply chain movement value numbers.

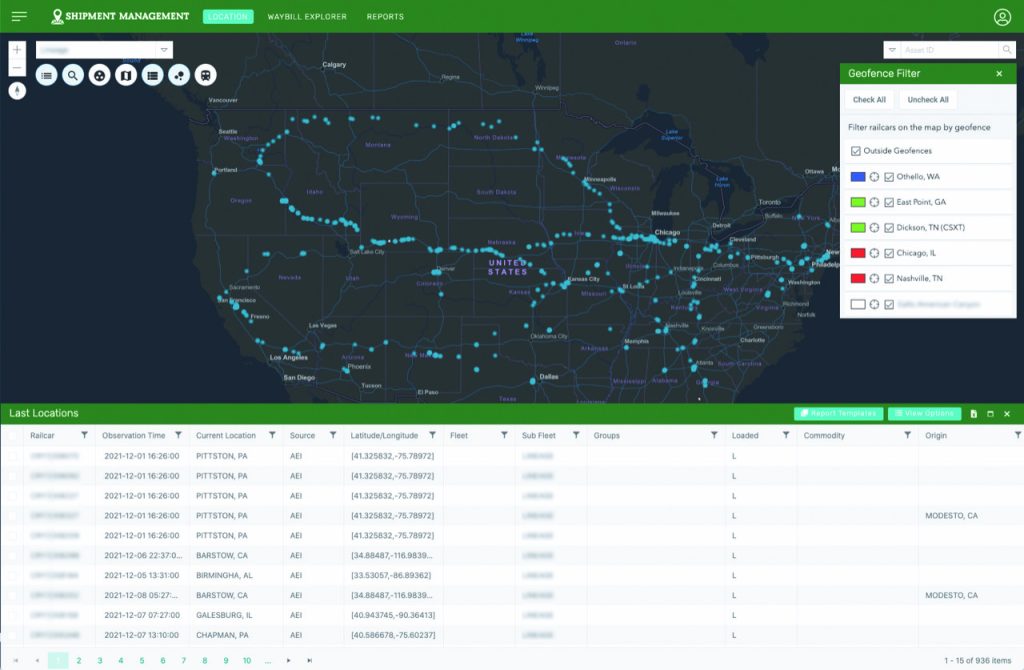

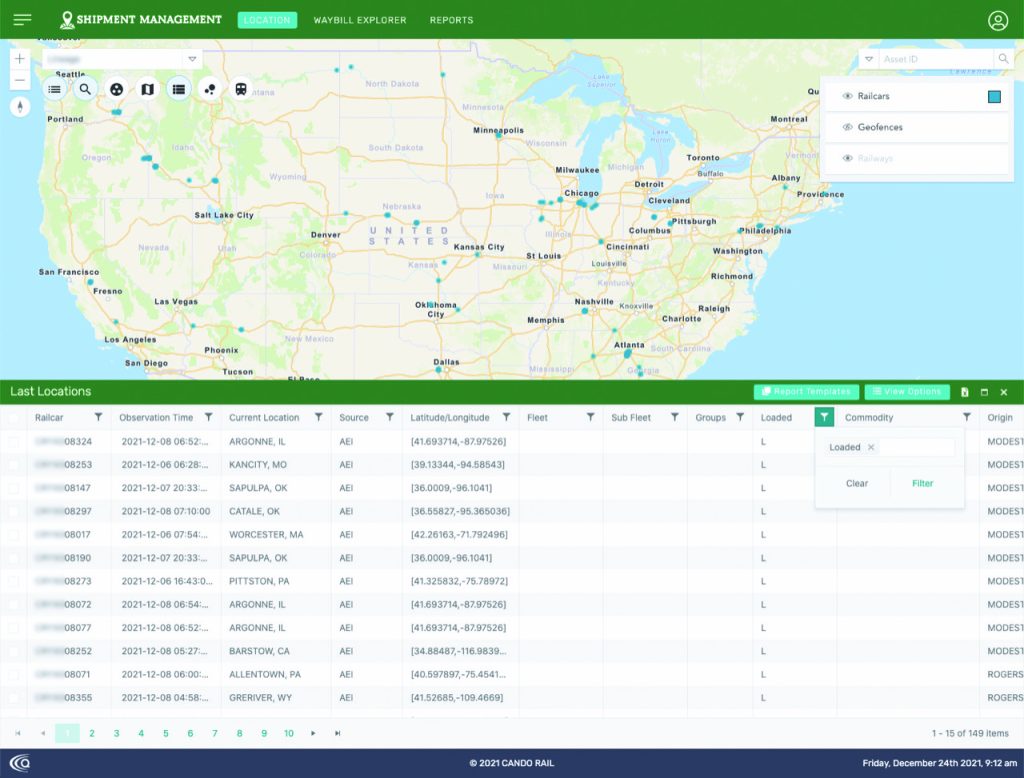

The Shipment Management application shows near-real-time data from several sources including GPS sensors visualized and ready for discovery on mapping software. The first is an entire North American equipment location visual. The second map shows equipment movement history and inventory along a selected corridor.

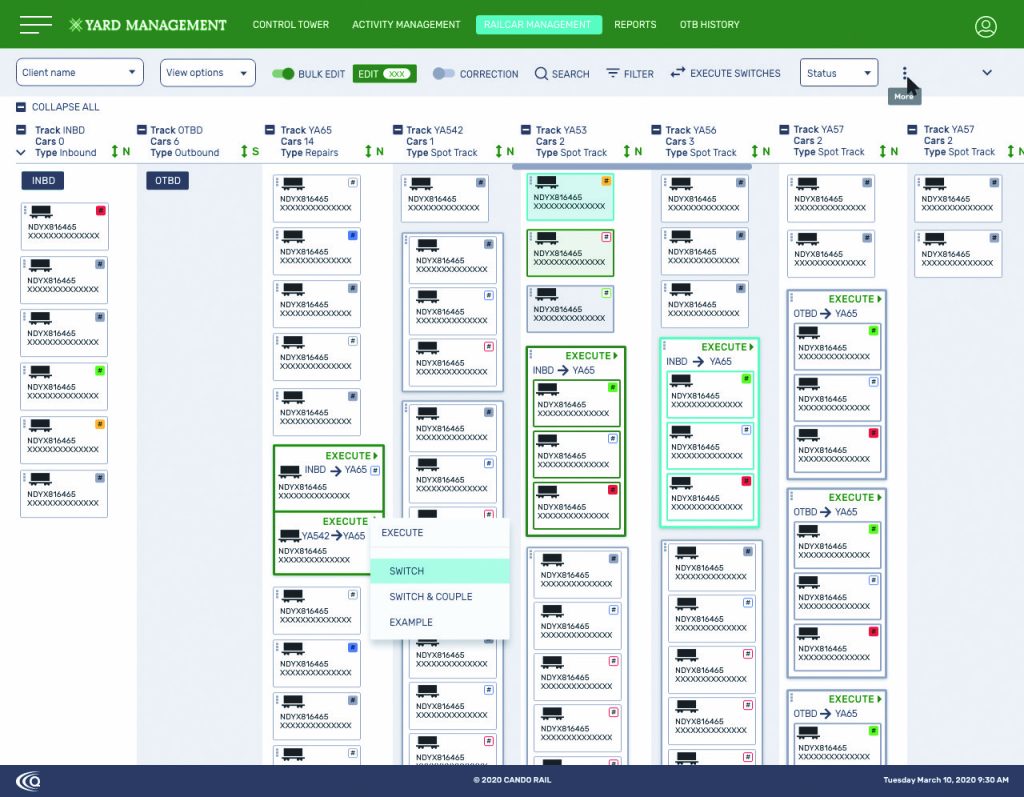

Below is a reproduced sample screen shot that automatically captures the inbound asset lineup in sequence using the Quasar Yard Management application.

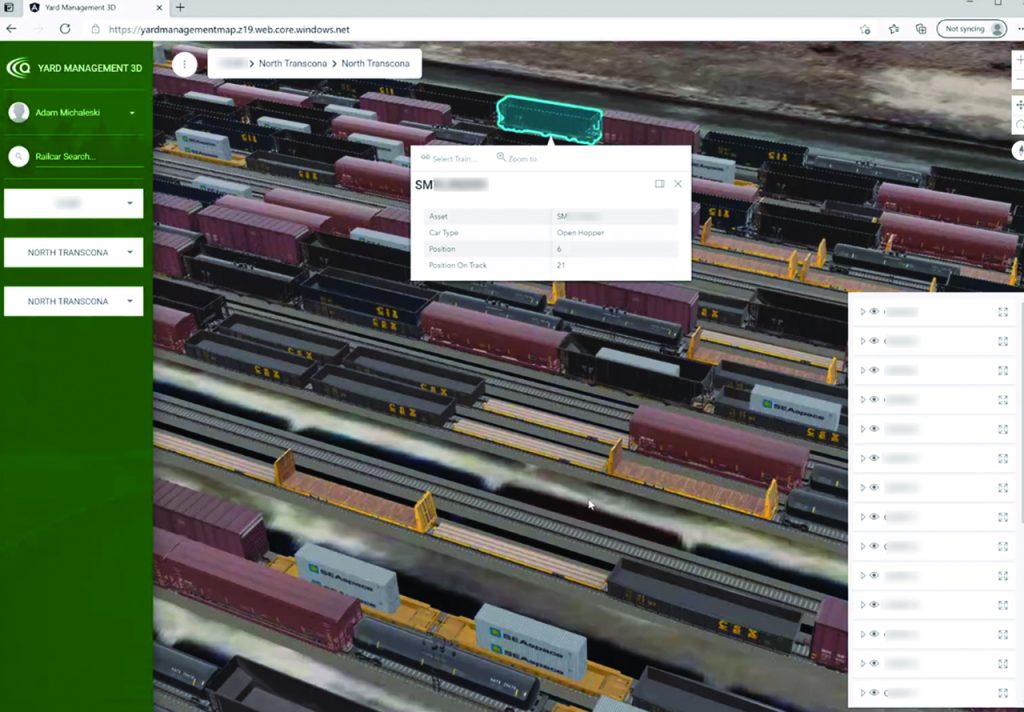

The Quasar software also can create a Yard Visualization image of the movement within the Yard Management application.

The Quasar Dataverse application provides complete supply chain visibility across the customer’s network, including differences in the railway networks measured for pooling, corridor performance inbound pipeline flow and cycle time analytics. Quasar also provides activity-based costing screens, tables and graphs.

Independent railway economist and Railway Age Contributing Editor Jim Blaze has been in the railroad industry for more than 40 years. Trained in logistics, he served seven years with the Illinois DOT as a Chicago long-range freight planner and almost two years with the USRA technical staff in Washington, D.C. Jim then spent 21 years with Conrail in cross-functional strategic roles from branch line economics to mergers, IT, logistics, and corporate change. He followed this with 20 years of international consulting at rail engineering firm Zeta-Tech Associates. Jim is a Magna Cum Laude Graduate of St Anselm’s College with a master’s degree from the University of Chicago. Married with six children, he lives outside of Philadelphia. “This column reflects my continued passion for the future of railroading as a competitive industry,” says Jim. “Only by occasionally challenging our institutions can we probe for better quality and performance. My opinions are my own, independent of Railway Age. As always, contrary business opinions are welcome.”